New-age customers today expect banks to provide the same kind of intuitive features and services that they routinely receive from companies on the leading edge of digital innovation, like eCommerce and more. And, within the BFSI vertical, fintech companies are providing stiff competition to banks with their customer-friendly products and fast-paced services.

Do you know that the world retail banking report 2022 also suggests that 75% of customers surveyed preferred the seamless and cost-effective services of fintech over traditional banks? And 95% of top global banking executives revealed that their legacy systems and core banking platforms are failing them.

With the rapidly changing market dynamics and increasing customer expectations, age-old systems are no longer helping the banks. What’s even more critical is the fact that the operation and maintenance of the said legacy systems would become even more difficult and costly going forward. So, delaying the modernization of their core banking system could not only impact their profitability but also risk their survival.

Through this article, we’ll get into the details of modernizing legacy banking systems – the need, benefits offered, best practices, real-life use-cases & helpful technologies. So, Let’s get started!

The Need for Legacy Banking System Modernization

Outdated software brings many process challenges to banks.

Here are some of the factors that suggest why the modernization of banking legacy software is crucial:

- Compatibility: Speed of services, online & mobile banking facilities and a wide range of products are increasingly influencing customers’ choice of bank. Legacy systems are incompatible with meeting the rapidly increasing user expectations

- Speed: Customers today want to complete transactions, make payments, or even open an account swiftly. But outdated core banking systems are slow, making every process lengthy

- Security: Age-old security protocols of dated systems lack adequate tech support and updates. So, such banks are vulnerable to security breaches. At times, they are even incapable of meeting regulatory compliance requirements. As customers trust their money with the banks, legacy systems reduce their reliability

- Growth: As mechanisms behind the time make it impossible for banks to offer new-age products and services, they cannot get future-ready. It leads to the shrinking of their current position and growth in the industry

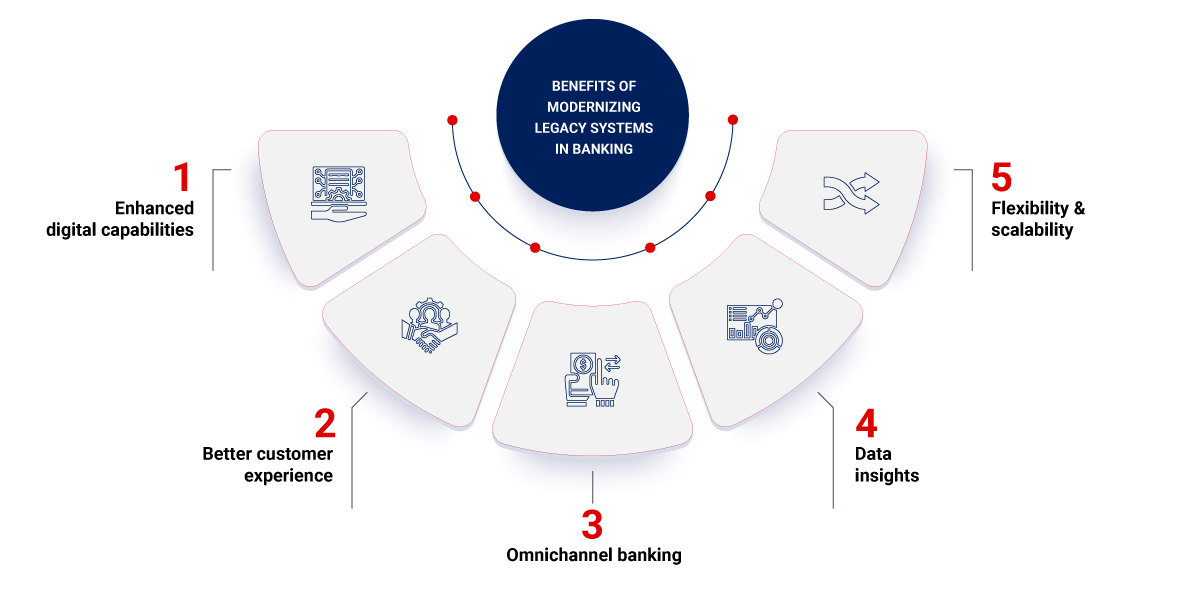

Top 5 Benefits of Modernizing Banking Legacy Software

- Enhanced Digital Capabilities: Modern platforms can integrate advanced capabilities to help stay compatible with APIs. It would include the latest tech like artificial intelligence, machine learning & more to enable banks to keep up with the increasing demands of the industry with digital features and capabilities

- Better Customer Experience: Modernization of the legacy financial systems helps improve the service levels of banks, encourages product innovation, and facilitates faster seamless customer onboarding. It further saves users from slowdowns and crashes associated with outdated systems while improving customer experience.

- Omnichannel Banking: With the latest tech, banks can provide omnichannel experiences by allowing customers to perform the same operations via online banking, mobile phone, call center, or bank branch. For instance, a customer can begin the onboarding process online and finish it via a call center.

- Data Insights: Upgrading legacy banking software helps extract age-old institutional knowledge and opens the door for advanced data analytics to give a competitive advantage. It provides actionable insights into improvement areas and opportunities, leading to better decision-making and achieving business goals.

- Flexibility & Scalability: While outdated systems limit the growth potential of banks, tech like cloud computing, artificial intelligence, machine learning, etc., ensures that they enjoy flexibility and scalability across the value chain.

Best Practices of Banking Legacy Software Modernization

Upgrading the core systems can be expensive, and you want to complete this project smoothly. Here is a list of best practices to follow:

- Evaluate your legacy system & measure its technical debt: Start by identifying where your core system is failing under the current market environment. Your age-old software could suffer from low-quality code or bugs due to the long-term project handled by multiple developers over time. So, factor in the technical debt when evaluating the upgrades, features, and functionalities needed.

- Get involved in the process & examine the options: It is essential to consider the cost and complexities involved in the project. Take guidance from an experienced Fintech software development company to identify the right approach for modernizing the legacy systems in banking. Your core team of decision-makers should work closely with the IT team and provide relevant inputs to shape the solution better.

- Keep your business objectives at the fore: Focus on the business goals and strategic benefits you want to achieve from upgrading core systems. It will help create and maximize business value. So, define tolerance, set measurable goals, and evaluate risk by discussing them with the IT partner to ensure that the work progresses as per plan.

- Prioritize data security: Banks hold confidential financial information of numerous account holders. They accumulate immense intellectual property and valuable data over the years. So, ensuring complete data safety during system transition is of utmost importance.

- Plan for the future: Select the tech that will stay compatible and relevant for many years to come. The experienced IT partner can provide recommendations on deployable architecture. Choose a highly scalable and flexible tech stack to enable further enhancements with minor iterations cost-effectively.

- Ensure seamless integration of your revamped system: The implementation stage is tricky as even efficient systems can fail. Prepare for it in advance with the IT partner. Train employees, understand the update and maintenance schedules, and simply anticipate likely incidents & prepare for them.

Real-life Use Cases of Legacy System Modernization in Banking

Upgrading core systems is a big project. You would want to know how other banks have performed with their software reconstruction efforts before starting your own. So, here are some real-life examples of major banks:

JPMorgan Chase

One of the largest banks in the US, JPMorgan Chase started undergoing a digital transformation and moving away from legacy systems around 2016.

Within 2 years, by 2018, their efforts to scale up the technology and prepare for the next generation of banking resulted in:

- 48 million active digital customers, surpassing the top competitor Bank of America which had 36 million users

- Mobile active users jumped 12% YoY

Zions Bancorporation

Having a presence in 11 western states, Zions Bancorporation transformed its core loan and deposit systems that were customized for every affiliate into a single core platform. It helped them simplify and modernize their operations and technology infrastructure.

The transformation resulted in:

- Deposit products consolidated to just 70 from a whopping 407

- 3000% improvement in time to receive an application and fund products

Technologies to Consider When Modernizing Legacy Systems in Banking

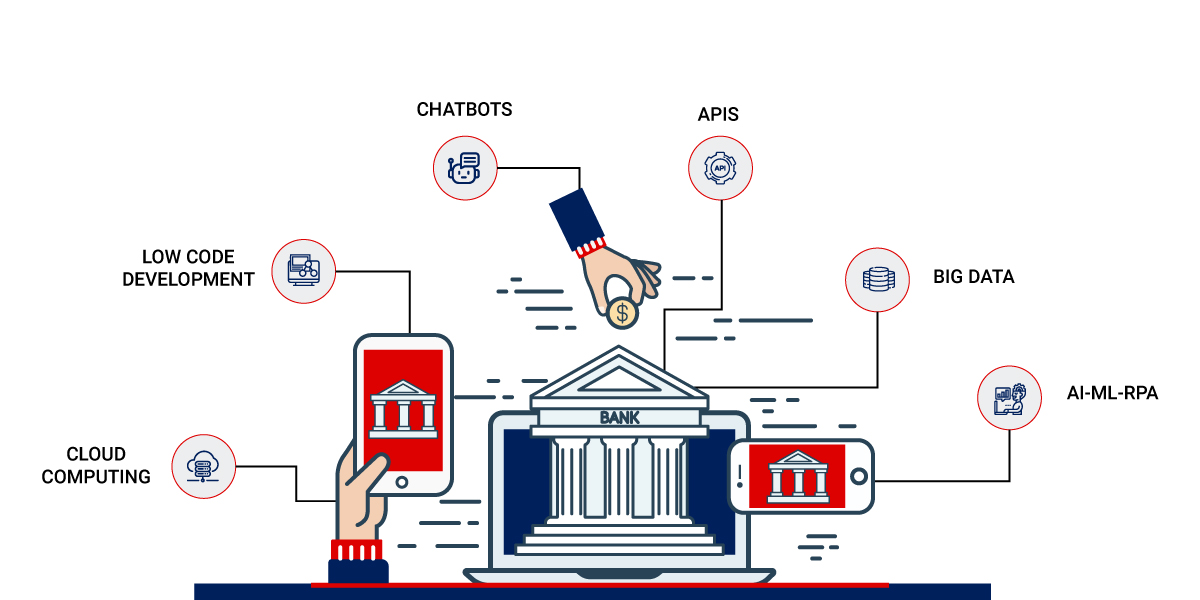

Here’s a list of tech blocks that could take your revamping efforts to the next level and ensure that your business is future-ready:

- Cloud Computing: Banks can adapt to the ever-changing market needs and bring flexibility to their products & services with cloud computing services. Without big investments, they can store data and applications in remote servers and automatically scale resources while improving operational efficiency.

- Low Code Development: One of the biggest benefits of applying low code development is shortening delivery time. It requires little or no coding to add valuable enhancements in terms of applications and processes to legacy systems.

Microsoft’s Power Platform leverages low code/no code to enable banks to design and build end-to-end business solutions. Its use cases include:- Automation of manual processes

- Gaining a 360-degree view of customers and enhancing their experiences

- Providing mobility to employees with remote work empowerment

- Automating complex, multi-stage approvals

- Building a common data platform to improve inter-departmental collaboration

- Chatbots: They simulate online conversations with people while enhancing their banking experience. By responding to customer queries and issues 24/7, they help banks avoid reputational damage from negative online reviews. They even assist users with their banking tasks and provide personalized services. Read on how leveraging banking bot development can improve customer experience.

- APIs: Banks must be a part of digital ecosystems to thrive in the fast-changing market. They need to be able to receive money transfer requests from third-party financial services, mobile wallets, card systems, and digital payment systems. Their legacy banking system modernization efforts must include APIs as they enable software and apps to communicate with each other and share data.

- Advanced-Data Analytics with Big Data: As data-intensive institutions, banks can benefit from the immense data they collect from different sources like KYC, online transactions, ATMs, etc. Advanced data analytics can give actionable insights and help them provide personalized services.

- Process Automation with AI-ML-RPA: The automation of digital processes helps banks to scan & mitigate instances of anti-money laundering & sanction screening, adhere to regulatory compliance, trade finance, commercial lending operations, letter of credit & guarantees, and much more.

Rishabh’s Experience in Upgrading Legacy System Modernization

We have over 20 years of software development experience and have successfully delivered application modernization services for clients from different industries.

Our committed team comprises highly skilled and experienced developers who have the required know-how with clean coding best practices. They maintain transparency in every interaction while providing personalized attention & customizing the solution for your needs & wants and delivering them on time.

Case Study Update: Re-engineering Investment Portal to Boost Efficiency

A renowned US-based venture capital firm wanted to centralize its document management portal so that all account metrics across the business entities are visible in real time.

The challenges included:

- Obsolete technology spectrum

- User interface affected productivity

- Limited operating system support

- Problems in integrating data from different sources

Our team integrated disparate data sources and optimized information architecture to modernize the legacy portfolio management portal. It helped enhance collaboration & transparency among users and improved user experience for search & contextual help.

The developed solution resulted in:

- 60% faster & accurate search of information

- 30% increased user engagement

- 50% boost in productivity with centralized document management

Concluding Thoughts – The Next Step

In this age when everything is going digital, the time to stick with traditional banking practices is long gone. The changing industry dynamics have left no other choice but to opt for modernization of the banking system.

Banks and other financial institutions must weather the storm while adapting to the new reality dictated by the rapid evolution of fintech. This would enable attracting newer customers and unlocking profitable revenue streams. However, this can’t and shouldn’t be a solo journey. Finding a trusted software provider is the natural first step.

So, the obvious next step is to connect with an experienced and reliable IT partner, like Rishabh Software. With a dedicated team who can analyze your business needs, provide recommendations, and create top-quality custom solutions that fit your current and future requirements.