Cloud is widely recognized as one of the most transformative technologies for businesses today. From modernizing operations and simplifying data access to preventing fraud and improving service quality – cloud computing offers endless benefits. And, for the insurance industry, cloud adoption is here to stay. Even though the overall sector has been slow in adapting technology to transform its traditional ecosystems – cloud services help insurers to improve underwriting, claims processing, fraud prevention, customer services & business operations.

This article explores how cloud adoption in insurance can help transform traditional ecosystems into customer-centric & data-driven business models and why now is the time to embrace the cloud.

If you are someone who is yet to consider and wants a bigger picture of how the cloud can help your business, and what challenges it helps solve with key cloud players, then this article is for you!

Potential Of the Cloud For Insurers

Mckinsey’s recent report suggests, EBITDA (earnings before interest, taxes, depreciation and amortization) run-rate impact of the cloud on the insurance sector will be $70-110 billion by 2030.

Below are 3 key trends that are pushing insurers to adopt the cloud:

- Increasing reliance on digitalization: New business models in insurance are now trending towards the decentralization of digital systems to accelerate deployment, modernization, and replacement of solutions as needs evolve. Insurers are upgrading their digital ecosystems with emerging technologies at every touchpoint of the customer lifecycle.

- Customer-focus: A growing trend, customer-centricity is greatly achieved with the cloud. Today it is all about personalization, satisfied customers, and speed. Big data enables insurance carriers to identify customer needs and pain points. Easy access to thousands of data points when combined with the cloud’s data processing power make it possible to deliver personalized experiences faster and cost-effectively. This technology helps insurers build strong customer relationships with new clients, retain old ones, and provide more sales opportunities. Further, the cloud’s pervasive analytics help customers get personalized products and services. As customer needs evolve, cloud solutions allow insurers to communicate better and get prompt feedback on end-customer needs

- Reduction in operating costs: Cloud solutions are cost-effective as compared to on-server/on-premises solutions. This translates into insurers spending less on hardware & licenses while cutting costs even on managing in-house legacy systems. Further, insurance companies can leverage the varied automation opportunities offered by the cloud. Whether the need is to streamline business aspects from claims processing and management, underwriting, or client onboarding, a cloud service vendor can help.

Why Do Insurance Institutions Still Prefer Legacy Systems?

Many institutions prefer the comfort and familiarity of legacy technology. Even though they are aware that the modernization of enterprise systems and software would enable them to leverage the benefits of increased performance and competitive advantage. Also, there exists plenty of other justifications that organizations cling on to prevent or delay system upgrades.

Some of them include;

- Doubts about cloud computing: It is usually observed that decision-makers and primary stakeholders might be apprehensive about cloud computing. Many fear that it might prove to be unreliable because the services require network connectivity to off-premises infrastructure. Additionally, there’s also this popular misconception that building your system with cloud vendors would add increased risk for security & compliance. Whereas it is exactly the opposite. Modern-day platform providers constantly update the security technologies, and cloud service vendors ensure they tend to stay up-to-date with local and global compliance requirements while helping you with cloud movement.

- Time and cost: The upgrade or replacement of enterprise legacy solutions usually requires time and money. For large regionals and multinationals, this task proves to be a major obstacle standing in the way of operational enhancements. It would vary depending on the size and nature of the business. An experienced cloud service provider would apply diverse approaches & engagement models to utilize resources to maintain a functional legacy system migration/modernization throughout the project life cycle. It could include a combination of cloud migration strategies like modernizing code (rearchitecting), rehosting, or adding new technologies in tiers (refactoring).

- Adoption training: A legacy system transformation will cause disruptions to business continuity that would cost time and money. Staff education for new business tools usually comes with its own set of challenges. While some team members might be stuck in their ways and resistant to different ways of doing things – others may find it difficult to learn to use this new tech. Further, goes without saying the more outdated the legacy system is, the more foreign modern tech would appear to the team.

Your cloud migration partner can help implement a strategy of continuous improvement for your tech stack.

How Cloud Adoption in Insurance Can Solve Challenges?

Cloud computing in the insurance industry has matured significantly over the past decade. It has expanded tremendously to include a massive ecosystem of services and tools that efficiently address major business problems. AWS & Azure today offer more than 200 services with limitless storage to support AI, ML & analytics services.

Here are some key benefits of capitalizing on these modern cloud platforms:

Enhanced infrastructure agility

- Ability to quickly develop and deploy new apps

- Flexibility to experiment more frequently & much faster

- De-provision resources with negligible risk

Flexibility & scalability

- Ensure adequate capacity to manage business operations seamlessly even when activity levels peak

- Provision of the right amount of resources with the flexibility to scale up and down instantly with user demands while reducing the cost

- Ability to rapidly deploy apps globally without the heavy lifting of managing data centers and IT infrastructure

Automation

- Ease of integrating multiple products and offerings while catering to unique customer needs in a more connected environment.

- Automation of the enrolment procedure to ensure real-time validation of eligibility and policy pricing for a personalized policy buying experience.

Cloud Use Cases for Insurance

Despite the challenges, many insurers are moving to the cloud because of its benefits in areas like analytics, system modernization, data storage, and more. Here are a few real-world use cases of benefits leveraged by insurance companies with cloud adoption:

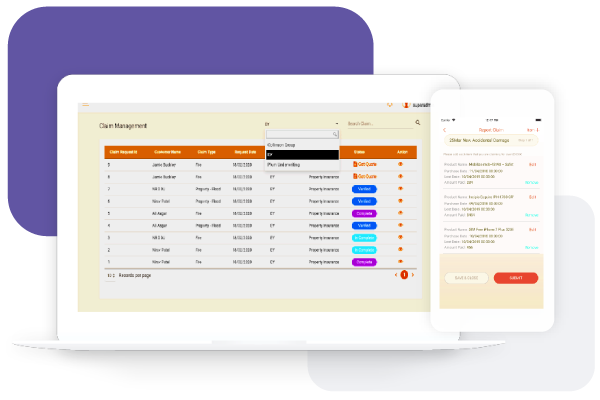

Use Case 1:

How a major UK-based general insurance provider leveraged Azure to take its insurance processing from days to minutes

A leading general insurance company was in the pursuit of a comprehensive solution to be built over mobile and web mediums that enables the submission & management of insurance claim requests. Further, there was a dire need for a common collaborative platform that connects customers, insurers, and claim assistant companies seamlessly to manage the transparent flow of policy information.

This issue was addressed with the development of a cloud-based platform that simplified the claims process and helped save time for the policyholders.It keeps their customers updated on their claims in a secure ecosystem, offers insight to insurers, and helps the insurance company to build customer loyalty. Automation of the claim settlement process enabled the insurance carrier to:

- Reduce their claim handling costs by 62%

- Facilitate faster and more efficient settlement

- Ensure zero human errors in claim settlement

Leveraging Microsoft Azure’s cloud hosting service, the insurance provider dramatically reduced the insurance processing time from days to minutes!

Use Case 2:

How Cloud Migration Enabled a Leading Dutch Insurer to Cut Infrastructure Costs by More Than 50%

A health insurance company’s premium calculator attracted at least 12,000 users daily for only two months in a year. This yearly cycle meant unnecessary payments for infrastructure and server capacity that remained unused for the remaining 10 months. The spike in online traffic exerted immense pressure on the digital infrastructure throughout November and December.

Additionally, with more and more policyholders turning to the digital platform, the peak in traffic would only grow.To cope with this, the company was looking for a more cost-efficient and scalable alternative to hosting. Moving the application to the cloud made sense and it empowered the insurance carrier to:

- Instantly release improvements to its app

- Quickly find and fix problems in app performance

- Exceed customer expectations even with sudden traffic spikes

- Increase savings by more than 50%

By migrating its calculator app to Microsoft Azure, the insurance company unlocked its capability to scale infrastructure on demand and reduced hosting costs. The move was well worth the effort and proved to be highly profitable.

Cloud Platform – Which One to Choose?

While there’s no definitive answer: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) have apparent pros and cons, so the choice boils down to the specific requirements of your business.

Though, while selecting, do keep in mind the following;

- Current usage of the cloud service provider

- Availability of the needed services (mainly PaaS)

- Team’s familiarity with the toolset

- Vendor lock-in vs. open-source tech support

- Pricing

- Regulatory/industry compliance adherence & vendor experience

Each of the three cloud platforms AWS, Azure & GCP is unique in its way. They offer a plethora of options for organizations to select from based on their specific requirements. From our experience, Microsoft Azure has usually been a go-to choice of big market players with Windows integration requirements, while AWS and GCP are preferred by SMBs (primarily US-based ones).

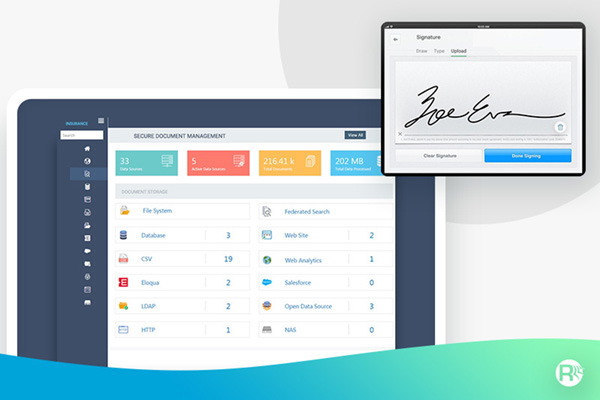

How We at Rishabh Can Help?

Drawing on over a decade of cloud experience, we can help you define your expectations in terms of operational efficiency & enable swift adoption of new cloud technology in your insurance processes. We follow a proven approach for assessing, developing, deploying & integrating modernized technologies in ways that ensure the optimum use of your existing resources. We work with you to understand your needs, modernize legacy apps, seamlessly navigate your migration journey, and build solutions that leverage the right cloud tools and services for optimal business outcomes.

Explore our capability around how as service partners for AWS (Amazon Web Services), and Microsoft Azure, we offer app development & modernization along with consultation, cloud-managed services & migration. We can help you make the most of serverless cloud computing so you don’t have to go through the hassles of provisioning & configuring servers. From helping you improve your database scale to developing new cloud-based apps, we will help you navigate your cloud migration journey with an incremental approach.

Cloud Computing for Insurance: What the Future Holds

To conclude, a move to the cloud may seem costly for insurers. In the distant future, it would drive the way for businesses. Forward-thinking organizations that will embrace it early will have an added advantage. Those who are reluctant to this change may later struggle to match their competitors.

Rishabh Software has extensive experience in implementing custom solutions for the cloud in the insurance industry that are tailored to meet the company’s dynamic needs. We can build custom cloud solutions to automate your business operations, enhance customer experience and lower your overheads. You can count on our experienced team, equipped with a comprehensive technology stack to help you capitalize on opportunities with the cloud.