Mobile Payment App Development

Payments-as-a-service platform for banks, fintech & businesses in Tier 2 & 3 countries

With the growing demand for fast and convenient cashless transactions, a progressive FinTech firm partnered with Rishabh Software to tap into the profitable market of digital payment solution apps. Rishabh Software was engaged for a mobile payment app development project that aimed to provide Mauritian users with seamless, secure, and convenient digital transactions. This collaboration focused on enhancing the client’s financial landscape, fostering financial inclusion, and optimizing mobile money adoption throughout the region.

Capability

Digital Experience

Industry

FinTech

Country

Mauritius

Key Features

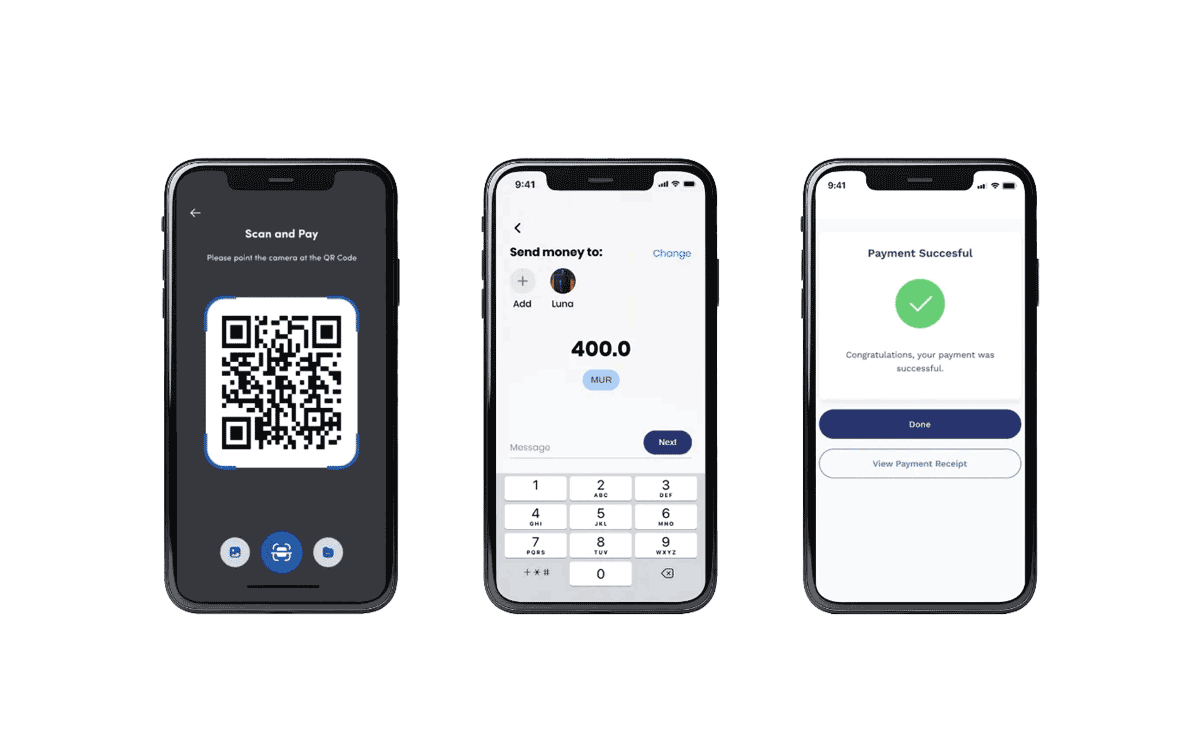

To address the client’s need for custom digital payment app development, we designed a feature-rich digital payment solution that efficiently bridged the gap between banks and individuals. To ensure financial inclusion and optimized mobile money adoption, this user-friendly payment solution was further enhanced with the following key features:

Digital Wallet

Virtual Cards

Payment Enablement

Cross-Border Payments

ISO 20022 Messaging Standard Support

Ensures seamless integration and communication across the global financial ecosystem.

Challenges

Complex traditional banking systems with intricate payment processes involving multiple intermediaries.

The absence of an app with a unified payment platform complicated payment processes across various institutions.

The need for receiver’s registration initially hindered mobile-to-mobile transfers.

Successful execution was crucial for seamless communication and transaction processing due to complex backend integrations.

Technical complexities hindered the integration of critical banking APIs.

Compliance challenges with national and international regulatory standards.

Scalability needed enhancement to accommodate the increasing transaction volumes and expanding user base.

Solutions

We implemented a multifaceted mobile payment application development strategy. It aimed to overcome the above-mentioned challenges and deliver a solution that simplified and streamlined the payment process.

Unregistered Number Transfers

Expert API Integration

Robust Callback Handling

Precise QR Code Decoding

Outcomes

CSAT score in the Q1 of implementation with hassle-free payments

Technologies Used

Project Snapshots

Recent Case Studies

Optimize your cloud infrastructure, implement robust solutions, and stay ahead of trends with our resource hub.