AI-assisted fraud isn’t “next”, it’s here! In 2024, consumers lost $12.5B to scams; investment scams rose 24%, and the share of victims who lost money increased from 27% to 38%. Fraudsters use AI to operate at machine speed, while traditional rule-based systems flood security teams with false positives, missing key threats.

In 2025, leading fraud prevention teams move beyond static rules. They deploy autonomous AI agents that monitor transactions in real time, adapt to learning behavior, and prevent fraud. The goal is to reduce fraud losses and manual reviews, while maintaining customer experience, audit trails, and compliance. This means shifting from fixed rules to adaptive AI agents that autonomously detect anomalies and ensure regulatory audit trials.

AI agents aren’t the future of fraud detection; they already are. The real question is how fast can you implement them to stay ahead of your competitors? This blog explains why Agentic AI for fraud detection is becoming the new standard by outlining what AI agents are, the components that power detection, the types of fraud they target, and the benefits they deliver. You’ll also explore cross-industry applications, best practices for implementation, and what’s next in agentic AI.

Key Components of AI Agents in Fraud Detection

Fraud detection AI agents scan real-time data, score risk, and act in seconds. They employ real-time analytics, behavioral modeling with continuous learning to prevent fraud while staying compliant. The architecture of AI-driven fraud detection can be organized into four core categories: Data Intelligence, Decision Intelligence, Learning Intelligence, and Adaptive Intelligence.

Data Intelligence

1) Data Ingestion

Agents pull data from transactions, user sessions, devices, threat intel, and past fraud cases. They normalize and timestamp every event to keep context.

2) Feature Engineering

They turn raw signals into features like transaction velocity, device change rate, geolocation drift, and behavioral biometrics. These capabilities drive model accuracy.

3) Model Training & Detection

Supervised, unsupervised, and anomaly-detection models learn normal vs. risky patterns. Clustering and graph analysis highlight networks, mules, and synthetic identities.

4) Profiling & Knowledge

Agents maintain evolving profiles for users, accounts, merchants, and devices. Knowledge base adds industry rules and regulatory guidance to refine judgments.

Decision Intelligence

1) Risk Scoring & Anomaly Detection

Each event gets a risk score. Real-time detectors flag deviations from a user’s or peer group’s baseline.

2) Decision & Alerting Engine

Policies map scores to actions: allow, step-up authorization, block, or escalate. The engine notifies analysts immediately for high-impact cases.

3) Action & Output

Agents execute the response, log the rationale, and generate clear case summaries and dashboards for reviewers.

Learning Intelligence

1) Feedback Loops

Analyst outcomes feed back into training data. The agent trains on a schedule or on a trigger to reduce false positives over time.

2) Compliance

Explainable AI shows which signals drove a decision. Audit trails support AML, KYC, PCI, and GDPR requirements.

3) Human Interaction

Analysts work in a focused UI to review evidence, add notes, override decisions, and propose new checks that the agent can test.

Adaptive Intelligence

1) Language & Knowledge Integration

NLU and entity extraction help parse claims, receipts, or tickets. External knowledge bases enrich risk context.

2) Continuous Adaptation

Agents adjust to new tactics using fresh data, updated rules, and third-party intel. They tighten controls during attacks and relax them as risk drops.

AI Agents for Fraud Detection combine ingestion, intelligent analysis, risk scoring, and automated decisions backed by learning and compliance. The result is fast, accurate prohibition with the right balance between automation and human oversight.

Types of Fraud Detected by AI agents

AI agents protect high-risk touchpoints across industries. With every decision they refine their models, cut false alarms, and stop losses while keeping trusted users moving quickly. Below is a comprehensive list of common fraud types detected by agentic AI:

Payment Card Fraud

AI scans each transaction in real time, tracks spend velocity, compares merchant categories to a cardholder’s history, fingerprints devices, and flags impossible travel. It triggers step-up checks, such as OTP or 3DS, to block fraud without hurting conversion.

Fake Account Creation

ML Models score email and phone reputation, detect disposable domains, read SIM and device age, and uncover IP or device reuse across multiple sign-ups. They link shared attributes in a graph to prevent promo misuse and fake leads while facilitating fast onboarding.

Account Takeover

AI detects sudden changes in login location, network, and device fingerprint. It monitors password reset bursts and unusual 2FA prompts, then applies robust authentication or locks accounts when multiple risk signals align.

Document Forgery

Systems extract text with OCR, compare fields to templates, and inspect metadata. They reveal copy–move edits, cloned stamps, and inconsistent lighting. All low-confidence files are forwarded to reviewers with highlighted regions for timely decision-making.

Insurance Claims Fraud

AI matches narratives, timestamps, and repair networks to uncover duplicates and staged incidents. Image forensics catches reused photos and edited damage, and targeted checklists help adjusters reduce cycle time and leakage.

Lending-Specific Fraud

AI agents protect the full lifecycle by spotting synthetic IDs, income or document fraud, and velocity or loan stacking in real time. They block account takeovers at funding, pause disbursements on payout-account mismatches, and cut first-payment defaults by pairing pre-fund checks with post-fund behavior signals. Agents also surface collusion and AML red flags, raise good approvals, and reduce charge-offs and manual reviews.

Healthcare Billing Fraud

Models surface upcoding and unbundling as statistical outliers. They flag schedule overlaps across locations, services that do not match diagnoses, and identity collisions. Agents then feed audits and recoveries without adversely impacting value-based patient care.

eCommerce Return Abuse

AI builds a return-to-keep profile by user, SKU, and season. It flags wardrobing and serial refund behavior, compares photos with product attributes, and adapts policies in real time so genuine customers retain low-friction returns.

Telecom Fraud

AI links SIM-swap events to high-risk windows, detects call-forwarding loops, and spots roaming anomalies. It also finds promotion and subscription abuse so carriers cut write-offs without blocking genuine travel.

Procurement and Invoice Fraud

Models track unit prices against contracts, detect split invoices that bypass approval limits, and catch bank account reuse across vendors. Graph analysis exposes shell companies and bid rotations. These discrepancies enable finance teams to stop payments in time.

Gaming and Virtual Economies

AI monitors rapid asset flips, abnormal price moves, and risky login sources tied to inventory drains. It freezes only contested assets, protects fair players, and keeps live operations stable.

Anti-Money Laundering and Transaction Laundering

Models learn normal payment paths, detect structuring and smurfing, and trace funds through merchant fronts. They score beneficiaries by risk and deliver clear reason codes and trails that investigators can quickly act on.

Identity Theft

AI combines device fingerprinting, typing cadence, selfie liveness, and document-to-selfie matching. It adds verification steps when risk rises and keeps genuine users moving when signals look clean.

AI Agents Vs. Traditional Fraud Detection Methods

Fraud changes fast, while your controls must stay fast and precise. AI agents learn normal behavior from live data, spot subtle anomalies in context, and act in real time. Traditional rule systems still help when regulations demand fixed logic, but they struggle when patterns shift or data volume spikes. Here’s a quick comparison to help you decide where AI agents fit, what to keep from rules, and how to run both without adding friction.

| Capabilities | AI Agents | Traditional Methods |

| Data processing | Ingest and analyze multi-source, high-volume streams in real time | Review narrow data slices, often in batches |

| Pattern recognition | Find non-linear and cross-channel patterns that humans miss | Depend on static rules and thresholds |

| Adaptability | Learn from feedback and drift signals continuously | Need frequent manual updates |

| Real-time analysis | Score events instantly and trigger step-ups | Detect after the fact due to batch jobs |

| Accuracy | Reduce both false positives and false negatives over time | Produce alert floods or miss novel attacks |

| Scalability | Scale horizontally with traffic and features | Scale only with headcount and hardware |

| Automation | Automate triage, investigation hints, and decisions | Rely on manual reviews for most steps |

| Cost effectiveness | Higher upfront cost but lower ongoing costs with automation | Lower setup cost, which increases over lifetime due to manual effort |

Why AI Agents Outperform Traditional Monitoring

Traditional rule engines trigger static alerts that degrade over time. AI agents continuously learn from feedback, new fraud trends, and signals across various channels. Unlike black boxes, they explain their decisions in clear, human terms, enabling analysts to trust and fine-tune them.

When needed, AI agents respond in real time by prompting extra verification or pausing a payment for review. This reduces false alarms and detects emerging threats faster. AI agents excel when patterns shift, data volumes increase, and quick decisions are essential.

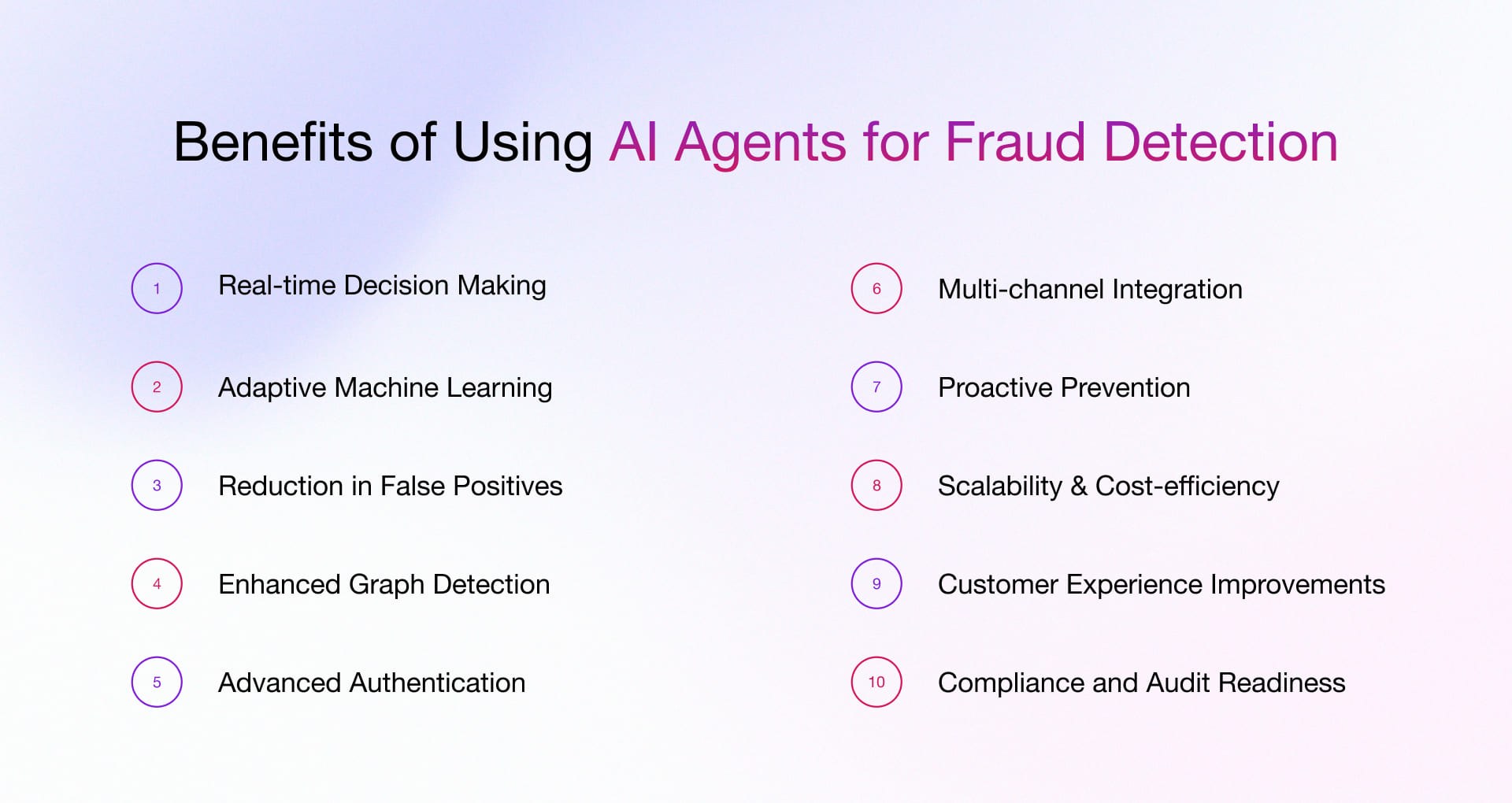

Key Benefits of Using AI Agents for Fraud Detection

AI agents use signals from behavior, devices, content, and networks. This data enables teams to cut losses while protecting genuine customers across banking, insurance, retail, and healthcare domains.

1) Real-time Decision Making

AI evaluates risk the moment an event happens and chooses an action on the spot. That speed stops an inconsistent activity before it settles and keeps legitimate users moving. You gain fewer chargebacks, less fraud loss, and faster approvals. Your ops team spends less time chasing after-hours incidents because the system already contains them.

2) Adaptive Machine Learning

Attack patterns change all the time. Adaptive models retrain on fresh outcomes so they learn what worked and what failed. The system notices drift in behavior, adjusts thresholds, and promotes new features without waiting for long release cycles. This reduces model decay and keeps detection sharp. Watch precision, recall, and model drift metrics to confirm the model stays current.

3) Reduction in False Positives

False positives create disruption and waste analyst hours. Multi-signal scoring and tuned thresholds reduce confusion so you only review cases that really need attention. Feedback from reviewers loops back into training, which improves accuracy week after week. The result is lower manual review rates and higher conversion for trusted users. Measure false positive rate, manual review rate, and approval lift to quantify progress.

4) Enhanced Pattern and Graph Detection

Fraud rarely happens in isolation. Agents link people, devices, addresses, and payment instruments to expose patterns across the network. Graph analytics highlights clusters, shared attributes, and unusual paths. This highlights coordinated activity that single-event scoring would miss. You can shut down entire rings instead of chasing incidents one by one.

5) Behavioral Biometrics and Advanced Authentication

Good security should feel invisible to honest users. Behavioral signals like typing rhythm, touch patterns, and liveness checks help confirm a real person is present. When risk is low, the system stays silent. When risk increases, it asks for a simple step-up. This approach protects accounts while keeping the experience smooth.

6) Multi-channel Integration

Fraud flows across channels. When you unify signals from web, mobile, call center, and stores, the agent sees the bigger picture and makes better calls. Shared identity graphs and device intelligence prevent blind spots between teams. You reduce repeated customer checks and close gaps that attackers love to exploit. Measure cross-channel match rate, duplicate investigation rate, and reduction in multi-touch fraud.

7) Proactive Prevention

Prevention beats response. AI fraud management agents find weak points in journeys and highlight high-risk segments before losses spike. You can tighten limits, raise friction only where needed, and introduce controls that match the level of risk. This lowers cost and avoids blanket rules that punish everyone.

8) Scalability and Cost-efficiency

Fraud volumes rise with growth. Streaming features, automation, and smart case routing let you scale without hiring in lockstep. The system closes low-risk alerts on its own and sends only meaningful cases to analysts. This concentrates talent on high value work and shortens case queues by tracking alerts per analyst, average handling time, and cost per investigation.

9) Customer Experience Improvements

People remember how easy or hard it was to finish a task. Risk-based challenges replace blanket blocks so trusted users get instant approval. When something looks unusual, the system asks for a quick confirmation and then moves on. It monitors approval rate, checkout speed, and repeat usage to improve satisfaction, loyalty and revenue.

10) Compliance and Audit Readiness

Strong controls protect the business and make audits painless. Versioned models, clear reason codes, and replayable evidence create a complete record of every decision. You can explain what the model saw, why it acted, and how you governed the process. This supports regulatory standards and reduces audit effort. Track audit pass rate, evidence completeness, and time to respond to regulatory requests.

Top Use Cases for AI Agents in Fraud Detection Across Various Industries

AI agents now operate as real-time fraud teams that never sleep. They learn from every interaction, connect signals that humans would miss, and act in seconds. The result is fewer losses, smoother CX, and less manual effort for analysts. Below is a clear view of where these agents deliver value and how they change outcomes.

Banking and Fintech

AI agents watch transactions, device fingerprints, and login behavior in real time. They detect account takeovers, mule activity, and synthetic identities before any money moves. They also streamline KYC and AML processes by verifying documents, screening against watchlists, and escalating only the cases that truly need human attention. Banks that adopt agents approve more good transactions, cut false positives, and protect interchange revenue.

E-commerce and Marketplaces

Online retailers use agents to detect stolen cards, promotion abuse, reshipping rings, and return fraud. The agent learns each customer’s normal behavior and blocks risky orders while letting good buyers check out. It assembles dispute evidence automatically, which shortens chargeback cycles and recovers more revenue. Marketplace operators also benefit when agents evaluate seller reputation and buyer claims.

Insurance

Insurers deploy agents to evaluate claims, policy data, repair estimates, and image evidence in one pass. The agent flags staged accidents, inflated invoices, and repeated claim patterns tied to networks. It triages clean claims for straight-through processing and routes suspicious ones to SIU. Customers see faster payouts when everything checks out, while loss ratios improve due to early fraud interception.

Healthcare and Payers

Payers use AI agents to flag issues like phantom billing, upcoding, duplicate claims, and identity misuse. The system compares claims against clinical guidelines and typical provider behavior to immediately alert reviewers when something looks off. This creates clearer feedback for providers, ensures fewer coverage disruptions for patients, and averts financial leakage without slowing essential care.

Transportation and Logistics

Carriers and logistics platforms use agents to track telematics, routing data, customs declarations, and invoices. The agent identifies route deviations, cargo tampering risks, and misclassified shipments. It reconciles billed amounts with contracted rates and highlights anomalies for audit. This improves margin control and reduces disputes with shippers and brokers.

Retail and Omnichannel

Brick and mortar teams combine POS feeds, CCTV metadata, and staff activity logs with agent monitoring. The agent detects refund abuse, suspicious voids, and serial returners. It also reviews new credit applications and loyalty signups for identity risk. Loss prevention becomes data driven and checkout friction stays low for shoppers.

Best Practices for Implementing Agentic AI for Fraud Detection

Implementing agentic AI for advanced fraud detection proves to be an excellent approach when you follow a staged plan that combines technology, data, and human expertise. The goal is a proactive system that is always learning, acts autonomously and stays compliant. The best practices outlined here takes you from preparation through pilot to scaling and long-term governance.

Assess Current Processes and Define Goals

A visual representation of your current fraud operation is a good start. Identify all workflows, handoffs, and system interfaces. Also, document all impediments such as alert fatigue, slow reviews, or data gaps. Verify the compliance requirements that are applicable to every touchpoint. Once all of this is in place, establish measurable targets for agentic AI. Concentrate on specific risk areas like account takeover or payment abuse, and state success criteria like fewer false positives, quicker decisions, and better recovery.

Prepare and Integrate Data

Data foundations can make or break fraud models. Clean and standardize transaction, account, device & behavioral data. Resolve identities to unify profiles across channels. Build pipelines that support real-time streaming and scheduled batch loads from ERP, CRM, and payment platforms. Include feature stores so agents can access normalized signals such as velocity, geodistance, device reputation, and network indicators without heavy engineering each time.

Design the Agentic AI Architecture

Define the roles your agents will play. Typical roles include data extraction, risk scoring, anomaly detection, and action execution. Plan how these agents coordinate through an orchestration layer that handles task routing, conflict resolution, and state management. Keep humans in the loop for ambiguous cases. The architecture should support policy controls, versioning, and audit logs so you can explain every decision later.

Develop and Train AI Models

Train models on labeled historical cases and recent operational outcomes. Use supervised learning for classification tasks, such as fraud or not fraud, and unsupervised or semi-supervised methods for anomaly discovery. Incorporate text analytics where notes or claim descriptions provide a signal. Close the loop by feeding investigator outcomes and chargeback decisions back into training. This continuous learning cycle reduces drift and improves precision over time.

Pilot on a High-Risk, High-Clarity Use Case

Launch a pilot in a controlled environment. Choose a narrow scenario with clear labels and strong business ownership. Route live traffic in shadow mode first to benchmark accuracy, coverage, and latency without affecting customers. Move to action mode once the model meets thresholds. Track decision accuracy, false positives, time to decision, and operational impact to validate value.

Define Autonomy Levels and Human Interaction

Decide when the system can act on its own and when it must involve an analyst. Set thresholds for automatic block, approve or challenge actions. Create escalation paths for edge cases and define service level targets for reviews. Document who can override an agent decision and how the system records that override.

Implement Explainability and Monitoring

Every alert should come with a reason that a human can understand. Provide feature contributions, policy references, and a short narrative that explains why the agent acted. Build dashboards that show model health, agent actions, investigation queues and KPIs such as precision, recall, false positive rate, and customer friction. Set alerts for drift, latency spikes, and unusual approval or decline patterns.

Scale Across Use Cases

After a successful pilot, expand to adjacent journeys such as refunds, credit issuance, or claims approval. Reuse common components such as identity graphs and feature stores to move faster. Integrate with enterprise risk, case management, and compliance systems so that the solution can be a part of the larger control framework. Validate the interoperability of the systems and the lineage of the data in order to avoid creating new silos.

Establish Governance, Security, and Compliance

Design a governance program that will take care of data privacy, model risk, and operational resilience issues. Apply access controls and encrypt data both during transmission and when stored. Maintain the versioned models, policies, and configuration. Create comprehensive audit trails for inputs, outputs, and human overrides. Synchronize with regulations like GDPR and PCI DSS. Plan for regular reviews to guarantee that the autonomy levels, thresholds, and reason codes are still appropriate.

Optimize with Feedback

Refresh training data with recent fraud patterns and closed investigations. Capture analyst feedback directly in the case tool and feed it back to model training. Run regular back tests and champion-challenger evaluations. Calibrate thresholds to balance protection and customer experience as the business evolves.

Training and Change Management

Prepare teams before the first pilot. Train fraud, finance, and compliance users on how agents work, what the explanations mean, and how to escalate. Bring product, data, and operations teams together to improve workflows.

Optimize for Production Performance

Monitor compute and storage costs and optimize feature computation so you pay for value, not waste. Validate disaster recovery and rollback procedures during drills and don’t wait for incidents to occur. Include smart error handling, retries, and safe failovers. Design with speed, scale, and reliability in mind.

How Rishabh Software Can Help You Implement AI Agents for Fraud Detection in Your System

Rishabh Software helps you move from idea to live fraud decisions with a clear, production-ready plan:

Kickoff with clarity

We begin by mapping your fraud hotspots and aligning stakeholders on measurable goals. You get a crisp picture of where losses occur, what “good” looks like, and how to prove impact fast.

Put clean data to work

Our team unifies transaction, identity, device, and behavioral signals, then sets up real-time and batch pipelines plus a reusable feature store. Models receive consistent, high-signal inputs, which boosts accuracy from day one.

Design agents that fit your stack

Roles are clear: data capture, risk scoring, anomaly discovery, and action execution. An orchestration layer coordinates these agents, enforces policy, and involves analysts when a case needs a human call.

Train models that keep learning

Supervised classification pairs with anomaly detection, and NLP comes in where notes or claims carry signal. Investigator feedback and outcome labels flow back into training to prevent drift and sharpen precision over time.

Pilot safely, then go live

Start in shadow mode to measure accuracy and latency against live traffic. When targets hold, switch to action mode and track precision, recall, false positives, time to decision, and customer friction in one place.

Integrate where decisions happen

Agents connect to core banking, processors, identity providers, ERP, CRM, and case tools. Approvals, challenges, and blocks execute in real time without interrupting customer journeys.

Keep decisions transparent

Every action ships with versioned policies and complete audit trails. Compliance teams get the evidence they need for GDPR, PCI DSS, AML, and model risk reviews.

Run with MLOps discipline

Drift and bias monitoring, champion–challenger testing, scheduled retraining, and clear SLAs keep performance steady and costs under control. Reuse data assets, features, and controls to cut time to value for each new journey.

Improve continuously

Regular reviews tune thresholds, refine workflows, and fold new fraud patterns into training. Protection tightens while customer experience stays smooth.

Looking to build and deploy AI-powered fraud detection agents in your system? Explore our AI agent development services to unlock the full potential of your business with AI-driven solutions that streamline operations, automate routine processes, and deliver custom-tailored experiences for your customers.

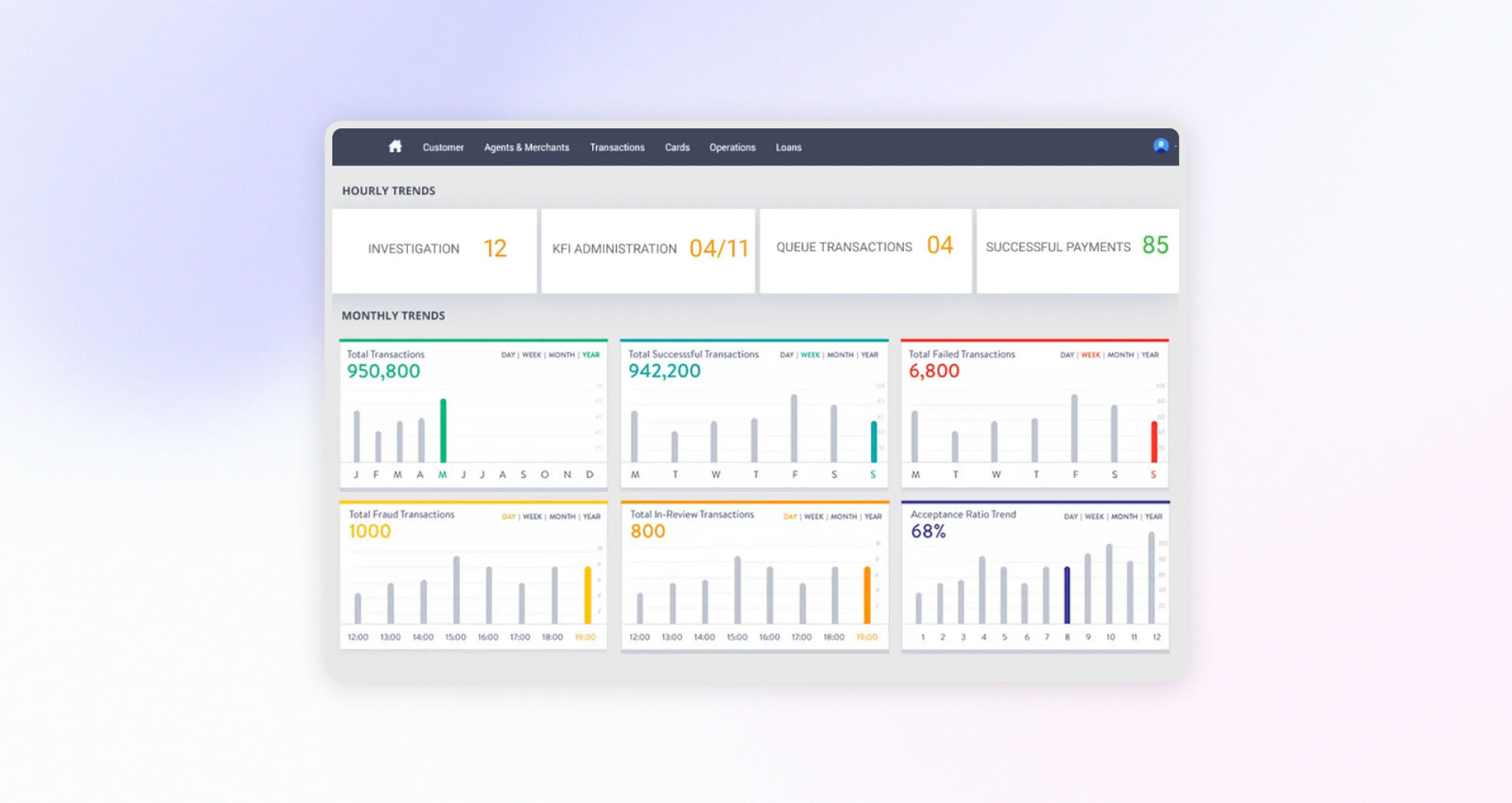

Case Study Showcase: Real-Time Fraud Detection Solution for a Canadian Credit Union

The Mission

A large Canadian credit union needed real-time fraud detection built into its payment flow, not bolt it on after. The goal was to ensure instant approvals, smarter risk checks and seamless scalability.

The Challenge

Legacy monitoring left blind spots, short review windows, and too many suspicious transactions to triage. The team needed real-time screening that could scale with rising volumes and still keep service fast.

The Solution

Rishabh Software embedded an AI-powered fraud layer directly into the core platform. A connector app validated each transaction and sent it to a hybrid analytics engine that combined rules and machine learning for risk scoring and anomaly detection. Orchestration handled routing, timeouts, and failover so actions like approve, flag, or block happened in milliseconds

What Made It Work

- Real-time screening and continuous checks for risky patterns such as rapid withdrawals and atypical locations.

- ML Models learned from historical and live data to stay ahead of new tactics.

- The agentic layer sat inside core banking and handled growth without disruption.

Results

- Zero downtime during processing peaks due to intelligent clustering and automatic failover.

- 4× boost in operational efficiency enabled by AI-driven automation and analytics.

- 100% of transactions screened in real time while sustaining transactions-per-second throughput.

View how we embedded AI-driven risk scoring inside the Bank Fraud Detection and Prevention Software to block fraud in real-time.

With Rishabh Software as your tech partner, agentic AI moves from plan to production quickly, blocks fraud in real time, stays audit-ready, and scales with your business growth.

FAQs

Q. What are Fraud Detection AI Agents?

Fraud detection AI agents are intelligent software systems that stay on top of transactions, user behavior, and system activity in real time to spot and stop suspicious patterns without waiting for human input.

Unlike traditional fraud detection tools that follow pre-programmed rules (“flag all transactions over $10,000 from new accounts”), AI agents operate dynamically. They observe data streams in real-time, build probabilistic models of normal versus anomalous behavior, make independent decisions about risk levels, and adapt their detection logic as fraud tactics evolve.

Example:

Lending platforms are prime targets for fraud rings and first-party abuse. Agentic AI keeps an eye on the entire loan journey from lead capture and KYC to underwriting, disbursement, and servicing, to prevent losses without slowing down approvals.

Q. The Future Trends of AI Fraud Management Agents

The future of AI fraud management is real time and autonomous. Agents will spot risk as it happens and act at once. They’ll use behavioral biometrics and predictive analytics to spot and stop threats before they happen.

These agents will learn nonstop. They will self-optimize with new data. Teams will use generative AI to train on many fraud scenarios, so models adapt fast to new tricks. Security will feel invisible for honest users. Automation will handle most cases, while experts review the hard ones.

Platforms will unify data and insights across every channel. Built-in explainability and compliance will keep regulators and customers confident. AI agents will also move beyond finance into healthcare and e-commerce. They will speed up investigations, fight social engineering, and strengthen defenses.

The result – faster, smarter, and scalable protection. Enterprises stay ahead as threats change. Customers stay safe without any hassles.