Did you know

- More than 24.8 million people currently have active personal loans, showcasing growing adoption of lending platforms.

- The Small Business Administration (SBA) reports average business loans around US$417,316.

This data clearly highlights how businesses, nonprofits, and individuals alike are increasingly leveraging diverse money lending solutions to meet their financial needs.

So, if you’re looking to explore the path of money lending app development to add value to your fintech organization, now is the right time to turn that idea into reality. Whether your goal is to serve individuals, small businesses, or larger enterprises, the opportunities are wide open and the market signals a strong green flag to move forward.

This blog post is the perfect place to start. Keep exploring to learn more about lending app development, including the types you can choose from, their advanced features, and more.

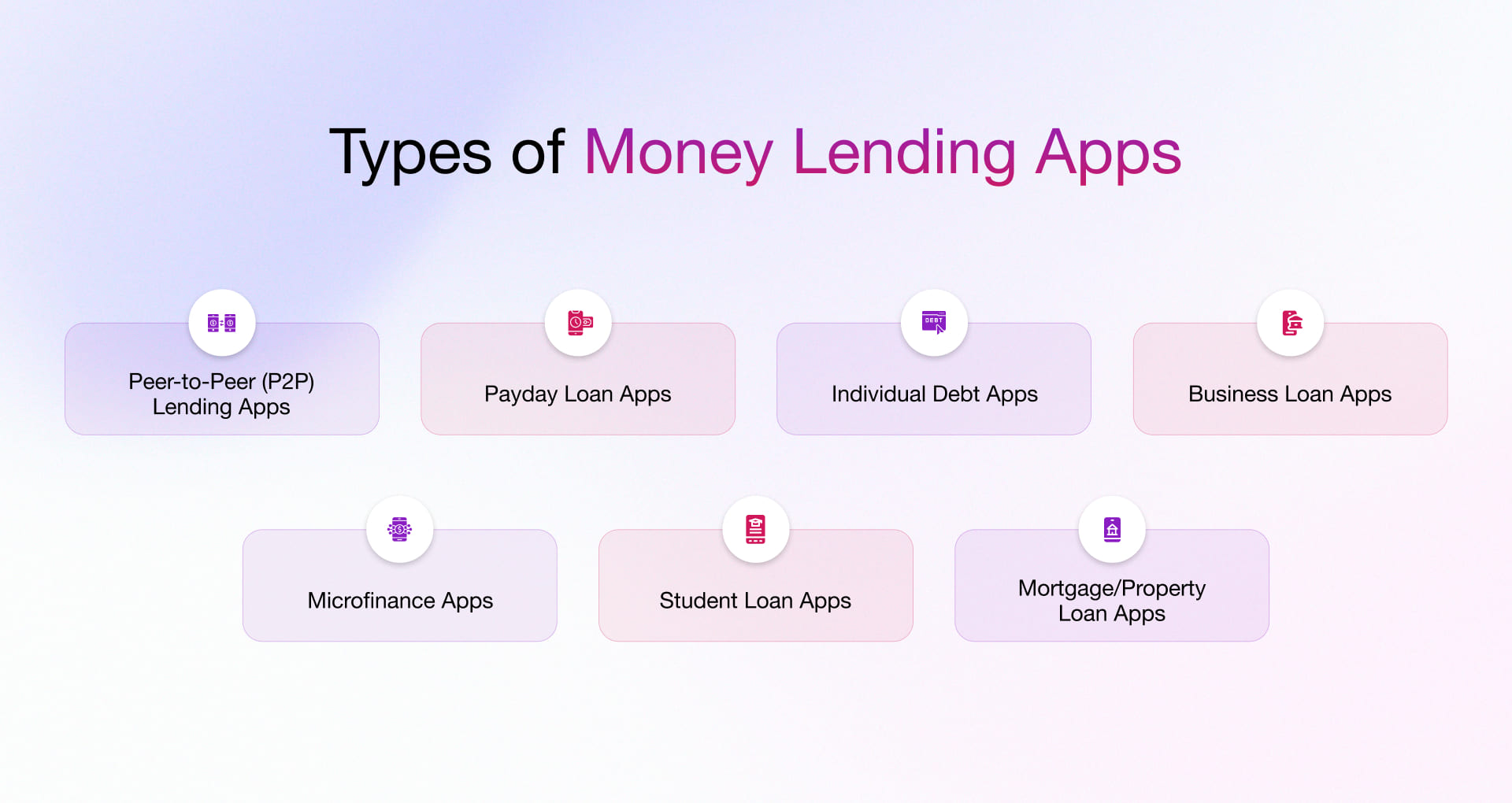

Types of Money Lending Applications

Proceeding with loan lending mobile app development, the very first and most imperative step is to be aware of what kind of application you need. Let’s take a closer look.

1. Peer-to-Peer (P2P) Lending Apps

Peer-to-peer (P2P) lending apps are making things easier and transparent by connecting borrowers directly with individual lenders, cutting out the banks. This means faster approvals and more cost-effective operations.

In terms of generating revenue, the P2P lending market has great potential. It is estimated to reach $176.5 billion by 2025 and $1,380.8 billion by 2034. Just look at platforms like LendingClub; they’ve shown how P2P lending can create a trustworthy, marketplace-driven environment that attracts both investors and those who are underbanked. It’s a fantastic option for businesses looking to grow and stand out in the digital lending space.

Features:

- Direct Borrower-Lender Connection

- Flexible Loan Options

- Automated Credit Assessment

- Secure Transactions

2. Payday Loan Apps

Quick, designed for short -term lending, payday loan apps provide immediate cash for immediate needs. Their strength lies in real -time credit checks, automatic compliance and rapid access, making them ideal for underbank users and is beneficial for fintech via interest and processing fee.

Features:

- Instant access to short-term funds

- Real-time credit checks

- Automated compliance processes

- Secure payment systems

3. Individual Debt Apps

These apps complete medium and long -term lending, offering flexible loan amounts and terms of repayment. With AI-powered credit scoring and seamless banking integration, they provide rapid approval than traditional banks and are continuously on a scale with diverse loan products.

Features:

- Flexible loan amounts & repayment terms

- AI-driven credit scoring

- Faster approvals than banks

- Seamless banking API integrating

4. Business Loan Apps

Focusing on SMEs and large enterprises, business loan apps provide working capital and expansion funds. Automatic risk evaluation, cash-flowing analysis, and helping advanced analytics help Fintech in a large-scale market service, promoting long-term customer relations.

Features:

- Working capital for SMEs & enterprises

- Automated risk assessment

- Cash-flow analysis tools

- Advanced analytics for lending decisions

5. Microfinance Apps

Targeting unqualified communities, microfinance apps provide small, collateral-free loans to promote financial inclusion. The first allows to increase the increase in low-income areas, generating permanent revenue and alternative credit scoring fintech.

Features:

- Small, collateral-free loans

- Mobile-first onboarding

- Alternative credit scoring methods

- Cloud-based secure operations

6. Student Loan Apps

These apps simplify education financing with individual repayment plans and flexible interest rates. Integration with universities and automated disruption helps to create confidence and recurring revenue opportunities in the growing $ 1.7 trillion student loan market.

Features:

- Personalized repayment plans

- Flexible interest rates

- Digital KYC & automated disbursement

- Integration with university systems

7. Mortgage/ Property Loan Apps

Mortgage credit apps streamline complex processes such as loan applications, document verification, and repayment management. With AI-powered property evaluation and risk analysis, these apps accelerate loan approvals while ensuring compliance. They deliver customer-focused solutions in one of the largest credit markets globally.

Features:

- Streamlined loan applications

- Document verification & management

- AI for property valuation & risk profiling

- Transparent repayment tracking

Must-Have Features of a Money Lending App

Here is a list of common features of money lending applications. The features remain the same across different types, though the app type may vary.

- User-Friendly Onboarding – Digital onboarding via KYC followed by identity checks for rapid onboarding.

- Loan Application & Approval – Customers are able to request loans through an easy and straightforward process.

- Secure Payment Integration – Diverse payment choices, all of which are encrypted and have mechanisms to counter fraudulent activities.

- Credit Scoring & Risk Assessment – Real-time borrower credibility checks through AI and machine learning.

- Repayment Management – Automated reminders, flexible EMI choices, and clearly defined repayment plans.

- Dashboard & Analytics – Analytics dashboards for users and admins to understand their performance, loans, and repayment.

- Regulatory Compliance – Ensured with built-in financial guidelines and regulations adherence checks.

- Push Notifications – Approval and status changes, offers, and upcoming deadlines alerts.

- Customer Support – Automated chat, voice services, and chatbots streamlining query resolution.

- Scalability & Cloud Integration – To handle growing user bases and transaction volumes efficiently.

How to Create a Money Lending Mobile App

How to create a money lending app often comes with loads of queries, confusion, unclear thoughts, and more. Building one is not an Effortless process, it requires a strategic mindset, readiness for implementation decisions, and technicalities at the core. This section will help you understand the end-to-end lending app development approach and the key things to consider.

Step 1. Market Research & Define Your Lending Model

The process of loan lending mobile app development should be slower but deeper in terms of data gathering, analysis, and more. Ensuring you don’t need to revisit the stage repeatedly if research & market analysis part done thoroughly and correctly. The foundation of the query “how to create a money lending app” lies in identifying who you serve and how your lending system operates. So here is key point in the very first stage you should focus on:

- Identify Your Niche: Decide if your app will cater to small businesses, salaried employees, students, or underserved communities. Why this? Because each group has unique borrowing behaviors, repayment capacities, and expectations. Niche identification is necessities to build lending app.

- Clearly defined niche improves user engagement, loan repayment rates, and marketing effectiveness, while fostering trust among users.

- Competitive Analysis: Study existing apps to evaluate what makes them succeed or fail. Look for gaps such as high interest rates, long approval times, or poor customer support, these are opportunities for your app.

- Lending Models to Consider: As discussed earlier, you now have a clear understanding of the different types of money lending apps you can develop. If you still have any questions, feel free to reach out to us at sales@rishabhsoft.com and get instant solutions from our experts.

Step 2. Focus on Design and Functionalities

This stage is where your ideas start taking shape. For example, if you are going with a school loan or education loan mobile app development, then what should be the top priority of functionalities and features?

- For instance, a student loan app like SoFi offers flexible refinancing options, no fees, and tools to help users manage and automate payments while tracking their credit health.

- Similarly, a personal loan app such as Upstart provides features like AI-powered instant approvals, competitive interest rates, and transparent repayment terms, targeting borrowers with limited credit history through an entirely digital process.

Your market research and competitor analysis will guide you here, allowing you to implement solutions smartly and strategically. Focus on features that create a clear difference between your app and the existing ones in the market.

We have already mentioned the features and functionalities in the above section. You can finalize from there, or you can consult our experts to guide you further.

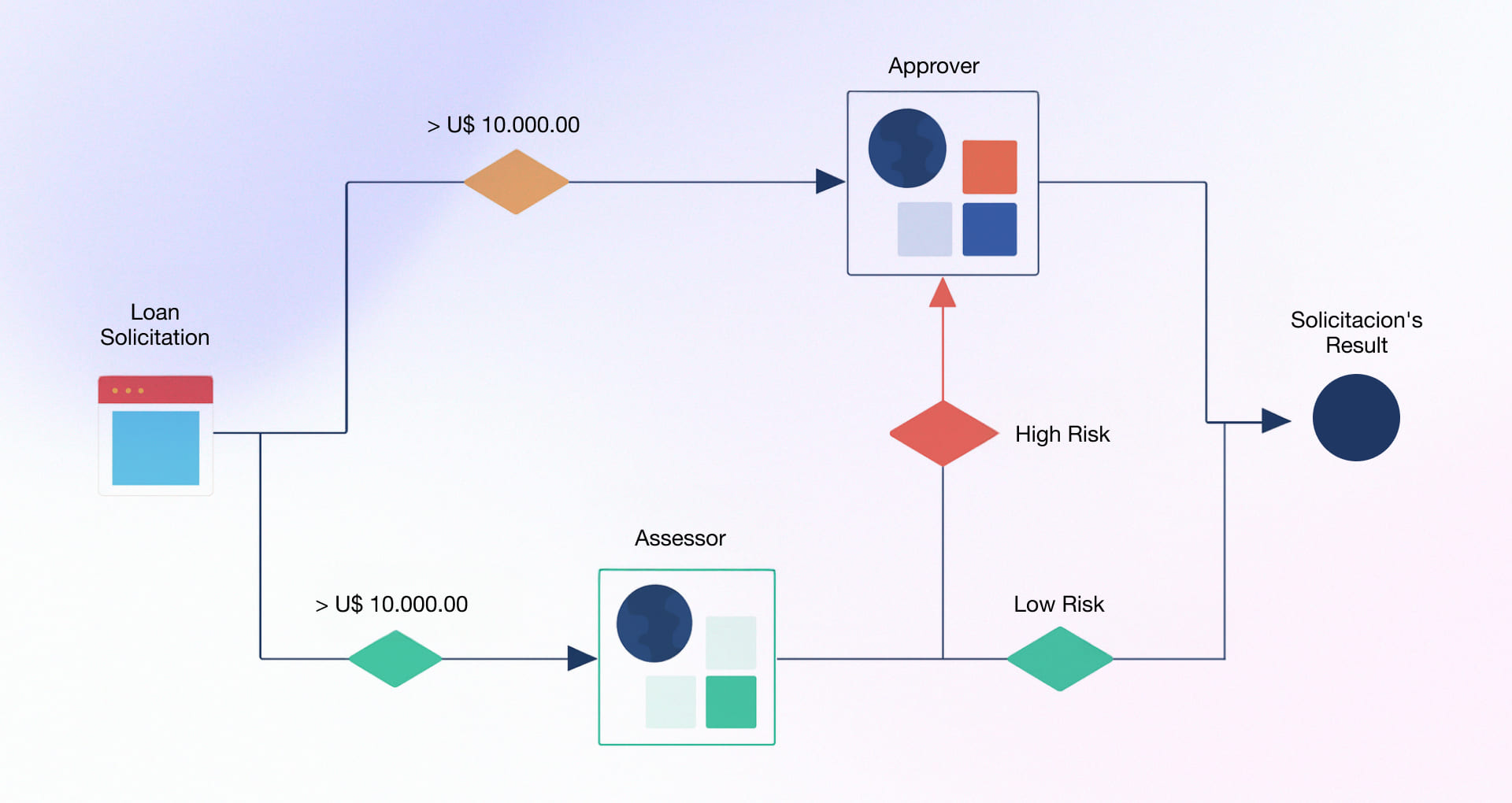

Step 3. Strategic & Technical Roadmaps

This is a critical stage that should not be overlooked to keep the loan app development process aligned with the business perspective. Ensure you start the project as soon as possible, aligned with your vision and mission, incorporating the perspective of the CEO or CTO. Here are a few aspects to consider:

For the CEO

- Business Model and Financial Projections: If you are venturing into money lending app development, a strong financial return is likely one of your key targets. Define a clear revenue model (e.g., interest-based, fees, tiered subscriptions) and create detailed financial forecasts such as such as projected loan disbursements, expected default rates, customer acquisition costs, revenue growth, and break-even timelines. This will be crucial for securing funding and demonstrating viability.

For the CTO

- Technology Roadmap: Outline a long-term plan for the app’s architecture, including future features, platform scalability, and necessary infrastructure upgrades.

- Scalability: Design the backend and database architecture to handle rapid user growth and increasing transaction volumes. Choose technologies that can scale horizontally, such as cloud-native platforms (AWS, Azure), containerization with Kubernetes, and distributed databases like MongoDB or Cassandra.

- Security Architecture: Implement a comprehensive security strategy from the ground up, including data encryption, secure authentication protocols, and regular security audits. Compliance with standards like PCI DSS is essential.

Partnering with Rishabh Software can help you to be burden free technical as well as planning aspect.

Step 4. Collaborate with Tech Partner, Develop & Integrate

Collaboration with the right tech partner not only supports you in technical aspects but also takes care of everything from the initial roadmap to launch. Things become even more promising when you choose a leading FinTech software development services partner like Rishabh Software.

So, you can partner with us at every initial stage of money lending app development. How we can help you are listed below:

Choosing the Right Tech Stack

- Native Development (iOS/Android): Offers the best performance and user experience but requires separate codebases.

- Cross-Platform (React Native, Flutter): Allows you to use a single codebase for both platforms, saving time and resources.

Backend and API Development

Build a secure and scalable backend to handle all financial transactions, user data, and business logic.

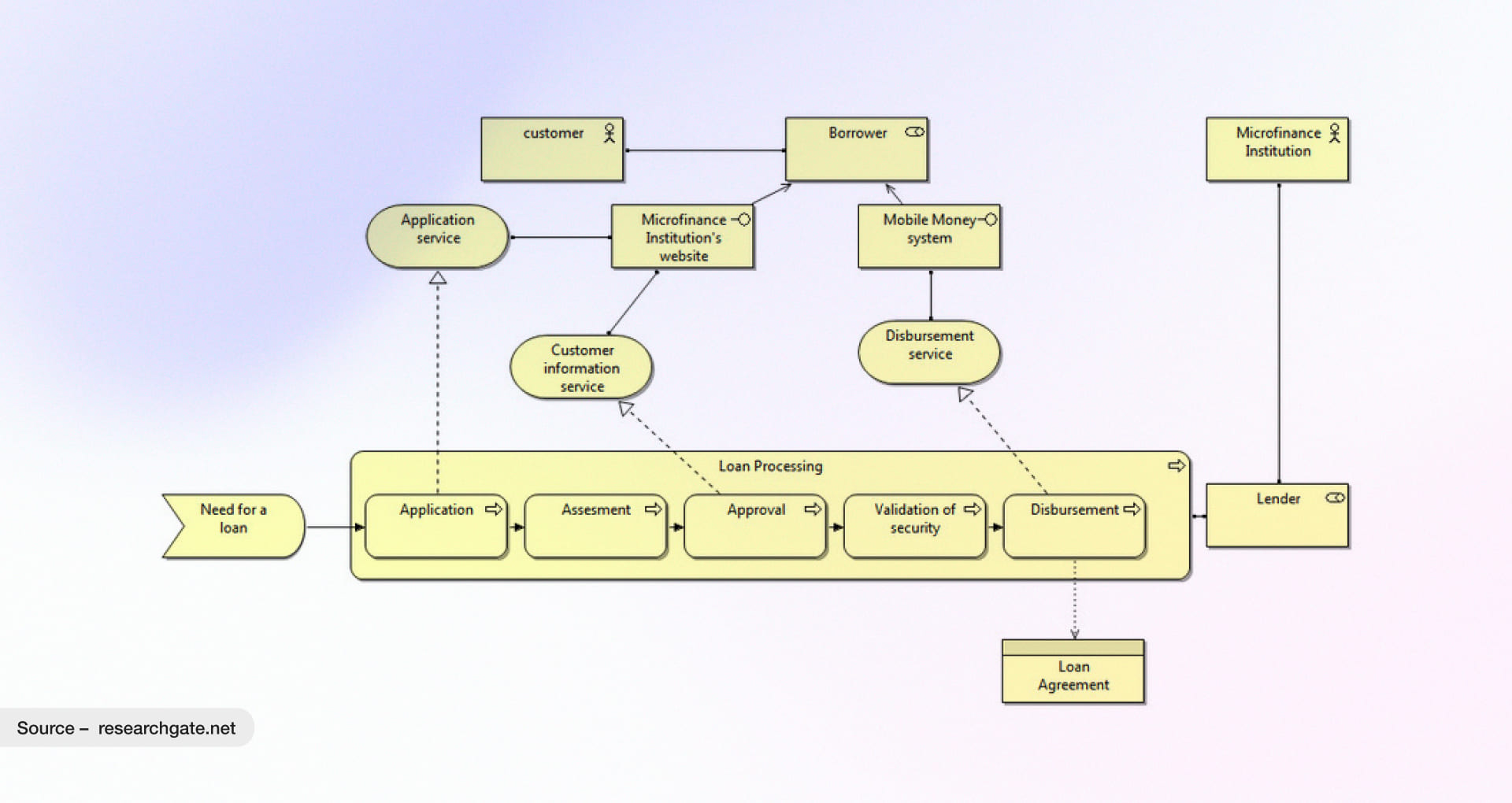

Integration Aspect

Integration is also very important in lending money applications, where there must be smooth operations of the users and admin activities. Integration accelerates the processes by linking payment gateways, credit bureaus, KYC systems, and third-party APIs, allowing automatic loan processing and risk evaluation. Zero-failure, cross-board integration with a focus on the smoothness of workflow, regulatory compliance, and end-to-end secure lending experience is very important.

Step 5. Test, Launch and Monitor

Building an app is one thing; building a quality product is the real meaning of development. Perform various types of testing, including:

- Functional Testing: Verify that each feature and functionality developed with the intent is achieving the same or working in a similar manner.

- Integration Testing: Ensure smooth interaction between different modules, such as the payment gateway, backend, and third-party systems.

- Performance Testing: Check app behavior under normal and peak loads.

- Security Testing: One of the most important testing approaches for a money lending app. Conduct penetration testing, vulnerability scans, and compliance audits.

There are many other ways to check the quality of your money lending solution, such as user acceptance testing (UAT) to gather feedback and load balancing checks to ensure reliability, along with compliance measures to prevent issues such as potential money laundering risks.

Factors to Include for Launch

- Go-to-Market (GTM) Strategy: Design a plan for the step-by-step process of app launch. Establish a plan for acquiring your first users by means of marketing channels, partnership opportunities, and an initial user acquisition budget.

For Monitoring Purposes

- Key Performance Indicators (KPIs): Set measurable metrics to measure the success of the app, including loan volume, retention rate of users, and customer lifetime value (customer LTV) vs. customer acquisition cost (CAC) ratio.

Key Benefits of Money Lending App Development

For CTOs and CEOs, the real value of a money lending app lies in its ability to merge customer convenience with operational efficiency. Here’s why it’s worth the investment:

- Faster Time-to-Market: In lending, speed is a competitive advantage. Traditional systems often slow down product launches with integration roadblocks and dependency on third-party platforms. A custom-built mobile lending app changes this equation. By removing legacy bottlenecks, it enables you to deploy new loan products, repayment models, or customer features in weeks instead of months. For a CEO, that means faster revenue capture. For a CTO, it means your team can respond to market shifts without rewriting the entire tech stack.

- Risk-Managed Growth: Every executive faces the challenge of scaling lending while maintaining credit quality. Modern money lending apps come with AI-powered risk and fraud detection and instant KYC, safeguarding the growth of borrower volumes while keeping defaults under control. Automated underwriting provides timely balances between growth and risk, avoiding delays and managing growth with precision. This results in increased loan disbursement capacity and NPA control, and builds investor trust in your scaling capability.

- Operational Efficiency at Scale: Time and money can be drained by manual loan approvals, fragmented repayment systems and paper-heavy documentation. A digital-first lending app integrates loan origination, disbursal, and repayment systems into a single flow. This centralization, combined with automation, decreases manual workload and operational costs. Strategic leadership can thus enjoy the benefits of streamlined processes: the capacity to service ten times the customer base, improved financing, and the same headcount.

- Customer Stickiness: In loan lending app, loyalty is built on experiences, not solely on rates. While lending apps can be designed with user-first principles, the apps also need to include personalized dashboards, automated reminders, and streamlined repayment processes. Customers appreciate the ease of borrowing; hence, they are likely to return. This translates to reduced churn and enhanced competitive advantage for you against rivals with traditional lending models reliant on bank branches.

- Regulatory Confidence: Compliance is not optional. It is existential. Every lending business has the potential to face the fallout of penalties, reputational damage, and having to exit the market. A well-designed money lending app incorporates compliance into its lending engine, from the GDPR and PCI-DSS standards for data privacy to the lending mandates of the RBI or FDIC. Worry-free encrypted automated audit trails and regulatory reporting systems are designed to ensure you are aligned with standards. This means, for most CEOs or CTOs, a good night’s sleep during audits at franchise lending institutions.

- Revenue Diversification: Lending apps do not just process loans. They open the door to adjacent revenue streams. With built-in analytics, you can identify opportunities to cross-sell insurance, savings products, or even buy-now-pay-later (BNPL) services. The infrastructure supports modular expansion, so you can grow your ecosystem without overhauling your core platform. For leadership, this means new revenue lines at lower acquisition costs, strengthening your long-term growth trajectory.

Challenges in Lending App Development and How to Overcome Them

Here are the key challenges you might face when getting started or during the loan lending app development process. Our experts have outlined solutions to overcome them in the most seamless way possible.

1. Regulation Never Sleeps: Every financial product is built on a foundation of law. You can have the cleanest code and the smartest algorithms, but if you miss a compliance update, say, a new data privacy rule or a cap on interest rates you’re suddenly exposed. Regulation is the ghost in the machine, always present. The only way forward is to treat compliance as a feature, not an afterthought. Build systems that flex when the rules change, and bring legal minds into the room from day one.

2. The Fragility of Trust (a.k.a. Data Security): A money lending app is essentially a vault. Inside it: people’s pay stubs, bank statements, ID documents, their entire financial lives. If that vault cracks, trust is gone, and no user acquisition budget can buy it back. That’s why encryption, multifactor authentication, penetration tests, and compliance audits aren’t “extras.” They are the walls, the doors, the guards. Without them, the product doesn’t exist, it’s just a liability with a login screen.

3. The Black Box of Credit Scoring: How do you measure the risk of someone you’ve never met, who has no formal credit history? Traditional models shrug. They exclude more people than they accept. But phones, transactions, even patterns in how someone fills out a form tell a story. Modern lending apps can weave that story into alternative credit scoring models powered by machine learning. The trick is not just to predict but to explain. Borrowers want transparency, regulators demand fairness, and the system must serve both.

4. Integration: The Hidden Plumbing: From the outside, lending apps look like a clean interface and a “Get Loan” button. Behind the curtain? A web of APIs: payment gateways, credit bureaus, ID verification, regulatory databases. Each system speaks its own dialect, and your app must translate in real time. If those connections falter, the experience breaks. The solution is boring but necessary: modular, API-first architecture, relentless integration testing, and choosing partners who value reliability as much as speed.

5. User Experience vs. Everything Else: Users want one thing: money, fast. The faster and simpler, the better. But behind that simplicity sits the chaos of risk, compliance, and data checks. The paradox of lending apps is that the smoother it feels for the borrower, the harder the system is working backstage. Success lies in designing flows that hide the machinery without losing the rigor, progressive forms, clear language, and automation where possible. It’s like theater: the lights, the cues, the scene changes all have to work, so the audience sees only the story.

Why Choose Rishabh Software for Money Lending App Development?

Our expertise in FinTech App Development goes beyond just writing code. We focus on building solutions that create long-term value. We don’t compromise on a deal; instead, we prioritize value creation by aligning business goals with technology from start to finish. Our purposeful culture and deep client engagement ensure that every feature, integration, and compliance step is executed the right way. We believe in working collaboratively as we go in one direction with our clients to actually get the work done, delivering secure, scalable, and user-centric money lending apps that stand out in the competitive financial services market.

Frequently Asked Questions

Q: What Factors Affect Money Lending App Development Costs?

A: Costs can vary based on the type of lending app (payday, personal, business, mortgage, etc.), the complexity of features (such as KYC, credit scoring, and payment integrations), choice of platform (iOS, Android, or cross-platform), design complexity, and the use of third-party APIs. Furthermore, routine maintenance, compliance, and future scalability will affect the budget as well.

Q: How does Rishabh Software Ensure Compliance and Data Security?

A: We implement the best compliance and data security practices. As part of our fintech app development, we ensure all local compliance laws such as PCI DSS, GDPR, and financial local laws. Our security-first integrations of multi-factor authentication, secure API gates, and data end-to-end encryption will shield against unauthorized data access and fraud, earning the trust of lending and borrowing clients.