For a financial institution dealing with a lot of data – managing, processing, and analyzing it requires efficient & dependable data management services. And to optimize operations, data warehousing can be extremely helpful. It is transforming analytics for the vertical by centralizing data from multiple disparate sources & managing it for productive utilization.

This post will discuss the need for a data warehouse in finance, notable use cases and its benefits.

The Importance of Data Warehouse in Finance

A data warehouse is a data storage system that manages financial operations smoothly while tracking crucial data points over time and analyzing them. Today, financial services institutions need to provide customized & customer-centric services to compete with their peers. And, for that, you must have access to historical & current customer data. The right analytics supported by data warehousing can help them create a segmented customer base to channel efforts. This has increased the demand for data analytics & business intelligence (BI) to improve operations & make better financial decisions. A financial data warehouse can help you look for seasonal trends and how they affect your clients’ portfolios. Even investment decisions can be made with a combination of information from the client database and historical data from the data warehouse.

Do you know:

- Mordor Intelligence suggests that the financial analytics market will grow at 11.4% CAGR between 2022 and 2027. And one of its driving factors is the increasing demand for financial analytics solutions.

A data warehouse for the Banking, Financial Services & Insurance (BFSI) vertical can help:

- Provide a complete picture of the business’s health by centralizing & structuring data.

- Track crucial financial indicators over time with data analytics & reporting

- Enhance the quality of financial data by extracting accurate & reliable data from different sources.

- Improve compliance with regulations by ensuring that the necessary information is readily available.

- Boost personalized customer service by making relevant information accessible from one place.

- Support with credit risk modeling & risk analysis while automating the risk management process.

- Deliver fast & simple analysis of complex data

- Keep track of financial scams and frauds

Data Warehouse Use Cases in Finance

Listed below are some of the applications of using data warehouse in the financial services industry;

- Customer Data Management: Finance companies, like any other industry, need to analyze customer data to improve their service quality & build long-term client relations. A data warehouse helps them to understand customer behavior & develop a persona by capturing data from multiple sources & facilitate relevant analytics. It allows them to run sales & marketing campaigns better & identify cross-selling opportunities.

- Pattern Discovery: Financial services institutions need to monitor critical indicators for success & failure constantly to draw rightful insights. For instance, a bank needs to track customer deposits, loans, required reserves and more to understand how it performs. Further, they need to consider trends over time, and a data warehouse makes both current & historical data accessible in one place. Analysis of accurate data also helps in detecting fraud.

- Minimize Risks: A data warehouse helps automate the risk management process while monitoring the risk that different entities, like investors, and competitors, could pose. It also secures data by not giving away complete information & providing only limited role-based access to employees.

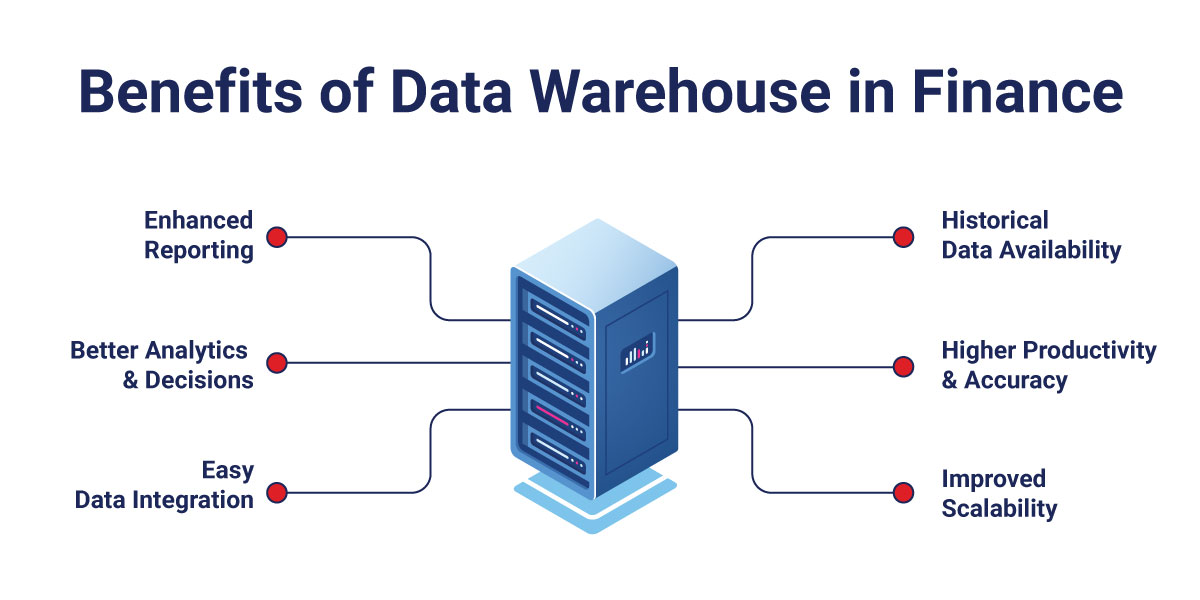

Benefits of Data Warehousing in Finance

The finance industry needs consistent & smooth data management & analytics to grow. Using data warehouses by banking, insurance & other financial services institutions makes it possible as it provides the following advantages.

- Enhanced Reporting: The DWH integrates data from several sources, processes unstructured data using ELT/ETL procedures, and saves it in structured formats. This makes the data easier to read & understand while simplifying data analysis & querying.

- Better Analytics & Decisions: Data Warehouse improves financial data quality while ensuring accurate and reliable access to information from several sources. And higher data quality results in better data-backed decisions.

- Easy Data Integration: Modern financial institutions deal with alternative data and supplementary financial information. Often this information is required for making investment-related decisions that are away from corporate or official sources. With DWH, financial institutions can combine all gathered information into a single source. It can offer a complete picture by effortlessly integrating such supplementary financial information from third-party apps.

- Availability of Historical Data: The data warehouse eliminates the need for source transaction systems to preserve data histories by maintaining a record of specific data points. It enables financial services such as hedge funds to operate seamlessly with access and utilization of historical data for audit trails & more.

- Higher Productivity & Accuracy: The data warehouse eliminates human effort & error in finding, integrating & managing large data sets, making them accurate. The automated data & functions allow for handling large amounts of sensitive information. It helps financial staff to save time & increase their productivity and capacity.

- Improved Scalability: The cloud-based data warehouse makes it easier to scale up & down while increasing flexibility for the business to ensure business continuity & enhance capabilities to grab opportunities.

How Can Rishabh Software Help in Finance Data Warehouse Development?

More and more financial institutions are turning to data warehouses to solve their data management and reporting challenges. Should you join them? Well, you must. But how do you find the right data warehouse for you?

We at Rishabh Software have experience assisting companies from the BFSI vertical to assess their data storage requirements and quantify their needs. Explore our data warehouse consulting services to learn about our capabilities. Therefore, if you have an on-premises data warehouse or wish to move between platforms, our cloud and data engineers can assist you in migrating without downtime or data loss. Our data science team enables quick decision-making by analyzing & visualizing data to maximize the ROI.

You can read our blog on data warehouse development to get a deeper insight into the components of a DWH, the steps to build it from scratch, cost considerations, & much more.

Final Words

Core business functions & decisions rely on complex financial data from disparate sources. Therefore, organizations from the banking & finance sectors need a data warehouse for centralized & reliable storage, followed by accurate analytics & reporting. If you’re considering building a data warehouse to meet your fast-growing financial data analytics needs, you would require a dedicated tech partner like Rishabh Software. They can help you navigate the entire data warehouse development process & deliver a personalized DWH that meets your business needs.