In today’s digital world, it is important to quickly adapt to market trends to stay relevant in the business. This holds for the financial services sector, where there is a greater need to exceed the customer expectations while providing uninterrupted services. It is where almost all the players ranging from small firms to medium-sized financial companies and big companies compete for quick delivery of services to succeed in the race

And, DevOps tools, practices & ideas have emerged as the mechanism to lead this transformation from identifying patterns to uncovering new revenue streams. It helps improve the quality of application releases and addresses governance, risk, security & compliance strategies.

So if you’re a C-suite executive considering the adoption of DevOps culture within your organization, the article will try to answer most of your questions to help your business stay ahead in the modern competitive landscape.

Why DevOps for Finance Organization?

DevOps is a set of practices to organize processes, software delivery pipelines & operational workflows. For the financial services industry unlike other industries, technology has not evolved much. It is because many companies felt that it is too risky to embrace DevOps considering the amount of legacy code and old methodologies they still in practice.

You would agree the elevated customer experience and high-volume of transactions make the finance sector one of the busiest industries.

The new-age companies want to become more flexible to adapt to customers’ evolving demands and provide better interactions. While the companies have already begun their quest to upgrade legacy banking infrastructure. This is where DevOps has come to meet the emerging demands. This practice helps them deliver value to the market safely and efficiently with optimized expenses.

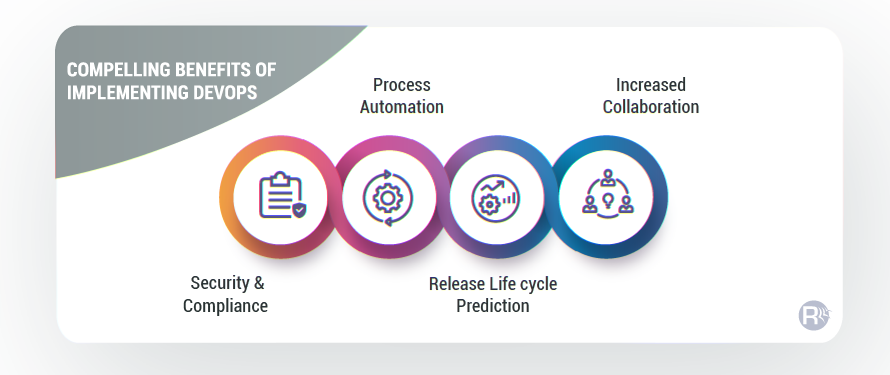

Benefits of DevOps for Financial Services Sector

DevOps is a combination of the best methodologies, tools & operational platforms to help optimize end-to-end business operations. Let’s explore the main benefits of utilizing this approach:

- Improved Security & Compliance

The industry has a general tendency of dealing with a large number of transactions and investments. So, it is quite essential to secure the customer data & comply with multiple regulations and standards. The adoption of continuous integration (CI), continuous deployment (CD) and leveraging immutable infrastructure as code (IaC) leads to automate software lifecycle pipelines which leave limited/no room for human errors. Further, the adherence to the regulatory compliance process removes security concerns from the product development lifecycle. - Routine Process Automation

It fosters automation while implementing DevOps approaches in software development and infrastructure operations across multiple processes. This further promotes speed, greater accuracy, consistency, reliability to ultimately increase the number of deliveries. It provides server provisioning, configuration to data backups and restoration easily. This covers everything right from building, deploying & monitoring. From software updates, testing environments setup, software delivery pipelines to servers monitoring and logging. This eliminates the need to budge through repetitive, low-skill and time-consuming tasks - Better Prediction

When most of the processes get operated and managed automatically, the probability of accurate prediction increases. Through this businesses can deliver more value to their clients by ensuring the execution of rapid feedback and successive product operations. - Increases Collaboration within Teams

The DevOps culture is all about communication and collaboration between various departments. Most of the financial businesses are geographically distributed and outsource some part of their business operations. Effective participation is vital for operational stability.

Key Challenges of Implementing DevOps in Finance

Like every other industry, even the financial services sector is no exception when it comes to catching up with the latest digital trends. Listed below are some of the several challenges with the implementation;

- Data Privacy regulations & strong restrictions on securing the network that eliminates data leakage and hack

- Full lifecycle governance to monitor each step of the development process

- Seamless integration with third-party applications

- Detailed auditing which does not accept defects and errors

- Diverse Access Control List Modules

Regulatory compliance and data security are of prime importance for organizations in this vertical. The immature adoption of DevOps may cause a threat to regulatory controls and governance. So, it is wise to choose an experienced software development company as your consulting partner. This would provide flexibility to adopt the latest technologies and even get familiarized with the modern software delivery practices.

Essentials of DevOps for Financial Services Industry

Let’s take a look at the essential practices that are revolutionizing the finance landscape.Mitigates Potential Security Hazards

Compliance and security are the two major concerns for the industry that impede modernizing legacy software development and delivery procedures. Initially, the implementation of DevOps was considered a high-security risk. Also, the enhanced speed of software releases was viewed as a major threat to governance and regulatory controls.

But the real implementation of practices allows the organizations to get rid of preconceived notions. It helps minimize potential security problems and locate issues and tackle threats more effectively. Further, it assists with frequent releases and stays up to date with the emerging market trends.

Business Process Automation

Leveraging DevOps in Fintech helps automate repetitive processes, yields efficiency & provides you the ability to serve your clients in a better way. Automation processes can be developed more easily than ever before. This eliminates paperwork and allows the staff to deliver great customer service.

Automating tasks across software delivery lifecycle proves effective to achieve the right resource utilization, increase in developer productivity and improved product quality. It ensures balancing responsibilities across the cross-project requirements, regular updates & entire process management at the enterprise level. This offers the business with the opportunity to speed up delivery times, ensures faster time-to-market while ensuring scalability and compliance with standards.Drives Cultural Transformation

It is not just about changing technological processes. But it also alters the entire industry landscape. For the finance industry, the culture shifts to flexibility by implementing agile development’s adaptable working methodology and going away from the top-down hierarchical processes.

Popular Use Cases of DevOps in Financial Industries

Now that you know the significance of implementing DevOps, let’s look at some examples of how organizations have adopted and scaled the DevOps practices across their organizations. These insights will help you to explore how major companies are leveraging this practice to take their business to new heights.

Business Case 1: UK based Multinational Banking and Financial giant adopted agile DevOps working practices

The digital transformation resulted in increased developer’s morale and quality of code. It reduced delivery risk by 70% and improved the quality of customer services by 60%.

Business Case 2: US-based banking and financial services corporation embrace DevOps to accelerate development cycles

By incorporating Kubernetes, the bank today runs more than 2,000 in-house applications in a metro cluster environment. The move to containers, Kubernetes and a microservices architecture ushered to enormous improvements that resulted in scalable, reliable & faster development and deployment.

Business Case 3: Europe-based finance company wanted to automate the deployment of new configurations to its several customer-facing credit card websites.

Leveraging continuous integration/continuous development (CI/CD), the company’s application teams can now quickly make changes, test & deploy configurations. The solution resulted in a 70% faster time to market and a 50% reduction in a manual effort.

If you’re still not considering DevOps adoption, then you might want to rethink as your competitors will surely leverage them to stay ahead!

Concluding thoughts

Financial services companies are under great pressure to adopt complex and rigorous software development processes that meet intense corporate and regulatory requirements. With DevOps in finance sector, they can release software faster than ever to meet the expectations and beat the competition.

Why Choose Rishabh Software?

As a DevOps services company, we help financial enterprises to realize all the benefits of this methodology. Our proficient team possesses unmatched technical expertise across tools like Jenkins, Kubernetes & Docker to deliver a range of impeccable services that provide best-in-class customer experiences.

The team helps embed security at all stages of the delivery pipeline by breaking down the functional silos. It is by segregating massive tasks into individual components and distributing the same among collaborative teams, to ensure effective collaboration. We help reduce costs by offering better collaboration between teams and accelerate the speed at which the code can be deployed. Our experience enables us to identify the right technology stack and tools that will align with your regulatory compliance requirements.

30 Min

30 Min