Modernization of Legacy Asset Based Lending System for SMBs

To streamline asset-based lending for SMBs across Industries

A leading US-based financial institution specializing in asset-based lending partnered with Rishabh Software for legacy asset based lending system modernization for SMBs. The collaboration aimed to digitize and automate the entire lending process, from collateral assessment and risk evaluation to loan approval, disbursement, and repayment tracking. The goal was to enhance operational efficiency, improve risk management, and provide a swift and smooth experience to both lenders and borrowers while ensuring compliance with state and federal regulations.

Capability

Legacy System Modernization

Industry

FinTech

Country

USA

Key Features

Efficient management of asset-based lending operations is critical for financial institutions, especially when dealing with SMBs. Our client’s legacy lending system relied heavily on manual processes, disparate modules, and dated risk management practices. These inefficiencies led to errors and delays. We tackled these challenges by implementing a modernized asset-based lending platform with the following essential features:

Account Management

The system facilitates the creation and management of collateral-based accounts for ABL and factoring services. It also includes a dedicated module for licensing deals and offers the scalability to meet varied business needs.

Invoice & Credit Memo Management

The platform accurately records and manages invoices and credit memos. It links these documents to specific schedules and assignments to provide a clear audit trail, thereby simplifying the reconciliation processes.

Customer/Debtor Management

The platform organizes and maintains customer/debtor data linked to accounts receivable (AR) collateral. It enables easy tracking of debtor payments and credit risk for improved collections and reduced possibility of defaults.

Risk Management

The system automates risk calculations based on invoice updates and provides real-time insights into credit exposure. It flags pre-qualified risks on invoices, enabling proactive risk mitigation and better credit decisions.

Challenges

Fragmented data across multiple financial processes, including client onboarding, risk assessment, and assignment management.

The existing system required heavy manual intervention for credit approval, invoicing, reconciliation, and payment processing.

Frequent errors in General Ledger (GL) mapping and account classifications led to financial inconsistencies.

Limited automation in cash application and invoice reconciliation processes.

Compliance with state-specific financial regulations (NY, CA, CT, NJ) was challenging due to a lack of a centralized audit and reporting framework.

Data security risks are due to insufficient encryption and role-based access controls.

The legacy system lacked the flexibility to support expanding business needs.

Generating industry-specific reports for management and regulatory purposes was time-consuming and prone to errors.

Solutions

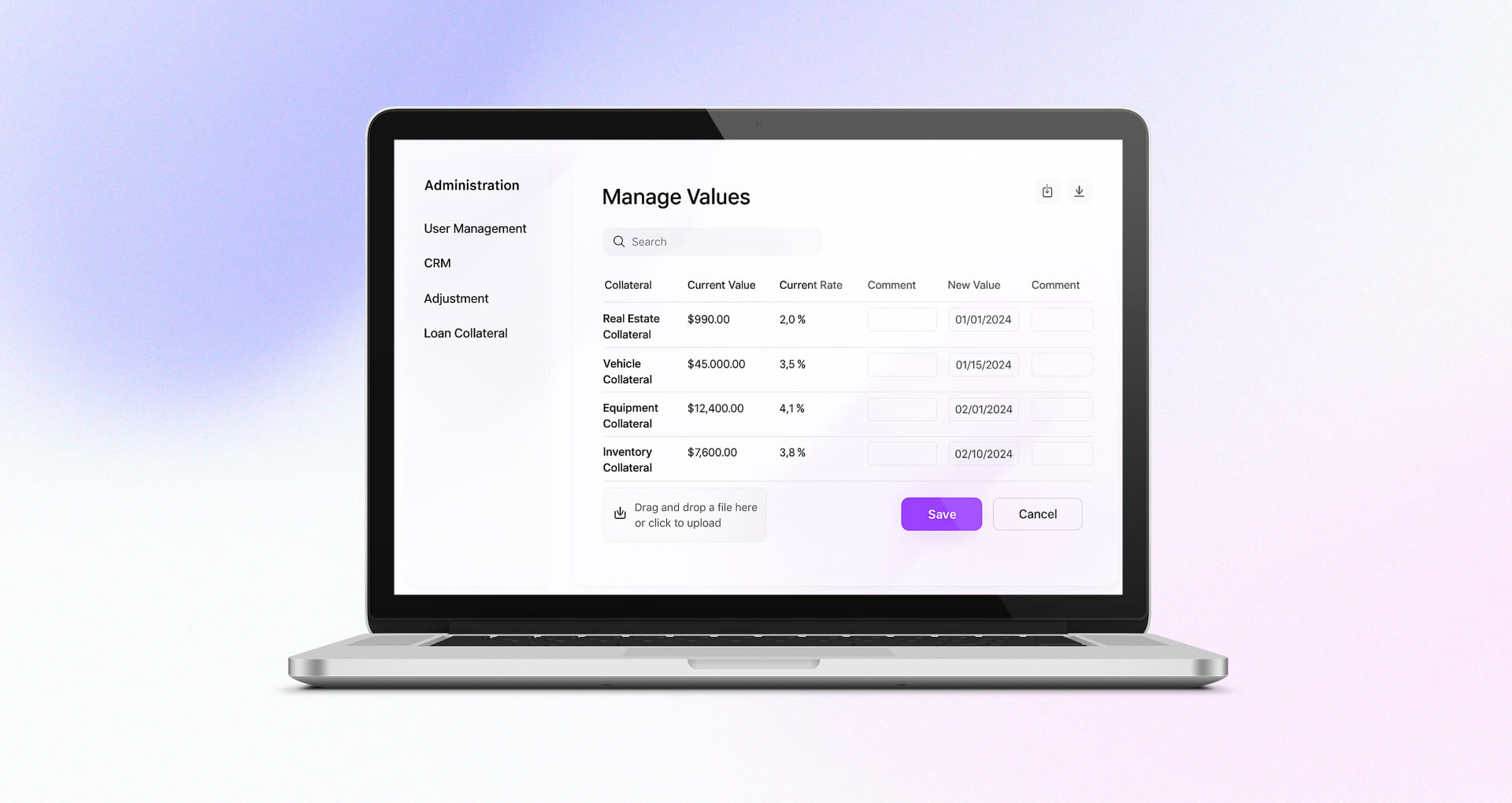

The asset based lending software modernization focused on addressing four critical aspects that were identified as major pain points in the existing system. Our team applied Angular development services in combination with .NET and Azure technologies to build a responsive, scalable, and intuitive user interface that enhanced usability and streamlined operations across all modules.

Below is an elaboration on the six key areas that were worked upon:

Real-Time Data Integration and Dashboards

Limited real-time data slowed decision-making. We fixed this by integrating data coming from various sources into one system. Placing interactive dashboards upon it gave instant insights into client balances, risk exposure, and payment status. This level of visibility enabled truly efficient operations and speedy, transparent service to clients.

Regulatory Compliance and Reporting

Managing multiple state-level regulations posed a challenge. We addressed this with an automated compliance module that checks transactions against each state’s rules (NY, CA, CT, NJ) and generates necessary reports. The solution streamlines reporting by reducing manual audits and minimizing compliance risks without disrupting daily operations.

Robust Architecture for High Performance

We built the asset-based lending platform on a microservices-based architecture, ensuring each service can function independently without straining the system as a whole.

API-First Approach

We made it easy to connect the platform to external banking systems, payment gateways, and other third-party services by emphasizing an API-first design. This open architecture automates fund transfers, reconciliations, and credit checks. As a result, the platform can quickly adopt new tools and integrations for better functionality and flexibility.

Integration and Scalability

Disconnected modules cause data silos and inefficiencies. Our modular architecture seamlessly integrates account management, risk management, and cash application, ensuring consistent data flow. A Cloud-agnostic design supports seamless scaling and adaptability, enabling growth with increasing loan volumes without sacrificing speed or stability.

Fortified Security

We prioritized security with multi-factor authentication and encrypted data transmission. Our comprehensive audit logs documented every system action to support transparency and regulatory obligations. Role-based access control ensured that users only see the data and features relevant to their work.

Outcomes

faster credit assessments

fewer payment processing errors

shorter reporting times

fewer data discrepancies

Technologies Used

Project Snapshots

Recent Case Studies

Optimize your cloud infrastructure, implement robust solutions, and stay ahead of trends with our resource hub.