The Internet of Things (IoT) stands as a key force in streamlining processes and enabling real-time data analysis for financial services. IoT has significantly transformed the banking and finance sectors from enhancing operational efficiency to revolutionizing customer experiences. Based on industry statistics, IoT in banking and finance market is projected to undergo a significant compound annual growth rate (CAGR) of 50.1%[1] between the years 2023 and 2030.

This transformation has empowered the BFSI industry to leverage IoT-enabled devices and networks that reshaped traditional banking practices. It continues to transform the banking sector into smart banking by offering customers more personalized, efficient, and secure services.

But this is just a drop in the ocean. Let’s explore in detail how IoT is revolutionizing services and operations of the banking and finance industry with detailed benefits and real-world use cases through this blog.

Benefits of IoT in Banking and Finance

Through the adoption of IoT, the BFSI sector achieves several digitalization benefits such as enhancing operational efficiency, introducing automation, security advancements, and access data analytics insights to make informed decision-making outcomes. Let’s explore the advantages of IoT for banking and how this groundbreaking technology is fundamentally revolutionizing the BFSI sector:

Improved Customer Experience

IoT technology plays a pivotal role in effortlessly gathering and analyzing customer data (such as regular payment patterns, consumer preferences, and even behavioral patterns like driving habits). This wealth of information enables banking and financial institutions to comprehensively understand their clientele, recognize their requirements, and mitigate potential risks. Integrating IoT technology thus helps enhance the overall customer experience by offering targeted services to personalize customer interactions and extending relevant financial guidance.

Intelligent Automation

IoT-powered systems excel in executing specific operations automatically, from handling requests to initiating new bank accounts and even deactivating credit cards. This level of automation drastically reduces the dependence on manual intervention and the occurrence of human errors. It will ultimately help streamline complicated processes of the banking and finance industry.

Enhanced Security Measures

IoT in finance sector facilitates advanced security protocols with continuous remote monitoring and control of CCTV cameras, smart alarm systems, and other surveillance technologies in branches, ATMs, and data centers. This constant vigilance ensures round-the-clock security for various assets like offices, ATMs, and CIT vehicles, promptly alerting authorities in case of any suspicious activities. It also contributes significantly to cybersecurity by enabling various forms of biometric authentication thereby strengthening the security of financial transactions.

Data Analytics & BI for Better Insights

The wealth of data generated by IoT presents a goldmine of information on customer behavior and preferences. By utilizing this data, banks can precisely customize their services, create robust marketing strategies, and bring innovative financial products that resonate with customer needs. Business intelligence in banking helps in converting this data into actionable insights for making informed decisions and fulfilling evolving end-user demands.

Seamless One-Touch Payments

Integrating IoT technology with wearable devices empower users to execute payments without directly utilizing their credit or debit cards.

NFC-enabled devices such as smartphones and smartwatches have revolutionized payment systems by allowing contactless transactions, offering customers a seamless and convenient financial experience. Despite being relatively new, the capability to make payments with a simple touch holds immense promise. As this technology evolves and adoption grows, we can expect to see even more innovative payment methods emerge.

Use Cases of IoT in Banking and Finance

IoT creates exciting new possibilities for transforming financial institutions and creating personalized customer experiences. Let’s take a closer look at some compelling use cases:

Intelligent ATM Networks and Branches

Adopting IoT in banking industry improves operational efficiency through predictive maintenance, energy optimization, and automated cash management through the use of IoT sensors for efficient cash replenishment. Embedded sensors easily identify issues such as cash shortages or technical glitches, enabling immediate resolutions. Smart branches, equipped with IoT devices, leverage biometric authentication for frictionless transactions while also offering personalized assistance based on their preferences and banking habits. The integration of IoT, thus enables intelligent ATM Networks and branches to accelerate full-scale digital transformation in banking in 2024 and beyond.

Asset Oversight

IoT sensors embedded in high-value physical assets, such as vehicles (fleet of trucks, delivery vans), construction equipment (cranes, excavators), or industrial machinery, have considerable financial value to the bank. These assets are held as collateral for loans or finance by the bank. By integrating IoT technology, banks can proactively monitor these assets’ health and even predict maintenance.

Adopting IoT further enables remote asset visibility for owned or leased equipment that facilitates real-time tracking and management. This is especially valuable for geographically dispersed assets as detailed data on data usage ensures enhanced security and optimal asset utilization.

Risk Assessment

IoT devices gather extensive data on environmental factors, market trends, and customer behavior. This data is harnessed by banks to assess risks linked with loans, investments, and insurance, thereby facilitating informed decision-making.

Customer-Centric Innovations

Real-time data from wearable tech such as smartwatches and mobile apps linked to banking systems offer deep insights into customer behavior, preferences and financial needs. It empowers banks and financial institutions to tailor seamless, integrated customer experience across all channels with personalized and relevant offerings.

Security Reinforcement

IoT sensors and smart devices help banking and financial services continuously monitor bank branches, ATMs and data centers. The integration of IoT with Multi-factor authentication (MFA) systems further adds an additional layer of security through biometric authentication, facial recognition, and behavioral analytics. Sensors efficiently detect irregular transaction patterns, promptly notifying banks of potential frauds or security breaches, effectively safeguarding customer accounts.

Real-World Applications of IoT in Banking and Financial Services

Let’s further explore how IoT is transforming the banking industry with real-life examples:

Citibank

This global bank has redefined the ATM experience by integrating beacons for smartphone-enabled access into their machines. Customers can effortlessly withdraw cash, deposit checks, or manage account details by simply tapping their phones at designated points, ensuring transactions are both seamless and highly secure.

John Hancock

This leading investment management company is harnessing data from interconnected health gadgets, such as smartwatches, to craft dynamic insurance schemes. Through analyzing health metrics like sleep patterns and physical activity, personalized insurance plans are designed under the John Hancock Vitality Program[2] to incentivize healthy living, offering mutual benefits to both insurers and policyholders.

DBS Bank

By embedding sensors in their branches, they optimize energy usage by adjusting lighting and HVAC systems based on real-time occupancy and environmental cues. This not only reduces their ecological footprint but also leads to substantial cost savings.

Samsung and Mastercard

These global giants have collaborated to launch ‘Wallet Express’[3] that promises to redefine the global landscape of seamless payments. Imagine effortlessly purchasing groceries by waving your smart refrigerator at the checkout. Their partnership equips smart appliances with secure payment capabilities, transforming daily routines into effortless financial transactions.

How Rishabh Software Can Help You Develop IoT-enabled FinTech Solutions?

We’re a top Fintech software development company offering tailored services for the banking and finance sector to develop next-gen fintech solutions. With a strong track record in delivering secure IoT-enabled fintech solutions, we specialize in improving data analytics, risk management, and customer engagement. We develop highly secure mobile banking apps and enterprise-grade solutions that ensure compliance with industry standards for data protection. At Rishabh Software, we prioritize data security and privacy, integrating advanced technologies like Cloud Computing, IoT, and AI to create user-friendly and secure financial apps.

As a leading IoT application development services provider our highly experienced team can help you develop one-of-a-kind IoT solutions that are scalable and can easily integrate with your existing banking systems. This scalability ensures that solutions grow alongside the institution’s needs, accommodating future advancements seamlessly.

Our Success Story

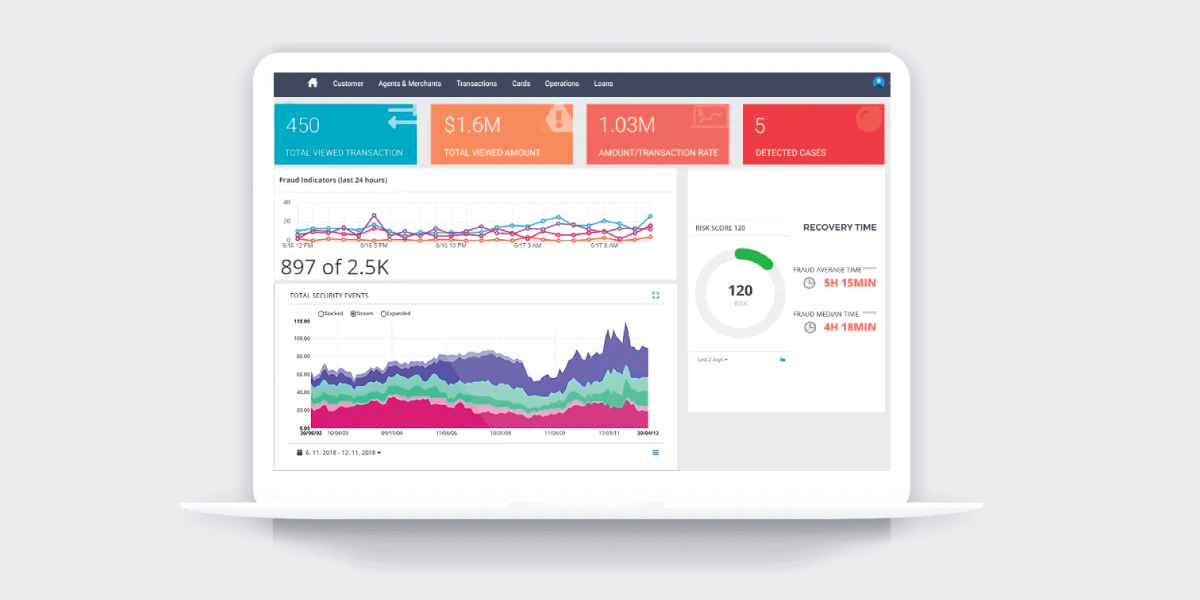

A leading Canada-based union bank wanted Rishabh Software to integrate fraud detection capability into their core banking solution with data analytics capabilities to monitor and prevent fraudulent transaction activities.

Challenges:

- Limited visibility into payment processing across applications

- The limited window for fraud discovery on transactions occurring at a specific terminal.

- Inability to handle a high volume of unexpected fallback transactions.

- Minimal transparency and traceability for unexpected transaction scenarios.

Our expert team provided real-time bank fraud detection & prevention software that combines a rules-based decision engine & tracks past transactions for usage patterns to detect anomalies & prevent fraudulent attempts. To offer proactive banking fraud analytics, we incorporated key components such as load balancer, connector application, automated analytics engine to provide better insights and zero downtime.

Key Benefits Delivered:

- Zero downtime failover with load balancing

- 4x increase in operational efficiency

- Million transaction processing supported per second

Frequently Asked Questions

Q: What is IoT in banking and finance?

A: IoT in Banking and Finance involves linking smart devices, sensors, and systems in banks to gather and analyze real-time data. These devices include ATMs, mobile apps, and transaction sensors. Its aim is to improve customer experiences, make operations more efficient, and use data insights for better data-driven financial decisions. IoT technology thus helps banks understand customer behavior, offer better services, reduce risks, and simplify financial tasks.

Q: What are the top challenges of IoT in banking and finance?

A: Implementing IoT in banking industry faces several challenges. Here are some common drawbacks that you need to understand in detail.

- Data privacy and security: Fintech struggles to safeguard sensitive data, hindering personalized IoT services in banking. AI integration helps counter fraud, fortify processes, and combat cyber threats in financial technology applications.

- Non-universal standards in IoT: Diverse approaches by various IoT device manufacturers pose challenges due to the absence of standardized practices, potentially leading to device malfunctions. However, relying on a sole producer for all devices isn’t practical to resolve this complexity.

- Data management challenges: Gathering user data across multiple IoT devices poses data management hurdles for financial service providers, necessitating comprehensive management.

Q: What role will AI and blockchain play in the future of IoT banking?

A: These innovative technologies will play a significant role in the new future of the fintech industry.

- AI: Artificial intelligence will analyze vast data from IoT devices to forecast customer needs, identify fraud, and customize financial services. The use of Generative AI in fintech offers exciting possibilities through hyper-personalized finance, automation, AI-powered fraud detection and risk assessment, among other use cases.

- Blockchain: This secure tech will monitor real-time financial transactions, enhancing transparency and efficiency, especially in trade finance and lending.

Q: What is the Future of IoT in Banking and Finance?

A: With the help of IoT technology, the future of financial services will seamlessly grow and reach new heights. Here are some predictions.

- Voice-activated Banking: NLP and AI-powered banking through voice activated interactions hold immense potential for a seamless, and personalized banking experience.

- Personalized Insurance: Health and driving habits monitored by smart sensors could lead to custom-tailored insurance.

- Predictive Loan Approvals: Banks using real-time IoT data could provide quicker and more personalized loan approvals.

Footnotes:

1. https://www.verifiedmarketresearch.com/product/iot-in-banking-and-financial-services-market/

2. https://www.johnhancock.com/life-insurance/vitality.html

3. https://news.samsung.com/uk/samsung-joins-mastercard-for-payments-with-wallet-express