Business intelligence (BI) solutions have long been integral to the fintech sector, offering invaluable tools for risk assessment, cost management, and obtaining detailed customer insights. In an era where data-driven decision-making is paramount, BI has become a crucial asset that empowers financial institutions to make informed decisions. The successful implementation of robust business intelligence practices is no longer an option but a necessity as you seek to fully leverage BI’s transformative potential.

Let’s explore how BI in the banking and finance industry works. We will highlight its key benefits, practical applications, and how it is transforming the industry. By the end, you will have a clearer understanding of how to leverage business intelligence to drive better decision-making and enhance your organization’s performance.

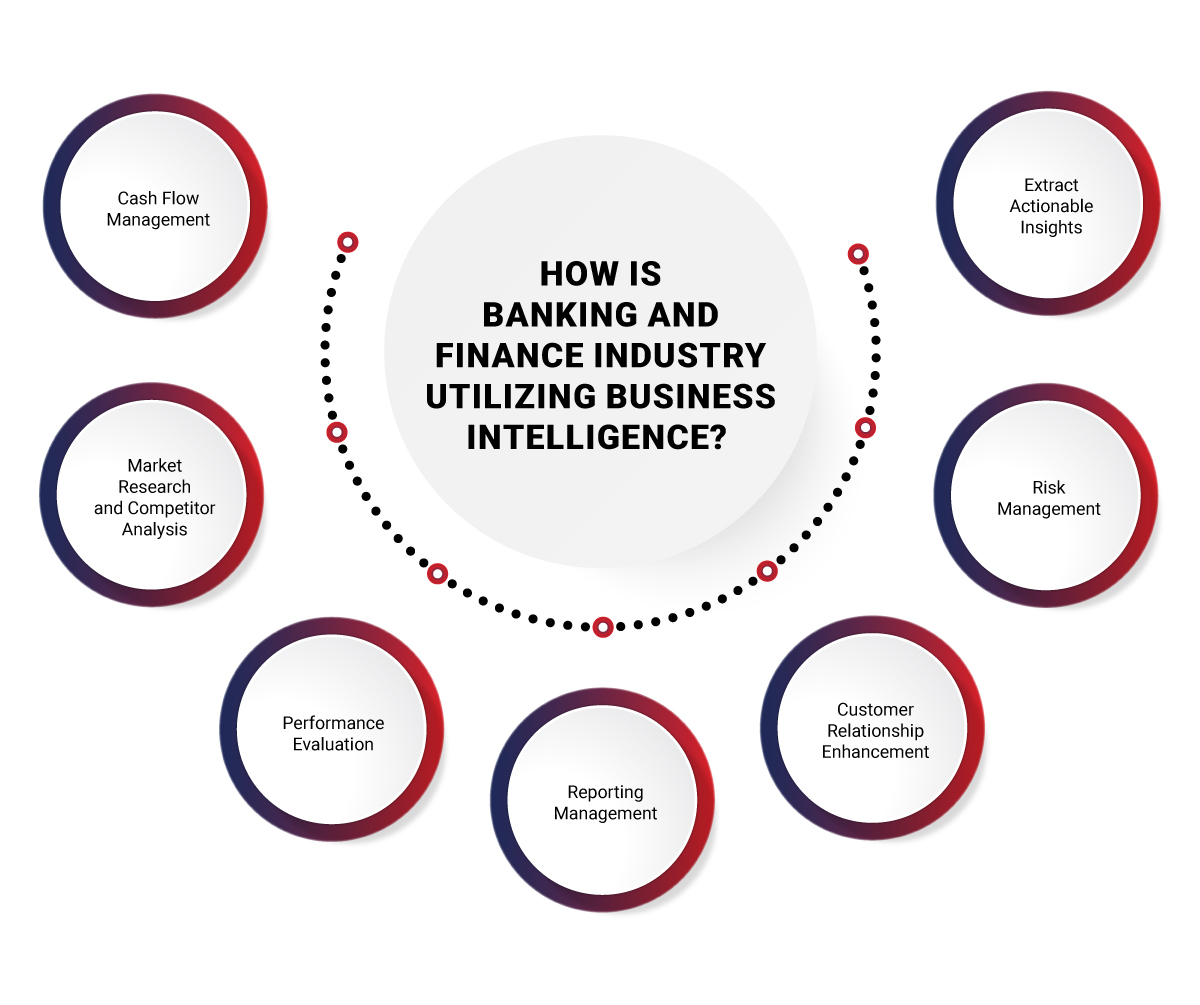

How is Banking and Finance Industry Utilizing Business Intelligence?

Banks, investment firms, and various financial institutions are progressively shifting to Business Intelligence (BI) solutions as a foundational tool for acquiring more profound insights into their operational complexities, evolving market dynamics, and the behaviors of their clientele.

Let us understand how BI in banking and finance industry works to make data-informed decisions, enhance operational efficiency, and elevate customer experiences.

Extract Actionable Insights

Business Intelligence entails a technology-driven process of scrutinizing and presenting data, enabling organizations to make intelligent business choices. BI for financial services involves detailed analysis of extensive financial data to extract insights, detect patterns, and forecast market movements.

Risk Management

Risk assessment and mitigation are the cornerstones of BI deployment within banks and financial institutions. These entities scrutinize data pertaining to customer transactions, market dynamics, and economic indicators to evaluate potential risks. Timely identification of unsafe investments or borrowers empowers them to make prudent decisions, minimize losses, and safeguard their assets.

Customer Relationship Enhancement

Enhancing customer relationships is the most-important aspect for banks and financial institutions. They analyze customer data through banking business intelligence, encompassing transaction histories, account balances, and preferences. This data-driven approach enables them to tailor their services and marketing strategies, resulting in superior customer experience and strengthened customer loyalty.

Reporting Management

Business intelligence in banking industry provides interactive dashboards and charts that enable organizations to use advanced data visualization capabilities. These visual representations help simplify complex financial data easily. With effective and accurate reports, decision-makers can quickly identify trends, deviations, and key performance indicators, facilitating quicker and more effective decision-making. It also expedites error identification and correction within the finance department, enabling data-driven decision-making.

Performance Evaluation

Business Intelligence tools for banks enable comprehensive performance assessments of financial products and services. These allow banks to track KPIs like loan approval rates, investment returns, and customer satisfaction. This data-driven scrutiny helps banks understand the performance of their products and identify underperforming products to optimize their offerings and enhance profitability.

Market Research and Competitor Analysis

BI tools are used to collect data from diverse sources. This data is then utilized to conduct market research, facilitate gathering of market intelligence and competitor analysis. BI tools are also used to analyze data to identify trends, patterns, and valuable insights through reports and visualizations to understand the market landscape. This valuable insight guides product development and strategic decision-making. A deep understanding of market trends and competitor strategies helps you stay competitive.

Cash Flow Management

BI assists in identifying areas important for cost optimization. This helps banks streamline operations and optimize resource allocation to boost profitability while preserving the quality of their services. In the event of budget shortfalls or excessive spending, it is often a challenge to identify root causes and the right solution quickly. However, banking business intelligence tools make it easy to tackle such situations since they automate real-time tracking of expenditures, providing financial oversight to banking and financial organizations.

Benefits of Business Intelligence in Banking Industry

The Banking industry is experiencing a notable transformation by adopting Business Intelligence (BI) tools and practices. In a survey by SAS – ‘Banking in 2035’, 48%[1] of executives selected technology and advanced data analytics as the most important digital capability their organization must harness to remain competitive.

BI helps analyze trends and identify patterns and enables real-time reporting. Let us explore other major benefits of BI in banking sector to understand how it positively affects the overall banking industry.

- Enhanced Decision Making: BI systems provide real-time access to data, enabling banks to make quicker and more informed decisions. They can promptly analyze customer preferences, market trends, and financial performance, leading to better product development strategies.

- Improved Customer Service: BI helps banks understand their customers better. Banks can tailor their services to meet individual needs by analyzing customer behavior and preferences. This personalization enhances customer satisfaction and loyalty.

- Risk Mitigation: The Banking industry is inherently exposed to various risks, such as cyber-attacks, geo-political uncertainty, among others. BI tools assist in identifying and assessing these risks more effectively. Banks can use historical data and predictive analytics to manage credit risks, detect fraudulent activities, and ensure compliance with regulations.

- Operational Efficiency: BI streamlines internal processes and automates manual repetitive tasks. This efficiency leads to cost savings and faster response times. Banks can optimize resource allocation, automate routine tasks, and allocate capital more efficiently.

- Regulatory Compliance: Banking is a heavily regulated industry. BI systems assist banks in tracking and adhering to complex regulatory requirements. They can generate reports and audit trails to demonstrate compliance, reducing the risk of fines and penalties.

- Fraud Detection: BI tools are adept at detecting unusual patterns and anomalies in transactions. This helps banks identify potentially fraudulent activities in real-time, protecting the institution and its customers.

- Cost Reduction: By optimizing operational efficiency, reducing manual labor, and minimizing errors, BI eventually contributes to cost savings. BI tools help identify areas where the bank wastes money through inefficient processes, and underperforming products. It also guides on ways that banks can allocate resources more efficiently and manage their budgets effectively.

- Forecasting and Planning: BI enables banks to make accurate financial forecasts and long-term plans. Banks can thus anticipate future challenges, such as changing interest rates or economic downturns, and devise strategies to mitigate their impact.

- Competitive Advantage: Implementing BI gives banks, a competitive edge. Those who can harness data effectively are better positioned to offer innovative services, attract new customers, and retain existing ones.

BI Applications in Banking

BI solutions have become popular in helping banks leverage their data to enhance customer experiences. To give you a better understanding and overview, let us explore some common applications of BI in the banking sector and comprehend how it drives customer-centric strategies, empowers cautious risk management, and ultimately contributes to the industry’s overall success.

Analytical Customer Relationship Management (CRM)

Within the banking sector, BI tools prove invaluable for comprehending customer behavior, needs, and preferences. This understanding empowers banks to provide tailored services, execute targeted marketing strategies, and offer tailored product recommendations. The outcome is increased customer satisfaction and loyalty.

- Segmentation and Targeting: Utilizing BI, banks effectively segment their customer base based on demographics, transaction history, and behavior. This segmentation allows for tailored marketing efforts and increasing campaign effectiveness.

- Churn Prediction: Banks use predictive analytics offered by BI to forecast customers who might leave. This early identification enables banks to take initiatives, such as personalized service offers, to retain valuable clients.

- Cross-Selling Opportunities: Leveraging BI insights from customer data, banks can identify opportunities for cross-selling additional products or services. BI tools allow banks to personalize recommendations based on customers’ past behavior to enhance revenue and customer satisfaction.

Bank Performance Management

Banking institutions leverage BI to oversee and optimize their performance. By providing insights into critical financial KPIs such as profitability and operational efficiency, BI equips bank executives with data-driven decision-making capabilities, leading to improved financial outcomes.

- Key Performance Indicators (KPIs): Banks utilize BI to define and track KPIs like return on assets (ROA) and cost-to-income ratio, enabling them to assess financial health effectively and set performance targets.

- Budgeting and Forecasting: BI tools streamline budgeting and forecasting by providing historical data analysis and predictive modeling. This empowers banks to create precise financial forecasts and allocate resources efficiently.

- Branch and Channel Optimization: Banks can assess the performance of individual branches and digital channels through BI analysis. This data-driven approach helps banks allocate resources strategically and optimize their service networks.

Enterprise Risk Management

Banks benefit from BI in identifying and mitigating risks across their operations. BI’s analytical capabilities, fueled by historical data and market trends, enhance the assessment of credit, market, and operational risks. This proactive approach to risk management has proven instrumental in preventing financial losses.

- Credit Portfolio Analysis: BI supports banks in evaluating the credit quality of their loan portfolios. It identifies risk concentrations, assesses default probabilities, and aids portfolio diversification.

- Stress Testing: Using BI, banks conduct stress tests to simulate adverse economic scenarios. Banks can thus gauge their resilience to economic downturns and formulate effective risk mitigation strategies.

- Operational Efficiency and Risk Mitigation: BI tools help banks identify operational inefficiencies that can lead to operational risks. Process optimization and automation further help reduce the likelihood of operational failures and associated risks.

Asset & Liability Management (ALM)

BI tools are valuable assets for collecting, analyzing, and visualizing data from various sources, which helps banks gain a better understanding of their asset and liability structure. These tools allow banks to monitor cash flows, interest rates, and liquidity closely. By maintaining the optimal balance between assets and liabilities, banks ensure they can meet their financial obligations while optimizing profitability.

- Liquidity Risk Management: Banks monitor and manage liquidity risk in real-time by analyzing cash flows and liquidity positions through BI. This ensures they have sufficient liquidity to meet short-term obligations.

- Interest Rate Risk Analysis: BI tools assist banks in analyzing the impact of interest rate changes on net interest income. This analysis informs decisions about interest rate risk mitigation strategies.

- Balance Sheet Optimization: BI enables banks to optimize their balance sheets by identifying opportunities to improve the mix of assets and liabilities. This optimization enhances profitability and risk management.

Compliance

Ensuring compliance with regulatory requirements becomes more streamlined with the help of BI. It automates the data collection and reporting processes, effectively reducing non-compliance risk. Banks can thereby maintain adherence to industry regulations, safeguarding against potential penalties.

- Regulatory Reporting Automation: Utilizing BI, banks automate the collection and consolidation of data required for regulatory reporting. This reduces the risk of manual errors and ensures timely and accurate submissions to regulatory authorities.

- Anti-Money Laundering (AML) Compliance: BI supports AML compliance efforts by analyzing transaction data for suspicious activities, helping banks detect and report potential money laundering activities.

- Audit Trail and Data Governance: BI tools provide a transparent audit trail of data, ensuring data governance and compliance with data protection regulations. This allows banks to demonstrate data lineage and adherence to data privacy requirements.

Business intelligence is an incredibly powerful banking sector tool to eliminate siloed back-office operations. By employing the BI capability, banks can improve customer satisfaction, increase business efficiency, and gain a competitive advantage. Now, moving ahead, let’s explore how business intelligence is applied in the financial sector and how it helps to enhance your revenue streams, operational efficiency and increase profitability.

Benefits of Business Intelligence in Financial Industry

The Financial Industry relies on many factors to ensure its stability and growth. By thoroughly integrating data analytics, business intelligence for financial services helps enhance financial performance, make intelligent decisions, optimize operational efficiency, achieve regulatory compliance, and execute more precise financial forecasting.

- Improved Financial Performance: Financial Business Intelligence tools provide finance professionals with precise and up-to-date insights into their financial performance. This empowers them to pinpoint areas where cost reductions are possible and uncover new avenues for revenue generation. The ability to make data-driven decisions can significantly impact the bottom line.

- Enhanced Decision-Making: In the complex world of finance, data-driven decisions are crucial to success. BI provides financial teams with the necessary data to make well-informed choices concerning budgeting, forecasting, and other financial aspects. With access to comprehensive data and reports made available by BI, organizations can better allocate resources and adapt to changing market conditions.

- Streamlined Efficiency: One of the most compelling advantages of BI is its capacity to automate non-value-added repetitive manual financial processes, such as data collection and analysis. This automation saves time and minimizes the risk of errors in financial reporting and analysis. As a result, financial professionals can focus their efforts on high-value strategic activities.

- Regulatory Compliance: Financial institutions operate under a web of strict regulations and reporting requirements. BI systems provide the tools to monitor and report on financial performance accurately. This ensures that organizations comply with all relevant financial regulations, reducing the risk of costly penalties.

- Effective Financial Risk Management: The financial industry is exposed to various inherent risks. Financial Business Intelligence solutions assist organizations in identifying and evaluating potential risks. They also enable continuous monitoring of risk management strategies, allowing for proactive adjustments when necessary to safeguard financial stability.

- Enhanced Transparency: Transparency is crucial for internal stakeholders like management and stakeholders like investors in the financial sector. Business intelligence in financial services offer greater visibility into financial performance and trends, promoting trust and accountability. This transparency helps strengthen relationships and build confidence among stakeholders.

- Accurate Forecasting: Forecasting plays a crucial role in financial planning. BI empowers finance teams with historical data and trend analysis to create more precise budgets and forecasts. Organizations can thus make more reliable financial plans by basing predictions on robust data.

- Enhancing Financial Insights with Dashboards: BI tools gather data from various sources within the financial institution, including transaction records, market data, customer information, and more. This aggregated data is then transformed into meaningful visualizations. Dashboards present complex financial data in a visually intuitive manner. Charts, graphs, and interactive visual elements allow financial professionals to grasp and interpret information quickly, making it easier to identify trends and anomalies.

Advanced Applications of Business Intelligence in Financial Services

BI in the financial services industry enables organizations to utilize the wealth of data, transforming it into actionable insights and enabling a more informed and adaptive financial ecosystem. Let us understand in detail how BI is reshaping the financial industry and empowering it with exceptional potential for growth and innovation.

Investment Analysis

Business Intelligence tools are used extensively for investment analysis in the financial sector. They help financial professionals in hedge funds, mutual fund companies and others gather and analyze market data, historical performance, and asset trends to make informed investment decisions. Business intelligence in finance enables portfolio managers to identify potential investment opportunities and risks, allowing them to optimize asset allocation and maximize returns for clients.

- Data Aggregation: Business Intelligence gathers data from various sources, including financial markets, economic indicators, and historical asset performance, providing a comprehensive view for investment professionals.

- Risk Assessment: BI tools offer risk modeling capabilities, enabling investment analysts to assess the risk associated with different asset classes and investment strategies.

- Performance Monitoring: BI dashboards allow real-time tracking of investment portfolio performance, helping investors make timely decisions based on current market conditions.

Credit Risk Assessment

Financial institutions employ Business Intelligence to assess credit risk when extending loans or credit lines. To determine creditworthiness, BI systems analyze borrowers’ credit histories, financial behaviors, and economic indicators. This detailed and proactive approach makes lending decisions based on accurate risk assessments, reducing the probability of loan defaults. Microsoft and Moody’s Corporation[2] have recently announced a strategic partnership that leverages Microsoft Fabric and Azure OpenAI Service for corporate intelligence and risk assessment

- Credit Scoring: Business Intelligence systems employ credit scoring models to assess the creditworthiness of borrowers. This evaluation is based on a comprehensive analysis of borrowers’ credit histories, payment patterns, and financial behaviors.

- Historical Data Analysis: Financial business intelligence tools assess historical data to identify trends and patterns related to loan defaults, enabling financial institutions to refine their lending criteria.

- Automated Decision-Making: BI automates the loan approval process, making it faster and more consistent while reducing the chances of human bias in credit assessments.

Fraud Prevention in Payment Processing

Business Intelligence (BI) plays a crucial role in safeguarding the integrity of payment processing systems within the financial industry. BI systems help in preventing fraud by employing advanced analytics and monitoring capabilities.

- Transaction Analysis: BI tools thoroughly analyze every transaction that flows through the payment processing channels. They scrutinize many transactional attributes, such as transaction amounts, geographical locations, device types, and transaction frequencies. This comprehensive analysis allows BI systems to establish a baseline of typical transaction behavior.

- Pattern Recognition: BI leverages machine learning algorithms to identify patterns and anomalies within transactional data. It can swiftly identify transactions that deviate from the norm by comparing incoming transactions to the established baseline. Suspicious activities, such as extensive transactions, transactions from unexpected locations, or a series of rapid transactions, trigger immediate alerts.

- Real-time Monitoring: One of the strengths of BI in fraud prevention is its ability to perform real-time monitoring. As soon as a potentially fraudulent transaction is detected, BI systems trigger instant alerts to fraud prevention teams or automated security measures. This real-time response is crucial in halting fraudulent activities before they can cause significant financial damage.

- Adaptive Learning: BI systems employ AI algorithms to analyze new data continuously and update models to respond to emerging fraud detection capabilities. This adaptability ensures that fraud prevention remains effective despite ever-evolving threats.

- Enhanced Customer Trust: Business intelligence in the financial industry helps achieve transparency identify and mitigate risks to maintain customer confidence. Customers can rely on secure payment processing, reducing the risk of financial loss and identity theft. This trust is essential for the long-term success and reputation of financial organizations.

How Does Rishabh Software Assist in Maximizing the Advantages of BI for Banking and Finance Organizations?

As an experienced business intelligence services company, we specialize in building and implementing BI solutions across industries. Our team is proficient in building custom BI applications integrated with analytics capabilities to identify, measure, track, and analyze operations efficiently. With a complete range of reporting templates, the financial institution can create and extract real-time reports, graphs, tables, and dashboards to monitor real-time performance.

Our team helps achieve end-to-end visibility by empowering banks with custom BI solutions that:

- Better adjust to the individual’s customer needs

- Foster collaboration between business and IT teams

- Create a solid base for security and compliance reporting

- Optimize the management information system (MIS)

We utilize an extensive IT infrastructure encompassing data visualization tool such as Power BI, Tableau, and SQL Reporting Service and data warehousing solutions like MySQL, SQL Server, and various others.

Conclusion

Integrating Business Intelligence (BI) in the banking and finance sectors is not merely an innovation but a fundamental necessity. BI plays a significant role in reshaping how these industries operate in a world driven by data. It equips organizations to utilize their extensive data resources effectively, converting them into actionable insights that inform decision-making and enhance operational efficiency.

Frequently Asked Questions

Q: What are business intelligence tools for banks and finance?

A: Business intelligence tools for banks and finance are software solutions crafted to assist financial institutions in collecting, analyzing, and visualizing data for informed decision-making. These tools encompass data integration, reporting, dashboards, and predictive analytics, aiding banks and financial organizations in risk management, fraud detection, customer insights, and operational efficiency. Notable business intelligence tools for this sector include Tableau, Power BI, QlikView, and SAS Business Intelligence.

Q: What is the role of BI in banking and finance?

A: BI plays a crucial role by empowering data-driven decision-making through:

- Real-time analytics dashboards for monitoring financial performance

- Advanced reporting tools for risk assessment and management

- Data visualization for fraud pattern detection

- Customized financial insights and performance metrics

- Automated reporting systems for regulatory compliance

BI also enables:

- Performance monitoring

- Customer segmentation

- Data warehousing

- Market trend analysis

- Operational reporting

- Predictive modeling

- Business performance tracking and benchmarking

Footnotes: