The convergence of AI and mobile technology is revolutionizing enterprise operations, particularly within the insurance sector. Mobile apps are reshaping service delivery and redefining customer expectations, making them essential tools for success.

Both established companies and startups recognize insurance mobile app development as a competitive necessity. These apps provide policyholders with instant access to their insurance information from anywhere, while also boosting insurance agents’ efficiency through accelerated request processing. Modern customers expect seamless digital experiences, making insurance apps vital touchpoints that enhance customer satisfaction, engagement, and operational efficiency.

Rishabh Software supports organizations in the BFSI domain with multi-purpose mobile app development services. We offer custom insurance mobile app development that enables customers to file claims, contact consultants, and renew their policies with minimal effort.

If you are an insurance business looking to develop a mobile insurance app, this blog is for you. We will explore essential aspects of insurance app development, including reasons to invest, challenges, app types, essential features, the development process, and suitable tech stacks.

Why You Should Invest In Insurance App Development

An insurance app enables quick and easy communication between an insurance company and its customers. It automates tedious manual processes and eliminates paperwork. Even business leaders acknowledge the need to integrate mobile application technology into their operations. Let’s look at the benefits of insurance apps for both insurance companies & end clients:

Here are some key stats that substantiate the fact that insurance applications are a great business idea:

- The global InsurTech market size is expected to reach $32.47[1] billion by 2029, growing at a CAGR of 30.34%.

- An insurance market analysis indicates that the sector will expand at a CAGR of 7.2% from 2022 and reach USD 1,223.5[2] by 2030.

Insurance Mobile App Benefits for Customers

Customers today demand a seamless digital experience when engaging with their insurance provider. They expect need-based content to be readily available along with easy access to insurance services and greater transparency related to policy information. Let’s look at some prominent benefits of insurance mobile apps for customers.

- Seamless Insurance Access: Customers can easily access various insurance services worldwide through an insurance app. This eliminates in-person visits or time-consuming customer care calls and provides an effortless way to communicate with insurance companies.

- On-the-Go Policy Verification: An insurance mobile app helps customers instantly check their policy eligibility and coverage details anytime and anywhere. This provides peace of mind to customers and enhances the customer satisfaction ratio.

- Convenient Virtual Consultations: Whenever you need any help with the policy, consultants and insurance experts are just a click away through the mobile app. Through this, you will receive professional advice and guidance without any burden of scheduling in-person appointments.

- Mobile-Friendly Documentation: Whether it be payments, renewal forms, or any other form, customers can fill out necessary documentation online through their smartphones or tablets to easily share documents and access self-service options. This feature provides a convenient and transparent process for the customer and the insurance company.

- Timely Renewal Reminders: One crucial benefit of having a mobile app is automated push notifications to ensure that customers or insurance agents never miss a policy renewal deadline or update. This will help them maintain continuous coverage and avoid a lapse in protection.

- Real-Time Policy Updates: An insurance mobile app enables instant alerts and push notifications for all stakeholders, regarding any policy terms, updates, new benefits, or available discounts. This ensures they have the most up-to-date coverage information.

- Location-Based Assistance: Whenever and wherever you need any location-sensitive help, the mobile app provides easy access by connecting users with nearby agents and service centers for emergency assistance.

Insurance App Benefits for Insurance Companies

Mobile apps offer multifold advantages to insurance companies, such as reducing operational costs and streamlining processes. There are several other benefits that insurers can reap from developing a mobile app. Here are some of the key advantages.

- Enhanced Customer Communication: The mobile app provides a direct communication line between insurance companies and their customers. Integrated chatbots help in seamless 24×7 communication with customers that instantly address end-user queries while reducing human agents’ workload.

- Streamlined Operations: Mobile apps can automate many tasks currently done manually by insurance companies, such as processing claims and generating quotes. This can save companies time and money and increase operational efficiency by reducing errors.

- Data-Driven Insights: Insurance companies can leverage mobile apps to reveal valuable insights into customer behavior, preferences, and needs by collecting data on how customers use the app. This will help them provide personalized customer experience and develop new products and services.

- Tailored Customer Offerings: By utilizing collected data from the mobile app, insurance companies can analyze it and provide personalized product recommendations and coverage options. It will help increase customer satisfaction and increase potential sales.

- Rapid Customer Feedback: Collecting feedback is crucial so you can provide what the customer is looking for. The mobile app will help you collect instant feedback to identify and address issues, improving overall service quality quickly.

- Boosts Productivity and Sales: A mobile app goes beyond just offering a seamless customer experience. It also helps enhance insurance agents’ productivity by offering them the right tools to manage policies, process claims, and close deals efficiently. This helps in increasing overall sales and revenue.

- Accelerated Deal Closure: With streamlined application processes and instant policy issuance capabilities, mobile apps significantly reduce the time required to close insurance deals, significantly improving customer acquisition costs.

Challenges That an Insurance App Development Can Solve

You would agree that an insurance mobile app development helps users to simplify their association with the insurance company. Let’s look at the main issues that the customer insurance app can address once and for all:

- The Omnichannel Gap: Insurance companies often employ agents and brokers at key touchpoints to connect with potential clients. However, they cannot offer a personalized experience and stimulate profitable growth. For today’s tech-savvy customers, developing an app allows insurance companies to reach out and engage their customers most conveniently.

- Insufficient Data Protection: Insurance data is sensitive and needs to be protected. Conventional systems & practices might offer some room for hackers to steal this information. Partnering with an experienced insurance app development company would ensure proper protection of data. It would enable lowering operational risks and avoid fraudulent activities & data leaks. Skilled software developers follow the latest safety practices through modern technologies. It would include multi-factor authentication & secure SSL connection protocols, biometric authentication & more.

- Seamless Data Sharing & Access: When the insurance portal is down in case of an emergency, and there’s no alternative solution, the company’s reputation takes a significant blow. To avoid such issues & ensure uninterrupted business continuity, your insurance app development partner can help you with an operationally reliable platform. They can help you choose from reliable cloud services providers like Amazon Web Services or Microsoft Azure – based on your business needs.

- Inaccurate Forecast: Insurance companies collect vast data from disparate sources, making it challenging to organize and analyze. The influx of data is daunting, and policymakers need sophisticated analytics platforms to turn this data into actionable insights. When leveraged with powerful technologies such as the Internet of Things (IoT) or Machine Learning (ML), data analytics can make it easy to collate, visualize and analyze data. It would enable accurate forecasting & demand prediction for fast and effective decision-making.

- Slow Underwriting and Claims Processing: Manual insurance processes involve a great deal of error-prone paperwork. It hampers underwriting and claims processing. Insurance software automates various standard repetitive procedures, allowing you to make your services accurate, efficient, and speedy.

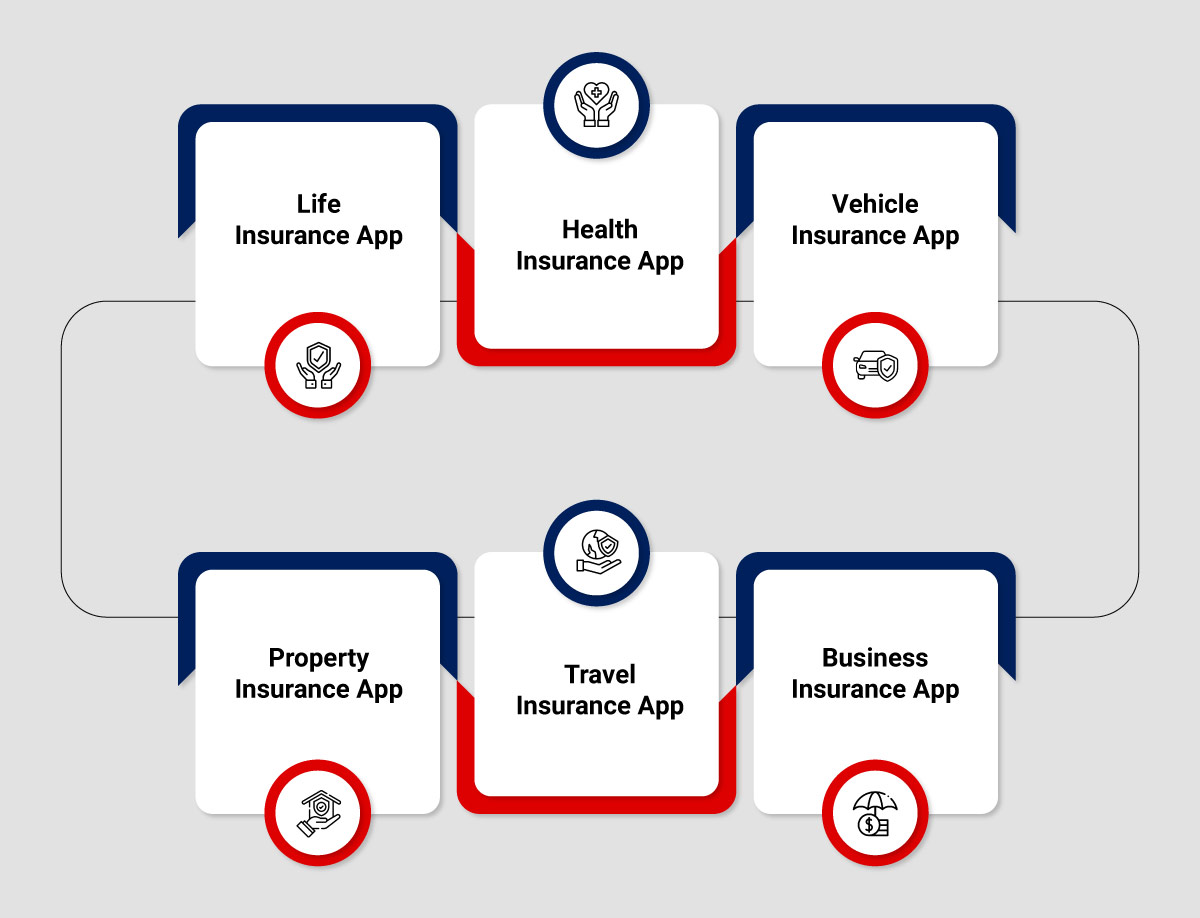

Type of Insurance Apps

Insurance app development solutions will vary based on the niche your insurance company serves. Here are six common categories of mobile apps that are developed in the InsurTech domain:

Life Insurance

A life insurance app allows users to manage their life insurance policies, update beneficiaries, and track policy value. Some apps also offer quick life insurance quotes or simplified underwriting processes. In short, it streamlines all routine processes, such as:

- Helping customers choose the right policy

- Review terms and conditions

- Fill in relevant data online

- Make all the payments online

- Receive instant notifications

- Automatically calculate the rate of interest

- Contact support service via a bot

Health Insurance

It allows users to manage their medical coverage, view policy details, and file claims digitally. These apps often include features like

- Select their preferred doctors

- Book appointments

- Access documents and complete formalities online

- Search for suitable health plans

- Compare the rates for doctors and pharmacies

- Accessing virtual healthcare services

Vehicle Insurance

These apps assist users in managing their auto policies, requesting roadside assistance, and reporting accidents quickly. They typically offer digital insurance cards, premium payment options, and tools for documenting damage and submitting claims after an incident. Vehicle insurance app is a real digital savior, especially in cases where the user may have met with an accident, as it allows to:

- Take pictures of the accident site and upload them on the system in real-time

- File a claim on the spot

- Receive a repair estimate

- Upload images, videos, locations, and relevant data

- Quickly access documents

- Get instant information about repair services

Travel Insurance

These apps allow travelers to purchase and manage travel insurance policies, file claims, and access emergency assistance services while on the go. It works like a safety net that minimizes your risk in emergencies by:

- Covering unexpected medical expenses

- Accident & sickness medical expense reimbursement

- Guarding policyholders against luggage loss and trip cancellations

- Protecting the insured person in case of loss of travel documents

- Making instant help accessible across the border

Business Insurance

It helps entrepreneurs and companies manage various types of commercial coverage, such as liability, property, and workers’ compensation. This app safeguards significant business investments against huge risks by allowing policyholders to:

- Select a suitable package based on business size & nature of risk

- Easily purchase a policy

- Minimize losses by quickly settling an insured event

Property Insurance

These apps cover a broader range of property types than just homes. It includes insuring jewelry, real estate, artwork, expensive equipment, and other types of properties with self-service options for:

- Choosing a policy

- Filing claims

- Receiving property maintenance reminders

- Tracking a property for damages, breakdowns, leaks, and so on

Insurance Mobile App Features – Basic & Advanced

The features you need to integrate largely depend on your business’s insurance segment – life, health, vehicle, or property. While the basic insurance mobile app features will be standard, we have also listed niche-specific features.

Common Insurance App Features

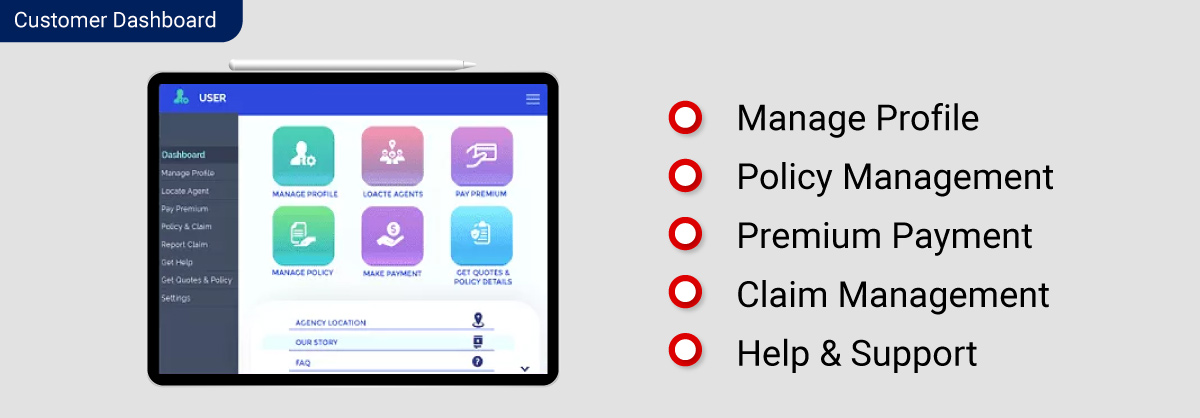

Customer Dashboard

It allows the customers to get an easy-to-use self-service interface with the following capabilities:

- Manage Profile: Users can manage their data, including contact details, submitted claims, and more, through this module.

- Policy Management: It displays the digital version of the insurance details, past payments, and current/past policy documents. Besides, it allows policyholders to use the insurance mobile app features to search other available policies, get quotes, and opt-in for policies that suit their budget and interest.

- Premium Payment: With an integrated payment gateway, this module allows insurers to pay their premiums through available methods. Here, they can even set instructions for automated payments and reminders for upcoming premium payments.

- Claim Management: Customers can submit and track their claims on a real-time basis through this module. For instance, in cases such as an accident or a house robbery, they can quickly take a photo and upload it with the app’s required documents.

- Help & Support: We enable the in-app calling feature and live chat support. It allows the customers to connect with service staff for their policies, premiums, claims, and more queries.

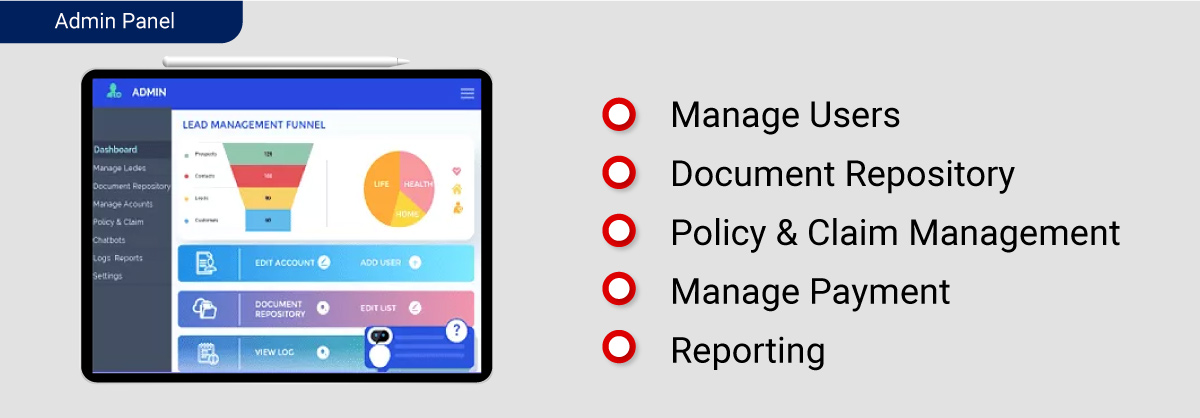

Admin Panel

As an integrated component of insurance app development services, we offer a secure admin panel that provides a 360° view of your business through a live dashboard. Besides, it allows you to add & edit app functionalities.

- Manage Users: Here, you can view, add, and manage the agent & customer profiles with corporate & personal details. Further, role-based access to users allows them to avail themselves of various features of the mobile insurance app.

- Document Repository: The module allows the upload, storage, and management of electronic versions of documents related to registration forms, policies, claim settlements, and more.

- Policy & Claim Management: Admin users can set and customize policy information for individuals, enterprises, corporates, and groups. They can even manage policy workflows, check cancellation & renewals, policy laps processes, claim assessment & processing, and more.

- Manage Payment: It will allow setting up commissions for agents/brokers, managing recurring billing for customers, and generating instant payment receipts. We even help implement various payment methodologies to enable payment through net banking, credit/debit cards, or mobile wallets by users.

- Reporting: We integrate third-party systems such as CRM, ERP, and more in this module. It allows easy generation & download of custom reports related to company performance, the region-wise breakup of reporting, customer profiling, and more.

Besides, we implement other admin-side modules as part of our insurance mobile app development focus. It includes offers & notification management, alerts & push notifications, geolocation management, insurance telematics, appointment scheduling, and more.

Advanced Niche-specific Features

Depending on the nature of your insurance business, you will need to integrate additional features that cater to the needs of your target market.

Vehicle Insurance

- Automobile-specific service listings to make informed decisions faster and receive on-demand insurance services

- Geolocation for policyholders to instantly notify the insurance agent of their location in case of an accident

- Integration with a mapping service to immediately track repair services, gas stations & other related help

- Sensor-led tracking the vehicle’s speed, braking pattern, and driving behavior to provide alerts & further support claim procedure

Life Insurance

- The mobile app development for insurance agents would cover policyholder profile with all the essential information of the insured person or object

- For the end customer, list of policies to browse all available options and make an informed decision

- Usage of policies detailing all the usage scenarios with terms and conditions

- On-demand insurance activation & deactivation in case the user wants to upgrade, switch or discontinue.

- Geolocation

Health insurance

- Search functionality for finding the right specialty and doctors

- Book appointments with an integrated calendar and receive reminders

- A symptom checker to determine which doctor to visit

- Pharmacy search if the insurance policy covers drugs

Property Insurance

- Reminders for periodic maintenance of assets

- Telematics to track leakages, breakdowns, and impending failures that can result in costly damages

- Push notifications to optimize the consumption of gas, power & water

Travel Insurance

- Travel guides with documented itineraries for offer a holistic user experience

- Service listings for seamless and hassle-free explorations

- In-app map to safely venture around new places

- In-app chat to tackle situations like baggage loss, flight delays, hospitalization, and more

- Language translation to make trips easy, fun, and safe

- Claims tracker for transparent and stress-free claim processing

Business Insurance

- Quick quotes with details on what is covered

- Robust authentication to verify user identity & credentials

- User-friendly dashboard to familiarize with all policy features

- Intuitive search functionality to find relevant information quickly and easily

- Automated claim processing for effective management of risk

Additionally, we also help implement advanced features, including;

- Advanced Search,

- Multilingual assistance

- Claim Filing Automation

- Hospital Mapping

- Medical History Tracker

- And more

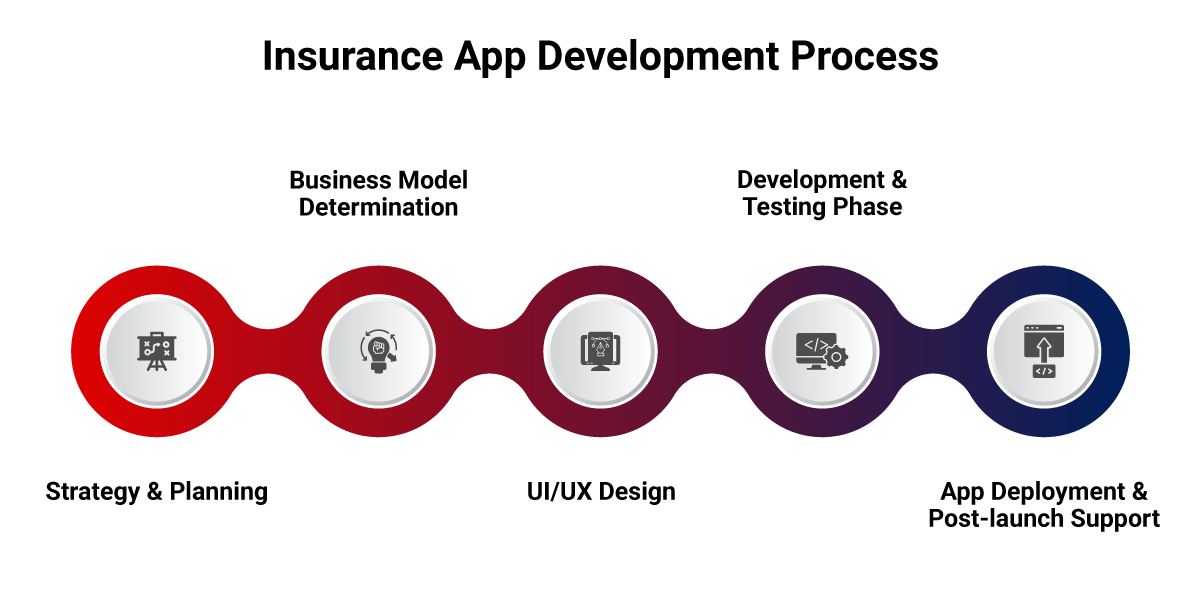

Insurance Application Development Process

If you want to digitalize your insurance management process, meet consumer expectations and stay competitive, below is a five-step process. As an experienced company for insurance mobile app development, we can work with you across all the steps.

Step 1 – Strategy & Planning

Begin by analyzing your target audience, competitors, and current trends in the Insurtech sector. Identify the specific needs of your customers and the unique features that will set your app apart. A thorough competitor analysis helps include a unique value proposition for your app.

Once you have all the analysis and insights, the next step is to create a wireframe of the final app to help you visualize the mobile app’s structure and functionality efficiently. Additionally, you’ll need to collate a list of the basic and advanced insurance app features in this blueprint that will form the core of your app’s offering. This research will help you define your app’s objectives and create a successful development plan.

Step 2 – Business Model Determination

Once the groundwork is laid, the next step involves determining the business model. This crucial decision determines how your app will generate revenue – whether through a paid model, subscription-based service, or sponsorship.

The chosen model should align seamlessly with how your app addresses user pain points, ensuring a balance between value delivery and financial sustainability.

Step 3 – UI/UX Design

Once the strategy and business model are finalized, the app will be designed using UI/UX. This phase brings your app to life visually and functionally. Initiate this by planning the user experience, selecting the app’s architecture, and preparing a prototype.

This prototype is a tangible representation of your app’s look and feel. The user interface design creates an aesthetically pleasing and intuitive layout that enhances user engagement.

Step 4 – Development & Testing Phase

Insurance mobile app development starts with creating an MVP by incorporating the key features, tools, and capabilities identified earlier. Quality assurance is a critical phase that cannot be overlooked. This MVP undergoes rigorous testing by quality assurance engineers to determine,

- Usability

- Compatibility across different devices

- Stability under various conditions

- Security against potential threats, and

- Identifying any bugs or glitches

- User feedback is also collected to refine and improve the app

This thorough process aims to find and fix all existing and potential failures to ensure the developed app provides a smooth user experience.

Step 5 – App Deployment & Post-launch Support

The final stage involves the app release and post-launch support. This phase ensures the app functions seamlessly across various platforms and devices. It is essential to collect user feedback once the app is launched. It will help add new features based on the initial feedback and continuously improve the end-user experience.

It also includes ongoing post-launch support and maintenance to provide regular updates, bug fixes, and feature enhancements that will improve the app’s capabilities and fulfill your business needs.

Tech Stack For Insurance Mobile App Development

The choice of libraries, languages, frameworks, development toolkits, and programming methods for an insurance app depends on the development approach and preferred platform.

Native

- Android: Java or Kotlin, Android Studio, Android UI

- iOS: Objective C & Swift, Xcode, UIKit

Cross-Platform

Factors That Influence the Cost of Insurance Mobile App Development

There is no one-size-fits-all solution when it comes to app development. To estimate the budget for developing an insurance app, it is essential to understand elements such as features, demographics, project complexity, business size, and more.

At Rishabh Software, we comprehend your business requirements to provide an optimal solution. Our development process follows a specific custom strategy and method by adopting a customer-centric approach. The insurance app development cost would heavily depend on the following:

- Project aim

- Types of features

- Choice of development platform (iOS, Android, or both)

- Number of hours invested

- Project size

- Type and no. of integrations

We can help you pick a cost-effective model that suits your needs.

How Rishabh Can Help You with Insurance Enterprise App Development

Our custom mobile app focuses on enabling the agents and brokers to streamline the insurance process workflow by helping them to:

- Engage in real-time for insurance policy and claim management to meet the customers’ expectations

- Walkthrough the information related to new and revised insurance programs, policy rules, and more with advanced analytics

- Provide claim status updates with quick assistance to customers using their smartphones

- Reduce paperwork to improve document management by speeding up the process for everyone

To Sum it Up!

We expect mobile devices to govern almost all financial transactions across the insurance industry vertical. Insurance applications are attractive to businesses. It helps them to increase the number of users and align with market trends & demands while outperforming competitors and ultimately generating revenues. So, if you want to create a successful app, ensure it is an end-to-end solution. Your app should seamlessly guide your clients from purchasing a new policy to processing the claim to renewing it with just a few taps on their smartphone screen!

As an experienced mobile app development services company, Rishabh Software is your reliable partner in building custom mobile apps by covering the global insurance ecosystem. We assist you with enabling AI-based features in the insurance app, such as chatbots, speech-to-text components, voice analyzers & more, to drive higher app adoption rates.

Frequently Asked Questions

Q: How can you find the right insurance app development company?

A: You need to keep the below-mentioned points in mind when finding the right insurance app development company:

- Research experience in the insurance sector

- Check their portfolio and client reviews

- Assess technical expertise

- Consider communication and project management approach

- Evaluate cost vs. value

Q: How long does it take to build an insurance app?

A: Typically, it takes 3-6 months to develop a small or MVP insurance app, depending on complexity and features. Building a highly complex app can take up to nine months or more.

Q: What are the latest insurance app technology trends?

A: Here are some latest Insurance app technology trends:

- AI and machine learning

- Blockchain for secure transactions

- IoT integration

- Chatbots and virtual assistants

- Telematics for usage-based insurance

- Cloud computing

- Big data analytics

Footnotes:

1. https://www.mordorintelligence.com/industry-reports/global-insurtech-market

30 Min

30 Min