Emerging technology disruptions have catapulted Fintech to the forefront of the financial services industry. Financial institutions must respond faster to innovation for driving more customer-focused solutions at lower costs.

That’s where Fintech app development comes in. It can make financial experiences better for customers while helping financial institutions become more responsive and agile.

The numbers speak for themselves. The global Fintech market is projected to soar from $340.1 billion in 2024 to $882.3 billion by 2030, growing at a CAGR of 16.2%. In 2024 alone, digital payments crossed $11.55 trillion, with over 60% of the global population actively using Fintech services. Investors are keeping pace too with $44.7 billion poured into startups in just the first half of 2025, with AI and payments leading the charge. By 2030, BCG estimates Fintech revenues could reach $1.5 trillion, capturing 7% of the global financial services market, largely driven by neobanking and embedded finance.

With 91% of Millennials already relying on Fintech for investing and budgeting, the shift is clear: Fintech apps are not optional anymore, they are essential.

Whether it be attracting new customers, technical developments, or assuring data protection, Fintech mobile app development provides tremendous benefits to your organization. But building a successful Fintech app is not an easy job. You need technical expertise, the right technology, and you should know the ideal process.

Let us help you in understanding the steps to develop a successful Fintech app for your business, along with its crucial features, types, and tech stack in this blog.

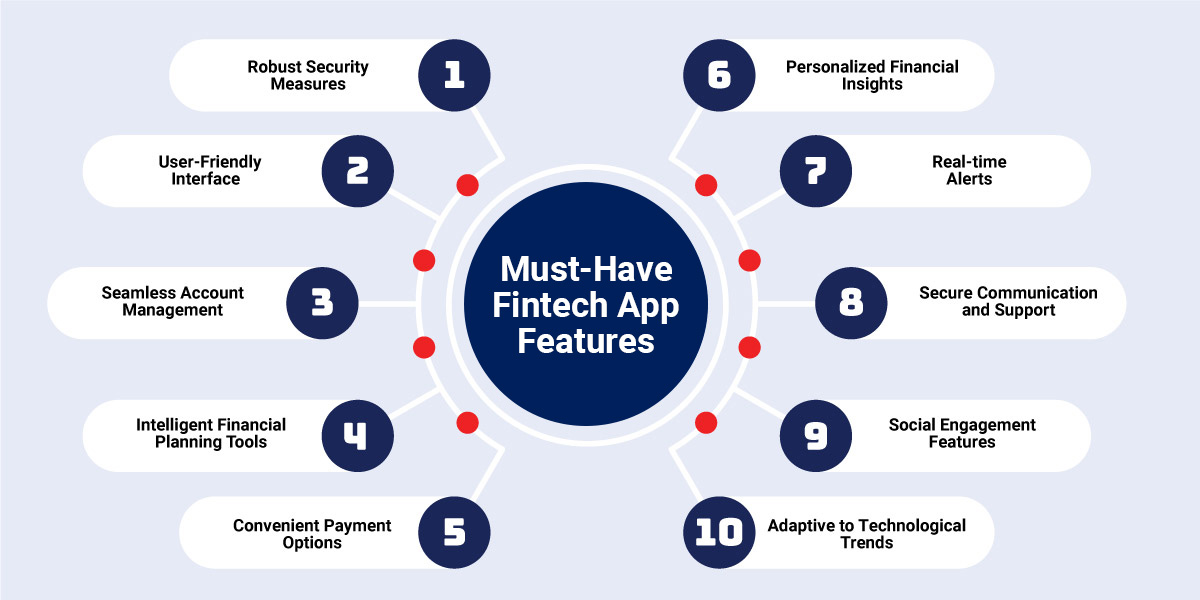

Must-Have Fintech App Features

Fintech application development requires careful consideration of various features essential to ensure security, usability, and functionality. Here are some must-have features for wide acceptance among potential users.

Robust Security Measures

The finance industry is highly regulated therefore it is important to take all security measures to ensure data privacy and safety of sensitive financial data and transactions. You must provide a sophisticated security infrastructure by implementing two-factor user verification methods, and encryption protocols, and integrating advanced role-based access controls RBAC systems to detect and prevent unauthorized access or fraudulent activities.

User-Friendly Interface

Simplicity is the key feature for any successful app regardless of its industry. The app user interface must be intuitive and easily navigable so that the users can effortlessly locate features, comprehend transactions, and follow straightforward steps. It should cater to all users of all financial expertise levels, making it accessible to everyone.

Seamless Account Management

Empower users with an intuitive dashboard to effortlessly manage their accounts, check balances, review expenditures, and conduct transactions with ease. Your app should support various account types, APIs like Plain, Trulioo, etc to facilitate integration with external financial institutions and provide real-time updates for a seamless financial experience.

Intelligent Financial Planning Tools

You should provide users with tools to take charge of their finances, offering personalized insights, expense tracking, and automated savings features. Provide tailored advice, showcase spending patterns, and assist in achieving significant financial goals through smart investment suggestions.

Convenient Payment Options

To provide a better user-experience, you need to simplify payment processes by incorporating diverse methods such as mobile payments, QR codes, and quick transactions. Offer secure and prompt money transfers, whether for peer-to-peer transactions or bill payments. It should support seamless integration with popular online payment systems.

Personalized Financial Insights

The app should contain advanced analytics to educate users about their financial habits, expenditures, and associated risks. It should leverage advanced algorithms and models of ML to offer practical ideas to enhance budgeting, increase savings, and make informed investment decisions.

Real-time Alerts

The app should trigger alerts to keep users informed with timely notifications. It should alert them about unusual activities, low balances, upcoming bills, or successful transactions. Users of the Fintech app should be able to customize their notification preferences for a personalized user experience.

Secure Communication and Support

Access to support helps build trust and confidence in your Fintech app. Ensure to facilitate secure communication channels for users to interact with customer support, report issues, or seek financial advice. Consider incorporating chatbots for quick responses and enhanced user support.

Social Engagement Features

Develop a community by introducing social elements like challenges, shared financial goals, and rewards for positive financial behavior. It helps boost engagement and retention while also increasing brand awareness and trust. Gamify the experience to engage users and make their financial journey enjoyable.

Adaptive to Technological Trends

You need to be aggressive while adopting emerging technology to stay ahead of the competition. Be prepared to embrace new technologies such as blockchain, smart computing, and open banking. Continuously enhance your app with innovative features to meet evolving user expectations and stay resilient against evolving cyberattacks.

Types of Fintech Apps with Real-Life Examples

There are various types of Fintech apps, including digital wallet apps, investment apps, digital banking, neo banking apps and many more. Let’s explore each type in detail with real-life examples.

1. Digital Banking

It is redefining the banking experience by providing users with the flexibility to oversee their financial affairs without the constraints of physical branch visits.

It offers a comprehensive suite of services comparable to traditional banks, these apps facilitate seamless account opening, balance inquiries, fund transfers, payment processing, loan applications, and more.

The integration of app notifications keeps users informed about their balance, transactions, and investment performance.

- Chime: This app is known for its fee-free financial services and early direct deposit feature. Through features like automatic savings and real-time transaction alerts, this mobile app enables customers to assert control over their finances.

2. Digital Wallet Solutions

Digital wallet solution is an industry game-changer for offering convenience, security, and innovative features for both consumers and businesses. These applications have revolutionized the way we make payments globally and has brought a new wave of digital transformation in financial services.

It has seamlessly transformed financial exchanges into a streamlined digital experience. With such applications, users can effortlessly send and receive money without indulging in any traditional payment methods.

- PayPal: This global Fintech giant has revolutionized online payments by enabling secure transactions worldwide. It serves as both a digital wallet allowing users to make purchases, transfer money, and receive payments seamlessly.

3. Insurance Apps

This type of app simplifies the process of buying and managing insurance policies. It offers a variety of features and benefits related to insurance such as speeding up policy management, claim processing, and emergency assistance.

- Lemonade: This company provides insurance services through its mobile app and website. It’s known for its reliability, easy processing, and prompt service. With its user-friendly interface, this app offers a wide range of insurance services to customers.

4. Investment Apps

With the help of technology, these apps provide an easy-to-use interface, real-time market data, and a diverse range of investment options. Several such apps are fast bringing investing into the mainstream, making it available to a broad audience.

It makes it easy for new investors to research financial assets and make smart investment choices. These investment apps help you understand how the financial markets work and let you easily create a mix of different investments in your portfolio.

- Robinhood: This is a popular app for investment. It has made investment simple and accessible to everyone with its feature rich application. One can invest in stock, options, ETF, and cryptocurrency trades with zero commission trading.

5. Lending Apps

Lending apps have transformed the borrowing experience by offering instant loan approvals, minimal paperwork, and faster disbursals. They use algorithms to assess creditworthiness and provide a wide range of lending options.

- Upstart: Powered by AI, Upstart evaluates borrowers beyond credit scores, helping more people access personal loans with fairer interest rates.

6. Personal Finance Apps

Personal finance apps help users track expenses, set budgets, and build savings habits. They provide insights into spending behavior and often sync with bank accounts for real-time updates.

- Mint: One of the most popular apps for budgeting and expense management, Mint categorizes spending automatically and provides tailored money-saving tips.

7. Neobanks

Unlike traditional banks, neobanks operate entirely online with no physical branches. They focus on offering faster, cheaper, and more user-friendly banking services.

- Monzo: A UK-based neobank known for features like real-time spending notifications, easy bill splitting, and low-cost international transfers.

8. Financial Planning Apps

These apps go beyond tracking to help users set long-term goals such as retirement, home buying, or education. They use automation and data-driven insights to recommend strategies and optimize financial outcomes.

- Personal Capital: Combines wealth management tools with human advisory services to help users plan for retirement, investments, and net worth growth.

9. RegTech Apps

Regulatory Technology (RegTech) apps help financial institutions comply with strict regulations around data protection, KYC (Know Your Customer), and AML (Anti-Money Laundering). They reduce compliance costs and minimize fraud risks.

- Onfido: Specializes in identity verification using AI-driven document scanning and facial biometrics to simplify compliance for financial service providers.

Key Steps to Develop a Custom Fintech Application

Developing a modern Fintech app that stands out from the competition isn’t easy, but you can make a great solution if you have the right strategy and process in place. You need technical expertise to achieve the best outcomes.

Let’s understand this process in detail from selecting your niche, designing the software, to deploying it for your valuable users.

Step 1: Figure Out Your Fintech Niche

Before you start making your fintech app development solutions, take some time to figure out what it’s all about. Ask yourself:

- What does your app do?

- What is the type of app you wish to build and which area of Fintech do you wish to focus on?

- What kind of services are you interested in? Is it personal finance, sending money globally, trading, crowdfunding, mobile banking, or something else?

Next, think about who will use your app and what they need. Also, consider these questions to help you pick the right focus for your financial application development:

- Is your app for a specific group of people or a particular place?

- Do you want to start your app in one area and then make it available globally?

- Do you know a lot about this industry?

Once you have clear answers, it’ll make the rest of creating your app much easier.

Step 2: Meeting Legal Compliance

Before starting the first phase of your app, it is important to understand the Fintech legalities.

Fintech application development deals with sensitive financial data, and hence, they need to comply with various regulatory standards. These may include data security standards, privacy laws, and financial regulations.

Financial protection systems like KYC and Anti-Money Laundering (AML) are created to monitor compliance. It is equally essential to adhere to legal compliances such as the California Consumer Privacy Act (CCPA), GDPR, LGPD, PCI DSS, BSA, OFAC, EFTA, and PIA to guarantee the protection and restricted access of users’ financial data. In the USA, there’s no single Fintech controller since the United States has a decentralized regulatory landscape, but you still must follow a bunch of state and federal laws.

Step 3: Choose Application Features

Now that you have your niche and legal compliance, the next step is to decide on the must-have features of the app.

This could include user registration, account management, transaction processing, analytics, and more. You should decide the features based on the needs of your target audience and the value proposition of the app.

Step 4: Set Up a Robust Team

Setting up a team is a critical step in the process. The most effective strategy for a Fintech app development is outsourcing. This approach not only saves both time and money, but also provides access to a skilled team of experienced developers.

The team should include roles such as,

- Project manager

- Business analyst

- UI/UX designer

- Developers

- Quality assurance

You need to determine the team size, set milestones, and outline deliverables according to your project requirements. Whether you need cross-platform mobile apps like Flutter or React Native or are thinking of beginning with native mobile app development, you can always hire the best resources according to your requirements.

Before hiring any Fintech app development company, ensure that you assess the company’s expertise in the Fintech industry. Also, evaluate their hourly rates, and consider the experience of individual developers to get the best outcomes.

Step 5: Initiate Application Prototype

Now that you have your ideal team ready. Here comes the next step of designing the app. This is a primary version of the application that gives a visual representation of how it will look and function. The prototype serves as a reference for the developers and provides early feedback from users.

Step 6: Develop an MVP

Once the prototype is approved, the team moves on to develop an MVP. This is a basic version of the application that includes the core features. The MVP is launched in the market to get feedback from real users and to understand how the app performs in the real world.

Step 7: Quality Testing & Analysis

Once your app is launched, it’s important to continue evaluating its quality. Performing A/B testing phase helps you in generating valuable user feedback that can be used to improve your current integrated features and introduce new ones.

By doing this, you ensure that the Fintech app provides seamless, secure, and user-friendly performance to the end-users.

Key Tech Stack for Building a Fintech Mobile App

Fintech mobile app development requires a careful selection of technologies to ensure security, scalability, and a seamless user experience. The following table outlines the common components of a Fintech tech stack, including programming languages, frameworks, databases, APIs, and security measures.

| Category | Technologies |

| Programming Languages | Swift (iOS), Kotlin/Java (Android), Dart (Flutter) |

| Cross-Platform Frameworks | React Native, Flutter |

| Backend Development | Node.js, Java (Spring Boot), Python (Django/Flask) |

| Database | MySQL, PostgreSQL, MongoDB |

| APIs | RESTful APIs, GraphQL |

| Cloud Services | AWS, Azure, GCP, Firebase |

| Security | SSL/TLS, OAuth 2.0, Tokenization |

| Payment Gateway Integration | Stripe, PayPal, Square |

| Testing | Jest/Appium, XCTest (for Swift/iOS), JUnit (for Java/Android) |

| Containerization and Orchestration | Docker, Kubernetes |

Role of AI/ML in Fintech App Development

AI and Machine Learning are transforming Fintech apps into intelligent, customer-first solutions. They do more than manage transactions. They personalize experiences, improve security, and drive smarter business decisions.

With AI, apps can analyze spending patterns and financial behavior to suggest tailored savings plans, budgeting tips, investment strategies, and credit options. ML models continuously learn from data to detect unusual activity and prevent fraud in real time.

AI chatbots and virtual assistants provide instant support, guiding users through transactions, answering queries, and resolving issues without delays. ML-driven credit scoring evaluates both traditional and non-traditional data points, enabling faster, fairer lending decisions.

The results are tangible. Customers get personalized insights and faster responses. Businesses benefit from lower fraud risk, operational efficiency, and smarter, data-driven decisions across lending, investing, and financial planning. AI and ML make Fintech apps not only functional but intelligent and ready for the future.

FinTech App Development Cost Overview

Building a FinTech app is an investment in technology, security, and customer trust. While exact pricing depends on complexity, features, platform, and integrations, a typical range for a market-ready FinTech app starts from $50,000 to $250,000 and can go higher for advanced solutions with AI/ML, multiple integrations, or enterprise-level security.

Several factors influence the cost:

- Platform choice: Developing for iOS, Android, or both affects timelines and budget.

- Features and complexity: Digital wallets, investment tools, lending capabilities, or real-time analytics each add development time.

- AI and Machine Learning: Integrating AI-driven personalization, fraud detection, and robo-advisors increases sophistication and investment.

- Compliance and security: FinTech apps must meet regulatory standards, implement encryption, and follow data protection protocols.

- UI/UX design: Intuitive interfaces and seamless experiences require expert design and testing.

Investing wisely in these areas ensures the app is not just functional but secure, scalable, and capable of delivering a superior customer experience. While costs vary, understanding these factors helps businesses plan realistically and prioritize features that bring the highest ROI.

Why Rishabh Software Is Your Go-To Partner for Fintech Mobile App Development

We specialize in helping fintech companies revolutionize their financial services through cutting-edge technology. Whether it be Fintech mobile app development or complex enterprise-grade systems, our experts can handle all stages of Fintech development to meet the specific needs of your organization.

As an experienced fintech software development company, our expertise lies in building bespoke cross-platform applications, including but not limited to e-wallets, robotic advisors, aggregation platforms, and neo-banking solutions.

We also provide data and analytics services, ensuring efficient data management, migration, and reporting for your fintech business. With a wealth of expertise and a commitment to excellence, coupled with our vast practical experience in working on countless fintech projects, we are well-positioned to be your ideal custom fintech development partner.

Our Fintech Success Story

A renowned Canadian union bank wanted the expertise of Rishabh Software to seamlessly incorporate advanced fraud detection capabilities into their core banking solution. The objective was to enhance their system with robust data analytics features, enabling proactive monitoring and prevention of fraudulent transaction activities.

Challenges:

- Limited visibility into payment processing across applications

- The limited window for fraud discovery on transactions occurring at a specific terminal.

- Inability to handle a high volume of unexpected fallback transactions.

- Minimal transparency and traceability for unexpected transaction scenarios.

Our highly skilled team has developed cutting-edge bank fraud detection and prevention software to deliver real-time protection. Our solution integrates a rules-based decision engine that thoroughly tracks historical transactions to identify usage patterns, enabling the prompt detection of anomalies and preventing fraudulent attempts.

In our commitment to deploy proactive banking fraud analytics, we have seamlessly incorporated essential components, including a load balancer, a connector application, and an automated analytics engine. These components work synergistically to offer enhanced insights and ensure uninterrupted operation.

Key Benefits Delivered:

- Zero downtime failover with load balancing

- 4x increase in operational efficiency.

- 100% transactions processed per second with real-time fraud detection

FAQs

Q: Why is it the right time to launch a fintech app?

A: Launching a Fintech app right now makes a lot of sense for a few simple reasons:

- Digital Boom: More and more people are using digital tools for money matters. A Fintech app fits right into this trend, making it easy for users to handle their finances online.

- People Want More Options: Traditional banks are facing competition because folks want fresh, tech-driven choices for managing money. A Fintech app can offer new and personalized services that people are looking for.

- Tech Upgrades: Cool technologies like Generative AI in Fintech and blockchain are making financial apps smarter and safer. This means better security, faster transactions, and more reliable services.

- Everyone’s on Mobile: Almost everyone has a smartphone, and they use it for everything. A well-made Fintech app can become a handy tool for users, fitting right into their daily routines.

- Friendly Regulations: Governments are getting behind Fintech innovation. They’re creating rules that help new financial apps grow, making it a friendlier environment for startups.

- Changing User Habits: People now want things quick and easy. Fintech apps can offer smooth, personalized experiences, from quick payments to smart investment tips.

- Saving Money: Fintech apps usually run on lower costs than traditional banks. This means they can give users great services without hefty fees, attracting those looking for budget-friendly financial application development.

- Worldwide Connections: In today’s world, money moves globally. Fintech apps can handle transactions and investments across borders, meeting the needs of users with an international perspective.

Q: How do fintech apps make money?

A: Fintech applications employ various monetization models to generate revenue. Here are some common ones:

- Transaction Fees: This is the main source of income for these apps. They charge users a small fee for each financial transaction completed through their platform.

- Subscription Models: There are several financial apps that provide premium or subscription-based services with additional features or enhanced functionality. They charge a regular fee for their services.

- Lending and Interest: Some popular Fintech platforms charge interest by providing various types of loans and overdraft facilities.

- Partnerships and Collaborations: Many organizations collab with other businesses, such as financial institutions, retailers, or service providers. These charge a fee for these collaborations or do it on a revenue-sharing basis.

- Affiliation: You can also earn commissions through affiliate marketing by promoting third-party financial products or services on their app. When users sign up or make a purchase through the app’s referral links, they will get a commission.

Q: What are the latest fintech mobile app development trends?

A: The latest trends include innovative and incorporating cutting-edge technologies such as,

- Machine learning for personalized services and fraud prevention, Blockchain for secure transactions, voice technology for voice-activated features

- Open banking with API integration

- Robotic process automation for efficiency

- Enhanced cybersecurity measures

- Adoption of digital wallets for contactless payments.

These trends collectively aim to provide users with more secure, personalized, and efficient financial services.

30 Min

30 Min