Learn how a Southeast Asian FinTech company partnered with us to modernize their bookkeeping mobile app while making it more relevant, robust, and responsive to address the current & future needs of MSMEs.

Project Overview

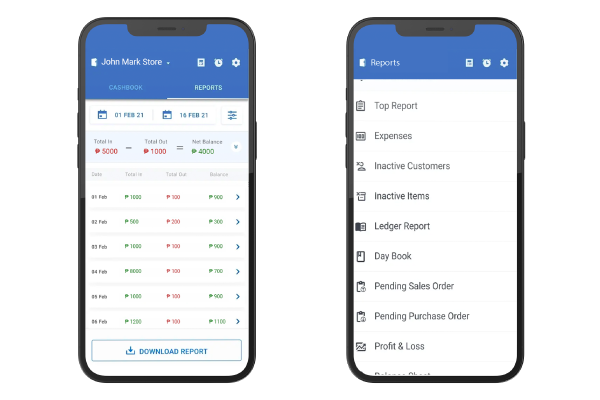

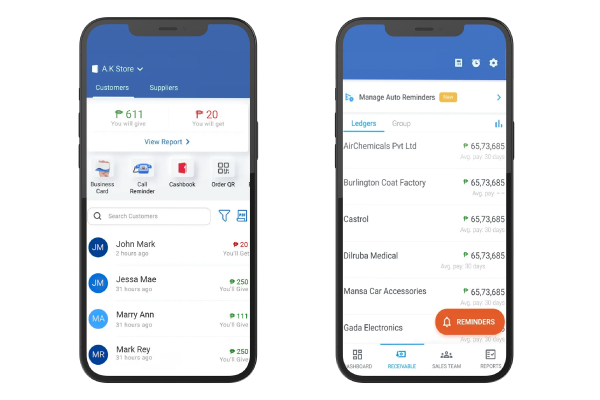

A Southeast Asian FinTech company was looking for an experienced technology partner to reengineer their bookkeeping mobile application on Android. It was with the latest in technology to streamline the billing & invoicing and other processes of their end customers – MSMEs. As part of the scope, they wanted to digitize varied modules, including inventory management, store management, customer management, invoice generation, reporting & more while improving user authentication & access.

Challenges

- Scalability & support for sophisticated accounting features

- No single place to view, analyze and record business financial transactions

- Limited/no scope for integration with new processes & systems

- Frequent maintenance & support with poor UX

Solution

The reengineering of the accounting bookkeeping app was focused on three main areas – restructuring the code, revamping the frontend & backend & adding new bookkeeping features. Our team analyzed the existing backend and frontend code and restructured classes to improve the design & functionality of the app for ease of use. The client had a special consideration to enable the use of the app in offline mode and our team achieved that by enabling the synchronization of data, users, stores & transactions. All the use-case scenarios were carefully considered to ensure there was no data loss.

Code Restructuring

- API re-development to handle authentication and authorization & trigger OTPs to registered users

- Finding and fixing bugs to ensure accurate reporting of financial transactions

- Third-party data integrations to deliver real-time insights into inventory, sales, cost, suppliers, and revenues

Feature Enhancement

- Ability to track and manage lending transactions with SMS-enabled notifications

- Weekly & monthly sales, expenses, and profit charts

- Users can manage their client’s invoices and details

Database Configuration

- Enabled faster query processing & management

- Modified the migration classes and room entity of the database tables to reflect the changes

- Secured storage and data sharing for accurate and error-free financial data

UX Revamp

- Utilized React Native and React Libraries to enhance the existing functionalities including home screen, profile, reporting, charts & transaction flow. The revamp enhanced the app’s overall performance, functioning & usability.

Benefits

- 3x faster & more accurate financial reporting

- 25% increase in efficiency for account management

- 40%+ improvement in decision making with the right visibility

Customer Profile

A South-East Asian Fintech Company

Technologies

Nest JS, MySQL, TypeORM, Twilio, Slack API, Firebase, React Native, Redux, SQLite

30 Min

30 Min