The insurance industry embraces digital transformation in various ways to address complex business challenges from consumers, regulatory and digital ecosystems. Digitization in insurance industry is essential for agile workflows, better data access, and advanced data analytics to improve risk assessment and make informed business decisions. To realize the actual advantages of insurance and digital transformation, it would require data analytics, reporting on the financial performance of products (BI), and strategic plans to offer a holistic view of all the micro and macro indicators of the business.

This blog will explore the importance of digitalization in insurance industry, exploring its key benefits, use cases, trends and common challenges along with their solutions.

Benefits of Digitization in the Insurance Industry

Digitization in the insurance industry has brought about a host of benefits for both insurance companies and insurers. Cost savings, personalized policies, data security, faster claims processing, and better risk assessment are just a few of the advantages.Let’s explore the importance to understand how emerging tech reshapes the insurance sector by making policies more customer-centric, facilitating immediate claim settlement, and making the overall experience innovative.

Enhanced Customer Experience

Digitalization in the insurance industry has enhanced customer experience with easy access to insurance services through online platforms, including websites, mobile apps, and customer portals. This convenience reduces the need for physical visits to insurance offices and long wait times. Policyholders can easily view and manage their policies, file claims, and get quick responses to their inquiries. This level of accessibility enhances customer satisfaction and loyalty.

Streamlined Processes

Digital platforms have streamlined various insurance processes, making them more efficient. Policy issuance, underwriting, and claims processing can be automated and completed much faster. Automation of routine tasks reduces the chances of errors and minimizes paperwork, which benefits both the insurance company and its customers. Insurers can use data analytics to assess risk more accurately, resulting in fairer premiums and improved decision-making.

Cost Savings

The elimination of paper-based processes, reduced need for physical infrastructure, and decreased manual labor all contribute to cost savings. Moreover, insurers can optimize their operations by leveraging cloud computing and data analytics to streamline complex processes. These cost reductions in insurance digital transformation can often be passed on to policyholders through lower premiums.

Personalized Policies

Digital technologies enable insurers to collect and analyze vast amounts of data. This allows insurance companies to offer personalized policies based on a customer’s needs. For instance, auto insurers may provide telematics or usage-based insurance (UBI) policies that adjust premiums according to driving habits. This personalization benefits customers by lowering their premiums and enhancing customer satisfaction.

Data Security

Insurance companies deal with sensitive customer data, prioritizing data security. Digital innovation in insurance industry allows robust security measures to protect this information. Insurers invest in advanced cybersecurity tools and encryption techniques to safeguard customer data against cyber threats. This raises trust and confidence in policyholders as their personal information is safe.

Faster Claims Processing

In the past, filing and processing insurance claims could be tiring and time-consuming. With digitization, policyholders can file claims online and receive quicker responses. Insurers can use predictive data analytics to assess claims more efficiently, reducing fraud and expediting payments to those in need. This not only benefits policyholders during stressful times but also enhances the reputation of the insurance company.

Better Risk Assessment

Digital transformation in insurance sector enables companies to use advanced data analytics and machine learning models to improve their risk assessment processes. Insurers can better understand and manage risk by analyzing historical data and utilizing predictive modeling. This, in turn, helps set more accurate premiums, reduce the chances of overpricing or underpricing policies, and ensure a fair distribution of risk among policyholders.

Challenges of Digital Transformation in Insurance Industry and How to Overcome Them

Digital transformation has several benefits to offer for the insurance sector, but at the same time, it comes with its fair share of challenges that need to be addressed. Accepting the idea of change has been one of the most significant challenges of insurance digital transformation.

#1 Data Security

The risk of cyberattacks and data breaches looms with the insurance industry’s growing reliance on technology. It leads to more potential vulnerabilities and an increase in cyberattacks. According to Verizon’s 2023 Data Breach Investigations Report, ransomware has soared to from 5% in 2020 to 24%[1]; in 2023 becomes increasingly digital. Safeguarding sensitive customer data is a top priority.

Solution:

Insurance companies must invest in robust cybersecurity measures to protect against cyber threats. This includes implementing encryption intrusion detection systems and providing thorough employee training on security protocols. Regular security audits and compliance with industry standards further bolster data protection.

#2 Legacy Systems Integration

Insurance companies often need to grapple with outdated on-prem or legacy infrastructures that are neither easily scalable nor compatible with modern technology. Integrating these systems with newer digital platforms can be complex and time-consuming.

Solution:

A gradual, incremental approach to modernization can ease this challenge. Insurers can progressively replace or upgrade legacy systems one step at a time, integrating new technologies. This approach minimizes disruptions in operations and ensures data consistency during the transition.

#3 Resistance to Change

Embracing new technologies and processes can often be met with resistance from employees accustomed to traditional methods. Adapting to change is a common challenge.

Solution:

To address this challenge, insurers should provide comprehensive training programs to familiarize employees with the new technologies and processes. Implementing effective change management strategies can create a culture of openness to innovation, making the transition smoother.

#4 Regulatory Compliance

The insurance industry is heavily regulated, with various laws and regulations that may differ by region. Ensuring compliance with these regulations during insurance digital transformation can be complex.

Solution:

Staying updated with evolving regulations is essential. Insurance companies should employ experts in regulatory compliance and invest in compliance tools and regulatory technology (RegTech) that automate and streamline regulatory reporting. These measures help ensure adherence to laws and regulations.

#5 Data Management

Digital transformation generates a massive amount of data, which must be efficiently managed and analyzed and turned into valuable insights.

Solution:

Insurance companies can tackle this challenge with advanced predictive and cognitive data analytics and management tools. These tools assist in organizing and analyzing data, enabling the extraction of actionable insights from the information generated.

#6 Cost Management

Digital transformation in the insurance industry comes with financial costs, from infrastructure upgrades to staff training and technology investments.

Solution:

Careful financial planning is essential. Insurers should prioritize investments that promise a return on investment (ROI). Implementing cost control measures, such as scalable cloud-based solutions that reduce infrastructure costs, can help manage expenses effectively.

Digital Transformation Use Cases for the Insurance Sector

Let’s explore some practical examples CIOs should know and how they can be implemented to make a real difference to generate better growth.

Claims Processing

Claims processing involves various tasks such as reviewing, adjusting, investigating, approving, or denying claims, typically requiring financial advisors to handle multiple documents. However, this entire process can be automated with the help of AI. Advisors can automatically extract data from documents and make decisions to approve or reject claims. This help insurance companies to be more agile, improve efficiency, and reduce processing time.

Risk Analysis

Insurers can gather personal data about applicants, including their age, pre-existing conditions, medical records, claims history, and lab test results. This data can then be used to set premiums for everyone accurately. By leveraging this information, insurance companies can offer personalized pricing based on the applicant’s risk profile.

Online self-service portals

Insurers can establish a customer portal that serves as an information hub. This portal allows customers to access their policy information, download resources, make payments, and submit requests or inquiries. This enhances the overall customer experience and ensures that policyholders can easily access information and receive assistance when needed, whether online or through other channels. Similarly, for insurance companies too, it leads to improved customer satisfaction, efficiency and reduced costs. This omnichannel approach improves accessibility and customer satisfaction.

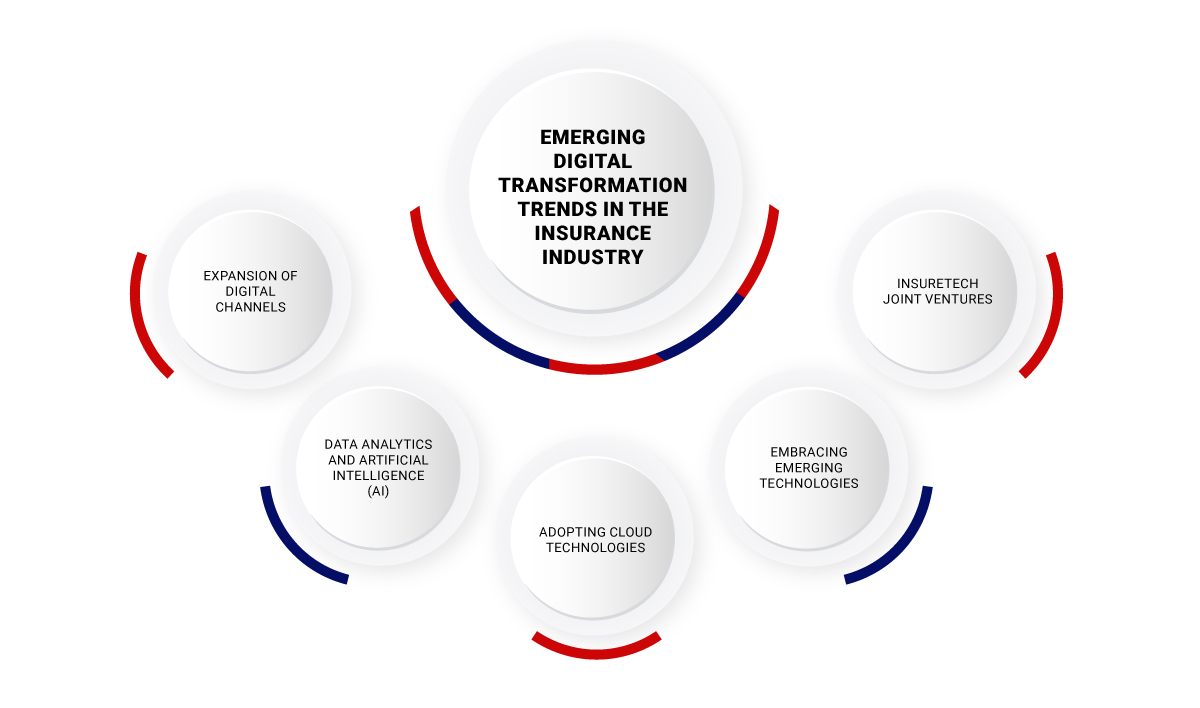

Top Digital Transformation Trends in Insurance Industry

Rapid technological advancements have brought about significant changes in the insurance sector. These trends are reshaping how the insurance industry operates, from harnessing the power of IoT, leveraging machine learning, and embracing dematerialization to offering personalized services.

Let’s explore the current trends in insurance digital transformation, highlighting how these advancements help insurance companies improve the services offered to policyholders.

Expansion of Digital Channels

Customers are increasingly looking for convenient ways to interact with their insurance providers, and this has led to the expansion of digitalization in insurance industry. Insurers respond to this demand by offering online portals, mobile apps, and chatbots to facilitate smoother customer interactions. Ensure you develop these digital channels from a professional Insurance mobile app development company to provide convenient, more personalized, and engaging experiences to your customers.

Use of Data Analytics and Artificial Intelligence (AI)

Insurers are getting smarter with data analysis and AI. They use these tools to improve their underwriting, pricing, and claims processes. For instance, AI enables insurers to analyze huge volumes of customer data to identify patterns that can help insurers predict risk and set more accurate prices. AI can also be used to automate claims processing and reduce fraud. Thus, Digital transformation in insurance industry brings many benefits for both insurance companies and their customers.

Adopting Cloud Technologies

Insurance companies constantly seek new technologies to provide exceptional customer experience and reduce insurer overhead costs. Around 72%[2] of insurance companies expect to increase their cloud computing and storage spending.

Cloud Adoption in Insurance Industry is a pivotal strategy that helps costs on IT infrastructure, achieve on-demand scalability and eliminate data silos to amplify the growth of insurance companies.

Cloud technology offers a direct and real-time channel for customers to engage with their insurance provider. This digitalization in the insurance industry helps insurance companies streamline internal processes and significantly reduces the time required for claims processing.

Embracing Emerging Technologies

The insurance sector is rapidly adopting cutting-edge technologies such as the Internet of Things (IoT) and blockchain to enrich the quality of their services and provide an exceptional customer experience.

IoT assists insurance companies in collecting data from interconnected devices, such as smart homes and vehicles, to offer highly personalized insurance coverage. This data empowers insurers to gain deeper insights into customer behavior and risk profiles to develop more tailored insurance policies.

Blockchain technology, on the other hand, introduces secure and efficient systems for processing insurance claims and managing policies. Blockchain technology’s inherent transparency and security features establish a trustworthy means of handling these critical aspects of the insurance industry.

The Rise of InsureTech Joint Ventures

There is steady growth in the partnerships between InsureTechs and incumbents. Popular companies are tapping on customer data to create new income streams. InsureTechs on the other hand, are stepping forward to provide technical know-how, technology, and all-around support.

Choose Rishabh Software as a Trusted Partner to Digitize Your Insurance Business

As a trusted development partner in this digital transformation journey for your insurance business, we offer a compelling combination of domain expertise, strong partnerships in the industry, and technology prowess. We can help you develop enterprise software solutions that you need to stay competitive in the market.

As a leading enterprise mobile app development company, our approach rests on understanding APIs, Analytics, Data Virtualization, Agile Delivery, and DevOps to meet the growing needs of global insurers. This expertise empowers us to develop customized solutions that drive efficiency, enhance customer experiences, and unlock new revenue streams for your insurance business.

Conclusion

Although the insurance industry is usually seen as slow to change, it’s now adapting through digital transformation. This is altering how insurance companies do business. Many insurance firms — especially small-to-medium carriers and those with smaller sets up with the right tech talent are effectively leapfrogging the competition. They are addressing revenue, retention, and customer experience concerns by implementing advanced technology.

Frequently Asked Questions

Q: What Does Digital Transformation Mean For Insurance Industry?

A: Digital Transformation in insurance is the integration of digital technologies into various aspects of business operations. This involves using digital tools to improve tasks, offer better customer services, and make insurance processes more efficient. Examples include online policy purchases, digital claims processing, and using data analysis to understand and manage risk. The aim is to make insurance companies more adaptable and customer-friendly in the digital age.

Q: How can insurance companies accelerate their digital transformation?

A: Insurance companies should begin by

- Identifying their specific goals and needs.

- Investing in modern technology, like automation and digital platforms, is crucial to streamlining processes and enhancing customer experiences.

- Collaborating with technology experts can provide valuable guidance.

- Finally, embracing agile methodologies and fostering a culture of innovation can further expedite the transformation process.

Q: How can insurance companies use data and analytics to improve their business?

A: Companies collect and analyze customer data, claims history, and market trends to refine their underwriting, pricing, and risk assessment processes. Data-driven insights also help detect fraud, predict customer behavior, and offer personalized services. By harnessing the power of data and analytics, insurers can enhance efficiency, reduce costs, and provide better value to their policyholders.

Footnotes:

1. https://www.insiderintelligence.com/content/insurance-industry-poised-transformation