Digital transformation in financial services is necessary for businesses in today’s fast-paced and ever-evolving digital landscape. It enables the end customers to handle their finances effectively. The new normal includes receiving financial services from chatbots and paying at shops using a smartphone.

With new technologies and changing consumer preferences, finance companies must adopt digital transformation strategies. It enables staying competitive, improving their bottom line, and future-proof their business. It refers to using digital technologies to fundamentally change how a company operates and delivers value to its customers. People often ask:

- What exactly is digital transformation for the finance industry, and why?

- Is it about moving to new technologies, like cloud, IoT & more?

- How do I know which technology is suitable for my business?

- Would it help increase data-driven decision-making capability?

- Does it help in improvising operational efficiency?

Through this blog, we will try to answer some of the questions and explore the role of digital transformation in the finance industry. Here, we will discuss the benefits and challenges and provide insights on how finance companies can successfully navigate the digital transformation journey.

So, let’s begin!

Digital Transformation in Financial Services

Digital transformation in financial services is rapidly changing how the industry operates, from how customers interact with their financial institutions to how transactions are processed and managed. Financial services companies leverage digital technologies to improve operational efficiency, enhance customer experience, and drive innovation.

Digital transformation in the financial sector involves various technologies such as cloud computing, data analytics, artificial intelligence, machine learning, and the Internet of Things (IoT). This may not involve entirely displacing your existing systems. It is about implementing new technologies and changing organizational culture and processes to adapt to the rapidly evolving digital landscape. It remarkably changes how you do business and provide value to consumers. Also, it’s a cultural shift that necessitates constant status quo challenge and experimentation.

Did you know?

A Financial Services Digital Transformation Survey of 100 C-suite executives’ plans around digital transformation suggests that:

- 61% of financial institutions are starting a new digital project,

- 51% of finance companies are revising long-term strategic vision, and

- 48% are accelerating some or all digital transformation plans,

to increase agility and resilience and improve customer experiences in the years ahead.

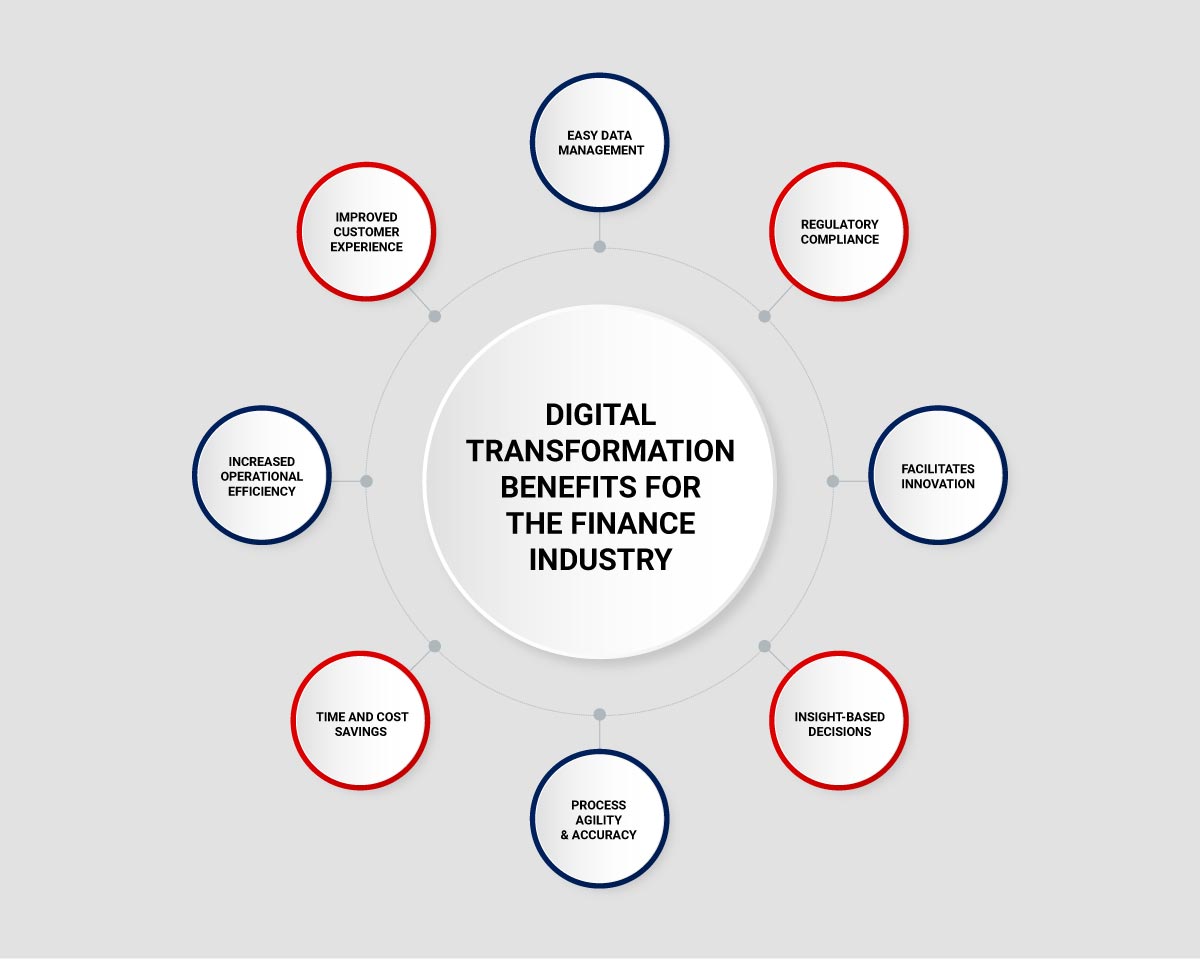

Advantages of Digital Transformation in Financial Services

Digital transformation in financial services refers to integrating digital technologies into financial services, enabling the industry to meet customers’ evolving needs, increase efficiency, and reduce costs. Some of the advantages of digital transformation in financial services include the following:

- Improved Customer Experience: Digital transformation provides customers with a seamless and convenient experience. Today’s tech-savvy customer expects fast-paced services, and digitization takes financial services to their fingertips. It helps financial service companies positively engage customers and offer personalized products and services. It enables customers to access financial assistance anytime and from any location, improving their satisfaction with the services.

- Increased Operational Efficiency: Digitization helps streamline operational processes and automate manual tasks. Using digital technologies such as artificial intelligence, blockchain, and cloud computing reduces the time and cost of financial transactions. Automation of processes also reduces human error and improves efficiency. It helps integrate and share data across the systems easily while enhancing operational efficiency. Digital transformation helps financial institutions move from legacy applications to a user-friendly centralized system.

- Time And Cost Savings: Digitization facilitates cashless transactions that reduce spending on intermediary channels to deliver cash from one party to another. Digital transformation projects leading to reduced hardware by retiring old systems could save costs. Digital transformation enables financial institutions to reduce manual processes, paper-based transactions, and physical infrastructure costs. It leads to cost savings that can be passed on to customers.

- Process Agility & Accuracy: Automation in operations eliminates human errors and increases the precision of repetitive tasks while enhancing efficiency and productivity.

- Insight-Based Decisions: Accurate and real-time data availability with advanced analytics powered by AI (Artificial Intelligence) and ML (Machine Learning) helps finance companies make tough decisions faster and meet customer needs. It is while analyzing this data through effective analytics to derive valuable insights and optimize growth.

- Facilitates Innovation: Digital transformation provides opportunities for financial institutions to create new products and services that are more responsive to customer needs. It also enables them to collaborate with fintech companies to develop new business models.

- Regulatory Compliance: Digital transformation helps financial institutions to comply with regulatory requirements more efficiently. For example, it enables real-time tracking of transactions, which helps prevent fraud and money laundering.

- Easy Data Management: Digital transformation helps finance companies collect, manage, and store data effectively with cloud technologies. Cloud-based digital transformation solutions help smooth transition during events like mergers and acquisitions, which are commonplace in the financial services sector. Contrarily, traditional physical systems cause compatibility issues and increase complexities.

Digital Transformation Trends in the Financial Industry

Banks and non-banking financial institutions that adopt and implement the latest tools and technologies in their operations are far more likely to keep up with changing customer expectations and dynamic market demands. The effective use of technology in the financial services sector offers a lucrative opportunity to update traditional work methods, upskill, innovate, and start adopting digitalization. Some of the pivotal trends that banks and other financial institutions must prioritize include the following:

Banking Sector

- With the surge in FinTech offerings, digital banking services are booming. The use of Automation and Artificial Intelligence has made “digital banking” a reality – from front-end to back-end! For instance, these technologies now enable customers to apply for loans, make account deposits, process transactions, and receive personalized money management advice remotely.

- Neobanks are fully digitalized banks or app-based financial services providing a wide range of services. These banks work much faster, are more convenient, safer, and cost-effective, as all the interactions are 100% online. Plus, customer support services are easily accessible round-the-clock.

- Contactless, instant payments, digital wallets, and “buy now, pay later” (BNPL) options are reshaping the entire payment ecosystem.

- Banks are moving towards cloud-native technology for cost savings, flexibility, and enhanced security.

- With APIs facilitating faster, easier, and cost-effective connections between banks and third-party financial companies, open banking and Banking-as-a-Service (BaaS) are gaining momentum.

Investment Services

- The investment sector is prioritizing digital transformation, especially after facing challenges during the pandemic. APIs, cloud adoption, and automation are industry-specific trends transforming investment experience in terms of convenience, speed, and security.

- Hybrid advisory models that combine self-learning tools and human expertise are gaining traction as robo-advisors are being leveraged to provide wealth management advice.

Insurance Companies

- Insurers are transitioning to user-first, omnichannel approaches to meet evolving client expectations of an omnichannel experience.

- They are leveraging automation and RPA to enhance customer satisfaction while lowering operating costs.

- Insurance companies are turning to advanced analytics to detect fraudulent claims, mitigate risks, personalize marketing campaigns, and predict customer lifetime value.

Tax and Accounting Industry

- Continuous accounting is an innovative approach that leverages automation and technology to streamline processes and enhance accuracy across accounting procedures.

- Data harmonization combines all the transactional data from different sources and forms into a unified system to eliminate data disparities. This is paving the way for more effective analysis and reporting with the use of analytics powered by AI and other predictive tools.

Digital Transformation Technology Trends

Banks, insurers, investment agencies, and accounting firms are now modernizing their operations to offer lightning-fast, hassle-free, and secure access to services. They are transforming digitally with the widespread implementation of technologies such as AI, machine learning, and cloud computing. Let’s look at some of the top technologies that will continue to thrive as financial institutions adopt new digital strategies and business models to serve customers better and stay competitive.

AI and ML to Identify Fraudulent Activities and Automate Processes

Financial institutions are increasingly adopting Artificial Intelligence (AI) and Machine Learning (ML) technologies to improve customer experiences, automate processes, and reduce risks. The applications include fraud prevention systems, trading algorithms in wealth management (including the stock market, real estate, crypto, commodity, and more), risk assessment, prediction and management, chatbots, compliance with rules and regulations, advisory, process automation, and more. They enable institutions to analyze large amounts of data to identify patterns and insights that can inform decision-making. It offers benefits like improved data-driven decisions, increased income using accurate predictions, enhanced customer relationships by learning from user experiences, and faster automated processes. For example, The Bank of America’s AI-powered virtual financial assistant (chatbot) Erica surpassed 1 billion client interactions, significantly increasing operational efficiencies.

IoT to Collect Data and Track Customer Behavior in Real-time

The Internet of Things (IoT) can revolutionize the financial services industry by enabling financial institutions to collect real-time data from connected devices, analyze it, and use it to inform decision-making. It uses a network of interlinked wireless devices that embed sensors like radio frequency identification (RFID) and Bluetooth low energy (BLE) to collect and exchange data in real-time and for cashless transactions. Here are some examples of how IoT is being used in the financial services industry:

- Smart ATMs: IoT-enabled ATMs can monitor their performance and report real-time issues, reducing downtime and increasing customer availability. These ATMs can also provide personalized services based on customer preferences and transaction history.

- Insurance telematics: IoT-enabled vehicle sensors can collect data on driver behavior, such as speed, braking, and acceleration. Insurance companies can use this data to offer personalized policies based on individual driving habits, reducing costs for safer drivers and incentivizing safer driving behavior.

- Smart homes: IoT-enabled sensors in homes can collect data on energy usage, water consumption, and other metrics that can be used to offer personalized financial services, such as energy-efficient mortgages or home insurance policies that incentivize eco-friendly behavior.

- Asset tracking: IoT sensors can track the location and condition of assets such as vehicles, machinery, and inventory. It can improve supply chain management, reduce the risk of theft or damage, and enable financial institutions to offer asset-based lending or financing.

Cloud Technology for Greater Scalability, Security and Resilience

As the cloud has become more secure, banks and other financial institutions like insurance companies have warmed up to moving to the cloud and utilizing its advanced technology tools for better services and products. Cloud technology offers finance apps and microservices frameworks to reduce complexity and cost and improve business agility. For example, investment management company Vanguard uses cloud-based Amazon Web Services (AWS) solutions to build more resilient applications and improve internal communication.

There are many use cases of cloud technology in the finance industry, like Customer Relationship Management (CRM) systems, high-performing applications, monitoring trading activities and deploying risk mitigation strategies, real-time analytics, and more.

Big Data for Accurate Forecasting, Financial Analysis & Investment Advice

Utilizing predictive and prescriptive analytics, Big Data provides benefits like forecasting financial trends, analyzing risk, automating tasks, making data-based decisions, and improving customer transparency. It helps insurance companies with customer analytics and insights to determine whether they should accept someone as a client. It provides real-time analytics and support in marketing initiatives across all financial services.

Other use cases of Big Data in finance include financial market analysis and assistance with investment advice, future planning using predictive analytics, customer segmentation and targeted marketing, fraud detection and prevention, risk assessment and management and more. For example, JPMorgan Chase and Co., one of the largest banks in the US, employs Big Data Analytics to generate insights into customer trends and offers reports to its clients. They can analyze a customer individually and create the report within seconds.

RPA to Drive Speed, Efficiency, and Compliance Across Operations

Robotics Process Automation (RPA) in finance is fast evolving. Complete process automation increases the accuracy of analysis and forecasts. Financial institutions can drive greater productivity, efficiency, and compliance by combining RPA with other intelligent automation technologies.

The use cases of RPA in finance include Customer onboarding, Compliance, Loan processing, Customer service, Accounts payable, Credit card processing, Fraud detection, Know your customer, Account closure, and General ledger. It provides advantages like scaling operations, cutting down expenses, saving time, smooth integration with the existing infrastructure, reduction of human errors, and more.

For example, KAS Bank, wanting to solve the recurring problem of high operational costs, utilized RPA. It implemented five RPA bots and automated 20 financial business processes, including internal invoicing, treasure operations, calculating and booking, and obligation payments.

Blockchain to Expedite Transactions and Secure Data Across Finance Verticals

It enables a decentralized finance (DeFi) ecosystem, offering users more control. It moderates financial settlements and replaces centralized banking systems with smart contracts. This results in faster transactions and real-time cross-border payments. Blockchain-based ledgers increase transaction security.

The DeFi architecture consists of Cryptocurrencies and other services like decentralized exchange (DeX) protocols, Web3-ready infrastructure, non-fungible tokens (NFTs), and peer-to-peer (P2P) protocols. Financial institutions also use the blockchain to safeguard sensitive information, improve brand value, and enhance customer trust. Blockchain has many use cases in finance verticals like capital markets, asset management, payment and remittances, banking and lending, trade finance, and insurance. It applies to almost every operational process in the finance sector.

Cybersecurity for Safeguarding Sensitive Data and Mitigating Risks

The finance industry handles highly sensitive customer data and third-party information. So, it utilizes data privacy solutions like financial data encryption, automated data compliance, role-based access control, network monitoring solutions, and biometric authentication. They help network admins mitigate cybersecurity risks by monitoring data access and network activities in real time. FinTech also leverages quantum computing for data security and integrity in the quantum era.

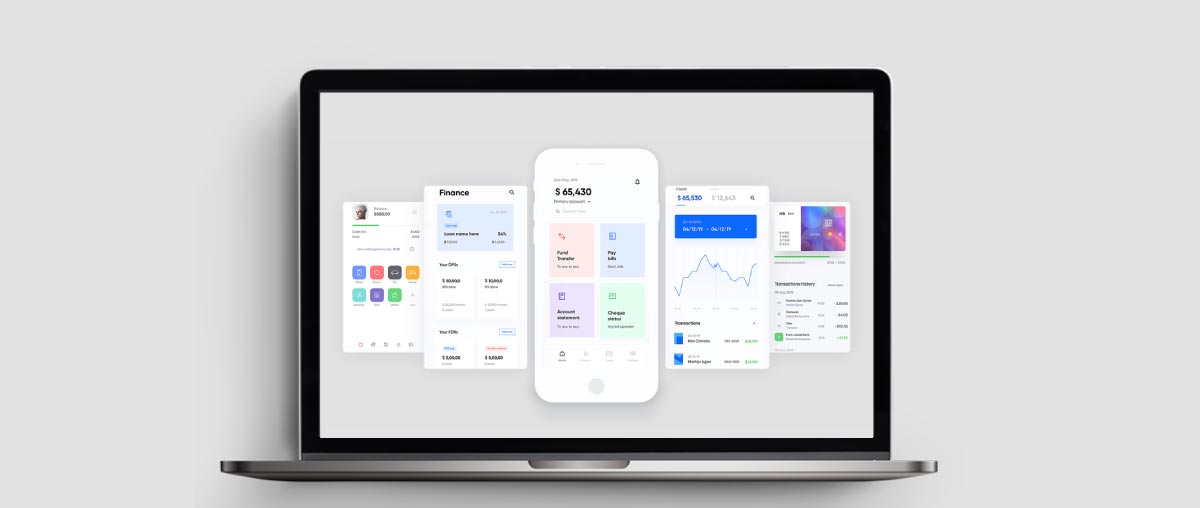

Mobile for Instant Access, Secure Transactions, and Enhanced UX

Google found that six out of every ten mobile users prefer using a finance app over websites on other platforms to manage their accounts. Mobile banking and financial services apps provide instant access to user accounts and associated services. They incorporate user authentication at every step to ensure robust security and reliability. Monitoring all financial transactions, including payments, receipts, and savings, and identifying trends like spending habits and saving cycles is easier for mobile app users. Financial institutions can offer various services with enhanced user experience on mobile apps while reducing operational costs. The world’s first fully functional banking app was launched by the Royal Bank of Scotland in 2009. It was a mobile iPhone banking app that helped customers check account balances and recent transactions on the move.

How can Rishabh help with Digital Transformation in Financial Services?

As digital transformation consultants, we can support you in driving better outcomes powered by enterprise-level tools & technologies. Our team enables us to identify and unlock opportunities. We help identify, open, and activate options for achieving tangible, accurate results regardless of project scope or focus. As an experienced fintech software development services provider, we have worked on developing several FinTech solution to enable organizations throughout their digital transformation journey. We will ensure that the digital transformation project meets your current and potential needs.

Here are some ways in which a custom enterprise software development company can help you with your digital transformation initiatives;

- Assessment And Planning: We help you to assess your current state of digital readiness, identify areas of improvement, and develop a digital transformation roadmap that aligns with the organization’s strategic goals.

- Technology Consulting: Our technology consulting services focus on helping organizations choose and implement the right digital technologies, such as cloud, analytics, and IoT, to enable them to achieve their digital transformation goals.

- Change Management: We support you in managing the cultural and organizational changes that come with digital transformation. It would include developing a change management plan, communicating with stakeholders, and providing employee training and support.

- Data Analytics: We help organizations collect, analyze, and interpret data from various sources to develop their digital transformation strategy. It includes using advanced analytics tools to identify trends, opportunities, and risks to help the organization make data-driven decisions.

- Project Management: Our team provides accurate project management support to help organizations to plan, execute, and monitor their digital transformation initiatives. It includes defining project scope, managing resources, and ensuring the project stays on schedule and within budget.

Success Story: Mobile Money Transfer App Development

The client wanted to simplify currency distribution and facilitate instant fund transfers anywhere for end customers in just a few taps. They wanted this platform to be scalable, intuitive & meet the global compliance norms for fraud detection, tax evasion & anti-money laundering.

Our team developed a Xamarin-powered mobile-based money transaction platform to simplify the global currency distribution process and facilitate instant fund transfers. It was with a .NET-based centrally hosted transaction platform that manages secure fund transfer transactions. It integrates reliable third-party solutions for payment processing. It includes multi-layer user verification, comprehensive support for 1000+ credit unions and bank accounts, international transfer and currency exchange, and real-time updates on exchange rates and currency trends.

Benefits Delivered;

- 100% transparency and traceability of transactions

- 5x increase in operational efficiency

- Highest customer satisfaction achieved to date

Read more about how we helped the client build this intuitive mobile money transfer app that meets the global compliance norms for fraud detection, tax evasion & anti-money laundering.

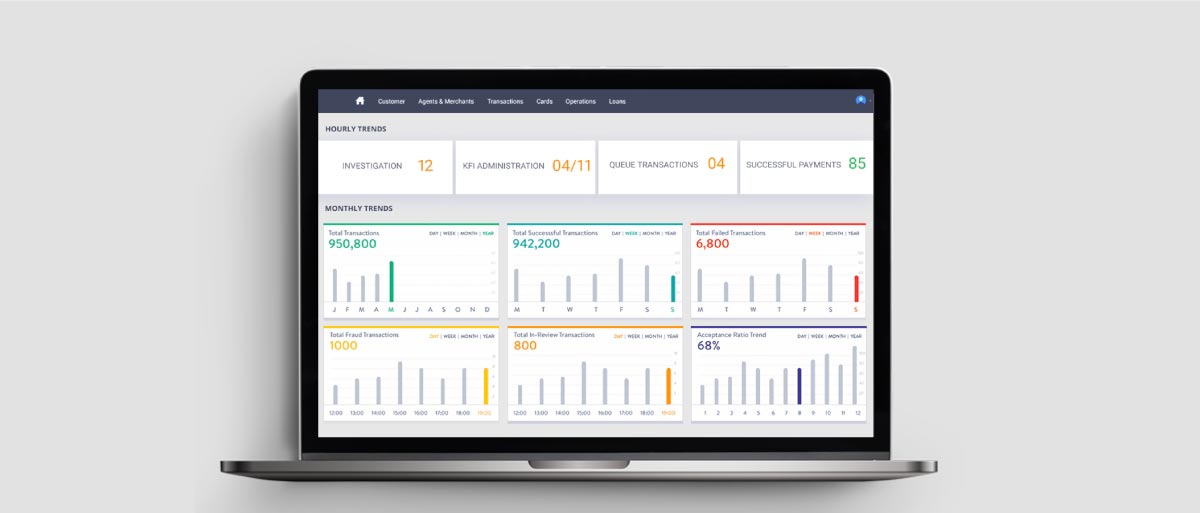

Success Story: Real-time Bank Fraud Detection and Prevention Software

A Canada-based union bank wanted to enhance transaction speed & safety. They wanted to integrate fraud detection and data analytics capabilities into their core banking solution to monitor, identify, and prevent fraudulent transactions.

Our team developed a bank fraud detection & prevention software. It combines a rules-based decision engine & tracks past transactions for usage patterns to detect anomalies & prevent fraudulent attempts.

Benefits Delivered;

- Zero downtime failover with load balancing

- 4x increase in operational efficiency

- Million transaction processing supported per second

Read more about how we helped the client to develop a fraud detection and prevention solution for the banking and finance industry.

Concluding Thoughts

In conclusion, digital transformation is rapidly changing the financial services industry, enabling financial institutions to innovate, streamline operations, and enhance customer experiences. Financial services institutions must prepare for the future and move quickly towards a new world powered by digital transformation. To stay competitive, financial institutions must embrace digital transformation and adopt new technologies and business models that will enable them to serve their customers better, reduce risks, and create new revenue streams. From AI and machine learning to cloud computing and IoT, a range of technologies are driving this transformation, creating new business opportunities, and disrupting traditional models. Companies like Rishabh Software, specializing in developing digital experience services & solutions, can play a crucial role in helping financial institutions to achieve their digital transformation goals, providing expertise, resources, and guidance throughout the process.

30 Min

30 Min