From being known as a niche retail monetization strategy to becoming one of the most transformative forces in advertising technology (AdTech), retail media networks are raising expectations across the industry. AdTech, once dominated by search, social media, and programmatic CTV, is now gradually shifting toward commerce-driven, intent-based advertising models. As a result, the retail media networks market is ready to reach USD 56.97 billion by 2030.

Retailers’ mass adoption of leveraging their first-party shopper data and direct purchase signals helps deliver highly relevant, measurable advertising experiences. It is redefining how brands connect with consumers and how AdTech must adapt to remain competitive in a privacy-first, data-driven world.

In this blog, we will dive deeper to understand how the new norms of the AdTech landscape are broadening over time under the influence of retail media advertising. We will also shed more light on retail media inflection points, the three-sided value exchange, the four core pillars, and more.

The Retail Media Inflection Point

Traditional AdTech is losing its structural advantage as scale reflects diminishing returns driven by fragmented data, measurement and proxy-based targeting. This shift is striking as RMNs are expected to capture 20.0% of U.S. ad spend by 2029, highlighting how the digital advertising value chain is changing. Advertising is moving closer to the transaction, where direct purchase signals and real-time intent enable more relevant and measurable outcomes, helping to break that cycle of inefficiency in traditional media buying.

In this booming retail media environment, retailers have quietly become media platforms by leveraging first-party shopper data within a sophisticated modern business model. Retail media networks allow brands to multiply the impact of their advertising investments through closed-loop measurement and commerce-driven inventory. RMN success now depends on scalable technology, data ownership, and performance accountability, reinforcing retail media as a structural shift within AdTech rather than a temporary trend.

Read Our Blog Retail Media Network: Build vs Buy!

The Three-Sided Value Exchange Powering Retail Media Networks

Retailers: How Retail Media Platforms Create a New Revenue Engine

The definition of retailer has evolved with the time, from just a media owner to they are becoming media operators powered by retail media technology.

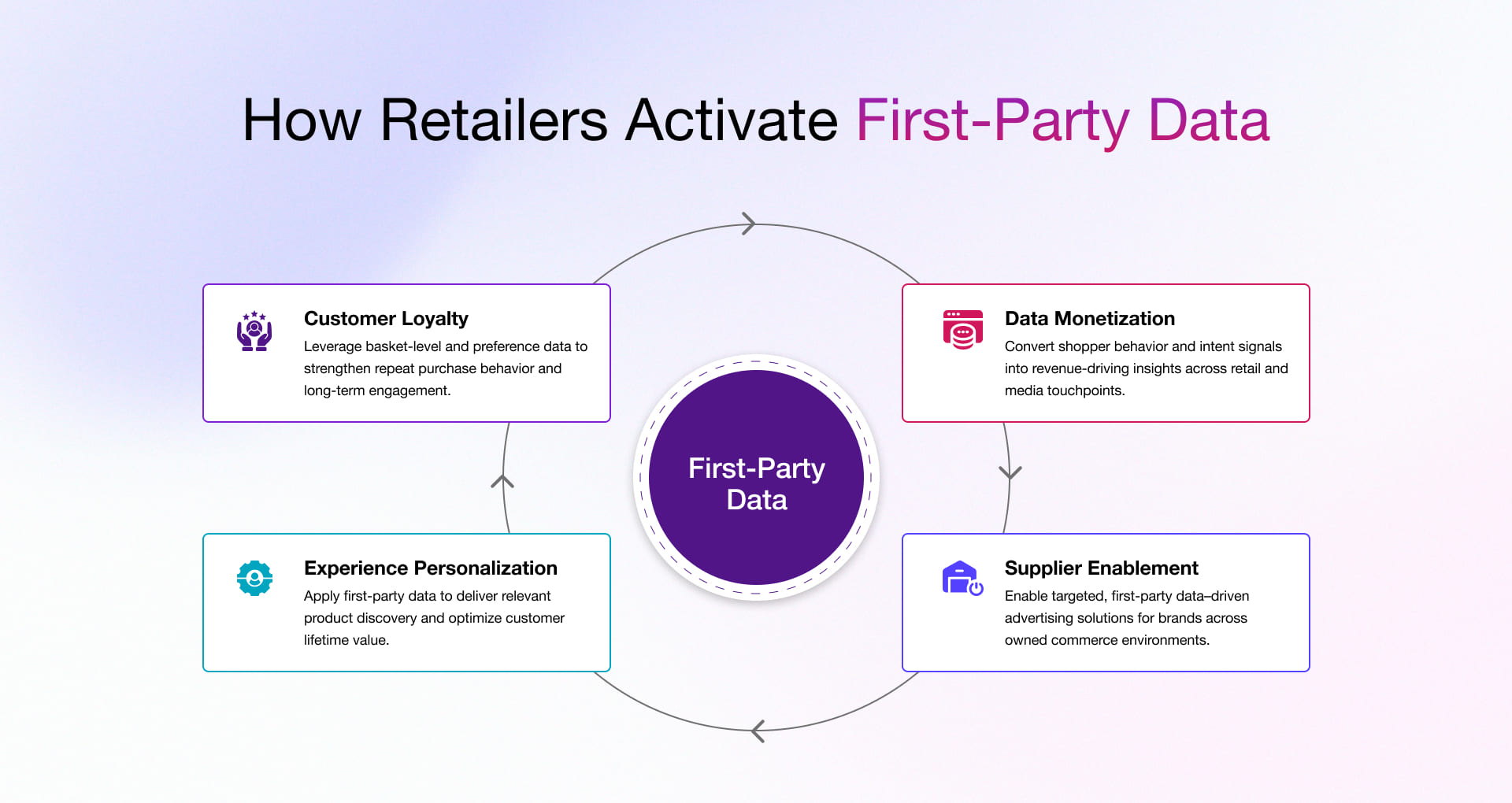

Through proprietary retail media advertising platforms, retailers activate first-party data generated across search, product pages, carts, and transactions. This data fuels both on-site and off-site retail media networks, enabling retailers to monetize shopper attention while maintaining control over identity and measurement.

Retail media platforms enable retailers to:

- Monetize high-intent traffic at the point of purchase

- Activate deterministic first-party data at scale

- Offer closed-loop attribution tied to actual sales

- Build high-margin media businesses alongside retail operations

Brands: Why Retail Media Advertising Platforms Drive Revenue Accountability

For brands, retail media advertising platforms change the economics of advertising.

Instead of relying on modeled attribution, brands buying through retail media networks can connect ad exposure directly to SKU-level sales. This makes retail media one of the few channels where brand investment can be evaluated against verified revenue outcomes.

Retail media platforms allow brands to:

- Target real shoppers using deterministic retail data

- Influence decisions at search, product, and checkout stages

- Measure performance using closed-loop attribution

- Align media spend with retail sales objectives

Consumers: The Role of Retail Media Technology in Improving Experience

Retail media succeeds because it delivers value to consumers not just advertisers. Ads served through retail media platforms appear in high-intent environments where users are already shopping. Powered by retail media technology, these placements feel more like personalized recommendations than disruptive advertising.

From the consumer perspective, retail media delivers:

- Relevant product discovery instead of interruption

- Personalization based on real shopping behavior

- Fewer irrelevant ads compared to open-web targeting

- Clear value in exchange for data usage

The Four Pillars of a High-Impact Retail Media Network

Retail media networks succeed when four structural pillars are in place. When any pillar is weak, networks may generate revenue but fail to scale, sustain trust, or remain defensible. From an AdTech development perspective, these pillars define the systems, platforms, and operating models that must be built to support retail media advertising at scale. Let’s explore four main pillars of retail media advertising.

1. First-Party Data Ownership and Identity Control

Core question: Who controls shopper identity, and who absorbs regulatory and platform risk?

Digital advertising was built on third-party identity. That model maximized reach but externalized risk. With comprehensive data privacy laws now in effect across multiple US states, third-party data strategies face higher compliance risk and diminishing reliability. Privacy regulation, browser controls, and signal loss progressively weakened its reliability.

Retail media networks operate on owned, commerce-derived identity. Authenticated users, transactions, and loyalty signals create deterministic identity that retailers control directly through their platforms. This requires identity resolution systems, consent management frameworks, and activation layers that can operate without third-party dependency.

First-party data enables lower-funnel accountability through metrics such as ROAS, advertising cost of sales, and new-to-brand contribution, making retail media platforms one of the few channels where performance can be validated at the revenue level. These collective advantages enabled research teams to estimate significant value creation: leveraging first-party data drove 2.9x higher revenue and 1.5x lower costs.

Leadership check

- Is identity deterministic or inferred?

- Can targeting function without third-party signals?

- Is consent governance internal and auditable?

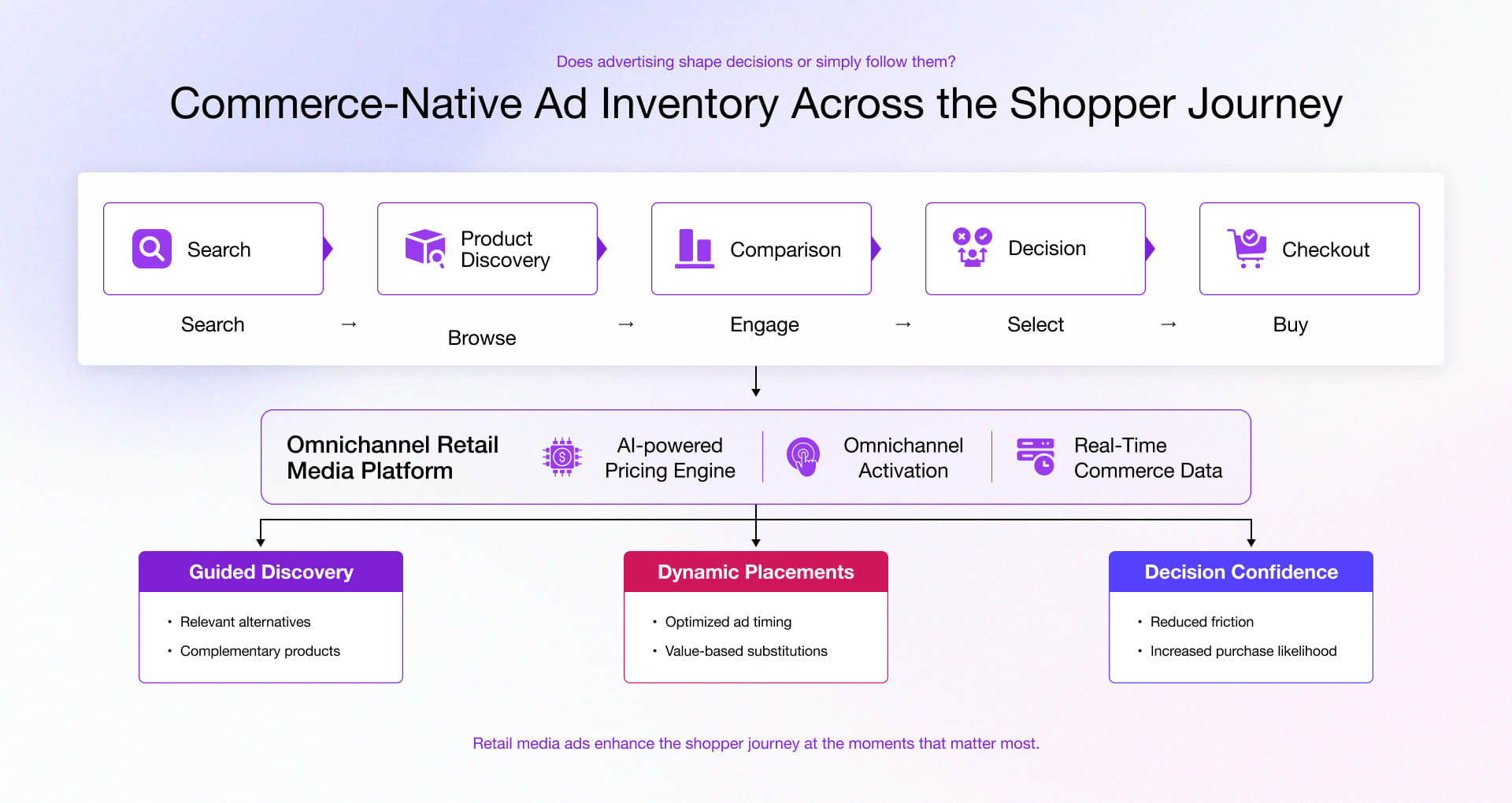

2. Commerce-Native Ad Inventory Across the Shopper Journey

Core question: Does advertising shape decisions or simply follow them?

Commerce-native ad inventory enhances the shopper journey by embedding advertising directly into moments of active decision-making rather than interrupting it. Unlike traditional media placements that compete for attention, retail media operates within search, product discovery, comparison, and checkout flows, where shoppers are already evaluating options.

What makes this model unique is the technology stack behind it. Retail media platforms use real-time availability, pricing, promotions, and purchase history to determine which ads appear and when. This allows advertising to function as guided discovery, surfacing relevant alternatives, complementary products, or value-based substitutions that improve decision confidence and reduce friction. Such as AI-powered pricing engine and model for optimize placement, omnichannel activation.

Leadership check

- Are ads placed inside shopping workflows?

- Can inventory influence discovery and substitution?

- Is omnichannel execution driven by a single data layer?

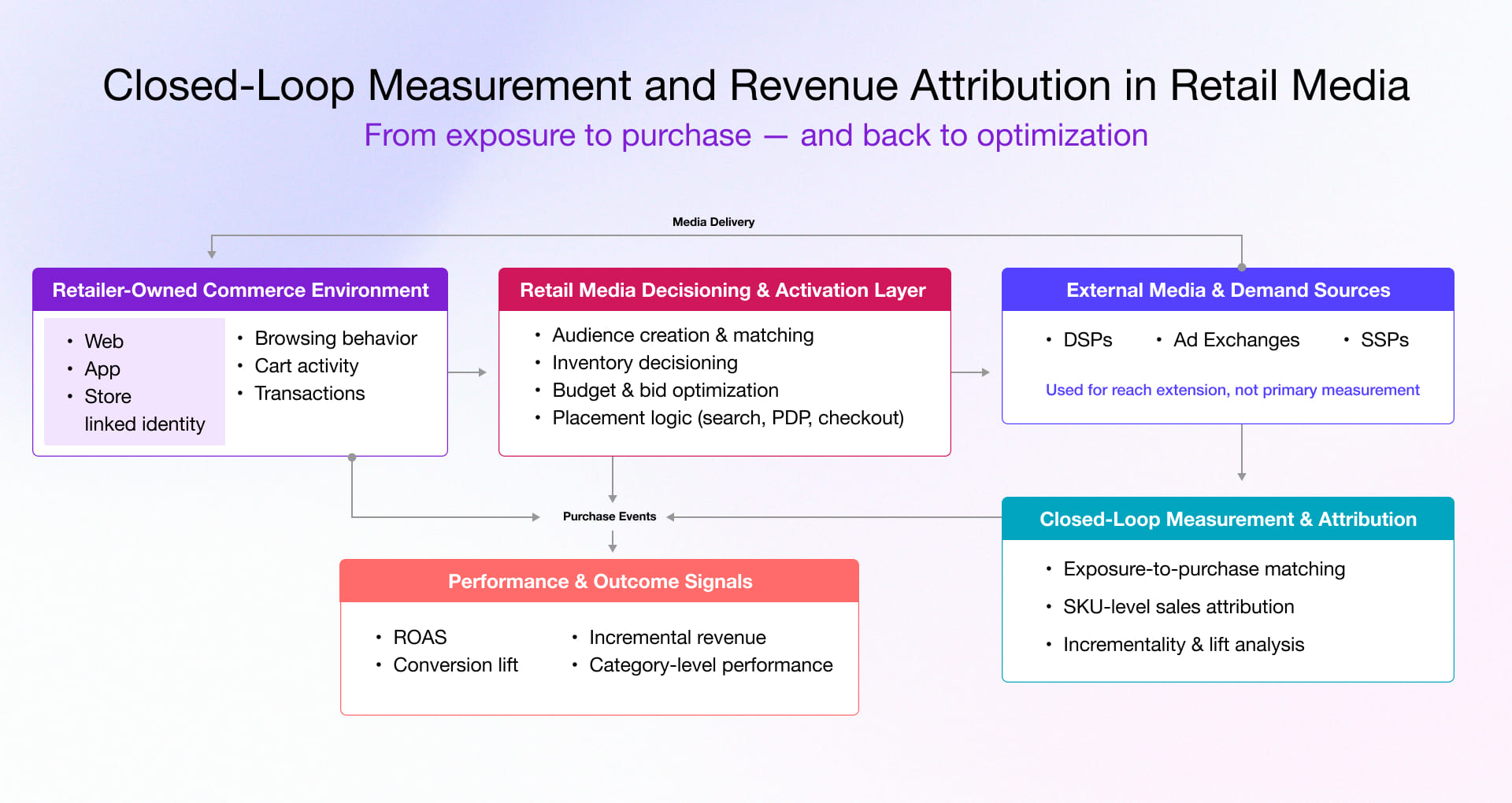

3. Closed-Loop Measurement and Revenue Attribution

Core question: Can performance be proven conclusively?

Traditional advertising depended on attribution models and indirect metrics. With signal loss, the trust in the performance of the ads decreased. The discussions about the performance happened several times, not just once or twice, throughout the process.

In contrast, retail media advertising brings about this elimination of uncertainty through its very nature. Because the data on media exposure and transactions are in the same system, it becomes possible to perform deterministic, revenue-linked attribution. To AdTech, this is a ringing of event-level data pipelines, transaction matching, and measurement frameworks that can hook impressions straight to the results. The visibility of the situation is one of the reasons why the investment in retail media keeps rising while other channels get a close watch.

Leadership check

- Is attribution transactional or modeled?

- Can impact be measured at SKU or category level?

- Do advertisers trust the numbers enough to scale budgets?

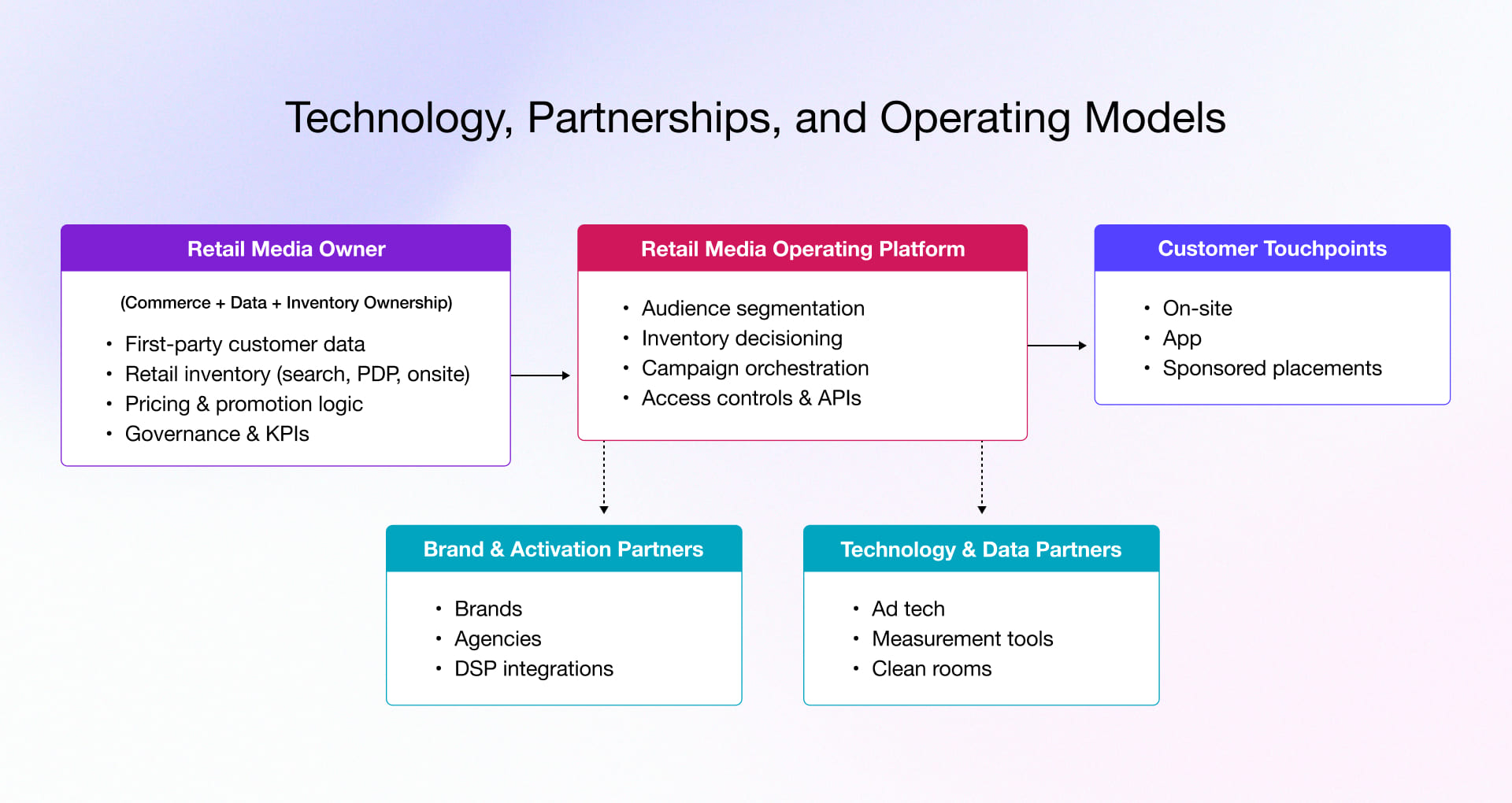

4. Technology, Partnerships, and Operating Models

Core question: Who owns execution, and who is accountable for outcomes?

Retail media rarely fails due to lack of demand. It fails due to operating friction. Legacy retail structures and agency-led models were not designed to run a media business inside commerce.

High-performing networks treat retail media as an operating model. Retail, media, data, and technology teams are aligned around shared systems and KPIs. Technology platforms are modular, and partnerships are governed through integration standards rather than ad hoc execution. Without operational ownership and scalable architecture, retail media platforms fragment

Leadership check

- Is accountability centralized?

- Are incentives aligned across retail and media teams?

- Does the technology stack enable speed or create drag?

Making Retail Media Networks Work for Modern Businesses

Already in the AdTech era or just wanted to jump into it through retail media advertising. Here are they key ways you can make your journey fruitful.

1. Building Retail Media as a Modular Platform

A modular architecture is foundational to contemporary retail media networks. What makes the difference is its ability to enable the disaggregation of capabilities such as audience segmentation, inventory orchestration, measurement engines, and data governance. This approach to building and adoption creates the right room for adjustment or enhancement within one module without impacting another.

If we consider modern business alignment, this approach fits well with current trends, where rapid adaptation to changing shopper behaviors, partner expectations, and regulatory requirements plays a crucial role. What comes a long way here is responsiveness to shifting commercial and regulatory conditions, a feature that is increasingly necessary in the privacy-centric landscape of digital advertising.

2. Integrating Retail Media Across the Commerce and Martech Stack

Operationally retail media platform can be a standalone system but functionality it has to build correlation and dependency based on commerce, marketing technology, and analytics infrastructure. Well-integrated retail media solution creates high image on first-party data from point of sale, customer interactions, and loyalty systems into media decisioning processes.

Such integration ensures that advertising decisions are not abstracted from actual purchase contexts but are embedded within the broader operational architecture of the retailer. Consequently, this leads to a tighter alignment between promotional activity and real commerce outcomes, a core differentiator compared with external digital advertising channels.

3. Designing for Multi-Stakeholder Value Exchange

Retail media networks function as multi-sided platforms where value is co-created and exchanged among retailers, suppliers, and end consumers. The design of these networks must, therefore, reconcile competing interests by embedding explicit mechanisms for allocation of advertising inventory, price discovery, and performance reporting. Unlike traditional retail channels, where the retailer and supplier relationship follows predictable inventory flows, RMNs invert this dynamic by positioning advertising as a strategic interface for influence and learning. In doing so, the platform fosters an environment where value accrues not merely from transactional exchange but from shared insights into consumer behavior and promotional effectiveness.

4. Embedding Intelligence into Media Decisioning

Within advanced retail media ecosystems, computational intelligence extends beyond descriptive reporting to prescriptive and predictive decisioning. Algorithmic can make optimization process related to bidding faster & smarter, and audience targeting in near real-time based on performance feedback loops that connect media exposures to purchased outcomes.

By leveraging machine learning models trained on closed-loop data streams, RMNs can dynamically adjust media variables in response to emerging patterns in shopper behavior. This embedded intelligence transcends static segmentation logic, enabling the network to evolve as participant behavior shifts, and it situates retail media within a broader scientific framework of adaptive systems analysis.

Partner with Rishabh Software to Convert Retail Media Vision into Platform Execution

At Rishabh Software, we have been working closely media buying and selling based platform/solution that fall under our Adtech development services. Our teams design and build integrated, unified platforms for retailers and modern businesses like developing retail media platforms, enhance the capabilities of supply side platform, demand side platform, ad exchange and other platforms that are robust, easily accessible, and ready for production.

Our developers contribute across critical layers of the AdTech, MarTech, and Commerce stack architecture. This includes the management of the first-party identity and consent, data running in real-time, making decisions and controlling the inventory, and finally, measuring the success of the whole process through closed-loop transactions that are already part of retail.

Frequently Asked Questions

Q: How do RMNs differ from other digital advertising platforms?

A: Here are the things that make retail media advertising different from others:

- Operate within retailer-owned environments such as search, product pages, and checkout

- Use first-party shopper and transaction data instead of inferred or third-party signals

- Target consumers with high buying intent during active shopping moments

- Link ad exposure directly to actual sales through closed-loop measurement

- Focus on revenue outcomes rather than clicks or impressions

Q: What are the retail media KPIs to measure?

A: Common KPIs include ROAS, advertising cost of sales (ACoS), incremental sales, new-to-brand revenue, and SKU-level conversion rates. These metrics focus on revenue impact rather than media exposure alone.

Q: How do retailers monetize their customer data?

A: Retailers monetize customer data by activating it within their own retail media platforms for targeting, ad placement, and measurement. Data stays internal and is used to drive media revenue while maintaining privacy and consent control.

30 Min

30 Min