Digitalization has made going cashless easier with the concept of digital wallets. It is dominating today’s touchless world due to the convenience, speed, and safety it offers. According to Juniper Research, the number of digital wallet users globally will likely exceed 5.4 billion in 2028, rising from 3.7 billion in 2023 [1]. Similarly, the total value of digital wallet transactions is expected to increase by 77%, reaching $16 trillion by 2028, up from $9 trillion in 2023 [2].

Hence many business owners are now partnering with eWallet app development companies to create custom apps like Walmart Pay and Starbucks mobile app to buy & sell products and offer services. It ranges from grocery to booking tickets and more for their customers while supporting their business ecosystem.

As a business, investing money into digital wallet app development can help garner good profits. If you’re thinking of building a feature-rich & customized mobile app, this post will provide you with a detailed overview of all essential factors.

What is an eWallet Mobile App?

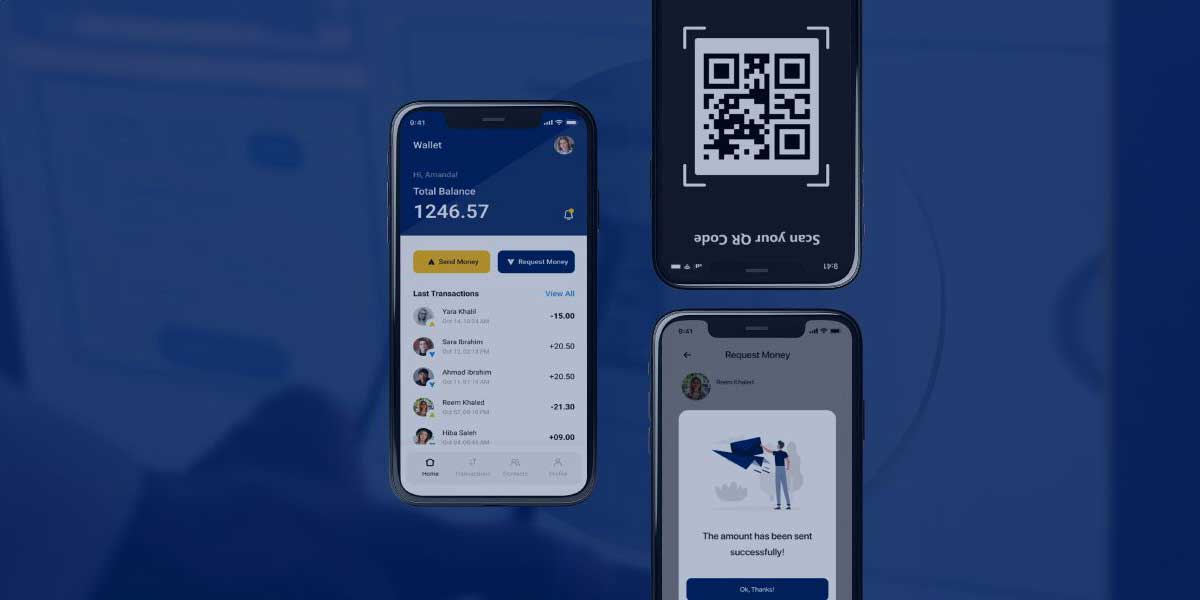

It enables the customers to make in-store, online, and in-app payments to you. It stores their debit & credit cards digitally and connects with their bank accounts. So, they can go both cashless and cardless while transacting with you. The digital wallet also stores the gift cards, loyalty cards, discount coupons, etc. that you offer to your customers.

Why You Should Invest in Mobile Wallet App Development?

The market has witnessed a tremendous rise in the use of digital payment applications that facilitate touchless transactions. Here are some stats to support this trend;

- According to Allied Market Research, the global market for digital wallets is estimated to go from $1.04 billion in 2019 to $7.58 billion by 2027.

- Research & Markets suggests by 2025 the volume of non-cash transactions in the global market is forecasted to surpass the 1.5 trillion mark

And beyond a terrific pace, this trend is garnering attention from both innovators and entrepreneurs. Beyond its simplicity, scalability, and security, let’s discuss core advantages.

Benefits of eWallet App Development

- Higher Conversion Rate: Don’t force your customers to line up in a queue to pay bills. Give them the convenience to purchase your products and services on the go. Accelerate their checkout process with a mobile payment app. This will directly influence their buying behavior and bring you more revenue.

- Reduce Abandoned Carts: The most significant benefit to retailers is fewer abandoned carts. eWallets simplify and speed up the buying process, which increases the number of shoppers who complete their purchases.

- Low Transaction Fee: Mobile commerce platforms have much lower transaction fees than the high-interest rates of credit cards. Merchants can issue a payment card of their own as well. It can work like a gift card, leaving the bank out of the transaction loop while reducing the transaction charges considerably.

- Easy Refunds: Order cancellations and returns are an inevitable part of the business. But with a digital payment system, you can turn them into an engaging customer experience. It facilitates quick and easy refunds to customers. This also means that your shoppers now have ready cash in their app to shop more. Business owners can then retarget these customers with product ads and encourage them to make further purchases in just a few clicks.

- Increased Revenue: Companies can push personalized offers with discount codes to stay in constant touch with their customers and keep them coming back. This can be done periodically to increase sales opportunities even in the long term.

- Expand Customer Base: Mobile payment applications enable businesses to reach out to potential customers quickly. Well-designed contactless payment solutions with advanced features enhance their credibility and allow business owners to perceive them as reliable and trusted. People worldwide prefer a touchless wallet. They will quickly switch over to you with robust security features, leaving your competitors behind.

Key Factors to Consider During the Mobile Wallet Application Development

Now as you decide to build an eWallet application, things could become complicated for you without the right direction. So, here are a few important considerations.

- Suitable type that works for the business

- Mobile payment methodology

- eWallet features & modules

- Security

- Regulatory compliance

- Technology stack

Let’s discuss the specifics under each phase;

1. Digital Wallet Types

Spend time understanding the different types of eWallets and analyze how industry peers are utilizing them.

CLOSED

- Exclusive payment app for store for making purchases by the customer (Walmart Pay)

- Funds transfer – To the organization’s account

SEMI-CLOSED

- Process payments with partner stores (Apple, Android & Google Wallets) that support payment made for eWallet service provider using the partner stores

- Funds transfer – To a trusted escrow account

OPEN

- Conduct transactions for different companies using the same platform. (American Express, Amazon Pay)

- Funds transfer – Directly to the bank

2. Mobile Payment Methodology

Start your digital wallet app development journey by deciding the payment options you want to offer to your customers to monetize maximum opportunities.

- Point of Sale (POS) System: It is essential for online or in-store sales, and includes hardware and software like credit & debit card readers, barcode scanners, receipt printers, etc. You can customize it to meet your business needs. For instance, an AI-based POS system is a boon to retailers.

- Near Field Communication (NFC) Tags: NFC tags process payments using a contactless chip. It enables automated transactions once the card is placed in affinity with the receiver machine. Read about the top 5 NFC payment apps and their benefits.

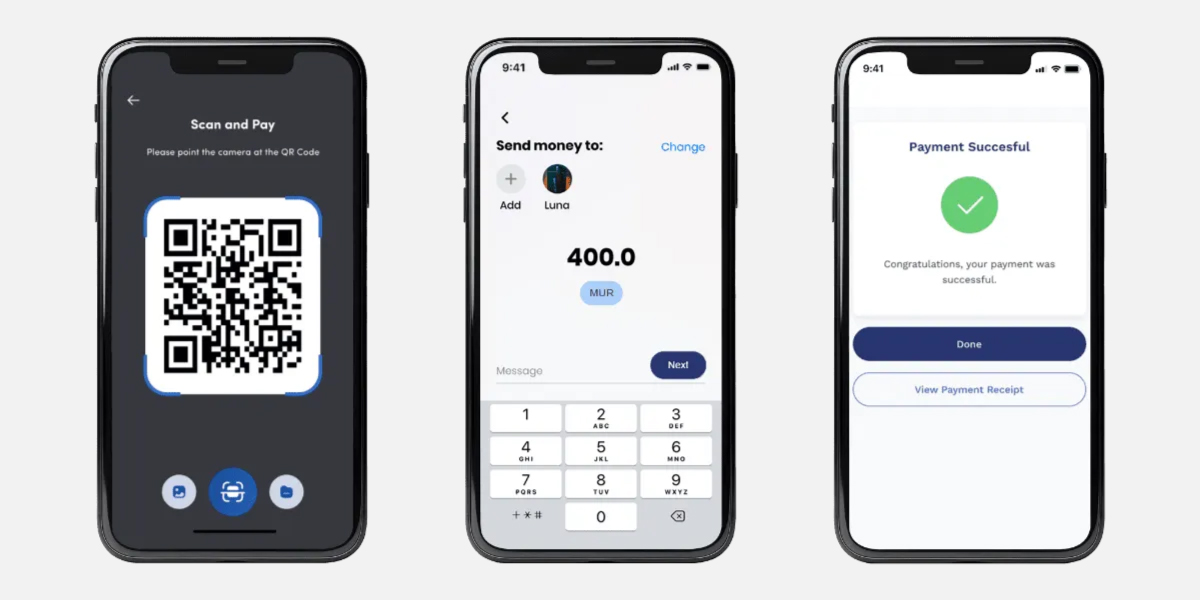

- QR (Quick Response) Code: You can display your QR code at the checkout point to accept payment. And the customer can pay just by scanning the code using the in-built camera on a smartphone or tablet.

- Beacon: Smartphones with Bluetooth 4.0 and above can use BLE transmitters to make online and offline payments. The POS terminal can fetch the card details of the shopper and automatically process payments without any hassles.

- Sound Wave Based: It enables transactions on smartphones, feature phones, card swipe machines, etc. The merchant’s device generates a sound wave containing encrypted data regarding the payment, and the customer’s device receives the data, decodes it, and completes the payment.

3. Features & Modules of eWallet Mobile App

Features

Depending on your unique business needs, you can incorporate advanced features into the eWallet mobile app. They include:

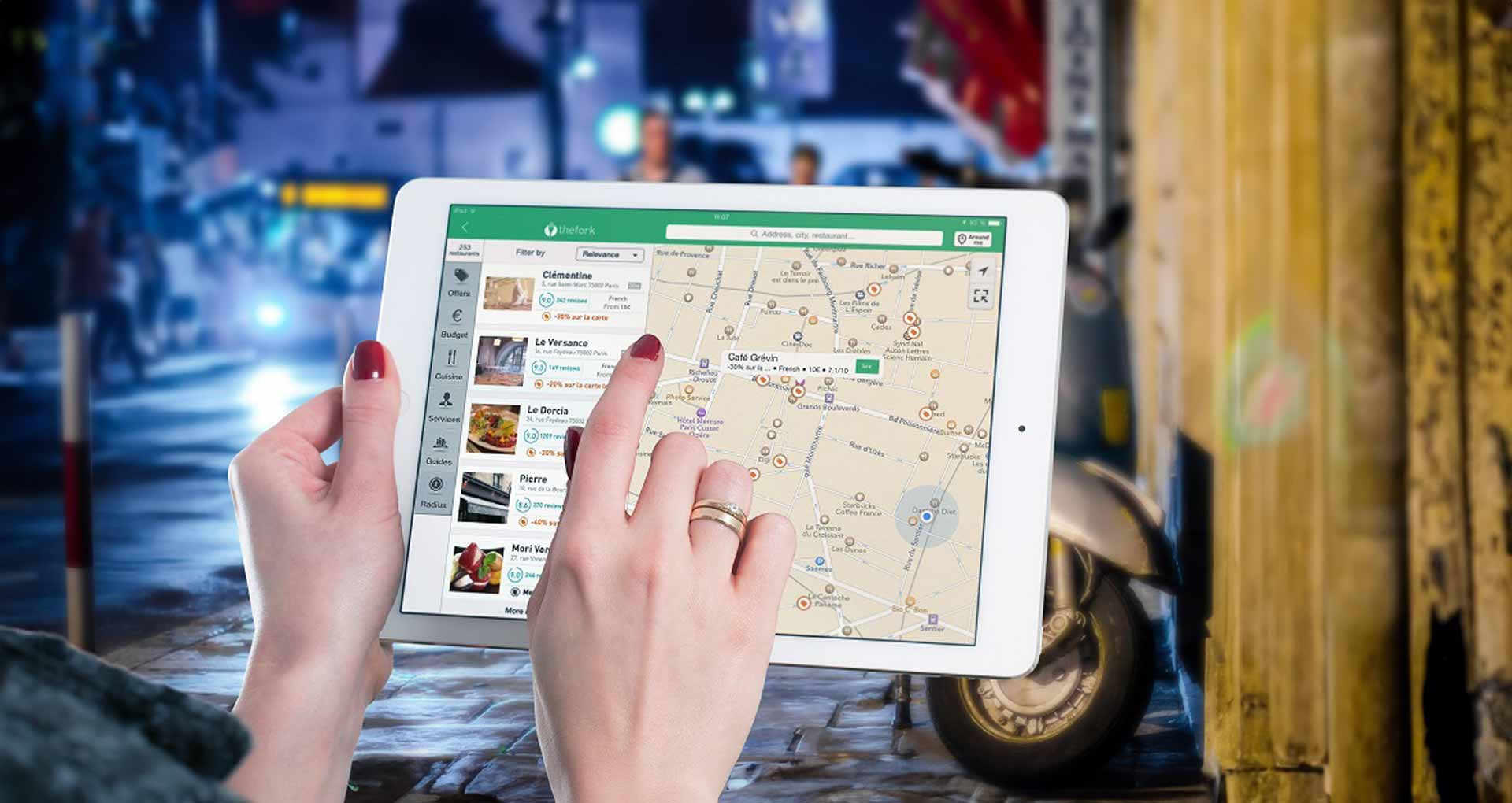

- Geo location: Considered one of the expensive features it helps significantly raise the visibility and popularity of the eWallet mobile app. The GPS technology helps easily locate nearby users and enables making the payment by simply tapping on the user name.

- Wearable integration: Thanks to the growing adoption of cashless transactions, the global wearable payments devices market size is expected to grow at 29.8% CAGR from 2021 to 2028. Reach out to more customers by integrating your mobile wallet app with wearable devices and accepting payments through them.

- Virtual card creation: The digital wallet app development allows the creation of virtual cards for credit/debit cards. This helps save time for making payments.

- AI Chatbot integration for 24×7 customer engagement: 40% of internet users worldwide prefer interacting with chatbots, and consumer retail spending via chatbots will reach $142 billion by 2024 from just $2.8 billion in 2019. So, you can provide round-the-clock service to your customers by integrating AI Chatbot into your digital wallet.

- Personalized recommendations: Advanced AI-ML integrations enable understanding customer data (their buying patterns, preferences, interest and more) to offer personalized recommendations with coupons, rewards, and much more to increase your sales.

Modules

Mobile wallet apps commonly have the below-mentioned components. Let’s go over them.Admin Panel

- Secure login

- Role-based access control

- Data control

- Merchant management

- User management

- Real-time analytics

- Revenue management

- Security management

- Add & edit new offers

Merchant Panel

- Intuitive dashboard

- Create/edit profile

- Add & remove products

- Create QR code

- Customer management

- Employee management

- Make withdrawals

- Discount coupons

- Reward points

- Promotional offers

- Push notifications

- POS integration

- EMI payment option

User Panel

- Easy registration

- Link bank account

- Add balance

- Transfer money

- Make bill payments

- Avail offers and discounts

- Check balance

- Track reward points

- Set autopay

- View transaction history

- Split bills

- Receive payments

- Send invites

- Earn referral points

4. Security

The payment app needs the end-user to store their account/ card details for making transactions. Your application can only succeed if your existing and potential customers can rely on its robust data security structure. Your primary responsibility is to make sure their financial data and passwords stay safe. You could use pins, fingerprints, retina scans, etc., to enhance security. For this, the eWallet development team needs to use industry-leading technologies and robust security mechanisms that are difficult to decrypt.

5. Regulatory Compliance

mCommerce platforms should ensure compliance with the applicable local & global (in some cases) banking laws and regulations. Therefore, they should be developed keeping in mind the application of the eWallet framework. Having an experienced technology partner will help avoid any risks and ensure transparent transactions.

6. Different Technologies Required to Develop a Mobile Wallet

- Frontend: Flutter, Xamarin, Native Mobile Development, Angular/React Native, CSS, Javascript, and HTML5

- Phone Verification, SMS & Voice: Nexmo

- Database: MongoDB, HBase, Cassandra, and MailChimp Integrations

- Payments: Stripe, PayPal, Braintree, and PayUMoney

- Data Management: Datastax

- Cloud Environment: AWS, Azure, Salesforce, and Google Cloud

- Email Management: Mandrill

- Push Notifications: Urban Airship, Push.IO, Amazon SNS, Twilio

- QR codes: ZBar Code reader

- Real-time Analytics: Hadoop, Apache Spark, Big Data

Industries That Leverage Mobile Wallet App Development

Food App Industry

- Faster processing of invoices and receipts

- Enables ordering, paying & tracking the food item and even placing orders

- Enhance customer service & guest experience

- Easy tracking of merchant settlements & refunds

Banks & Financial Establishments

- Enhance digitized services for retail customers

- Create a speedy & secure payment infrastructure

- Enable customers to avoid the inconvenience of cards

- Facilitate anytime-anywhere fund transfer

Retail & eCommerce

- Reduce cart abandonment

- Expand your reach & increase conversions

- Speed up the checkout process

- Run reward programs and promotions

Travel & Hospitality

- Enhance guest experience with seamless check-in and check-out

- Push notifications to loyalty card members with exclusive deals

- Secure sending & receiving money while safeguarding transactions

- Offers the opportunity to shop from anywhere

With a clear understanding of how various industries can leverage eWallet to enhance customer experience and streamline operations, we will now move to the development process behind this powerful financial tool.

eWallet Mobile App Development Process

A thorough understanding of user needs and preferences will guide the features and functionalities of your app. You can follow this step-by-step process to build an eWallet mobile app that improves user adoption and enhances digital payment experiences.

- Define your Goals – Determine your eWallet mobile app’s clear objectives, target audience it will serve, and features.

- Market Research – Conduct a thorough market analysis to understand the user preferences, know your competitors, and examine the loopholes your eWallet mobile applications might fill.

- Conceptualize your App – Identify key functionalities like money transfers, bill payments, and account management, and others to ensure that the app meets user expectations.

- Choose a Platform – Decide whether you need a native app or a cross-platform app and accordingly define your budget and resources.

- Technology Stack – Choose the latest technology stack for eWallet application development.

- UI/UX Design – Designing the user interface of the eWallet app includes the creation of a prototype, defining the app’s structure, and mapping the user journey. You also need to conduct user testing to ensure a smooth and intuitive user experience.

- Frontend Development – Build the frontend elements of your eWallet mobile applications. This involves coding and integrating the backend functionality, including user registration and authentication, secure payments, and transaction history.

- Security and User Authentication – E-wallet security features such as encryption and multi-factor authentication should be integrated into your digital payment app.

- Payment Gateway Integration – Integrate payment gateways with your app to enable cashless transactions usinig eWallet application.

- Finalize App Features – Depending on your eWallet mobile application needs, you can finalize the essential and advanced features you want to integrate.

- Testing and Quality Assurance – When the app development is complete, thorough testing is necessary to ensure its performance, compatibility, and security. This includes testing for any bugs or glitches and optimizing the app for various mobile devices and operating systems.

- Deployment – This step involves launching your eWallet mobile app across multiple app stores.

- Maintenance and Updates – Continuously monitor the performance of your digital payment app, resolve issues and gather user feedback to further refine the app’s functionalities.

Having outlined the eWallet app development process, let’s now explore the possible hurdles that developers face along with their solutions.

eWallet App Development Challenges with Solutions

You need to navigate various challenges that can impact an eWallet app’s performance, speed, security, and adoption. Below are the key challenges faced in eWallet app development along with practical solutions that your technology partner can implement to address them:

Fraud and Security Concerns

Challenge:

eWallet apps handle sensitive financial data. Despite advancements, eWallet applications are susceptible to cyber frauds that result in significant financial losses annually. Ensuring robust security is therefore vital to gain user trust.

Solution:

Implement multi-layered security protocols, including:

- Encryption: Secure data transmission with advanced encryption standards (AES-256).

- Biometric Authentication: Utilize fingerprint or facial recognition for user authentication.

- Real-time Monitoring: Deploy systems to monitor transactions and detect anomalies in real-time.

- Two-Factor Authentication (2FA): Add an extra layer of security that needs two forms of identification.

Compliance with Legal Requirements and Standards

Challenge:

Navigating the diverse legal and regulatory landscape across different countries can be complex and time-consuming for eWallet providers.

Solution:

Invest in regulatory technology (RegTech) and legal expertise:

- Hire Compliance Experts: Employ specialists familiar with international financial regulations.

- Automated Compliance Tools: Utilize software that tracks regulatory changes and ensures compliance.

- Certification and Accreditation: Obtain necessary certifications and adhere to industry standards (e.g., PCI DSS).

User Experience and Interface Design

Challenge:

A complex user interface can discourage users from adopting an eWallet app.

Solution:

Focus on offering a flawless user experience:

- Responsive Design: Ensure the app works smoothly across various devices and screen sizes.

- User-Centered Design: Conduct user testing to refine the interface and improve usability.

- Personalization: Allow users to customize their experience, such as setting preferred payment methods and notifications.

Device Compatibility

Challenge:

The fragmented mobile phone market means many users still operate on outdated devices and operating systems.

Solution:

Develop a user-friendly app with an intuitive UI that is compatible across a wide range of devices:

- Cross-Platform Frameworks: Use frameworks like React Native or Flutter to ensure compatibility across different OS versions.

- Scalable Infrastructure: Design the app to degrade gracefully on older hardware while utilizing advanced features on newer devices.

- Performance Optimization: Regularly optimize the app to run efficiently on various hardware specifications.

Integration with Financial Institutions

Challenge:

Different FIs use diverse software and communication protocols and often have strict security protocols and APIs, which can be technically challenging in the eWallet development process.

Solution:

Facilitate strong partnerships and utilize robust APIs:

- Open Banking APIs: Leverage standardized APIs for secure and efficient integration with multiple banks.

- Partnership Agreements: Establish agreements with financial institutions to ensure reliable connectivity.

- Sandbox Environments: Test integrations thoroughly in sandbox environments to ensure stability before going live.

Scalability and Performance

Challenge:

As the user base grows, the app must handle increased transaction volumes without compromising performance.

Solution:

Build a scalable architecture:

- Cloud Platforms: Leverage cloud platforms like AWS or Azure to scale resources on demand.

- Load Balancing: Implement load balancing to distribute traffic evenly and prevent bottlenecks.

- Regular Performance Testing: Conduct stress testing to identify and resolve performance issues proactively.

Why Partner with Rishabh Software to Create an eWallet App?

With 20 years of custom mobile app development experience and multi-domain expertise, develop on-demand enterprise-grade digital wallet app development solutions for native and cross-mobile OS environments.

Other synergies that make us stand out as an eWallet app development company include:

- Agile development process to consistently deliver a secure app version

- Experience in creating an appealing interface with impeccable functionality

- A dedicated development team for cross-platform solutions

- Extensive integration experience in NFC, QR codes & OTP-based transactions

Success Story: Enhancing Financial Inclusion through Mobile Payment App Development

A progressive FinTech firm collaborated with Rishabh Software to build a payment app designed to provide users with secure, seamless, and convenient digital transactions. This mobile payment app development project aimed to boost financial inclusion and mobile money adoption in tier 2 and 3 countries.

Key Challenges

- Complex traditional banking systems with multiple intermediaries

- Lack of a unified payment platform across institutions

- Requirement for receiver registration hindering mobile-to-mobile transfers

- Technical complexities in integrating critical banking APIs

- Ensure compliance with national and international regulatory standards

- Absence of scalable architecture to handle increasing transaction volumes

Value Delivered

To overcome these challenges, we developed a comprehensive mobile payment app with the following features:

- Digital Wallet: Secure storage and management of funds for quick and secure payments.

- Payment Enablement: Diverse payment methods including P2P, QR code scans, and contactless transactions.

- ISO 20022 Messaging Standard Support: Seamless integration within the global financial ecosystem.

- Virtual Cards: One-time or recurring subscription payments with customizable schedules and limits.

- Cross-Border Payments: Competitive FX rates and flexible fee configurations for international transactions.

Impact

Implementing this mobile payment app led to significant achievements for the client:

- 36% boost in transaction volumes from simplified transfers

- 28% increase in user base due to the user-friendly interface

- 98% CSAT score in the first quarter, reflecting high user satisfaction with hassle-free payments

Factors That Influence e-Wallet App Development Cost

While we’ve covered most of the essentials, you must be wondering what could be the factors that influence the development of eWallet apps? To answer, it would depend on the desired app design, the complexity of features to be integrated, chosen technology stack, and target platforms (iOS, Android, or both).

A decisive aspect affecting the total eWallet app development cost is whether you are developing it in-house or leveraging an experienced software development company’s tech expertise.

Listed below are some of the critical factors based on our experience,

1. App Design

The user interface is crucial to engaging and retaining customers with an online payment app. Creating an intuitive, easy-to-navigate app that runs seamlessly on every platform includes using emerging technologies that come at a cost.

2. Integrated Features

The number and type of features would most certainly affect the mobile wallet app development cost. The price will be less for the most basic features as opposed to certain specific or advanced features.

3. Platform

The cost also depends on whether your app is developed for a single platform or several platforms. The price of a payment app designed for iOS is relatively lower than for Android. However, a mobile commerce platform is typically developed for both Android & iOS.

4. Technology Stack

It also varies depending on the tech stack employed to build the mobile app. Every platform and technology has its pros and cons. It is best to consult an experienced mobile app development company about developing a robust architecture.

5. Experience and skill set of the Development Agency

The pricing also differs drastically depending on the developing agency’s resources’ skill set, certifications, exposure, and industry experience.

We often get inquiries concerning eWallet development. And, while we try to address it most of the time, here are some of the most common queries, we receive. We hope it helps you as well to find the right answers.

Final Words – Knowledge Without Action Is Futile

Now that you have gathered basic information about how digital wallets and our eWallet app development can help your business, it is time to act. Rishabh Software keeps its clients’ needs and goals at the forefront while developing customized solutions. Our highly skilled and experienced team will leave no stone unturned to deliver to your satisfaction.

Frequently Asked Questions

Q: How Does an eWallet App Work?

A: An eWallet app leverages various technologies to enable digital transactions securely and efficiently. Here’s how it typically works:

- User Onboarding – This lays the foundation for cross-device & platform data synchronization.

- Download the app from your device’s app store

- Register using your phone number or email address

- Verify identity through OTP or other secure methods

- Account Setup – The eWallet app is linked to the email ID and phone number.

- Create a unique profile

- Add necessary details like social security number

- Link account across platforms for instant access

- Security Measures – like passwords, PINs, patterns, facial recognition, and fingerprints add to total security

- Set up authentication methods: PIN, password, biometrics

- Enable two-factor authentication for extra protection

- Funding Your Wallet – link your bank account or debit/credit card to the platform

- Add funds to your in-app wallet

- Manage multiple funding sources

- Transaction Capabilities – access to a range of financial transaction types.

- Peer-to-peer transfers

- International money transfers

- Online and in-store payments

- Bill payments and recharges

- Investment options (in some wallets)

- Making Transactions – via communication between open banking APIs, the payment gateway, and the service provider.

- Initiate a transaction

- Authorize using your chosen security method

- Wait for encrypted processing and confirmation

- Review transaction details in your history

- Transaction History – a detailed overview of all the FinTech transactions

- View details including payments made, money received, details of the sender and receiver, amount, time, status, and so on.

Q. Can you help me build an app like Google Pay?

A. We have the proficiency to build different types of apps with features, functionality and even architecture similar to Google Pay, Apple Pay, Samsung Pay, or any other based on the need. Also, depending on your unique feature list, industry focus, and business model, we can customize eWallet mobile app development to deliver a distinctive solution that is “just” for you.

Q. Can you integrate a digital wallet into my existing e-commerce website?

A. Yes, depending on the payment gateway you choose, we can help integrate the digital wallet with your e-commerce store.

Q. Can you build an eWallet app that can be used across multiple mobile platforms?

A. Yes. Utilizing our cross-platform mobile app development capabilities, we can build an eWallet app that can work across multiple mobile platforms while helping you to reduce costs and efforts.

Q. Do you sign NDA & NC agreements?

A. We respect the privacy of our clients. Rishabh promises to protect your IP and confidentiality. As part of our standard agreement, we do sign a formal legal contract for our eWallet app development services with customers that covers technology, source code and more.

Q. I have an e-wallet idea? Where should I start?

A. You can start by contacting us and brainstorming your idea with our team. We shall take it forward from there to meet your goals.

Q. I want to upgrade the technology of my existing eWallet app. Can you help me?

A. We can help you with every modernization and up-gradation effort. Not just the technology, we can also help you integrate new features into your existing digital wallet.

Footnotes:

1. https://www.juniperresearch.com/press/digital-wallets-ericsson-comviva-and-huawei/

2. https://www.juniperresearch.com/press/digital-wallets-transaction-value-16-trillion-2028/

30 Min

30 Min