Bots are revolutionizing the banking sector like never before & the push toward new-age technologies is encouraging financial institutions to embrace a digital-first mindset. And as the need for multi-layered customer support becomes even more prevalent, traditional banks & startups are making the most of it.

For financial institutions, chatbot development helps focus on improving the business processes and providing a better user experience to customers. This article will provide a walk-through on the essentials of developing a custom banking bot along with the key features & interesting use cases and how we can assist you.

Why a New-Age Banking Bot Matters

Today’s chatbots in banking can perform much more – from streamlining the operations, providing financial advice and cross-sell personalize customer expectations while enhancing their digital experience. This is while creating a competitive edge for the banking institution. Further, banking can become more personalized when you create a chatbot. And, as users rely even more on their mobile devices, they also look for simplified ways of banking. The bots of today help to do just that. Through their choice of device, they help customers transfer money, check account balance, request check/card & more.

Let’s take a closer look at what encompasses the development of a new-age banking bot.

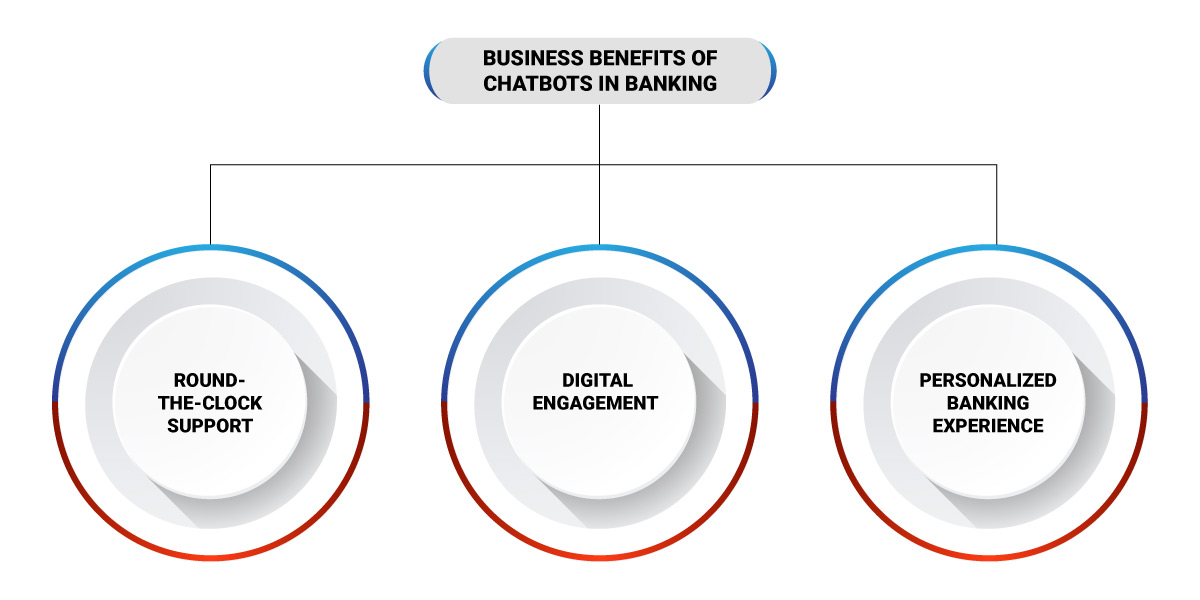

Business Benefits of Chatbots in Banking

Round-the-Clock Support

Chatbots must be able to provide 24X7 support that caters to the needs of customers at all times. In a scenario, even when a call to the bank does not go through, a chatbot can help answer queries.

Digital Engagement

The average customer is still unsure about money management. They could find it time-consuming, confusing and difficult. A banking bot has the power to put their worries to rest. Millennials form a significant part of digital banking. The convenience and ease of communication are of supreme importance to these digital natives. They find it much easier to adapt to newer technologies and even trust that it would make their lives easier.

Personalized Banking Experience

It is no secret that customers expect the best possible experiences at every turn. But personalization is not just about marketing and selling. It is also about keeping your customers informed, sending them updates, providing them with handy resources. Chatbots are as good as a friend whom you can trust with any information. So, the moment the chatbot has access to all customer details, it initiates a further conversation. The chatbot also verifies details like login/password, phone number, email & mailing address and more. This way, they can greet users by name & accordingly they can set up language preferences for a more engaging conversation.

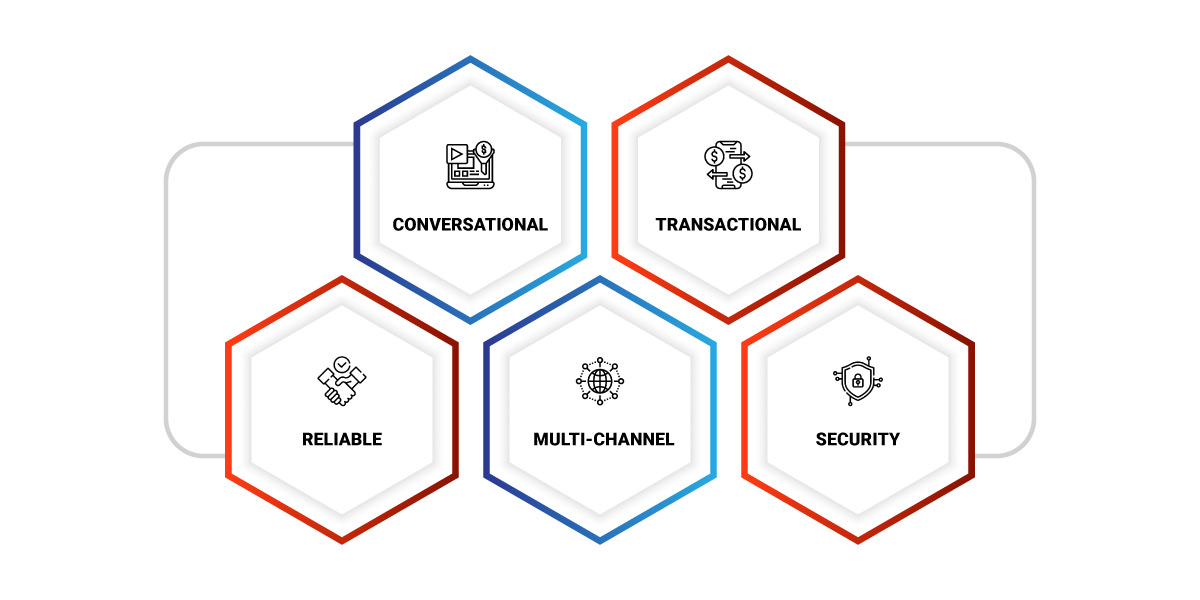

Key Features of a Banking Bot

An ideal virtual assistant should include the following features:

- Conversational: Your bot needs to behave like a financial advisor and not a robot. It is all about humanizing the technology in a way that ensures that customers are not put off by the service. Thus, introducing more conversational language in every interaction will help the customer feel connected.

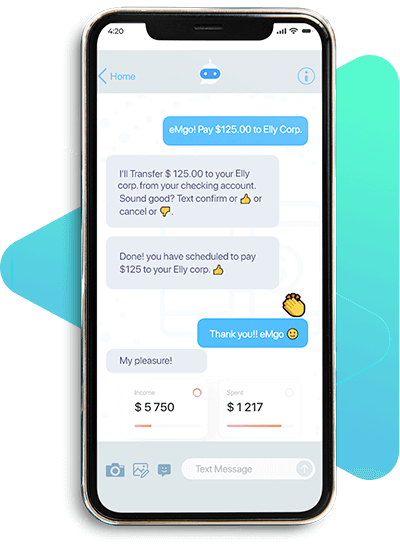

- Transactional: A chatbot is not worth the investment if it cannot manage important operations. The bot needs to be taught to respond to queries like, “I would like to open a new bank account” “Please help me transfer xxx to John” or “Help me create an investment fund”. A virtual assistant must help with facilitating these operations and at the same time, co-ordinate with back-end operations. These integrations are complex and where you require a conversational AI solution that integrates internal and external systems.

- Reliable: At the end of the day, money is a sensitive issue. That’s why the bot needs to represent two important characteristics – reliability and security. Errors in interpreting messages or inaccurate transactions can lead to bigger issues like losing the customer.

- Multi-channel: One of the biggest advantages of having a chatbot is its deployment across channels. Today, customers use different devices for different purposes. They may use their phone for making calls and be present on social media. But they may use a tablet or an iPad for banking and other services. Besides, some customers may be comfortable with banking on an app, while others would prefer a phone call with a virtual assistant. But some customers would enjoy voice assistants like Google Home or Amazon’s Alexa.

- Security: Data privacy and security are the most critical aspect of banking. You must ensure that the data retrieved from customers can be accessed only by your bank. Also, you must integrate your chatbot solution with a centralized authentication system.

Chatbot Banking Use Cases

To help you understand how a chatbot performs all these actions and more, let us take a look at some of the illustrative scenarios of such implementations.1. Transfer & Receive Money

As mentioned earlier, chatbots are a trustworthy virtual assistant that helps with money management. At any time, a customer can transfer funds, cancel transactions and even receive payments. It also integrates other functions like money recharge opportunities to further pay off mobile & credit cards.

2. Review & Customize Accounts

Beyond transactions and payments, users can even explore and customize other aspects of their accounts. They can view transfer limits, card bonus points and recurring payments. Users can also change & update the account with personal details easily.

3. Respond to FAQs

These bots are also trained to respond to any other queries that customers may have. These could be questions that people would ask customer representatives, bank staff, or search on Google. Some of the questions could include, “What’s the interest rate for my savings account?” or “How do I apply for a credit card?” or “How do I apply for a loan?”

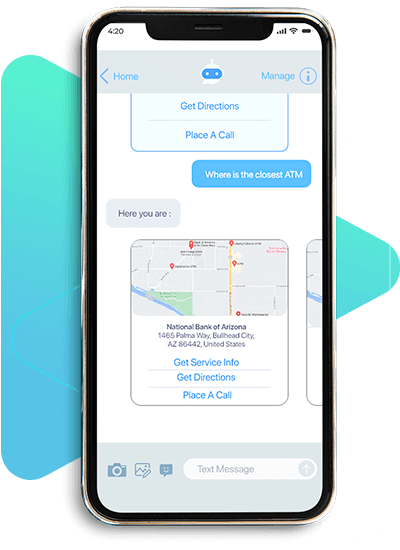

4. Provide Location-Based Answers

The questions you ask a chatbot can vary from one location to another. The answers are very specific to your area and can guide you to the nearest bank if necessary. The chatbot can answer questions like, “Where is the nearest ATM/bank?” or “What are the additional transaction fees for this card?” Once they have your location via GPS, chatbots can respond more accurately to each question.5. Push Notifications

Chatbots are programmed to send important reminders to users. These could be for bill payment, loan application processing, or necessary documentation. The notifications serve as important cues that make the customer aware of things they may have forgotten about.

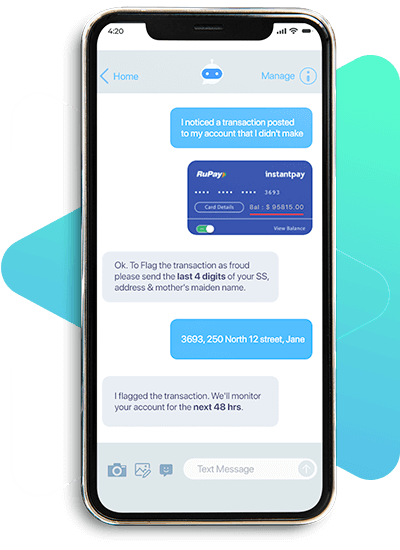

6. Assistance During Suspicious Transactions

One of the biggest concerns that most customers have is the security of their accounts. However, chatbots immediately respond to customer concerns about suspicious transactions. The bot will provide immediate assistance and redirect them to a live agent as quickly as possible.

Banking Bot Development

In an already competitive financial landscape, banks must fuel their strategy with innovation. However, this can come across as a challenge for financial institutions as lack the technological edge. Therefore banks, financial advisories & credit unions often turn to a reliable technology partner who can help design, develop & deploy required solutions for their organization with all the right resources & technologies. These partnerships not only help reap big rewards but also empower you to develop custom solutions at a competitive cost.

At Rishabh, we work with you to thoroughly understand your needs and challenges. And accordingly, we hand over your requirements to our dedicated team of chatbot developers who have the skills & experience in working with technologies like artificial intelligence and machine learning to deliver on your needs. This way, we let you take the backseat, while you watch the magic of automation unfold! We make it a point to ensure that our developed bots are as human as possible to ensure that your backend & front-end operations run as smooth as butter!

Technologies Used by Banking Chatbots

Chatbot development utilizes a whole range of technologies to maintain a balance between performance and functionality. And several programming languages can be used for developing chatbots.

Platform:

- Chatfuel

- Botsify

- Flow XO

- QnA Maker

- Motion.ai

- Dialogflow

Frameworks & languages:

- Python

- Wit.ai

- Microsoft Bot Framework

More importantly, it also has several useful libraries for machine learning to combine with language processing.

As a Microsoft Solutions Partner, we empower global enterprises with functional yet custom apps to better serve customers’ needs. We at Rishabh utilize low code platforms like Power Apps to develop custom bots for your business. After assessing the customer’s unique requirements, we architect the right-fit solution with the optimum number of Microsoft PowerApps developers needed to meet your business objectives. Explore our capability as a chatbot development partner to create a more personalized and engaging customer experience.

Final Words!

The growing adoption of chatbot development services for the banking sector organizations suggests that there’s a vast variety of competitive benefits of investing in this technology considering the profitable opportunities it can offer. Though creation and integration of customer chatbot solutions with the existing system could still prove to be a difficult task that might strain company resources. An experienced technology partner can help capitalize on the benefits for the financial institutions to personalize experiences and achieve digital innovation – the right way.