The fusion of Generative AI is helping FinTech companies process and analyze data to unlock new avenues for innovation and operational efficiency. Through the combination of NLP, ML, and Deep Learning, this technology helps FinTech companies automate routine and repetitive processes while delivering data-driven insights and personalized customer experiences. The impact is particularly significant in democratizing FinTech more accessible—through applications like personalized financial advice, fraud detection, and credit scoring, Generative AI is empowering individuals who were traditionally excluded from mainstream banking to access new-age financial services easily.

Let’s explore how Generative AI is transforming FinTech through key benefits, practical use cases, real-world examples, best practices, and emerging opportunities within the FinTech industry.

Generative AI in FinTech Market: Scope and Outlook

Generative AI tools and applications are finding diverse applications across various FinTech sub-sectors. From banking and insurance to investment management and payment systems, let’s take a closer look at the scope and future outlook of Generative AI in FinTech:

- The Gen AI market in FinTech is projected to grow from $1.61 billion in 2024 to $2.17 billion in 2025, at a remarkable CAGR of 35.3%, a clear indicator of its productivity-driven adoption. By 2029, it is expected to reach $7.23 billion, growing steadily at 35.1% each year.

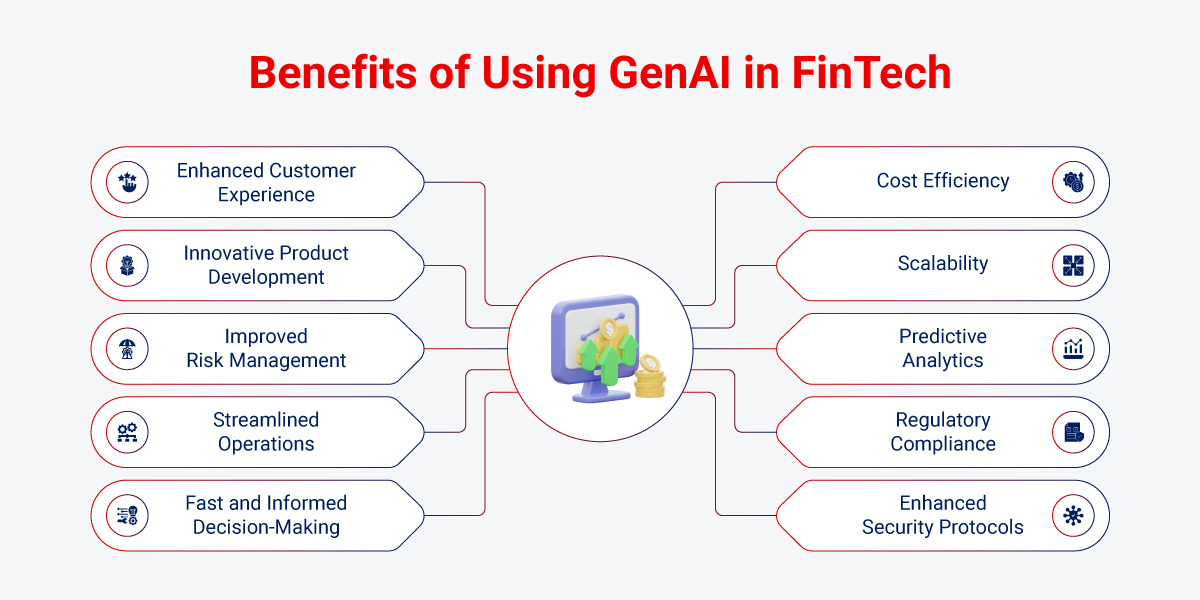

Benefits of Generative AI in the FinTech Industry

The adoption of Gen AI for FinTech goes way beyond automation. It has triggered a massive shift in productivity levels, personalization, customer-centricity, risk management, and strategic decision-making within the FinTech landscape.

Now, you may wonder how does generative AI impact productivity levels in the FinTech industry? The answer you will find in its ability of automating high-volume tasks such as document processing, compliance checks, customer onboarding, and fraud monitoring, it reduces manual effort and operational costs. This allows financial institutions to reallocate resources toward innovation, faster decision-making, and improved customer service.

Let’s explore key benefits of generative AI in FinTech industry:

Enhanced Customer Experience

Generative AI democratizes processes and procedures through enhanced accessibility, personalization, and improved service delivery while making them more affordable. It offers tailored experiences through data visualization and ETL (extract, transform, and load) processes, enabling customized product selection, personalized investment strategies, and 24/7 assistance. This enhances customer satisfaction, loyalty, and trust.

Innovative Product Development

Integrating GenAI helps accelerate the prototyping of FinTech products in a simulated environment. This agility allows FinTech firms to test scenarios and customer responses and innovate rapidly to keep up with ever-changing market trends and consumer demands.

Improved Risk Management

Generative AI can analyze vast datasets in real time to identify and assess risks immediately. It detects suspicious transactions and patterns to detect and prevent fraud. This helps FinTech firms safeguard their assets and maintain their reputation in the market.

Streamlined Operations

The best way to capitalize on Gen AI is by using it to automate repetitive tasks like data entry and compliance checks. It can boost efficiency, eliminate human error, put operations on autopilot mode, and help cut costs. With Gen AI, companies can manage their resources better and enable their teams to focus on strategy and customer engagement.

Fast and Informed Decision-Making

Generative AI provides essential insights into market trends, customer behavior, and financial forecasting. This actionable information empowers key decision-makers to act intelligently and align actions with business goals.

Cost Efficiency

FinTech agencies can achieve significant cost savings by reducing the need for human intervention in operational processes. Gen AI helps businesses accomplish much more in less time and boost their bottom line while maintaining high service standards.

Scalability

Generative AI solutions are designed with scalability in mind. They can efficiently handle increasing workloads as businesses grow. This flexibility ensures that companies can expand their offerings, diversify their services, and adapt to future growth.

Predictive Analytics

With historical data, Generative AI forecasts future trends and customer behaviors. This predictive capability helps the FinTech sector optimize resources and personalize marketing, staying competitive.

Regulatory Compliance

Generative AI streamlines complex regulatory and compliance requirements by enabling FinTech agencies to automate reporting, monitor regulatory changes, avoid penalties, and ensure ongoing compliance.

Enhanced Security Protocols

Gen AI tools enhance cybersecurity by identifying vulnerabilities and responding to threats. It implements real-time threat detection using advanced anomaly detection, behavioral biometrics, and network traffic analysis. These ensure ensuring data protection through end-to-end encryption and secure tokenization. Additionally, Gen AI models constantly learn from data patterns and evolving threats to secure financial information and boost customer confidence through continuous security protocol updates.

Generative AI Use Cases in FinTech Businesses

Gen AI finds versatile applications in FinTech, ranging from enhancing chatbot conversations and ensuring customer satisfaction to generating synthetic data, detecting fraud, predicting trading outcomes, and modeling risk factors. FinTechs, from InsurTech to PayTech, can enjoy tangible business benefits by adopting generative AI. Listed below are some of the most impactful applications of Generative AI in FinTech today:

Personalized Financial Recommendations

Generative AI can scan large volumes of data that pertain to user behavior, spending habits, and market trends. With this capability, FinTech agencies can offer specific advisory services to clients regarding finance matters. AI-based systems, for example, may provide users with customized budgeting advice, investment opportunities, and savings plans, thereby making a customer feel heard and satisfied. Such customization ensures customer delight and enhances loyalty.

Fraud Detection and Prevention

FinTech institutions can employ AI to analyze patterns and anomalies and identify fraudulent activities in real time. Generative AI models are designed to differentiate between normal and suspicious behavior precisely. For this reason, Gen AI is an excellent tool for detecting and preventing financial fraud. Through advanced analytics, Generative AI offers a number of advantages over existing AI and traditional fraud detection methods to identify real-time bank fraud detection and prevention. One of the growing online payment methods is voice-enabled transactions. Generative AI is revolutionizing voice-driven money transfers, allowing people to make payments through natural conversations. It also enhances fraud detection by spotting unusual activity in real time. This means users gain both ease of use and top-notch security.

Automated Dispute Resolution in Payments

In fintech, disputes occur every second and demand fast, accurate handling. Generative AI streamlines the end-to-end process by auto-classifying cases (e.g., unauthorized, incomplete, or unsatisfactory payments), extracting facts from transaction and communication data, and generating policy-compliant resolution paths. It orchestrates collaboration across customers, merchants, and processors with clear, transparent updates instead of ad-hoc back-and-forth. The result: lower operating costs, shorter cycle times, stronger customer trust, and audit-ready documentation.

Automated Financial Reporting

Generative AI automates the end-to-end process of financial reporting by generating reliable reports and retrieving data. With natural language, it lays down accurate reports in no time, saving much time while assuring the absence of human error. Automation of tedious, time-consuming processes frees the staff to focus on strategic operations. Meanwhile, with every financial detail at their fingertips, they can provide quick and correct insights.

Algorithmic Trading Strategies

Generative AI can efficiently identify anomalous patterns within large datasets. By analyzing historical market data, it can generate signals that drive informed trading decisions. These systems can execute trades at optimal moments by tapping into market trends that maximize gains. This capability has made Gen AI a key component in the portfolios of major trading firms.

Risk Assessment and Credit Scoring

Generative AI models are making lending decisions more accurately, reducing the rates of defaults, and enabling people to easily access credit. Unlike traditional credit scoring models that rely on information from very few data points, Gen AI models considers a much larger scope of data for better risk evaluation.

Natural Language Generation for Customer Support

Advanced NLG in customer service promotes interaction through Generative AI. The chatbots, created using Gen AI technology, handle routine inquiries such as account balances, history of transactions, and dispute resolutions. Since these bots learn from previous interactions, they address the needs of the customers more efficiently, while the focus of human agents can be on complex issues. This benefits the customers since it increases the level of satisfaction.

Portfolio Optimization and Asset Allocation

Generative AI can analyze risk profiles and financial goals to provide asset allocations that can best solve investment management. Generative AI helps investors balance their portfolios to gain maximum returns with minimum risks by using historical data as well as asset correlations. FinTech companies are now employing this technology to provide customized solutions so that clients can navigate complex decision-making on investments with ease.

Smart Contract Implementation

Generative AI facilitates the creation and execution of smart contracts. It automatically generates boilerplate code by analyzing existing contracts, which helps identify security vulnerabilities, improve code quality, and reduce development time. This ensures secure and efficient financial agreements while eliminating the possibility of human error.

Real-World Examples of Successful Integration of Generative AI in FinTech

Let’s explore some real-life success stories of FinTech companies that have effectively implemented Generative AI to reinforce the use cases highlighted earlier.

Morgan Stanley

Morgan Stanley has collaborated with OpenAI to gain early access to Gen AI products for personalized financial insights. Projects like Next Best Action and Genome showcase their commitment to Generative AI-driven personalization in client communication.

Bloomberg

Bloomberg is leading the charge with Bloomberg GPT, a language generation model. It is revolutionizing financial analysis and reporting with its speed and personalization capabilities. This Gen AI tool helps the company generate high-quality financial content, personalize news and alerts, engage in conversations, and conduct risk analysis and forecasting.

Nedbank

Nedbank leverages Microsoft Copilot Generative AI to create a chatbot called Electronic Virtual Assistant (EVA) that offers quick and easy self-service options for customers. EVA now handles 80 percent of the financial institution’s inquiries at a fraction of the cost. Machine learning and advanced data analytics are deployed to guide intelligent data-centric decisions to enhance productivity, streamline processes, mitigate risks, and foster innovation.

Stripe

Stripe uses GPT-4 to streamline the user experience and better understand users’ businesses so they can provide the right type of support. It also uses Stripe Docs, which acts as a virtual assistant for developers, so they spend less time reading and focus more on building.

Best Practices for Implementing Generative AI in FinTech

Generative AI offers immense potential in the FinTech sector. However, to maximize effectiveness while safeguarding user trust, FinTech companies must adopt a strategic approach that prioritizes transparency, regulatory compliance, and continuous model monitoring. Here are some essential best practices that FinTech companies can consider:

1. Data Quality Assurance

Ensuring high-quality data is crucial. Use only clean, accurate, and relevant data to train Generative AI models, as this underpins the reliability of Gen AI-driven decisions. Regular data audits and validation processes help maintain quality and enhance decision-making and trustworthiness.

2. Ethical Considerations

Ethics are paramount, especially around data privacy, fairness, and transparency. Implement frameworks to mitigate bias, obtain informed consent, and uphold fairness in Gen AI-powered services. Strive to maintain equitable treatment across all Generative AI interactions, enabling a more inclusive financial landscape.

3. Continuous Learning

The rapid pace of AI development requires a culture of ongoing learning. Invest in employee training to keep skills up-to-date and keep teams proficient in leveraging Generative AI. Continuous education helps your organization adapt to evolving technologies and industry trends.

4. Regulatory Compliance

To avoid legal pitfalls and protect your organization’s reputation, FinTech companies must adhere to relevant regulations. You need to stay informed on regulations governing the use of Gen AI in fintech and ensure your applications comply with these standards. This will help to avoid hefty fines and build customer trust.

The Future of Generative AI in FinTech

The synergy between Generative AI and FinTech has reshaped the industry with the convergence of innovation, efficiency, and personalization for the benefit of individuals and institutions alike.

Hyper-Personalized Financial Services:

As data becomes more unified and accurate, Gen AI’s unique strength will be used to create personalized payment experiences. It will further enable real-time adjustment of financial products and services based on an individual’s life events, user behavior and market conditions.

Potential Impact on Labor Productivity:

According to McKinsey’s report, Generative AI could significantly increase labor productivity by 0.1 to 0.6% across the economy. It will likely add trillions of dollars in value to the global economy, and about 75% of the value that Gen AI use cases will deliver will fall across areas like customer operations, marketing and sales, software engineering, and R&D.

Risk Management and Compliance:

Using deep learning, Gen AI can help FinTech companies analyze real-time data to identify potential risks and fraudulent activities more effectively than traditional methods. According to a McKinsey survey, 80% of credit risk organizations expect to implement Gen AI technologies within a year.

The future of Generative AI in FinTech is not just a tech evolution; it’s a paradigm shift toward a more agile, responsive, and user-centric financial ecosystem.

How Can Rishabh Software Help You Integrate Generative AI in Your FinTech Business?

Here’s how partnering with us can accelerate your digital transformation journey:

- Tailored Solutions for Your Unique Needs: Your business is unique with its own set of challenges and requires solution customized to your business needs. Leverage our expertise to build custom software solutions specifically designed for the intricacies of the FinTech sector.

- Precision in AI Integration: We have an experienced team that specializes in implementing Generative AI while ensuring seamless integration into your existing systems. From data analysis to real-time applications, we’ve got you covered.

- Enhanced Security Measures: Security is non-negotiable in finance. We can help you build custom solutions that prioritize robust security to ensure that your sensitive data is protected against potential threats.

- Optimized Operational Efficiency: Streamline your operations with tailored Generative AI applications. Whether it’s automating routine tasks or optimizing complex processes, our team can help you develop solutions that go beyond automation, providing strategic tools that enhance efficiency and enable data-driven decision-making.

- Continuous Support and Adaptability: The tech landscape evolves, and so should your solutions. We provide continuous ongoing to ensure that your Generative AI applications stay relevant and effective as your business grows.

At Rishabh Software, we identify optimal business opportunities to integrate Generative AI into your FinTech business while ensuring the highest level of cybersecurity and regulatory compliance. Whether you’re looking to start your digital transformation journey or enhance your existing processes, our FinTech software development services can help you build and launch products that ‘wow’ your customers every time. As a trusted Generative AI development company, we specialize in crafting tailored solutions that align with your business goals and industry regulations. Let’s redefine what’s possible in FinTech together.

Frequently Asked Questions

Q: Can small FinTech startups and SMBs afford Generative AI adoption?

A: Yes, but affordability depends on the adoption approach. Instead of building large-scale custom models, startups can use cloud-based AI services (like Azure OpenAI, AWS Bedrock, or Google Vertex AI) that offer pay-as-you-go pricing. Another way to save money is to use open-source LLMs tuned for specific money tasks. Starting small with focused uses like GenAI enabled solution for customer help or catching fraud keeps costs low while still adding value.

Q: How can FinTech companies measure ROI from Generative AI adoption?

A: You should look at the return on investment in three ways:

- Getting More Done: Saving money by using machines (e.g. less time spent by people on rules faster setup for new customers).

- Making More Money: Getting customers more involved, making money products fit each person better, or selling more because of what GenAI tells you.

- Cutting Down on Problems: Catching fraud better, following rules more, and making fewer mistakes when deciding things.

Things to measure might be answering customer questions faster more people buying stuff, losing less money to fraud, or spending less to follow the rules.

Q: Can Generative AI integrate with legacy FinTech systems without a complete overhaul?

A: Yes. Generative AI can integrate with legacy systems and workflow via API-first strategies, middleware, and cloud connectors. Instead of replacing entire infrastructures, companies can layer Generative AI on top of existing systems for tasks like customer query handling, document processing, or predictive insights. Over time, incremental modernization can be pursued, but GenAI adoption doesn’t require a full system rebuild.

Q: What are some potential benefits of using generative AI in finance?

A: Financial organizations gain a competitive edge by leveraging generative AI, leading to improved operational performance and staying technologically advanced.

- Portfolio Optimization: Generative AI assists in optimizing portfolio allocations by generating diverse asset combinations and simulating their performance.

- Market Data Analysis: Enhances portfolio management through in-depth analysis of market data, investment strategies, and risk profiles.

- Human-Like Interactions: Incorporating Generative AI models into chatbots and virtual assistants enables businesses to offer more human-like and intelligent interactions, improving customer engagement.

- Pattern Recognition: Generative AI’s ability to analyze large datasets and recognize intricate patterns proves invaluable in financial applications. It enables data-driven decision-making by providing insights into market trends, risk factors, and investment opportunities.

- Enhanced Customer Experience: Improves customer experience by automating customer service tasks, delivering personalized financial guidance, and ensuring swift and accurate interactions.

Q: What opportunities and limitations are associated with Generative AI in FinTech?

A: Opportunities exist for robust fraud detection, leveraging AI to identify suspicious activities more effectively.

- Generative AI empowers FinTech by providing data-driven insights for smarter decision-making.

- Generative AI enables the customization of financial services, tailoring offerings to individual customer needs.

- FinTech can leverage Generative AI for developing sophisticated algorithmic trading strategies, optimizing investment decisions.

- Improved risk management through AI analysis of market data, enhancing accuracy in assessing and mitigating financial risks.

The complexity of integrating Generative AI into existing FinTech systems poses a challenge that requires careful planning and execution.

- Challenges in ensuring fairness and mitigating biases in AI algorithms, impacting the ethical use of Generative AI in FinTech.

- The challenge of safeguarding sensitive financial data, requiring robust security measures.

- Compliance with evolving regulatory frameworks is a limitation, demanding continuous adaptation to legal requirements.

- Implementing Generative AI solutions may be resource-intensive, impacting the cost-effectiveness for some FinTech entities.

Q: How can Generative AI optimize the customer experience (CX) in FinTech?

A: Generative AI transforms the customer experience in FinTech industry by automating routine customer service tasks, providing personalized financial guidance, and ensuring swift and accurate interactions across touchpoints. It tailors services to individual needs, fostering client satisfaction and loyalty.

30 Min

30 Min