Modern banks are under constant pressure to meet compliance rules, improve CX and strengthen capital reserves. Simultaneously, they’re expected to use AI, ML, and IoT to speed up operations, accelerate decision-making and support faster product rollouts. This shift in already visible in retail banking, corporate services, and digital-only platforms.

Cloud systems now play a central role in compelling banks to revamp their legacy tech. It’s not just an upgrade; it’s a move to stay competitive through better systems that support digital payments, online lending, and Banking-as-a-Service.

As per the McKinsey study, by leveraging cloud services effectively, Fortune 500 financial institutes could possibly generate an additional $60 billion to $80 billion in annual profitability by 2030. This significant intersection of financial services and cloud adoption presents cost-saving benefits and operational efficiency. In this blog, we focus on the core benefits of cloud adoption in financial services industry. We also provide solutions to address common challenges faced during cloud migration. Additionally, we outline the strategic framework, cloud adoption across different financial institutions, key considerations and a foolproof process for a successful transition to the cloud.

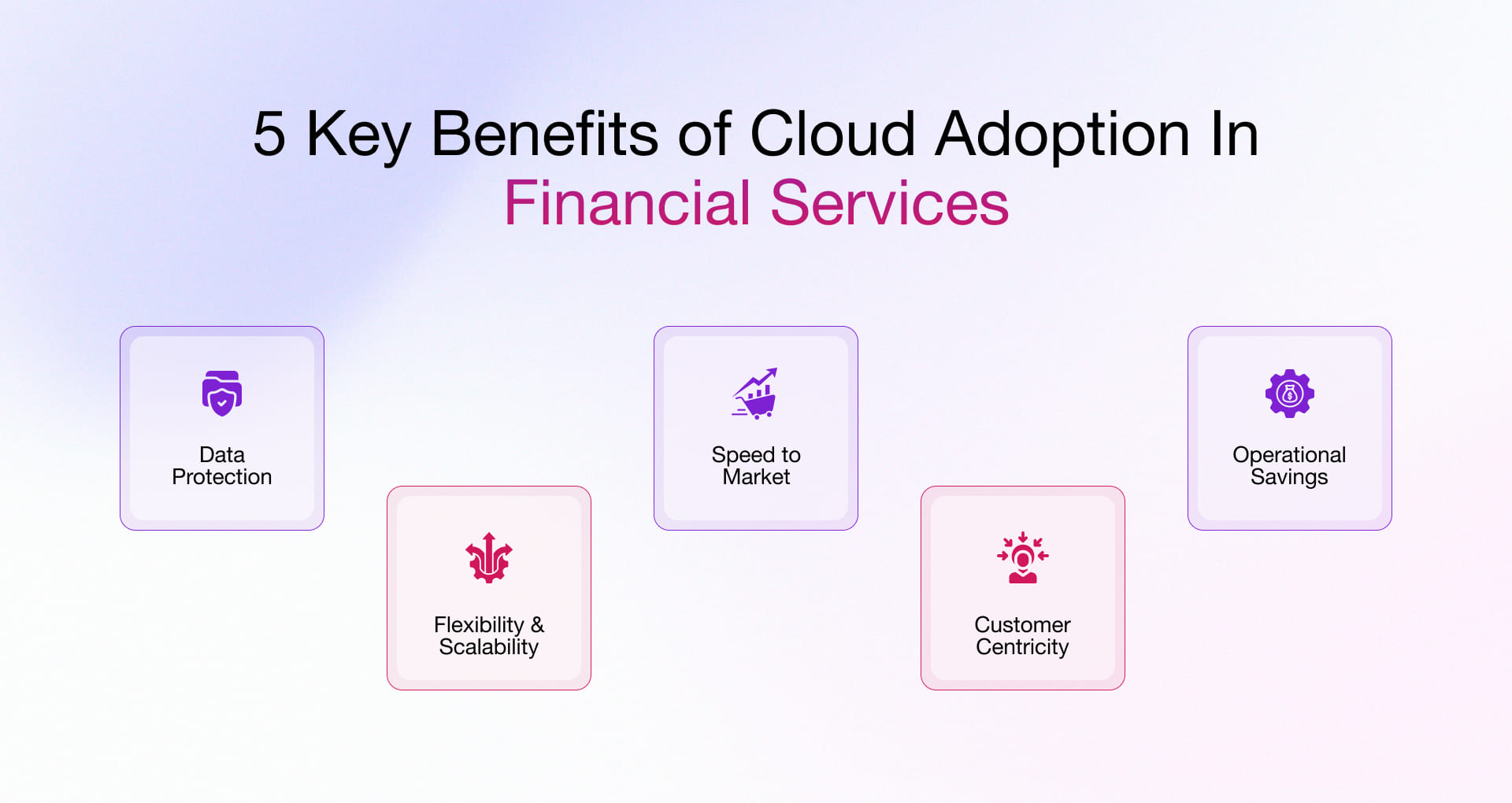

Benefits of Cloud Adoption in Financial Services

The importance of cloud adoption in financial services is evident in its capabilities to enhance agility, improve compliance, and scale digital services to meet client expectations. Unlike legacy systems, modern cloud infrastructure supports critical areas like mobile banking, core banking upgrades, and compliance-focused tasks such as KYC, AML, and fraud detection. Traditional IT systems often can’t keep up with innovation or scale in fast-changing areas like fintech partnerships, digital payments, and neo banks, making it harder for institutions to stay competitive.

In this section, we will address the key benefits the financial services industry can leverage by adopting & migrating to the cloud.

Increased Flexibility and Scalability

Banks and financial organizations are facing mounting pressure to keep up with growing customer expectations, align with compliance standards, and integrate emerging technologies. From retail lending platforms to next-gen BaaS ecosystems, the need to deliver scalable and adaptable operations is imperative.

Cloud adoption in financial services industry enables rapid development and launch of new products, services, and seamless technology integration. Financial institutions can utilize the capabilities of cloud to easily provision computing resources like virtual machines, storage, and databases based on changing needs and workloads.

Fortified Security and Risk Management

The financial services industry is highly regulated and sensitive. This is why data security is a key concern that cannot be compromised. Besides offering scalability and flexibility, cloud service providers also support regulatory needs across transaction monitoring, RegTech compliance, and credit risk analysis across corporate banking and fintech ecosystems.

Cloud computing in banking services involves implementing robust security measures, including highly secure data encryption techniques for confidential information, EMV compliance through tokenization, granular access controls, and regulatory flexibility. Additionally, it enables financial services to implement data backup practices and automate backup and recovery mechanisms to protect against accidental data loss, corruption, or cyber threats.

Enhanced Customer Engagement

Cloud computing enables financial institutions to create customer-focused digital strategies. They can analyze data to customize products, services, and recommendations by using cloud alongside advanced analytics. Cloud platforms support CRMs that give a complete view of each customer, which helps teams deliver more targeted marketing and improve CX. This approach is highly effective in internet banking, mobile banking, and personal finance management, where user-level insights shape engagement. Neo banks and fintechs now lead the industry in applying AI-driven personalization to strengthen loyalty and boost cross-sell results.

Lower IT Costs

Running on-premise systems drives up costs. Hardware maintenance, limited flexibility, and downtime all slow teams down. Large core platforms and older applications tied to outdated compliance tools add to the overhead. Cloud platforms reduce these costs by simplifying operations. Banks can run services more efficiently and scale up new tools like digital wallets, automated lending, and BaaS, without major capital expense.

Faster Launch Cycles

Retail banking teams must release updates quickly to stay relevant. Long dev cycles slow down adoption and delay returns. With prebuilt APIs and microservices, teams can launch features like card controls, savings goals, or digital onboarding in shorter sprints. Fintechs push updates daily using the same setup. This helps banks stay agile without needing to rebuild core systems.

Challenges Faced with Financial Services Cloud Adoption and Their Solutions

Cloud services are enablers of innovation and digital transformation in the banking and finance sector, especially when combined with technologies like AI and data analytics. Whether in digital banking, lending automation, or real-time fraud detection, institutions are under increasing pressure to modernize core functions while navigating a complex regulatory landscape. However, despite the business-critical cloud benefits, financial services institutions struggle to capture their full value.

In this section, we will address the key challenges faced by financial services while adopting the cloud and provide you with solutions to overcome them.

Data Security

Data security challenges while migrating to the cloud in a financial services organization are common yet critical concerns, as we know this sector operates in a highly regulated environment. Moving sensitive data to the cloud can introduce complexities in ensuring compliance with data residency requirements, privacy laws like GDPR, and industry-specific regulations like PCI-DSS.

Solution:

To address data security concerns during cloud adoption, financial institutions should implement robust, multi-layered security protocols. These may include data encryption, granular access controls, and regular security audits conducted by reputable third-party organizations. Additionally, partnering with cloud service providers that prioritize security and offer compliance certifications can provide added assurance.

Integration Complexity

Financial services institutions often have complex structures, operation workflows, and legacy systems, which can make integrating cloud services or platforms a significant challenge. Seamless integration is crucial to ensure smooth operations and minimize disruptions during the cloud migration process.

Solution:

It is advisable to partner with a specialized cloud integration company with considerable experience in the banking infrastructure domain. This technology partner should have the capabilities to bridge traditional core banking systems with modern platforms while ensuring continuity in areas such as digital payments, retail lending, and commercial account management. Institutions that depend on legacy internet banking portals or mobile banking apps can benefit from integration accelerators that minimize downtime and enhance interoperability.

Cloud Outage

Cloud outages are a major concern for the banking sector as they impact critical functions, causing operational disruptions that are difficult to manage and can potentially damage the institution’s reputation. Additionally, slow internet connections can hinder customers’ online activities, leading to lost of customer trust. Many times, cloud outages result in data inaccessibility, and data backup and recovery processes become time-consuming to conduct.

Solution:

To mitigate risks and ensure service continuity in areas like credit risk systems, fraud detection engines, and real-time banking transactions, institutions should implement robust business continuity plans. This includes multi-region deployments, on-premise failover support, and real-time alert systems integrated with IoT monitoring tools for infrastructure resilience.

A Strategic Framework for Accelerating Cloud Adoption in Financial Services

Many banks lose time and money during cloud adoption. Projects stall when teams rush into migration without clear goals. Others fail from poor vendor choices or siloed planning. The most effective approach connects cloud moves to real business needs like loan processing, transaction services, or customer onboarding. AI and machine learning help prioritize workloads, test models, and plan capacity across banking platforms.

Strategy and Management

Banks often skip planning and pay for it later. Some choose the wrong vendors. Others dive in without rules or oversight. We help fix this from the start. Our teams support vendor reviews, compliance checks, and contract planning. We focus on needs in areas like digital lending, payments, and customer support. We also help build strong partnerships with cloud service providers to avoid risk and reduce costs.

Domain Level Migration

Moving one system at a time creates problems. It slows progress and breaks connected services. A better way is to migrate by business domain. This means treating functions like credit checks, savings products, or loan approval as groups. In digital banking and fraud detection, AI models rely on clean, complete data. We help structure domain migrations to protect these models and keep services running smoothly.

Foundational Capabilities

Many failures trace back to missing setup. Banks often ignore the basics like access control, monitoring, or cost tracking. We make sure these are in place first. That includes setting rules for users, tracking cloud spend, and logging activity. We also prepare for AI workloads and real time data from ATMs or data centers. Once the setup is ready, we guide the migration through clear steps with progress checks and risk controls.

The next section looks at how different institutions are adopting cloud based on their business needs, regulatory pressure, and customer expectations.

Cloud Adoption Across Different Financial Institutions

Each type of financial institution uses cloud services differently. Goals vary based on business models, data volumes, and compliance demands.

Investment Firms

These firms need fast systems for trade execution, pricing, and market analysis. They use cloud to run risk models, manage market feeds, and reduce processing time. Teams apply ML to detect outliers in trades or shifts in portfolio exposure. GenAI is now being tested to summarize analyst reports, generate investment commentary, and support client research desks.

Housing Finance Companies

Loan decisions depend on multiple data sources like credit reports, income documents, and property valuations. Cloud platforms support integrations across these. ML models run real-time scoring, flag inconsistencies, and suggest risk-adjusted pricing. GenAI is helping frontline teams respond to borrower queries, draft communication templates, and auto-fill sections of loan forms.

Insurance Providers

Insurers use cloud to improve claims, underwriting, and servicing. AI processes claim documents, checks for fraud signals, and supports pricing adjustments. GenAI tools assist agents by drafting replies to customer queries, summarizing claim cases, and creating internal assessment notes for review teams. Models are trained using historical claims, policy text, and email threads.

NBFCs and Digital Lenders

These firms work with customers who often lack formal credit history. They use ML to evaluate spending, location, and mobile usage for alternate scoring. Cloud systems help scale this across regions. GenAI now supports faster collections by creating personalized communication in local languages and helps loan officers prepare reports or case summaries faster.

Capital Markets and Custodians

These firms handle massive transaction volumes. Cloud systems support clearing, settlement, and audit trails. AI tracks trade breaks and matches records. GenAI is being used to generate regulatory disclosures, explain portfolio changes in simple language, and automate report creation for investor relations or compliance filings.

Key Considerations While Adopting Cloud for Financial Services

Every financial services company will likely have a unique approach to cloud adoption. However, some key considerations can ensure a smooth and successful transition. Let’s explore more on these key considerations:

Security and Compliance

Banks dealing with personal loans, card transactions, or savings accounts must follow strict data protection rules. These include KYC, AML, PCI-DSS, and GDPR. RegTech tools now automate large parts of compliance, including real-time alerts for fraud or suspicious activity. This is especially useful for mobile payments and high-volume transfers.

Risk Management

Credit scoring models, fraud detection tools, and regulatory checks all need to work under strict controls. AI can now run simulations to test systems before they go live. Lending platforms and wealth management apps rely on this to stay compliant while rolling out updates fast.

Performance and Operational Management

Any downtime hurts trust. Online banking services, payments, and fintech APIs must run around the clock. Banks use AI tools to watch for issues and fix them before users are affected. IoT devices also help by tracking things like server temperatures or ATM status to avoid service breaks.

People and Change Management

Teams need time to adjust. Training systems backed by AI can help employees learn at their own speed. Some retail banks use AR devices to train staff in branch operations or tech upgrades. Change moves faster when employees understand what’s new and why it matters.

Microservices and Containerization

Breaking up large applications into smaller pieces makes updates easier and faster. Banks use microservices to roll out features like card freezes, budgeting tools, or real-time loan calculators without touching the whole system. Containerization helps manage these smaller services across different teams or geographies. It also keeps the systems more stable during changes.

Horizontal Scaling

Retail banking and digital lending platforms often face heavy traffic at peak times. With horizontal scaling, institutions can add more machines or instances instead of overloading one. This keeps services like account opening or payments running smoothly, even during busy periods like salary days or tax deadlines.

Customer-Centric Strategies

Banking is becoming more personal. Institutions build services around customer habits, not just products. AI models sort through spending history, income patterns, or financial goals to suggest the next best action. Whether it’s a saving tip, credit offer, or investment nudge, this approach drives better loyalty and lowers churn.

The Process to Follow for Financial Services Cloud Adoption

In the financial services sector, the possibility of migrating mission-critical apps and business functions to the cloud was once an ambitious goal. Today, it is a pressing need and a permanent reality for this industry.

So, if you want to embark on the path of cloud migration, follow the process below:

- Examine current applications, systems, and processes particularly core banking, mobile banking, and digital payments to build an inventory, identify interdependencies, and assess stability for the desired future state.

- Determine the applications best suited for modernization across domains such as retail lending, internet banking portals, or neo bank interfaces, and define strategies for their phased transformation based on customer impact and regulatory exposure.

- Determine the key apps suitable for cloud adoption and establish strategies defining how the migrations will be implemented.

- Use business-criticality, transaction load, and compliance requirements to bundle apps and schedule change events. Prioritize processes like credit risk evaluation, KYC validation, and fraud detection systems, which may have tight regulatory and operational windows.

- Evaluate the infrastructure’s risk tolerance in relation to key banking functions such as digital onboarding, commercial transaction processing, and RegTech reporting to ensure minimal disruption during execution. Define cut-over tasks with robust fallback plans for real-time systems.

- Use predictive ML models to estimate the impact and risks of each migration wave. IoT data feeds from branch infrastructure can help evaluate dependencies and real-world usage patterns.

- Evaluate the infrastructure’s risk tolerance in relation to digital onboarding, commercial transaction processing, and RegTech reporting to ensure minimal disruption during execution. Define cut-over tasks with robust fallback plans for real-time systems.

- Adhere to platform-specific protocols while using secure transfer mechanisms to preserve data integrity. This is particularly important when handling sensitive information from lending platforms, fintech integrations, and real-time account monitoring tools.

- Execute transformation by orchestrating run-book tasks, verifying business logic continuity, and conducting post-certification testing across high-impact workflows like mobile transaction alerts, payment gateway connectivity, and core banking ledger updates.

Why Choose Rishabh Software To Accelerate Cloud Adoption In Financial Services?

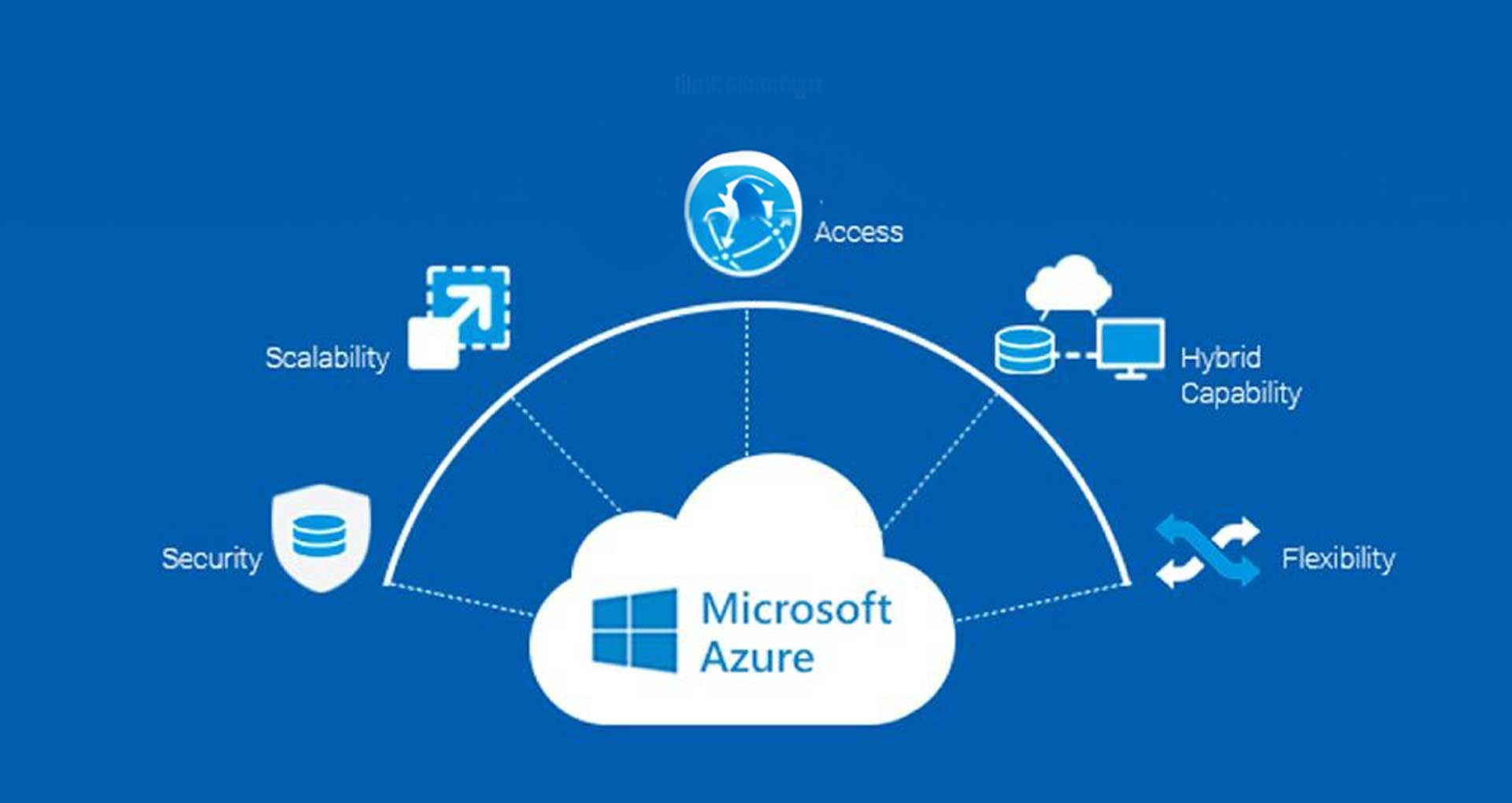

We are a trusted cloud software development company specializing in developing and deploying robust cloud-based solutions tailored for the financial services sector using AWS, Microsoft Azure, App Engine & Azure SQL. We empower financial institutions to leverage the true potential of the cloud in digital transformation through outcome-driven strategies. Rishabh Software helps financial companies of any size transform their businesses and boost operational efficiency by leveraging a cloud-first strategy.

We can also help you with next-gen fintech software solutions by integrating AI/ML models for use cases such as intelligent credit scoring, fraud detection, and automated underwriting. Our IoT integrations include real-time branch monitoring, connected devices for customer engagement, and remote infrastructure health tracking.

Our Success Story

A leading US-based client sought to revamp their existing accounting system by incorporating cutting-edge technology to ensure it meets contemporary standards. With expertise in accounting software modernization and analytics, we helped the client modernize the accounting software into a consolidated cloud-native application by utilizing Microsoft Azure and Power BI technologies.

Challenges:

- Complex Legacy Systems: The existing legacy applications were highly complex, slow, and disparate.

- Integration Challenges: The legacy system struggled to integrate with new technologies.

- Inflexibility: The existing legacy system failed to adapt to changing business needs.

- Absence of Advanced Data Analytics: The existing IT system needed advanced analytics capabilities.

- Data Mismanagement: Poor management of audit and historical data.

Our Solution:

- Re-engineered finance software with Azure & Power BI for enhanced asset-based lending.

- Legacy data migrated to Azure, merging core functions into a consolidated application.

- Developed a data warehouse using Azure Synapse Analytics to streamline data management.

- Utilized Power BI for diverse finance data visualization and reporting based on KPIs.

Key Benefits Delivered:

- 100% visibility into business operations

- 95% increase in employee efficiency

- 98% improvement in IT system performance

Learn how our Accounting Software Modernization efforts helped the client mitigate associated risks and ensure business continuity & sustainability.

Frequently Asked Questions

Q: How can financial services providers simplify cloud operations?

A: Simplifying cloud operations in financial services is key to business continuity in order to compete in the dynamic market. Financial services can leverage managed services, the power of automation, and infrastructure as code (IaC) and implement them with emerging technologies in interactions with cloud operations like AI, data analytics, and others.

Q: How can financial services firms accelerate the cloud shift?

A: Financial services firms can accelerate the shift to cloud by following the below-mentioned steps:

- Assessing their cloud readiness

- Developing the outcome-driven cloud strategy

- Prioritizing the workload and focusing on cloud migration

- Collaboration with vendor partner

- Invest in training and upskilling

Q: What are the significant trends of cloud adoption in financial services?

A: Major trends in cloud adoption in financial services are listed below:

- Hybrid and Multi-Cloud Strategies

- AI and Machine Learning

- Fintech and Open Banking

- Data Analytics and Insights

- Customer Experience

Q: Our trading system slows down during high volume. Can you build something that fits us?

A: Yes. We don’t reuse templates. We build systems based on your actual trading needs, whether you need faster pricing, more stable order processing, or better data handling. We can add GenAI to assist with reporting and trade summaries.

Q: Our loan process is slow, error-prone and manual. Can you help us streamline it?

A: We can build a loan system that matches your flow by integrating credit checks, approvals, disbursals, and collections. We will train ML models on your data to improve decision-making. GenAI can support your team by drafting updates, letters, and borrower messages.

Q: Our claims team spends too much time on each case. Can you automate this?

A: We can help you build an AI-powered insurance claims management system that aligns with the way your team works. It will employ AI to scan documents and flag errors and integrate GenAI to draft case notes or policy replies. If needed, we can also add IoT to pull real-time data from field devices.

Q: We work with customers who don’t have a credit history. Can you support alternate scoring?

A: Yes. We’re fully-equipped to build scoring tools that use mobile data, spending behavior, and location information. GenAI integration will help with clear messages in your customer’s language and tone. We will connect these systems to your current apps and staff workflows.

Q: Our reporting is time-consuming and full of manual edits. Can your systems help?

A: We can design systems that collect, and process reporting data end to end and integrate GenAI to drafts compliance summaries, filings, and client reports based on your structure. This will eliminate the need for manual templates and rework while ensuring compliance with your reporting cycle.