Explore how Rishabh Software developed an invoice fraud detection & prevention platform for a UK-based technology company to detect anomalies, validate suppliers, prevent unauthorized transactions and reduce financial risks in real time.

Project Overview

Our client is a UK-based software company. They wanted to develop an integrated system to identify, monitor and prevent real-time payment frauds for their customers.

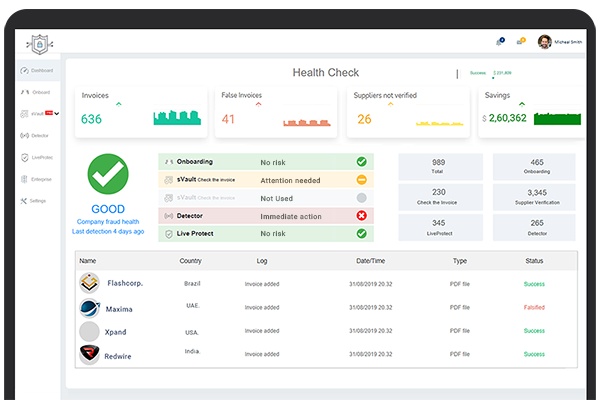

Rishabh Software designed and developed a robust platform for the client to go-to-market with. The application can detect potential fraudulent anomalies by utilizing AI functions like Deep Learning and Neural Networks.

Challenges

- Lack of proper system to identify false invoices

- Limited visibility to handle transactions and payment applications

- No platform to detect falsified sections in the document to verify supplier

- Availability of an automated system to safeguard from an internal fraud risk

- Ineffective accounts payable fraud detection measures

- Integration challenges with third party accounting systems

Solution

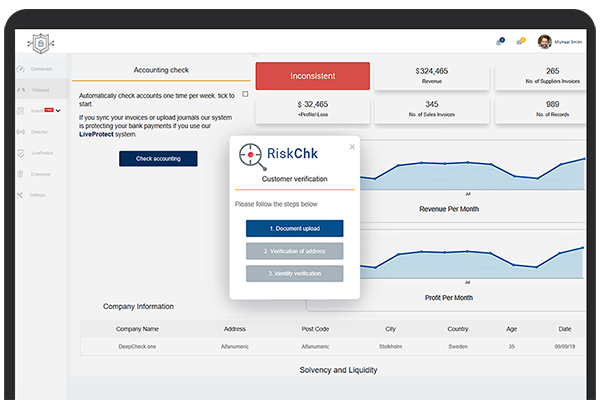

We custom developed a web application to detect and prevent invoice fraud. It helps manage customer invoices and supplier verification. The centralized solution included the listed modules; Safe Pay – Supports seamless & secure integration between ERP/accounting system and bank accounts reducing the need for high-security checks. This helps cut down the risk of losing money and prevent overpayments.

Check Invoice and Supplier – The deep learning algorithms help detect & rectify any instance of uploading false invoices/documents and manipulating supplier verification.

Fraud Check – The system identifies fraud patterns mostly internally by connecting to company accounts to validate invoices and expenses. It helps detect and report anomalies within the structure.

Onboarding – Helps onboard new employees with two-step identification in-line with new regulations by validating individuals’ identity as per their bank account and other required documentation.

Benefits

- Real-time insights to detect patterns of fraudulent or unauthorized activity

- 90%+ accuracy in identity validation to track & report false invoices

- 80% accurate fraud detection with internal invoicing to prevent financial losses

Customer Profile

UK-based Technology Company

Technologies

- Laravel

- MySQL

- Python