With rising online fraudulent activities in Finance, our client wanted to automate the investigation process and deliver faster case resolution. We developed a custom investigation management solution using Java technologies and followed CMMI 3 processes to adhere to the standard development norms.

Objective

With the recent resurgence in regulatory enforcement actions and media focus on anti-money laundering (AML) & sanctions issues, financial institutions are under tremendous pressure to monitor and identify suspected illegal activity. As a result, the client required an Investigation management software in its AML compliance program. The investigation management solution developed by us automated the process for detecting, investigating and reporting suspicious behavior activities in financial institutions.

Challenges

- Lack of group-wide compliance and supervision

- Low monitoring and evaluating new AML events and rules

- Unstructured analysis of customer transactions and low security

- Manual process of Suspicious Activity Reports (SARs) filings

Approach

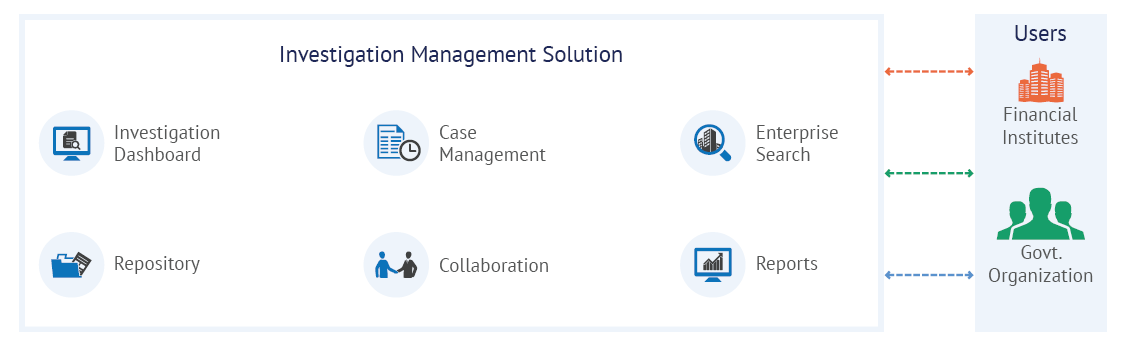

On understanding the client’s business challenges and requirements, Rishabh Software leveraged Java application development to build an investigation case management software, designed to enable financial institutions to identify, develop and apply money laundering and risk assessments in financial transactions.

Investigation management software used a pattern-based approach for identifying transactions, monetary instruments and dates of transactions. It used business intelligence techniques and provided a wide array of predictive and early warning alerts. The solution served strong anti-fraud, anti-money laundering and business intelligence capabilities.

Business Benefits

- Generate investigation reports automatically

- Business intelligence through in-depth monitoring

- Ensure compliance and international norms for fraud events

- Automated process for detecting, investigating and reporting suspicious behavior

Industry Segment

Finance

Customer Profile

Based in New York, USA, the organization was founded in 2006 as a research and development firm specializing in real-time data analysis for the purpose of dynamic knowledge management (“dKM”), data surveillance and business intelligence. The client offers a wide range of risk management and knowledge management financial services.

Technology and Tools

- Java

- Jasper Reports

- JDesktop Integration Components

- Apache Tomcat

- WebSphere

- Oracle

- Microsoft® SQL