AI-Powered Personal Finance Management App Development

Empowering Southeast Asia’s underbanked communities with a data-rich and AI-driven mobile finance experience

A leading Singapore-based FinTech company partnered with Rishabh Software to build a mobile-first platform that redefines how underserved communities across Southeast Asia engage with financial services.

We developed a unified personal finance management app using Flutter, with a single codebase, to ensure consistent performance across both Android and iOS. The app is integrated with open finance APIs and AI-driven personalization features to deliver real-time financial insights. It improves access to credit and empowers users, from traditional banking customers to underbanked individuals, to make smarter financial decisions with greater confidence.

Capability

App Development & AI Integration

Industry

FinTech

Country

Singapore (Serving Southeast Asia)

Key Features

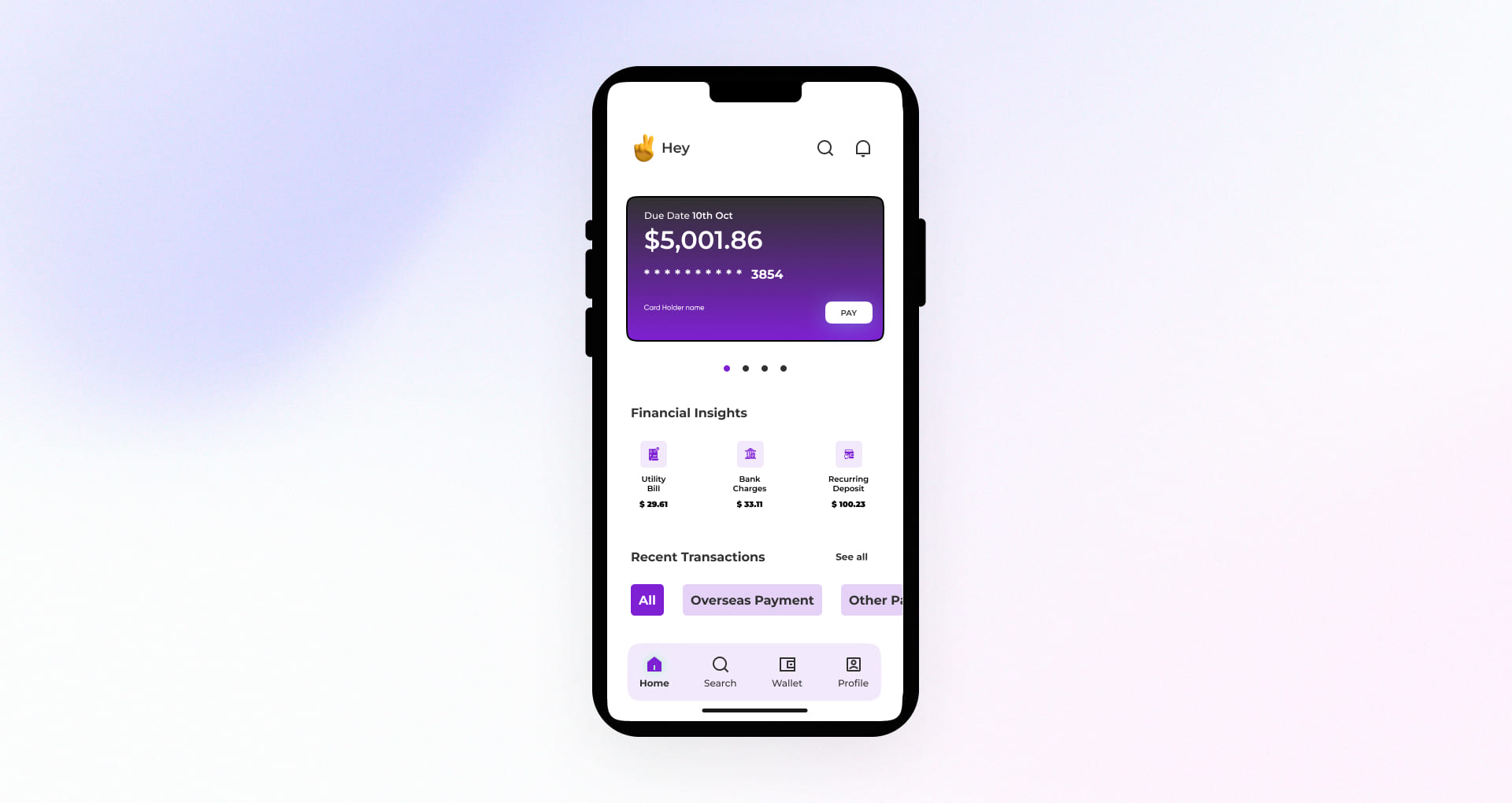

We developed a secure, cross-platform personal finance management app that integrates open finance APIs and robust security protocols to ensure the safe handling of user data. We incorporated AI-powered capabilities to deliver real-time insights into spending behavior, personalized credit card recommendations, and curated merchant discounts.

One Codebase. Zero Fragmentation

We leveraged Flutter to build a single codebase that runs seamlessly across Android and iOS devices. This approach enabled faster time-to-market, reduced maintenance costs, and ensured consistent performance across Southeast Asia’s highly diverse mobile device landscape.

AI-Driven Personalization Engine

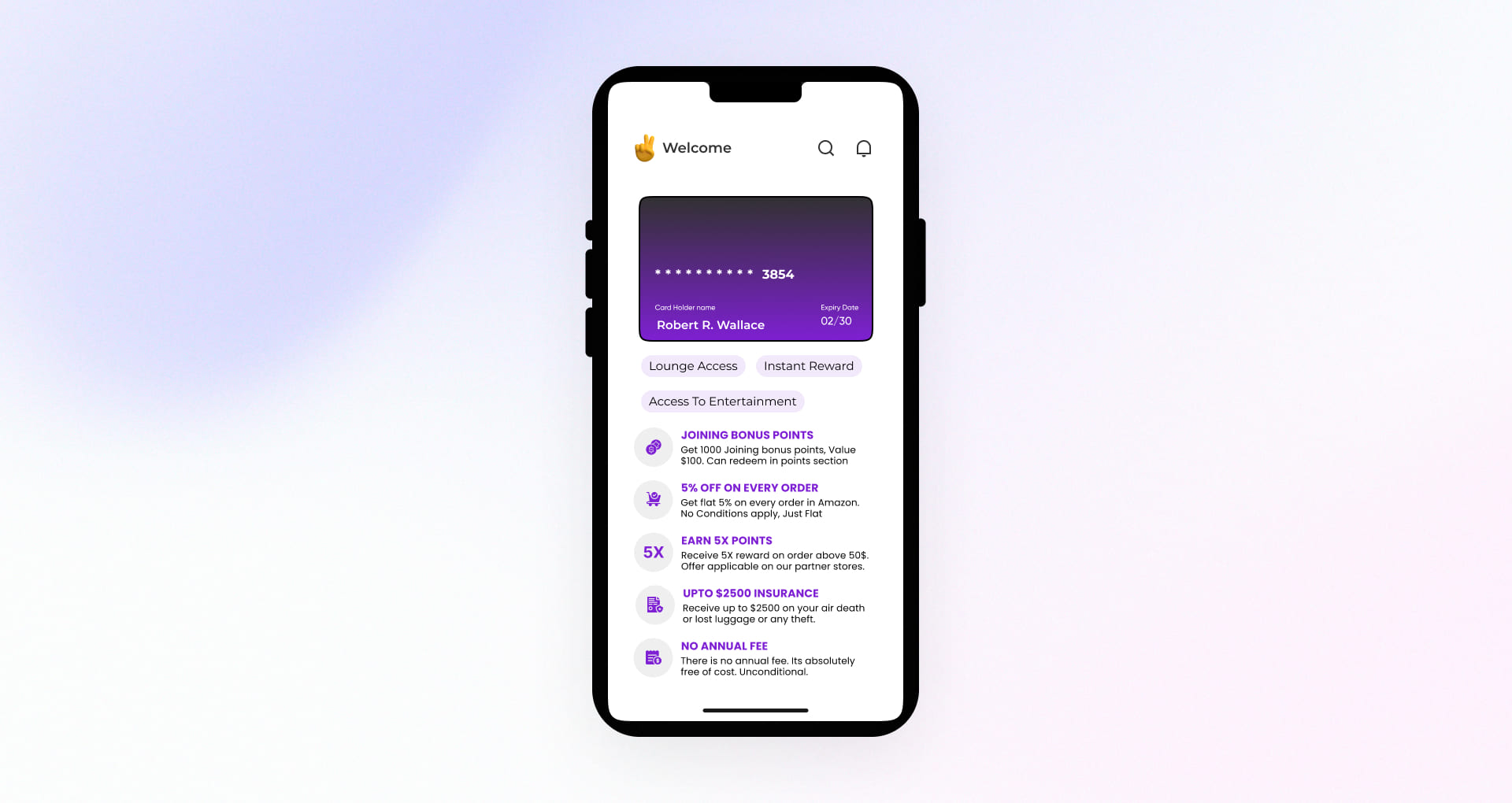

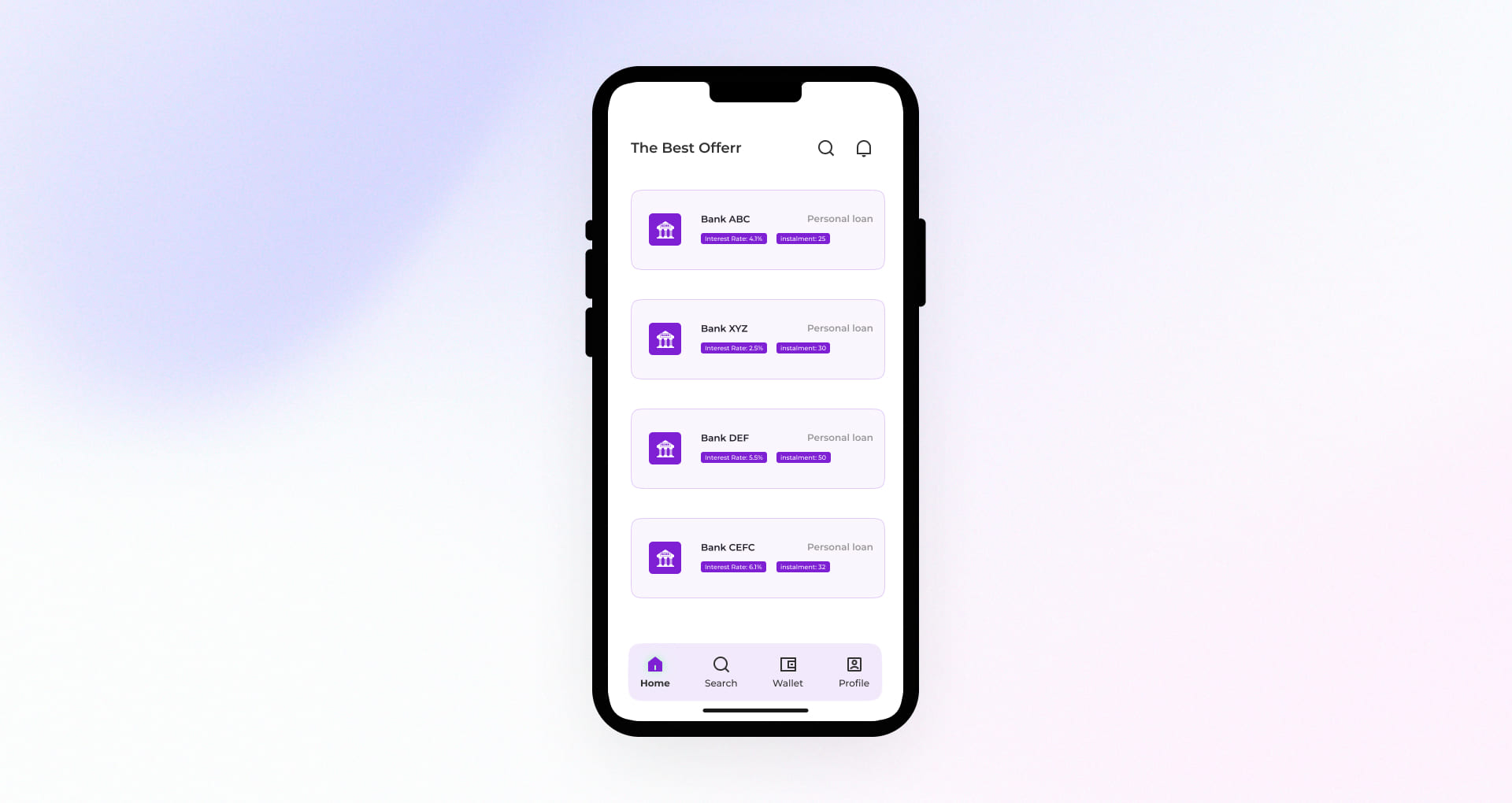

We implemented advanced AI algorithms to analyze user spending patterns and deliver hyper-personalized credit card suggestions, merchant offers, and actionable financial insights—all in real time. This intelligence empowered users to save smarter and stay in control of their financial goals with ease.

Secure, Compliant Financial Data Aggregation

Bank accounts. Digital wallets. Credit platforms. We integrated them all through encrypted APIs to provide users with a unified financial view, while ensuring full compliance with regional data privacy laws such as Singapore’s PDPA.

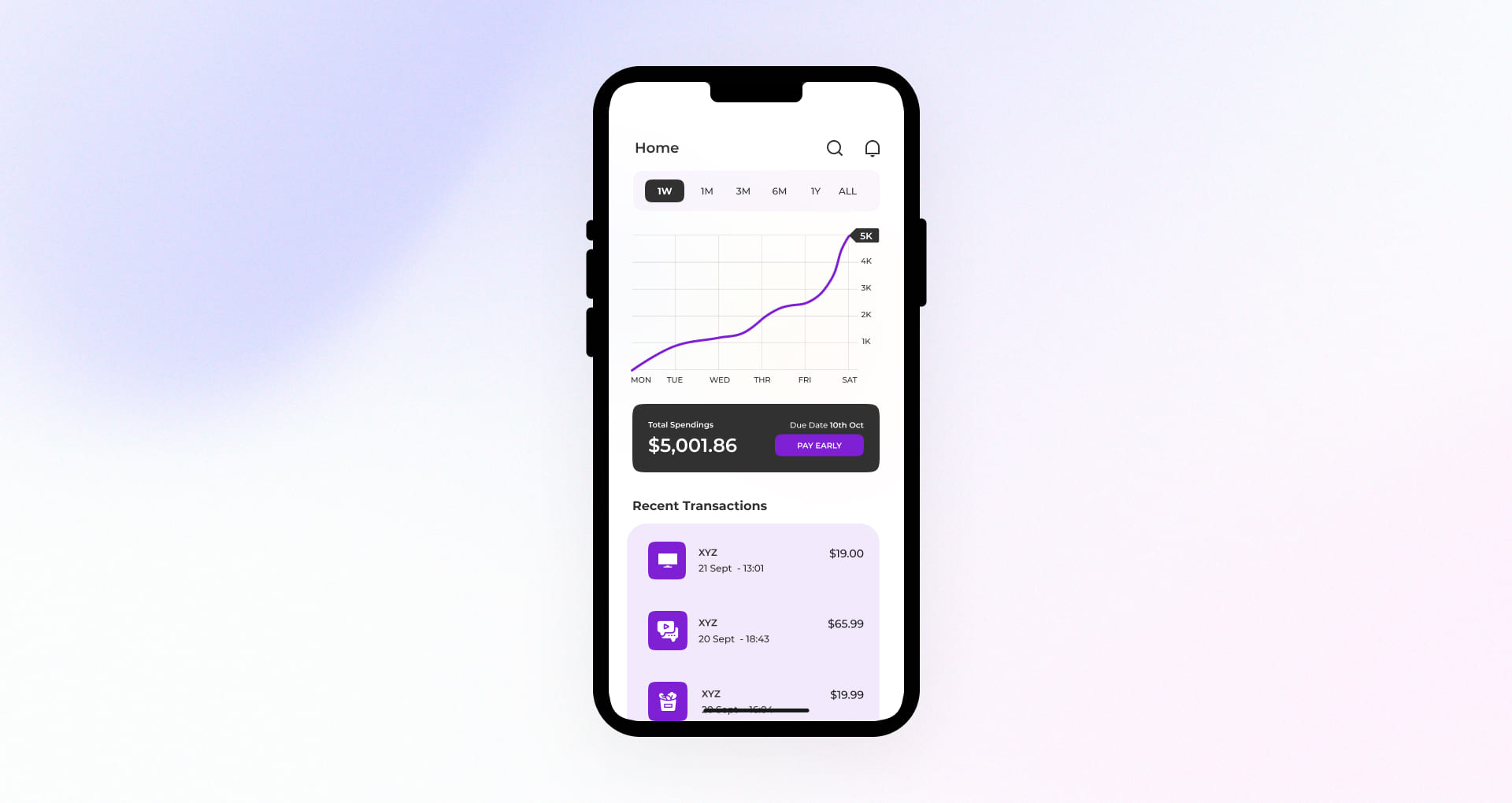

Embedded Insights for Financial Wellness

No more spreadsheets or guesswork. We built a smart layer of interactive dashboards, alerts, and tracking features that translate raw data into clear, actionable insights. This empowers users to manage budgets, track expenses, and make informed financial decisions with confidence on a daily basis.

Challenges

Fragmented and inconsistent APIs from banks, wallets, and credit cards made real-time data integration complex and error-prone.

Designing a user experience that worked seamlessly for both tech-savvy users and those with low digital literacy posed a critical usability challenge.

Real-time AI features had to run smoothly even on low-end smartphones.

Ensure compliance with regional data privacy laws like Singapore’s PDPA, which mandates a secure, privacy-first architecture from the ground up.

Limited financial data made it harder to train AI models and personalize insights accurately.

Solutions

To support the client’s vision of inclusive finance, we developed a future-ready unified personal finance management app using Flutter that combines AI, open finance, and security-first architecture. From seamless data integration to real-time AI insights, every feature was carefully tailored to serve the diverse financial needs of users across Southeast Asia.

Flutter-Based Mobile Development

As a Flutter Development Company, we built a single codebase using Flutter to ensure consistent UX across Android and iOS. This accelerated development, reduced maintenance effort, and improved time to market for new features.

Secure Open Finance Integration

Implemented encrypted API connectors to integrate data from banks, wallets, and credit card providers. This enabled a unified financial view while complying with data protection laws across multiple jurisdictions.

AI-Personalization Framework

We developed real-time Python-based AI/ML models to power spending insights, credit card suggestions, and merchant discounts. The engine adapts to behavioural signals, even with minimal historical data, to deliver meaningful recommendations.

Lightweight, Device-Agnostic Performance Tuning

Our team optimized app performance for low-end smartphones by utilizing caching strategies and implementing responsive UI logic. This ensured reliable access for users regardless of device capability or internet strength.

Frictionless Insights via Bank Statement Upload

For users concerned about sharing login credentials, we have enabled a secure PDF upload feature. The app reads bank statement data directly from the uploaded file, performs real-time analysis, and provides the same level of hyper-personalized insights—credit card recommendations, merchant offers, and spending trends. This ensured high adoption without compromising user trust or data depth.

Outcomes

Increase in app engagement through personalized insights and an intuitive mobile experience tailored to user behavior.

Expansion in market reach by onboarding underbanked users with limited financial access.

Compliance with regional data privacy laws through secure, encrypted architecture.

Reduction in manual data handling due to unified financial views, automated tracking, and built-in AI-led recommendations.

Technologies Used

Project Snapshots

Recent Case Studies

Optimize your cloud infrastructure, implement robust solutions, and stay ahead of trends with our resource hub.