Your underwriters are drowning in paperwork. Claims take weeks to process. And customer queries? Still routed through clunky IVRs and outdated systems.

You know the gaps. What you need is a way to close them—fast.

Generative AI is already doing that for insurers who’ve moved past pilots and into production. It’s generating policy documents in seconds. Summarizing loss histories. Powering chatbots that don’t sound robotic. And flagging fraud patterns long before they escalate. In fact, according to a business research study, generative AI in the insurance market is expected to reach $5.7 billion by 2029, continuing at a CAGR of about 39.4%.

For CTOs and CEOs, this isn’t about chasing the next shiny object. It’s about building leaner, faster, and smarter operations. It’s about reducing time-to-resolution, improving customer retention, and unlocking new growth opportunities in a hyper-competitive market.

Looking for real Gen AI use cases in insurance, not just ideas, but what’s working on the ground? This blog breaks it down. From underwriting and claims to agent productivity and customer support, we demonstrate how generative AI is driving measurable ROI across the entire insurance value chain.

You’ll explore top use cases, the tangible benefits, real-world deployment challenges with solutions, and a step-by-step roadmap to get started.

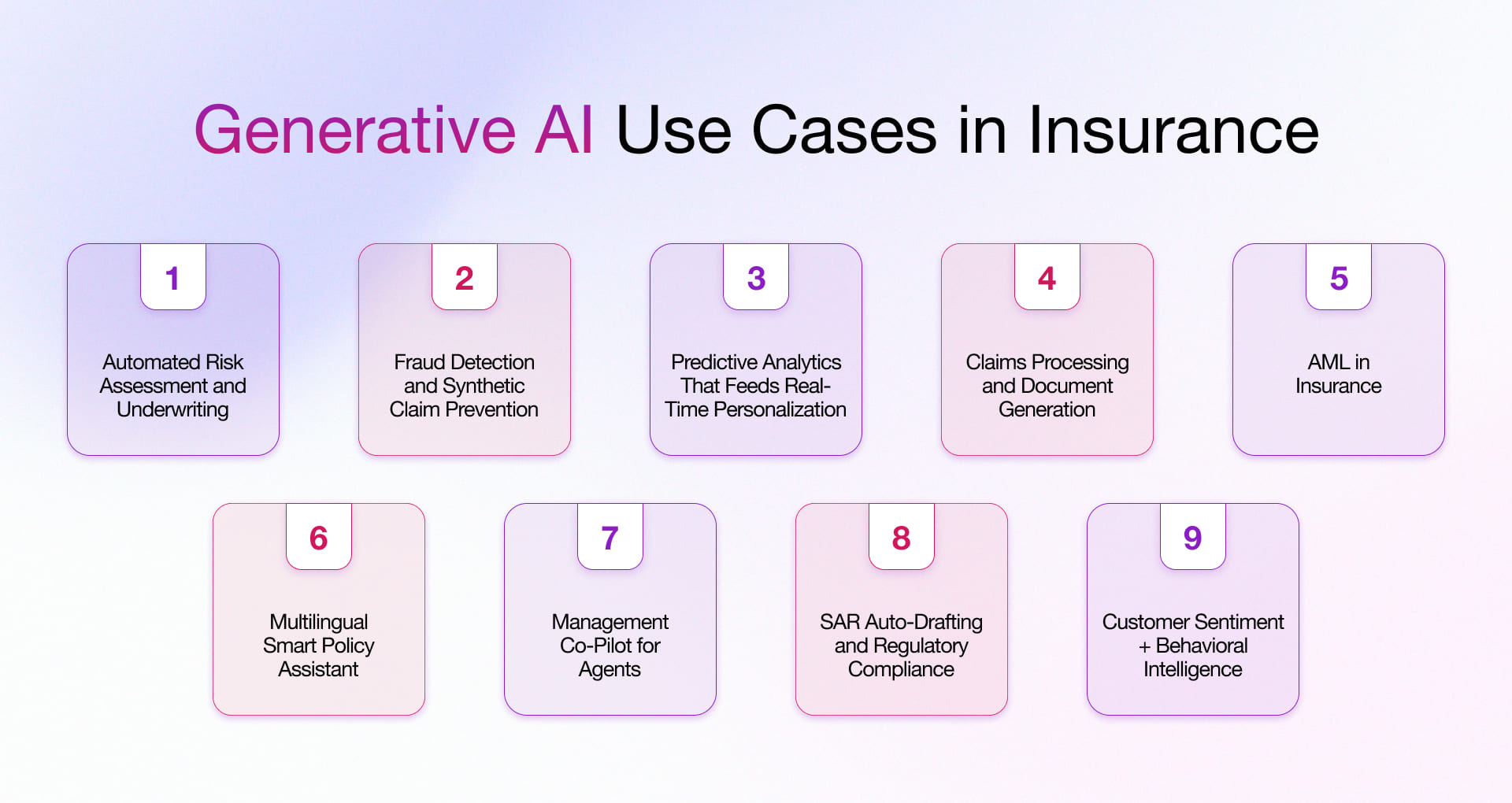

Top 9 Generative AI Use Cases in Insurance You Should Know in 2025

Insurers are no longer just digitizing their operations. They’re automating decisions, enhancing customer interactions, and reducing operational risk at scale. And Generative AI is the force multiplier, making it happen. Let’s break down the real-world applications of generative AI in insurance that go beyond hype and actually move the revenue needle.

1. Automated Risk Assessment and Underwriting

Traditional underwriting is time-consuming, data-heavy, and often inconsistent. Generative AI changes that. By analyzing historical data, policy documents, customer inputs, and third-party sources in real time, it can draft initial risk assessments with contextual precision. AI-generated underwriter summaries are faster to process, easier to audit, and reduce the turnaround time for complex products, such as cyber or commercial insurance.

2. Fraud Detection and Synthetic Claim Prevention

According to one study by Coalition Against Insurance Fraud (CAIF), Insurance fraud costs around $308 billion in US annually. Insurance fraud isn’t just increasing, it’s evolving. Generative AI models are now trained to identify patterns of fraudulent behavior across structured and unstructured data, including handwritten forms, emails, and call transcripts. AI can generate synthetic claim scenarios to stress-test fraud models and fine-tune detection strategies before new schemes emerge.

3. Predictive Analytics That Feeds Real-Time Personalization

This is where Gen AI goes beyond dashboards. Instead of just visualizing historical trends, it generates hyper-personalized customer insights and next-best-action suggestions for agents. For example, based on behavioral patterns and coverage gaps, it can generate tailored policy upsell emails or recommend policy changes before the renewal window closes.

4. Claims Processing and Document Generation

Filing and processing a claim often feels like navigating a maze for both customers and agents. GenAI accelerates the capture of first notice of loss (FNOL) by extracting relevant details from images, voice recordings, or unstructured text. It also auto-generates claim summaries, repair estimates, and client communication templates, thereby reducing the need for back-and-forth communication between departments.

5. AML in Insurance

Anti-Money Laundering isn’t just a banking concern. Insurers offering investment-linked products or annuities face compliance pressure too. GenAI models can auto-generate SAR (Suspicious Activity Report) drafts based on flagged transactions and customer interactions. It can also simulate high-risk customer profiles to enhance AML rule testing and fine-tune detection workflows.

6. Multilingual Smart Policy Assistant

Language shouldn’t be a barrier in a diverse customer base. A GenAI-powered multilingual assistant helps policyholders understand complex insurance terms, compare options, and get policy clarifications in their native language, via chat or voice. It can also auto-generate responses to FAQs and regulatory queries in multiple formats.

7. Management Co-Pilot for Agents

Your agents are juggling product knowledge, compliance, and client expectations, all within a single call. A Generative AI-powered management co-pilot lightens that load. It pulls up relevant client history, suggests tailored policy options, auto-generates quotes, and drafts follow-up messages on the fly.What sets it apart is real-time compliance support. The co-pilot alerts agents if they’re about to step outside regulatory bounds, making every consultation smarter and safer. The result? Better conversions, less rework, and more confident teams.

8. SAR Auto-Drafting and Regulatory Compliance

SAR drafting is a time-consuming, error-prone process. But among Gen AI use cases in insurance, this one stands out. Generative AI makes it easier for compliance teams to stay ahead. It can auto-fill key policyholder details, generate the first draft of the report, and align your internal actions with required legal language. This isn’t about replacing your legal team. It’s about giving them a head start, so they spend time refining, not starting from scratch. The turnaround is faster, and the risk of non-compliance is lower.

9. Customer Sentiment + Behavioral Intelligence

Every email, chat, or phone call from a customer contains signals—frustration, confusion, disengagement. Gen AI can now pick up on those signals in real time. It identifies sentiment patterns and behavioral cues that help insurers respond with empathy and precision. If a customer shows signs of dissatisfaction after a claim is closed, the Gen AI can trigger a personalized check-in message. This keeps relationships from falling through the cracks and builds trust at every touchpoint.

Want to see how this applies beyond insurance? Explore more generative AI industry use cases and how generative AI for enterprises is unlocking new value across sectors.

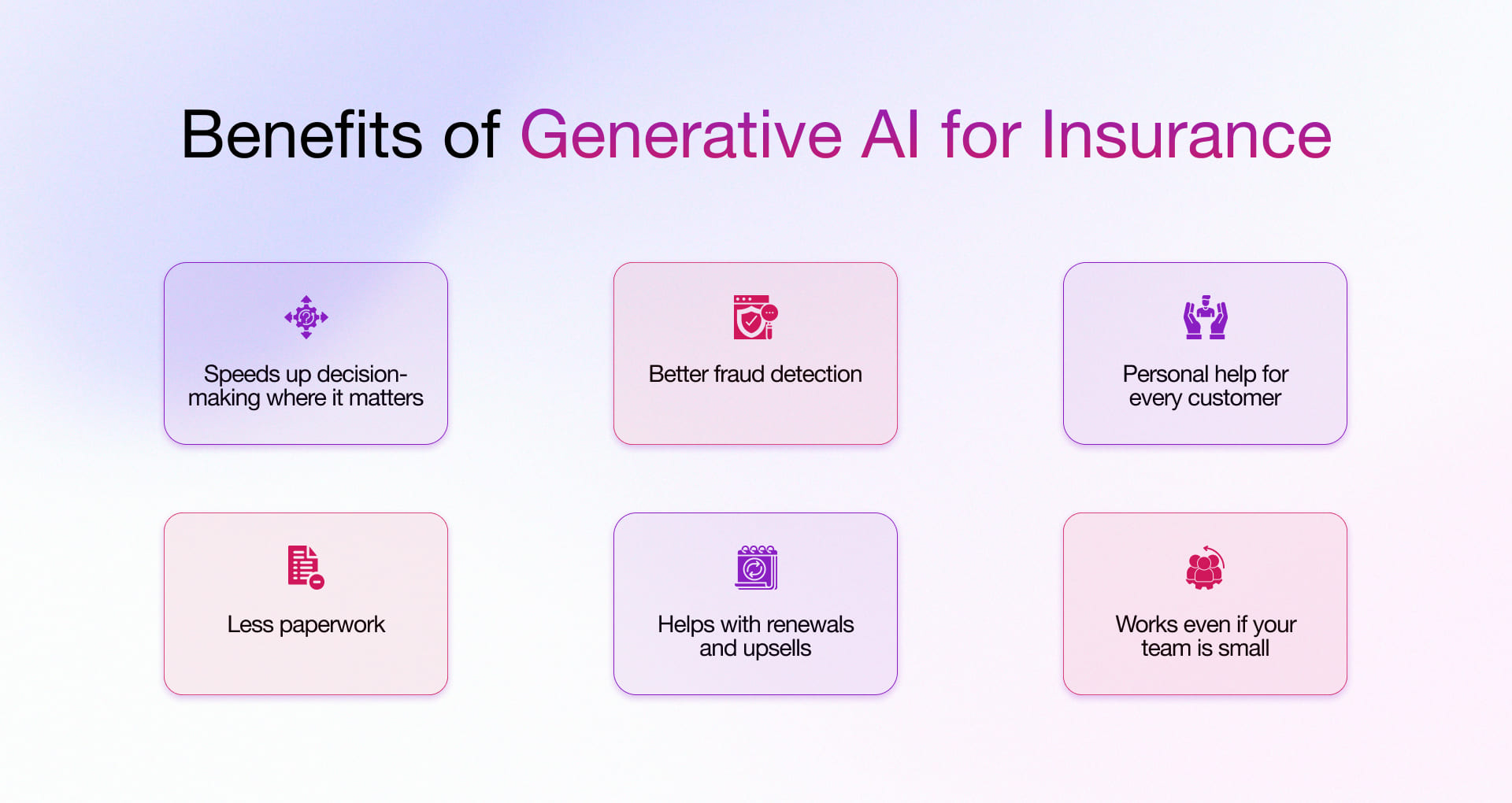

Key Benefits of Generative AI for Insurance

Generative AI in insurance is transforming the way carriers operate. It reduces delays, automates repetitive tasks, and improves decision-making across underwriting, claims, and customer service. Here are some benefits that show its growing impact on the insurance ecosystem.

1. Speeds up decision-making where it matters

Underwriters often lose hours sorting documents, reports, and risk profiles. Generative AI performs the initial pass, reading, summarizing, and highlighting the key insights. It can even suggest a risk rating or a draft decision.

Why It Helps: Your underwriting team shifts from document readers to decision-makers. This significantly reduces processing time and speeds up policy issuance without compromising accuracy.

2. Better fraud detection

Some claims may appear legitimate at first but turn out to be false. Gen AI can look for patterns in claim history, customer behavior, and even email tone. It can also help teams write suspicious activity reports faster when something doesn’t feel right.

Why it helps: It’s harder for fraud to slip through the cracks. Compliance teams get a head start when they need to act quickly.

3. Personal help for every customer

Customers often don’t understand their policies. Some want help in another language. Some need questions answered outside of office hours. Gen AI can handle all of this. It can explain things clearly in different languages and remain available 24/7. According to IBM survey, early adopters using generative AI in customer-facing systems have seen a 14% higher retention rate and a 48% higher Net Promoter Score compared to non-adopters.

Why it helps: People get the support they need without long wait times. And they’re more likely to stick with your company.

4. Less paperwork

Agents and teams often handle routine tasks, such as filling out forms, copying data, or writing follow-up emails. Generative AI can handle most of that. It can create drafts, generate quotes, or suggest what to say next.

Not only this, according to McKinsey, automation and Gen AI can drive productivity gains of 10–20%, premium growth of 1.5–3.0%, and improve technical results by 1.5–3.0 percentage points that ultimately improves overall business performance and efficiency.

Why it helps: Teams get more time to focus on customers instead of paperwork.

5. Helps with renewals and upsells

Gen AI can review a customer’s history and identify missing coverage or better plan options. It also reminds agents when to follow up before a policy ends. This means you don’t miss a chance to offer more value.

Why it helps: Customers feel like someone’s looking out for them. And your team sells more without needing to push.

6. Works even if your team is small

You don’t need a big Gen AI team to get started. Many tools are already built and easy to plug in. Even smaller insurers can use Gen AI to handle claims, answer questions, or support compliance.

Why it helps: You can start small, test what works, and grow from there, without a significant investment.

Challenges of Leveraging Gen AI in Insurance and How to Overcome Them

Gen AI can make a substantial impact on the insurance industry. But it’s not always easy to put into action. Many companies encounter issues during setup, use, or scaling. The good news is that most of these challenges can be addressed with the proper steps. Here are the main challenges and what you can do about them.

1. Data is scattered or messy

Gen AI Models require clean and complete data to function effectively. But in many insurance companies, data sits in silos. Some files are on paper. Some systems don’t talk to each other. This makes it challenging for Gen AI to obtain the complete picture.

How to fix it: Start by cleaning and organizing your data. Bring it all together in one place if possible. Utilize data integration tools or hire experts who can accomplish this efficiently. Once your data is in shape, Gen AI becomes much more helpful.

2. Hard to trust the output

Sometimes, Gen AI provides answers, but users are unsure where the information originated. This creates doubt, especially in areas such as underwriting or claims, where accuracy is crucial.

How to fix it: Pick Gen AI tools that show how they came to a result. Look for ones that explain their reasoning. Also, test Gen AI results against real cases before using it entirely. This builds trust with your team over time.

3. Risk of bias and mistakes

If the data you feed Gen AI has gaps or biases, it can lead to wrong or unfair results. This is particularly risky in insurance, where decisions directly impact real people.

How to fix it: Regularly review how your Gen AI model behaves. Set up checks and balances. Involve compliance teams from day one. Make sure the Gen AI learns from diverse and balanced data sources.

4. Too many tools, not enough clarity

There are numerous Gen AI tools available on the market. Some focus on documents, some on chat, others on claims. Without a clear plan, it’s easy to try too many things and not get results.

How to fix it: Start small. Focus on one or two clear use cases like claims summaries or agent co-pilots. Get them working, show the value, then expand. Don’t chase every new tool. Choose what fits your goals.

5. Security and privacy concerns

Insurance data is sensitive. Gen AI tools that use external servers or third-party APIs can pose risks. Customers also worry about how their data is being used.

How to fix it: Choose tools that follow strict security rules. Use private or on-prem versions if needed. Always follow local data protection laws. Make your policies clear to customers to build trust.

6. Skills gap within teams

Most insurance teams don’t have Gen AI engineers or data scientists on staff. Without the right skills, adoption slows down.

How to fix it: Train your existing staff in Gen AI basics. Start with short programs that explain how the tools work. For advanced needs, work with outside partners who know the insurance space.

7. No clear ROI in early stages

Gen AI projects can take time to show value. If you don’t measure results properly, it may seem like it’s not working.

How to fix it: Set clear success metrics from the start. Track time saved, errors reduced, or speed of decisions. Share early wins across the team. This helps build momentum and gets leadership buy-in.

Roadmap to Implementing Generative AI for Insurance Operations

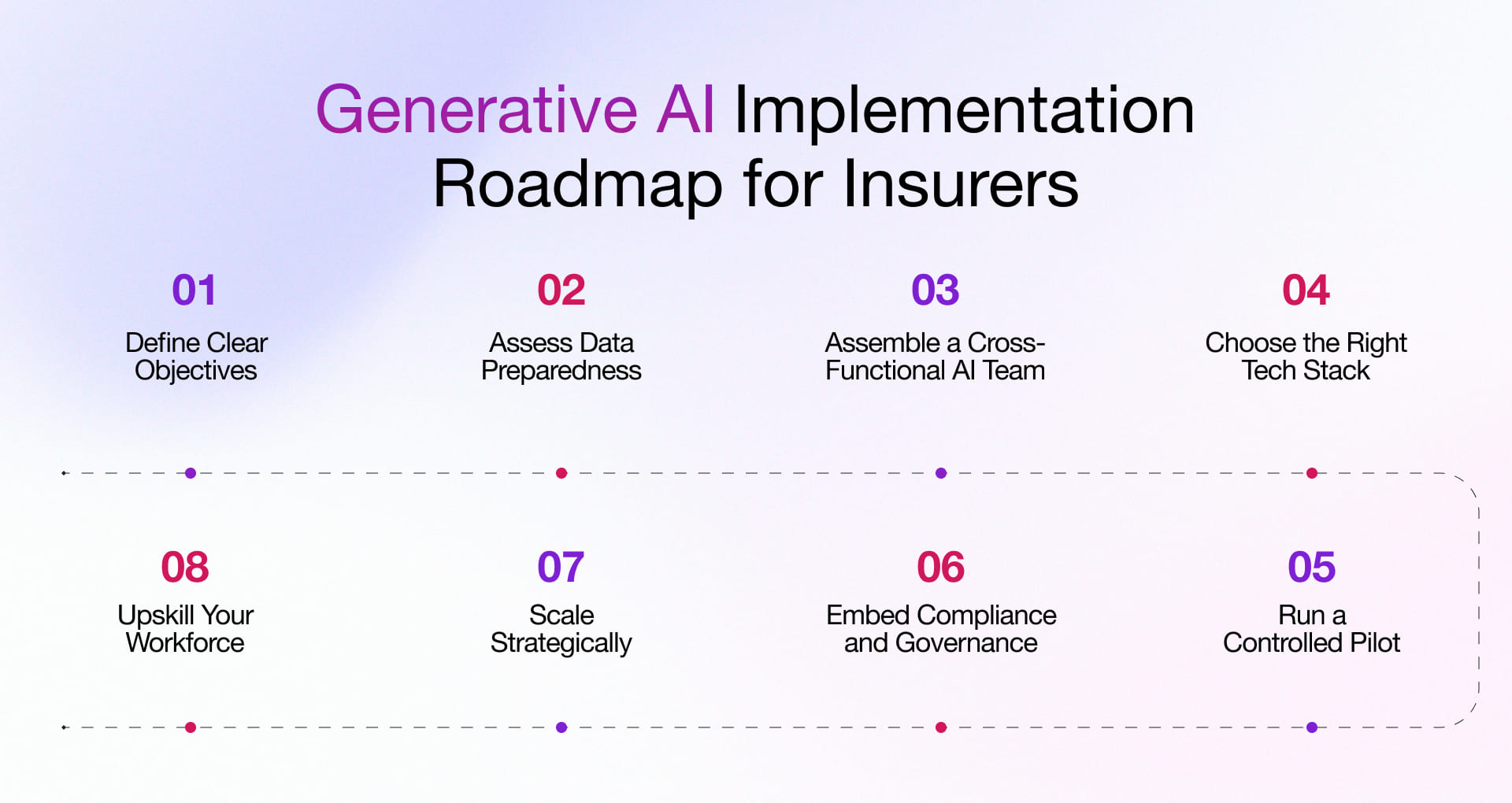

You’ve seen the potential of generative AI in the insurance industry. But where do you begin? Here is the step-by-step roadmap for your enterprise. Whether you’re exploring gen AI use cases in insurance or preparing to scale existing efforts, these steps will keep your transformation focused, compliant, and value-driven.

1. Define Clear Objectives:

Before implementing generative AI in insurance, identify the exact problems you’re solving. From speeding up claims to improving underwriting accuracy, clear objectives provide direction and accountability.

- Determine areas with high automation potential

- Establish measurable goals for Gen AI performance

- Align Gen AI objectives with business outcomes

- Set timelines and budgets for Gen AI adoption

2. Assess Data Preparedness

Poor-quality data leads to unreliable Gen AI output. For sectors like generative AI in life insurance or health insurance, accuracy is non-negotiable.

- Audit existing data for gaps and inconsistencies

- Clean and label data relevant to the selected use case

- Ensure compliance with data privacy laws

- Implement secure storage and access protocols

3. Assemble a Cross-Functional AI Team

Gen AI in insurance needs more than technical expertise. You need input from compliance, operations, and product teams to drive responsible adoption.

- Involve legal, risk, and domain experts from day one

- Assign clear ownership for each phase of implementation

- Foster collaboration between IT and business teams

- Define escalation paths for model performance issues

4. Choose the Right Tech Stack

Not every model fits every insurer. Tailor the stack based on your goals, data sensitivity, and regulatory obligations.

- Evaluate open-source vs. enterprise Gen AI platforms based on your content generation needs.

- Select models suited for insurance workflows

- Ensure the system supports explainability and auditing

- Prioritize tools with integration support for legacy systems

5. Run a Controlled Pilot

Start small, measure impact, and scale only after validation. Pilots reduce risk and build organizational confidence.

- Choose one high-impact use case, like claims triage

- Measure Gen AI impact on accuracy, speed, and cost

- Gather user feedback for continuous improvement

- Use pilot success to secure buy-in for broader rollout

6. Embed Compliance and Governance

Applications of generative AI in insurance must be compliant from the start. Waiting until deployment is too late.

- Implement model governance frameworks

- Ensure outputs are explainable and traceable

- Monitor Gen AI decisions for bias and fairness

- Stay aligned with evolving industry regulations

7. Scale Strategically

Once proven, extend the use cases of generative AI in insurance to other areas, such as policy generation, fraud detection, and customer support.

- Identify adjacent processes for Gen AI integration

- Replicate success from the pilot with minimal disruption

- Establish a change management plan for scale

- Maintain human-in-the-loop for complex decisions

8. Upskill Your Workforce

Adoption fails when teams don’t understand the tool. Training builds trust and unlocks actual productivity.

- Conduct AI literacy sessions across teams

- Offer tool-specific training based on user roles

- Highlight how Gen AI enhances their productivity

- Create Gen AI champions to lead internal adoption

How Does Rishabh Software Help Build Generative AI Solutions for the Insurance Industry?

We don’t build AI just for the sake of it. At Rishabh Software, we develop generative AI solutions that address real-world problems for insurers. Faster claims processing. More accurate underwriting. Smarter customer service. Better compliance.

You get solutions shaped around your needs. Whether it’s generating first-draft policy summaries or helping agents respond quickly with customer insights, we work with your teams to make Gen AI easy to use from day one.

We know insurance systems are complex. There are legacy platforms, disconnected data, and strict compliance rules. That’s why our Gen AI Development Services are built to fit into your existing systems. No rip and replace. Just smarter workflows, connected tools, and secure operations.

Your data stays safe. Every solution we build includes the right controls for privacy, audits, and governance. We also ensure that your teams understand how it works and where the outputs originate.

You don’t need a large Gen AI team to get started. We bring the technical skills, insurance domain knowledge, and delivery support. From planning to deployment to ongoing updates, we stay with you through every stage.

If you’re ready to move from Gen AI experiments to real business outcomes, we’re ready to help. One step at a time. With solutions that actually work.

Frequently Asked Questions

Q: How is Generative AI in insurance different from traditional AI approaches?

A: Traditional AI is rule-based or predictive and used in fraud detection, churn modeling, or underwriting automation. It works on structured data and historical trends.

Generative AI creates new content such as text, images, summaries, and even synthetic scenarios. It enables tasks like:

- Auto-generating policy drafts or claim summaries

- Producing multilingual responses in real time

- Simulating risk scenarios for training or underwriting

This marks a shift from decision support to decision augmentation, bringing a more contextual, conversational, and human-like interface to insurance operations.

Q: Is Generative AI for insurance secure and compliant with insurance regulations?

A: Yes, but only when implemented with intention. Generative AI systems must be architected for compliance from the ground up. This includes robust data governance, audit logging, encryption, access controls, and model explainability.

Insurance providers also need to consider where data is processed and stored, especially for global insurers operating under the GDPR, HIPAA, or local regulations such as IRDAI in India. Using fine-tuned, domain-specific models hosted in secure, jurisdiction-compliant environments is key. Moreover, Gen AI outputs must be monitored continuously to detect hallucinations or biases that could lead to legal exposure.

Q: Should we build our own Gen AI in insurance models or partner with vendors?

A: This comes down to build-versus-buy tradeoffs. Building your own models gives you greater control, tailored workflows, and the ability to fine-tune on proprietary data. However, it also requires significant investment in both Gen AI talent and infrastructure.

On the other hand, partnering with specialized Gen AI vendors, particularly those focused on the insurance industry, can accelerate deployment, reduce risk, and offer pre-trained models aligned with industry-specific needs. Many insurers are adopting a hybrid strategy by using external foundation models (such as Azure OpenAI or Anthropic) while building custom layers for underwriting, claims, or policy servicing.

Q: What are the ethical and legal implications of using Gen AI in customer-facing insurance interactions?

A: When AI speaks on behalf of your brand, the risks aren’t just technical. They’re also reputational and regulatory. Misleading policyholders, unfair denials, or biased decisions can lead to legal action and loss of trust.

Ethically, insurers must ensure transparency. Customers should know when they’re interacting with AI.

Legally, you need governance around AI usage: Who approves prompts? How are outputs validated? Is there a human fallback? Compliance teams should work closely with technology to develop clear policies for explainability, consent, accountability, and redressal.

Q: What is the future of generative AI in insurance?

A: Here are some future trends of Gen AI in insurance that you should watch:

- Embedded intelligence: Gen AI won’t sit in silos. It will be embedded into policy engines, CRM tools, and claims systems.

- AI-powered co-pilots: Underwriters, agents, and adjusters will increasingly rely on Gen AI for drafting, summarizing, and decision support.

- Hyper-personalization at scale: Customer journeys will be reimagined with context-aware, language-adaptive, real-time interactions.

- Continuous learning systems: Feedback loops from human agents, regulators, and customers will train models to get more innovative and more compliant over time.

- Rise of AI governance frameworks: Future-ready insurers are already establishing internal AI councils to vet use cases, monitor outcomes, and guide responsible adoption.