In today’s digital age, the financial services industry is increasingly driven by information and data. It generates a massive amount of customer insights from the payment information. For card issuers, retailers and acquirers, the financial transaction data offers better insights into customer behavior by providing a deeper understanding of sales and customer spending patterns. The valuable data insights help businesses to improve profitability, optimize revenue and cut costs.

Forward-thinking banks and finance companies are harnessing the speed & accuracy of analytics to monetize this data! Are you leveraging your transaction data to drive profits? If not, this read is for you where you discover;

- Why digitization of transaction data is mission-critical for your business success

- How you can unlock the enormous revenue potential presented by analytics in the payment industry

- How to use payment data for enhancing customer experience & increasing conversions

- Use cases of successful digitization in the financial services sector

- How to develop a data-driven analytics platform that helps your business grow

Why is Transaction Data Vital to Your Business Success?

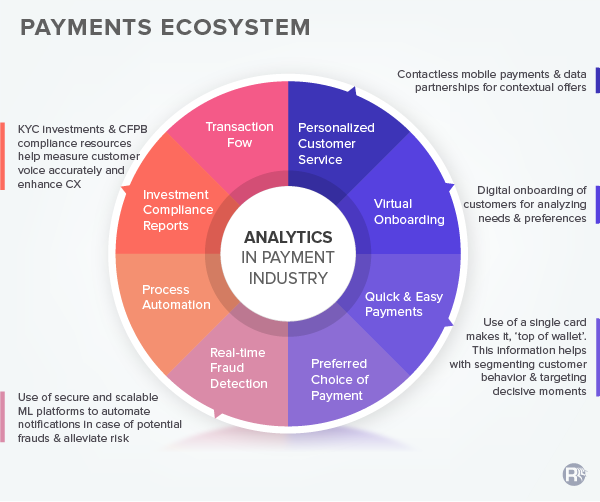

Banks and Non-Banking Financial Companies (NBFCs) take things a notch up by extracting value from distinctive data sets and integrating it with advanced analytics. Applying analytics to transaction data management offers end-to-end visibility into the payment environment.

This makes it easy to:

- Identify performance issues

- Detect frauds

- Fix anomalies

- Avoid service disruptions in net banking, mobile payments & online transactions

How Transaction Data Analytics Can Give Financial Institutions a Vital Edge

Analytics is a powerhouse for progressive banks in today’s highly competitive business landscape. Banks and NBFCs have realized the value of having real-time access to the right analytics and business intelligence tools. Strategies that are led by analytics can improve profits by optimizing customer service and cutting costs, directly impacting both the top line and bottom line.

Payment analytics helps institutions in making informed decisions every day. Formulating frontline strategies to make profitable choices enables financiers, marketers, and operations specialists to monetize payment processes and set the business direction. The right analytics platform helps understand customer behavior, buying patterns, and market trends to successfully enhance customer experience, increase sales, & avoid frauds.

Unlocking the Enormous Potential of Payment Data with Digitization

Data drive payment providers to tap into a wide range of revenue streams and retargeting previously qualified leads to exploring new markets with cross-selling products. Depending on how the data is leveraged, it can also have an extraordinary impact on customer satisfaction.

Any established financial firm or bank generates two types of customer data:

1. Enterprise-level

It consists of information related to assessment needs, customer preferences, spending habits, and so on. This data can be collected from different payment modes like credit and debit cards, mobile wallets, ATM transactions & payments made through digital wallets.

2. Supplemental

It is extracted from digital IDs to social media platforms to synthesized analytics extracted through sentiment analysis, predictive modeling and more.

The financial services sector can drive maximum value by adding supplemental data to their current internal data. New Fintech entrants are already using this information to promote targeted offers, provide personalized investment advice and prompt more meaningful customer interactions.

To unlock the potential of data monetization, it is essential to use advanced analytics tools to analyze, predict, and strategize. They cover vital elements of the customer lifecycle to act upon from the generated insights while maximizing the ROI.

Use Cases of Successful Digitization in the Financial Services Sector

Take a look at how we enabled two top service providers to harness the power of data analytics for better business outcomes.These use cases are a compelling reminder of how technology can revolutionize old patterns and processes. Analytics has that potential!

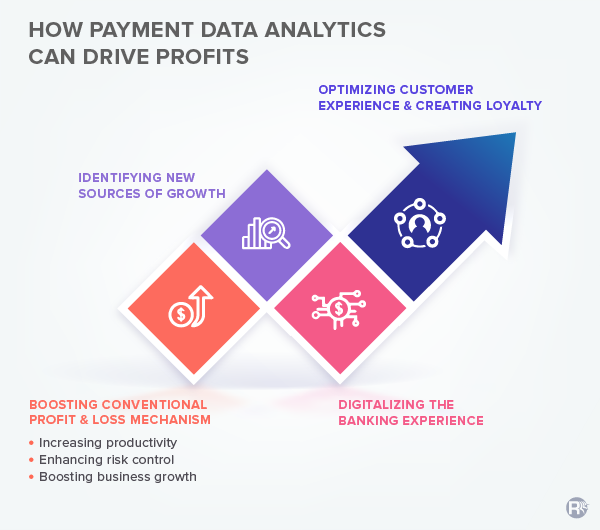

How Payment Data Analytics Can Drive Profits

Despite this, most credit unions and banks are still confined by information management silos. Now is the time to digitalize financial transaction data management.

Some crucial initial steps to follow are:

- Analyzing what industry leaders are doing with their payment data to understand potential opportunities better

- Identifying two-three uses cases with similar business goals

- Finding a technology partner that can help you leverage data analytics with a customized solution that caters to your client needs

- Assessing infrastructure needs and internal processes to ensure easy access to and optimum utilization of cross-business data

- Creating a well-defined roadmap for turning your business information into actionable insights

As the financial services sector continues to evolve, providers must leverage emerging technologies to stay in business. Simultaneously, competing with the new entrants, complex regulatory challenges, rising customer demands to mitigate fraud risks.

So, whether your IT environment is on cloud or on-premise, dynamic visualization tools can help you stay in business and thrive in the digital space.

How Rishabh Software Can Help You Develop a Data-driven Analytics Platform To Grow Your Business

We’ve enabled leading banks and financial companies to gain unparalleled access and insights into customer payment data & transaction KPIs. Rishabh can help you develop a dynamic platform that integrates transactions as a part of the payment solution and offers the following benefits:

- Real-time insights into different banking channels and the ability to track their performance to improve conversion rates

- A clear understanding of each system’s ROI with the breakdown of cost & revenue generated for every digital transaction

- An accurate analysis of transaction types and payments through a unified dashboard

- Sophisticated and seamless cross-channel integration with robust security and reduced risk of service disruptions

- Ensure regulatory compliance by finding anomalous transactions and suspicious behavior with automated alerts to specific errors in response codes

- Real-time transaction performance reports to improve customer interactions and increase conversions

The right set of payments and analytics tools will make a big difference to your revenue channel. Partner with us to future-proof your services with intuitive payment analytics, intelligent reports and real-time visibility of the entire ecosystem.

30 Min

30 Min