AI-based Real-Time Bank Fraud Detection and Prevention Software

Integrating Core Banking with AI Fraud Detection to Enhance Transaction Speed, Security, and Fraud Prevention for a Canada-Based Union Bank

Our client, a prominent Canadian credit union was battling with critical blind spots: disjointed payment processing, limited time to spot frauds, and an overwhelming number of suspicious transactions. Their legacy system was not equipped to keep up with fast-evolving fraud tactics. This increased the risk for both the bank and their customers.

They approached Rishabh Software to integrate an AI-powered fraud detection system directly into their core banking platform to enable real-time fraud prevention and detection. The aim was to embed an AI-driven solution with advanced analytics to dynamically identify new threats and block fraudulent transactions without impacting transaction speed.

Capability

Artificial Intelligence & Data Analytics

Industry

FinTech

Country

Canada

Key Features

We adopted a proactive, AI-driven approach to fraud detection and prevention in the banking industry by integrating advanced machine learning with real-time data analytics. This enabled the bank to proactively prevent fraud and protect both their assets and customers.

Fraud prevention framework

We combined a rules-based decision engine with ML algorithms to analyze historical transaction data and identify anomalies and fraud patterns. This proactive fraud detection software enables prompt intervention to prevent unauthorized transactions and minimize fraud risks. Discover how our AI development capabilities help drive real-time fraud prevention and smarter risk management for financial institutions.

Predictive Analytics for Fraud Prevention

We used AI models to predict fraudulent activities by analyzing past data and real-time transactions. This highly efficient fraud prevention solution evolves continuously and stays ahead of emerging fraud tactics.

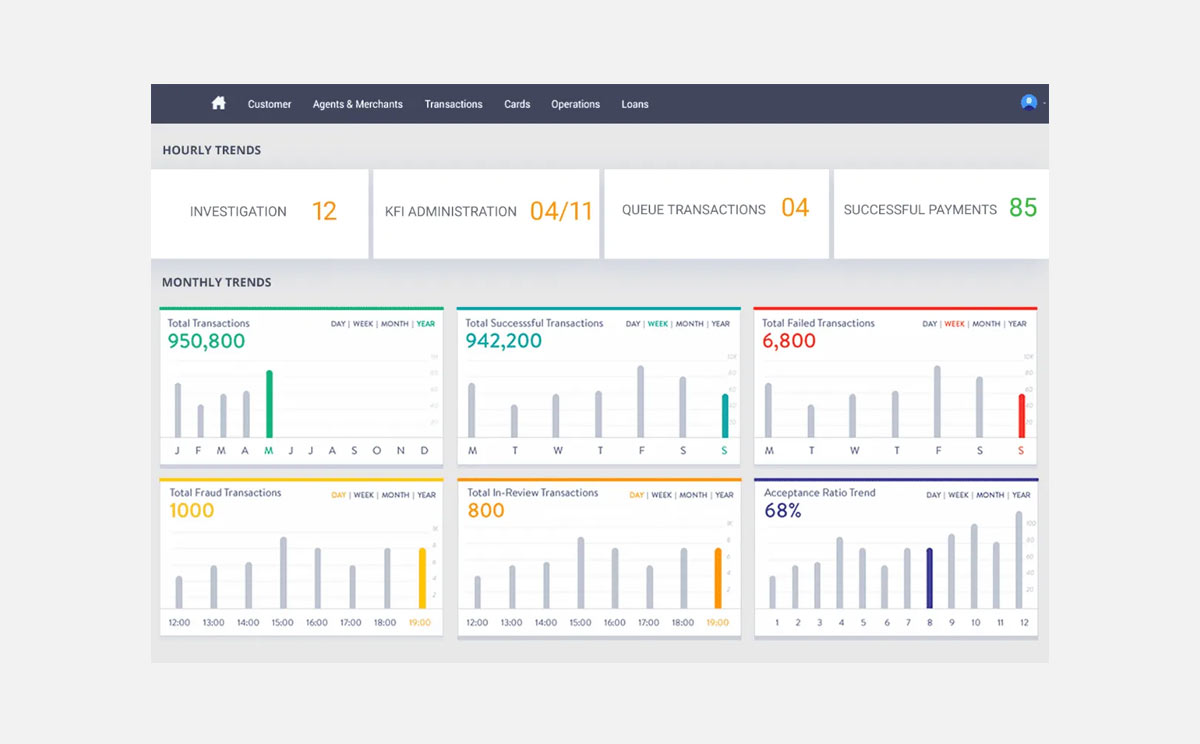

Real-time transaction screening

The bank fraud detection software performs real-time monitoring of transactions and flags suspicious patterns like rapid withdrawals, repeat transactions, and unusual spending locations. This critical capability supports real time fraud detection in banking sector environments by ensuring instant threat identification and quick mitigation.

Seamless Integration and Scalability

The fraud detection solution smoothly integrated with the bank’s core banking system and was built to support growing transaction volumes. This ensured uninterrupted operations and scalable performance as they are vital for modern bank fraud prevention and detection strategies.

Challenges

Limited visibility into payment processing across applications

The limited window for fraud discovery on transactions occurring at a specific terminal

Inability to handle a high volume of unexpected fallback transactions

Minimal transparency and traceability for unexpected transaction scenarios

Solutions

To deliver proactive banking fraud analytics, we focused on integrating AI at every touchpoint of the banking fraud detection software with these objectives:

- Connecting core banking endpoints as switch gateways

- Developing an AI-powered data analytics engine

- Seamlessly integrating the solution with the core banking system

Key components of the developed solution include:

Connector application

For each transaction submitted by the banking solution, the connector application establishes a synchronous socket connection with a timeout set according to SLA. It parses and validates incoming transactions, then forwards them to the AI-driven analytics engine for further processing.

AI-Driven Analytics Engine

We developed a hybrid solution combining rules-based logic and unsupervised machine learning to analyze transactions in real time. This adaptive system detects new fraud patterns and flags suspicious behavior, enabling timely alerts for the bank. Learn more about our data analytics services that power intelligent, real-time decision-making.

Predictive Models for Enhanced Fraud Prevention

Using AI-powered risk scoring models, we prioritized high-risk transactions by predicting fraud risks. These predictive models worked alongside heuristic rules to identify unusual trends and automatically route suspicious transactions to the case manager.

Load balancer

We implemented automatic failover and intelligent clustering to ensure reliability and scalability, which are critical to high-performance bank fraud prevention and detection systems. We achieved zero downtime and maintained an average transaction processing time of 125 milliseconds while handling 90 million transactions each month.

Outcomes

Zero

downtime achieved through failover and intelligent load balancing

increase in operational efficiency driven by AI-powered automation and analytics

100%

transactions processed per second with real-time fraud detection

Technologies Used

Project Snapshots

Recent Case Studies

Optimize your cloud infrastructure, implement robust solutions, and stay ahead of trends with our resource hub.