Since the inception of cloud computing, we’ve seen several organizations from the banking world incrementally migrating to the cloud. It’s no longer just about migrating to clouds; it’s about reimagining core banking functions through AI, real-time data intelligence, and cloud-native agility. Today’s leading financial institutions aren’t simply adopting cloud but building AI-driven ecosystems that automate compliance, personalize customer experiences, and detect fraud in real time.

As cloud maturity grows, so does the complexity of decisions around deployment models, regulatory alignment, and AI integration. Hybrid and multi-cloud setups are becoming the norm. With GenAI, advanced analytics, and open banking platforms taking center stage, the question isn’t if cloud fits your strategy; it’s how fast you can scale it securely and smartly.

If you’re in the middle of evaluating cloud services—or wondering how to plug in AI and other emerging tech into your modernization playbook—this blog will give you a clear, updated lens on what’s next for banking in the cloud era.

Need for Cloud Computing in the Banking Industry

Cloud services are on-demand, scalable solutions that provide access to shared resources, applications, and storage over the Internet. For banks, this means more than just shifting infrastructure. It’s about unlocking new business models, improving time-to-market, and powering AI-driven experiences with smarter data usage.

Instead of relying on outdated, on-premise systems, banking institutions now store and process vast data across distributed cloud environments. While the financial sector was once hesitant, understandably cautious about data privacy, regulatory risk, and legacy lock-in, today’s reality paints a different picture. Cloud adoption isn’t just growing—it’s accelerating, thanks to advancements in AI, secure multi-cloud frameworks, and industry-specific compliance solutions.

Now, the shift is no longer just technical. It’s a strategic transformation. Cloud adoption redefines IT ownership. Banks no longer buy and maintain infrastructure—they’re subscribing to platforms that evolve with them.

Here’s what a future-ready cloud model should offer:

- A foundation for secure, continuous delivery of content, applications, and AI-powered services

- Self-service agility to launch and orchestrate new offerings—without touching physical infrastructure

- Transparent, consumption-based pricing, allowing banks to scale operations dynamically based on real-time demand

- Elastic computing capabilities to scale up or down, backed by AI insights that predict usage trends and customer behaviors

- Data decoupling—where structured and unstructured data becomes a reusable asset across any business workflow or AI model.

You may also want to give this insightful post a read to know more about the key drivers and use cases of cloud adoption in financial services.

Here’s some insight into cloud adoption by banks:

- By building its cloud, Bank of America has saved $2 billion annually (on annual infrastructure savings). It helped reduce the firm’s servers to 70,000 from 200,000 and its data centers to 23 from 60.

- Wells Fargo is leveraging MS Azure as part of its digital transformation focus and has moved strategic business workloads, including data centers, to the cloud.

- Goldman Sachs leverages Amazon Web Services (AWS) to modernize a range of internal functions, including automated digital forensics, supply chain processes, and procurement systems.

Benefits Of Cloud Computing in the Banking Sector

The modern bank doesn’t just operate digitally; it thinks digitally. Cloud technology in banking serves as the foundation that enables this mindset to be scalable, secure, and strategic. Here’s a breakdown of how the cloud is reshaping financial services, backed by real-world implementations and powered by AI, automation, and analytics.

1. Cost Efficiency: From Capital Drain to Strategic Spend:

Let’s face it—on-prem infrastructure is a capital-heavy commitment. You invest upfront in hardware, data centers, cooling, power, licenses, physical security; the list is endless. This CAPEX model locks up massive budgets before you even see results.

Cloud flips that model on its head.

With the cloud, you shift to an OPEX model, and you only pay for what you use. No idle servers. No underutilized storage. No hidden maintenance costs. Need more computing power during tax season? Scale up. Done for the day? Scale down. Your costs move in lockstep with demand.

But it’s more than just accounting convenience.

Cloud platforms come with built-in cost optimization tools—right-sizing recommendations, usage analytics, and automated shutdowns for idle resources. You can actively monitor and fine-tune spending in real time. That’s the financial agility that most banks have ever had before.

Example: AYA Bank reduced its total cost of ownership (TCO) by 55% after migrating to the cloud. The savings didn’t just boost margins, they were reinvested into new digital products and AI-powered services that customers actually care about.

2. Smarter Customer Service with AI Chatbots and Virtual Assistants:

Customer expectations have changed. They want answers at 2 a.m. on a Sunday, and cloud-powered AI chatbots deliver just that. These virtual assistants are trained on massive datasets and operate 24/7, handling everything from balance checks to complex transaction queries.

Plus, with machine learning models continuously improving, these bots improve over time, personalizing service, predicting needs, and improving customer satisfaction scores (CSAT).

Example: HDFC’s cloud-enabled chatbot EVA answered over 3 million queries with a prompt response in less than 0.4 seconds to more than half a million unique users. Without involving human agents.

3. Scalability That Matches Customer Demand, Not Capacity Limits:

Traditional infrastructure struggles with demand spikes—whether it’s during festival offers, tax season, or new IPO listings. Cloud solves this by letting banks auto-scale their compute, storage, and networking resources in real-time.

Need 10x the processing power during salary week? Done. Want to scale down during lean periods? Easy. This elasticity ensures uninterrupted service delivery and optimized costs year-round.

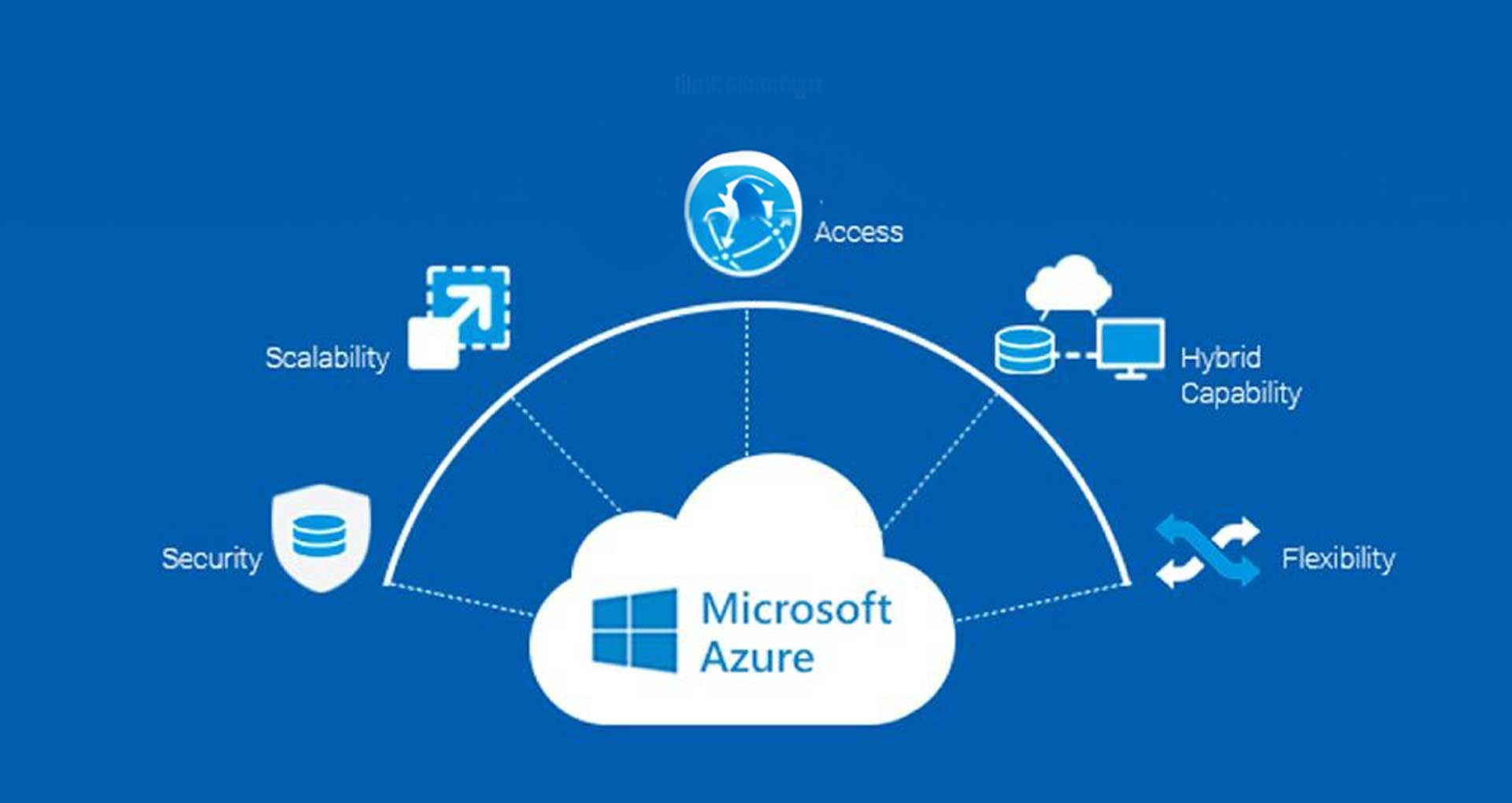

Example: ClearBank, post-migration to Microsoft Azure, scaled from 8,000 transactions/month to 20 million without hitting a single system failure.

4. Security That’s Proactive, Not Reactive:

Banks are high-stakes targets for cyberattacks, but cloud platforms offer security stacks far superior to traditional on-prem environments. Think of real-time threat detection, automated patching, multi-layered access controls, and encryption both at rest and in transit.

Plus, providers like AWS, Google Cloud, and Azure have dedicated compliance architectures tailored for BFSI—ensuring continuous adherence to frameworks like PCI DSS, SOC 2, RBI, and GDPR.

Key Takeaway: You’re not outsourcing security, you’re upgrading it.

5. Centralized Data Ecosystem for Unified Decision-Making:

Banks today sit on a goldmine of data, but siloed systems prevent them from extracting real value. Cloud platforms create a centralized data lake that combines customer data, operational insights, transactional records, and third-party inputs.

This setup enables faster decisions, real-time analytics, and AI/ML models that can drive hyper-personalization, fraud detection, credit risk scoring, and more.

Example: Capital One built a centralized data lake on AWS to break down data silos and enable real-time analytics—helping teams detect fraud, assess credit risk, and enhance customer experience across all touchpoints.

6. Business Continuity and Disaster Recovery Without Complexity:

In banking, downtime isn’t just an inconvenience—it’s a reputation killer. Cloud solutions offer geo-redundant architecture, built-in failovers, and disaster recovery setups that can restore services in minutes.

This ensures regulatory compliance, minimizes operational risk, and keeps the customer experience intact, no matter what.

Why It Matters: When disruptions happen—be it a cyberattack, hardware failure, or natural disaster—the cloud ensures that the bank doesn’t just recover; it rebounds.

7. Accelerated Product Development Through Agile Infrastructure:

In banking, product innovation can’t wait for the next quarter, it needs to ship in weeks, sometimes days. Whether launching a new savings feature, rolling out UPI 2.0, or integrating with fintechs, banks need infrastructure that moves at the speed of business.

That’s precisely what the cloud delivers.

With cloud-native development, banks gain access to containerization (like Docker), orchestration tools (like Kubernetes), and fully managed CI/CD pipelines. This means developers can build, test, and deploy new features without relying on rigid infrastructure or heavy manual approvals.

DevOps isn’t a buzzword anymore—it’s the operating model.

Cloud combines development and operations into one seamless workflow, cutting release cycles from months to days. Teams can experiment, take an A/B test, and roll back with minimal risk.

And because everything is API-driven and modular, adding new services—digital onboarding, KYC automation, or cross-border payments—becomes plug-and-play, not a six-month integration project.

Example: Capital One’s move to AWS enabled it to build and deploy new features multiple times daily, down from the legacy model of monthly releases. That’s not just faster development; it’s faster feedback, iteration, and value for customers.

8. Regulatory Compliance That’s Built-In and Regionally Aware:

From Europe’s GDPR to India’s RBI mandates, regulatory compliance is non-negotiable in banking. Cloud providers build compliance support into their platforms with tools for data localization, automated audit trails, encryption policies, and granular access logs.

This makes it easier for financial institutions to navigate audits, adapt to new regulations, and expand into new regions without needing to reinvent the wheel every time.

Cloud Bonus: Real-time dashboards for governance and automated reporting remove the manual pain from compliance checks.

9. A Foundation for Open Banking and Embedded Finance

APIs are the currency of digital banking, and cloud-native platforms make API management seamless. Whether integrating with fintechs, launching new lending services, or embedding financial features in third-party apps, cloud enables secure, scalable API ecosystems.

This allows banks to transform from product providers to platform players.

Example: ICICI Bank has launched India’s largest API banking portal, offering approximately 250 APIs to facilitate seamless integration with fintech partners. This initiative enables developers to co-create innovative customer solutions, significantly reducing the time to develop and deploy business solutions.

Applications Of Cloud Computing In Banking and Financial Services

Cloud computing provides easy access to storage, apps, and shared resources, enabling banks to analyze data in remote servers with faster processing speeds and enhanced security.

From enabling real-time personalization to scaling payment systems, cloud technology powers modern banking at every level. Here’s how banks can harness the potential of cloud to achieve their business goals while meeting customer needs simultaneously:

1. Digital Payment Processing:

Digital payments have become the heartbeat of modern banking, and the cloud is the circulatory system keeping it alive.

With cloud-native platforms, banks can process millions of transactions in real time, across geographies, payment gateways, and currencies, without latency or downtime. Elastic scalability ensures that transaction volumes during peak hours (like UPI surges or festive seasons) are handled seamlessly. Plus, integrated cloud AI models help instantly flag anomalies, reducing payment fraud.

For example, we developed a digital payment app for a FinTech firm in Mauritius, enabling cross-border payments, QR-based transactions, and unregistered number transfers. The solution led to a 38% boost in smoother transactions, a 28% increase in user base, and a 98% CSAT score within the first quarter of implementation.

2. Fraud Detection & Prevention:

With increasingly sophisticated cyber threats, reactive fraud detection is no longer enough.

Cloud-based fraud prevention systems allow banks to ingest and analyze massive datasets in real time—from customer behaviors to device fingerprints and geo-locations. Machine learning models spot suspicious activity before it turns into a breach, offering preventive controls instead of post-incident cleanups.

We helped a leading banking client implement a fraud detection and prevention solution that leverages cloud and machine learning to monitor transactions in real-time, flag anomalies, and significantly reduce fraud risks.

3. Data Analytics for Customer Intelligence:

Cloud platforms like AWS and Azure empower banks to consolidate, analyze, and visualize customer data from multiple touchpoints. These insights fuel hyper-personalization—from tailored financial products to predictive wealth planning or credit management nudges.

With cloud-powered analytics, banks aren’t just collecting data, they’re turning it into ROI-driven decisions.

Example: HDFC Bank uses cloud-enabled analytics to create micro-segmented campaigns for cross-selling, increasing product uptake among existing users.

4. Mobile and Online Banking Platforms:

The cloud makes mobile and online banking agile, secure, and scalable, offering customers a unified experience across devices.

From enabling biometric login to real-time balance checks, cloud infrastructure supports the high availability and speed that modern digital banking demands. It also allows banks to quickly roll out updates or new features, like cardless cash withdrawals or AI-powered chatbots.

5. Core Banking Modernization:

Legacy core banking systems are monolithic, expensive to maintain, and slow to evolve.

Cloud-native core banking platforms break this bottleneck. By adopting microservices architecture and composable banking models, financial institutions can decouple services (like loans, deposits, and payments) and iterate rapidly.

Example: Standard Chartered migrated several core banking workloads to the cloud, reducing operational costs and achieving faster product rollouts in emerging markets.

6. CRM & Customer Engagement Platforms:

Cloud-based CRM systems unify customer interactions across phone, branch, email, and app—all in one view.

This allows relationship managers and support teams to deliver context-rich experiences, upsell at the right time, and proactively resolve issues. Integrated AI tools also offer intelligent recommendations based on customer history and behavioral trends.

7. Compliance, Audit & Reporting Automation:

With financial regulations tightening globally, compliance can’t be an afterthought.

Cloud enables automated compliance workflows, centralized document management, and audit trail logging. It also supports secure data residency by choosing region-specific data centers to align with regulatory mandates.

Cloud Deployment, Service, and Operating Models

Cloud Deployment Models

Banks using legacy systems running on an on-premise data center may find it daunting to modernize and migrate to the cloud. Fortunately, they can take an incremental approach if they don’t want to opt for an all-in-one cloud model. Banks can use a mix of hybrid and multi-cloud solutions based on their business needs, readiness, and maturity.

- Private clouds: Managed & governed by a third party that works in-house or the bank itself. Banks usually prefer private clouds for hosting their services as it ensures greater flexibility, security & control as it is deployed within the enterprise’s firewall.

- Public clouds: This IT model is easily accessible to the banking sector for owning, managing & sharing cloud services. Banks looking for economies of scale can opt for the public cloud.

- Hybrid clouds: Comprises the best from private and public cloud services environments that can be used separately for specific use cases. This model enables standard data management for both private and public clouds. It allows deploying the system on a private cloud while scaling with the help of a public cloud whenever needed.

Cloud Service Models

The key to seamless cloud deployment & integration lies in implementing a suitable model that matches the needs of banking ecosystems. Here are four main types of cloud services that banks can choose from:

- Business Process-as-a-Service (BPaaS) – This model is used for standard business operations such as billing, payroll and human resources.

- Software-as-a-Service (SaaS): This cloud service consists of mission-critical business software and its corresponding data that end-users can access on their web browsers. The systems hosted on SaaS solutions include accounting & invoicing, customer relationship management, content management, and service desk management.

- Platform-as-a-Service (PaaS): This service delivery model offers a comprehensive development and deployment environment. It typically includes database development, web server, operating system, interface & software & hardware tools for hosting cloud-enabled enterprise apps. PaaS helps streamline the development, maintenance, and support of custom apps.

- Infrastructure-as-a-Service (IaaS): This cloud service model allows banks to use virtualized computing resources, including software, servers, and data centers, on an outsourced model instead of purchasing them.

Cloud Operating Models

Choosing a suitable delivery model with the required mix of resources and assets is vital. Rishabh Software works with global customers across the listed three operating models:

- Virtual Captive: This model provides a dedicated pool of experts or centers to help with cloud operations and meet demand. It is an excellent alternative to an absolute outsourcing approach.

- Leverage Skilled Talent: Banks can achieve cloud proficiency by employing experienced people with the right skills from cloud service providers. This operating model allows banks to hire the best resources for their unique business needs and unleash new ways of working.

- Outsourcing Vendors: In this operating model, offshore centers, facilities, and resources from third-party vendors manage operations. It blends resources and investments to cater to the services of multiple banks.

Getting your operating model right is the key to driving business growth. Our specialists can assist you in designing and building your cloud infrastructure.

Challenges Of Cloud Computing in the Banking Industry

Despite the numerous benefits of cloud computing technology, many banking organizations are still hesitant to adopt it. Here are some of the reasons that prevent banks from adopting cloud with potential solutions:

1. Security & Data Privacy Concerns:

Banks deal with mission-critical data. A single breach can cost millions, not just in fines, but in lost trust. When customer data is stored on third-party infrastructure, visibility gaps around access, encryption, and identity controls widen.

Solution:

Choose cloud providers with banking-grade security certifications (like ISO 9001 and ISO/IEC 27001, PCI DSS, and SOC 2). Insist on robust identity and access management (IAM), end-to-end encryption, and zero-trust frameworks. Implement continuous compliance monitoring and security automation to detect anomalies in real time.

2. Integration with Legacy Systems:

Core banking systems weren’t built with the cloud in mind. Integrating cloud-native services with monolithic legacy infrastructure is complex and risky and often stalls modernization efforts.

Solution:

Adopt a phased modernization approach. Use APIs and middleware to bridge legacy systems with cloud platforms. Focus on hybrid cloud strategies that allow banks to slowly decouple and modernize core components without disrupting operations.

3. Vendor Lock-in:

Switching becomes technically and financially daunting once data, applications, and workflows are optimized for a specific cloud provider. This lack of flexibility can lead to increased costs and limited innovation.

Solution:

Leverage multi-cloud or hybrid cloud models. Use open-source technologies and containerized workloads (like Kubernetes) to ensure portability. Prioritize vendors that support open standards and offer data exportability without excessive fees or downtime.

4. Data Migration Complexities:

Moving massive volumes of structured and unstructured data to the cloud is time-intensive and risky. Downtime, data loss, and format incompatibilities are common pitfalls.

Solution:

Conduct a cloud readiness assessment. Build a data migration roadmap that includes data validation, rollback strategies, and sandbox testing. Use purpose-built migration tools from cloud providers and ensure backup mechanisms are in place.

5. Interoperability & Standardization Issues

In a multi-cloud or hybrid environment, different tools and services often fail to “speak the same language.” This creates operational silos, delays, and data inconsistencies.

Solution:

Use cloud-agnostic orchestration tools and standardized APIs to improve interoperability. Embrace open banking frameworks and shared data standards (like ISO 20022) for smoother integration and collaboration across fintech ecosystems.

6. Governance, Risk & Compliance (GRC):

As workloads shift to the cloud, maintaining control over compliance, audit trails, and governance becomes more difficult, especially across global regulatory landscapes.

Solution:

Deploy centralized governance frameworks with defined policies for cloud usage, access controls, and data classification. Use cloud-native GRC tools to automate audit readiness and map workloads to specific regulatory requirements.

7. High Availability & Downtime Risks:

Banking systems demand 24/7 uptime, but relying on third-party cloud providers introduces risks of service outages, impacting customer trust and regulatory compliance.

Solution:

Adopt multi-region deployments, automated failover systems, and real-time monitoring to ensure business continuity and SLA-driven uptime across all digital banking touchpoints.

8. Performance Dependencies on Providers:

Bank performance is now tightly coupled with the cloud provider’s performance. Latency issues, outages, or updates from the provider’s end can impact business outcomes.

Solution:

Choose providers with low-latency infrastructure and local availability zones. Set strict SLAs and continuously monitor service benchmarks using third-party observability platforms.

Your Trusted Partner Behind Future-Ready Banking Transformation

We serve the banking services industry by taking a customer-first approach to everything we do. As a cloud application development company, we provide development, reengineering & cloud integration services to support financial organizations.

With a customer-first mindset and deep expertise in cloud-native and AI-powered development, we help financial institutions modernize legacy systems, reduce transition risks, and accelerate time-to-value.

Our team approaches cloud migration module-wise, reducing transition risks and enabling them to experience the numerous advantages of cloud computing. Whether it’s a secure mobile app, a real-time fraud detection engine, or a scalable open banking platform, our teams build with performance, compliance, and innovation at the core.

As an experienced FinTech software development company, we can help you build robust cloud banking solutions ranging from simple mobile apps to complex enterprise-grade software.

Success Story: Cloud-Enabled Microfinance Loan Processing App Development

An Africa-based fintech organization partnered with Rishabh Software to digitize and automate its microloan processing system. Leveraging AWS cloud, the solution streamlined the entire loan lifecycle from application assessment and KYC verification to approval and disbursement, enhancing operational efficiency and customer satisfaction.

Challenges:

- Delays in loan reviews due to manual document checks

- Identity mismatches caused verification issues

- No automated tools for screening or risk scoring

- Poor integration with banking systems slowed disbursements

Solution:

Rishabh Software re-engineered the existing loan application process by implementing a custom workflow engine using Spring Integration, ensuring seamless integration with the Java-based architecture. The solution was deployed on AWS, providing scalability and reliability.

Benefits:

- 62% reduction in loan processing time

- 80% improvements in loan distribution & Tier 2 & 3 bank partnerships

- 50% savings in operational costs

Read more about how our AWS-powered microfinance loan processing app helped the client improve operational efficiency, streamline loan approvals, and empower field agents with mobile-first capabilities.

FAQ for Cloud Computing in Banking Sector

1. Why is a cloud core attractive proposition for banking institutions?

Listed below are some reasons why the cloud can help reshape the future of the banking industry;

- Moving from closed systems to ecosystems: Banking institutions can make their products and services available through other providers’ channels and offer third-party offerings through their channels.

- Embedded services shift: Banking institutions are looking to connect credit products at the point of search rather than offering credit options after the end of the sale.

- Real-time data acquisition and automatic updates: They help upgrade the experiences for both end-customers and relationship managers.

- Advanced analytics: Help with product selection and promote better service delivery that is intelligent and personalized.

- Zero-trust security model: Includes data encryption in transit and at rest. It comprises multifactor authentication, access monitoring, tokenization and more

2. What is the success parameter for banks while shifting to the cloud?

Listed below are some success factors banks should consider while shifting to cloud solutions.

- Clear ROI definition for the cloud-based projects

- Selection of service providers with a holistic experience in offering cloud-based services

- Go for outsourcing contracts that utilize pay-per-use cloud delivery models

- Understanding of the regulatory & compliance framework with data confidentially requirements

3. According to you, what are the potential risks for banks while migrating to cloud services?

You agree that banks operate with a low regulatory and reputational risk tolerance. As part of this, the risks would include disrupting the business while shifting its code systems to the cloud. Further, they need to comply with stringent data, security, and privacy rules.

4. What are the best practices for cloud adoption in banking?

Here are some common best practices that will help you achieve cloud adoption proficiently:

- Start by selecting a cloud service provider with robust security features and compliance certifications.

- Implement a phased migration to minimize risks, and leverage cloud-native tools for scalability.

- Focus on data protection and fraud detection using AI

- Ensure continuous monitoring for regulatory compliance.

5. Which banks have successfully adopted cloud computing, and how have they benefited?

Many global banks, including ING, JP Morgan, and DBS, have successfully adopted cloud computing to enhance operational efficiency, improve customer experiences, and scale services faster. These leaders leverage the cloud’s flexibility to drive innovation and agility in the banking sector.

30 Min

30 Min