Digitizing insurance processes can reduce operational costs by up to 65%. While many insurers are still in the early stages of digital transformation, the shift towards AI and Gen AI-driven operations is already reshaping the industry. Among these innovations, agentic AI has emerged as a breakthrough which goes beyond rule-based automation to act with reasoning, adaptability, and human-like judgment.

In the insurance industry, this means AI agents can handle a wide range of functions, from customer onboarding and claims processing to risk assessment and fraud detection. They learn and adapt in real time, much like a human representative. Agentic AI can therefore be a bigger contributor to efficiency, accuracy, and prolong customer satisfaction than conventional digital tools.

A strong example of this in action is Lemonade, which leverages AI-powered agents to process claims within seconds, offering renters and homeowners a seamless, transparent insurance experience.

Like Lemonade, are you ready to get started with an AI insurance agent? Stay with us till the end you’ll discover everything you need to know, including the types, why AI agents are true differentiators in insurance, the roadmap to building one, and more.

AI Agents in Insurance Driving Measurable Impact: Types Explained

AI agents in insurance can be designed with different levels of sophistication. For simple tasks, it’s usually more effective to use a lightweight agent that avoids unnecessary computational overhead. Broadly, these agents can be grouped into five categories, ranging from the most basic forms to highly advanced models.

1. Reactive AI Agents

These agents operate purely on stimulus-response; they don’t store past information. In insurance, a reactive agent might quickly flag an obviously invalid claim form without referencing historical customer data.

2. Model-Based AI Agents

They maintain an internal state so that they can interpret situations beyond immediate inputs. For example, an insurance chatbot could use past interactions to refine its guidance when helping policyholders navigate coverage questions.

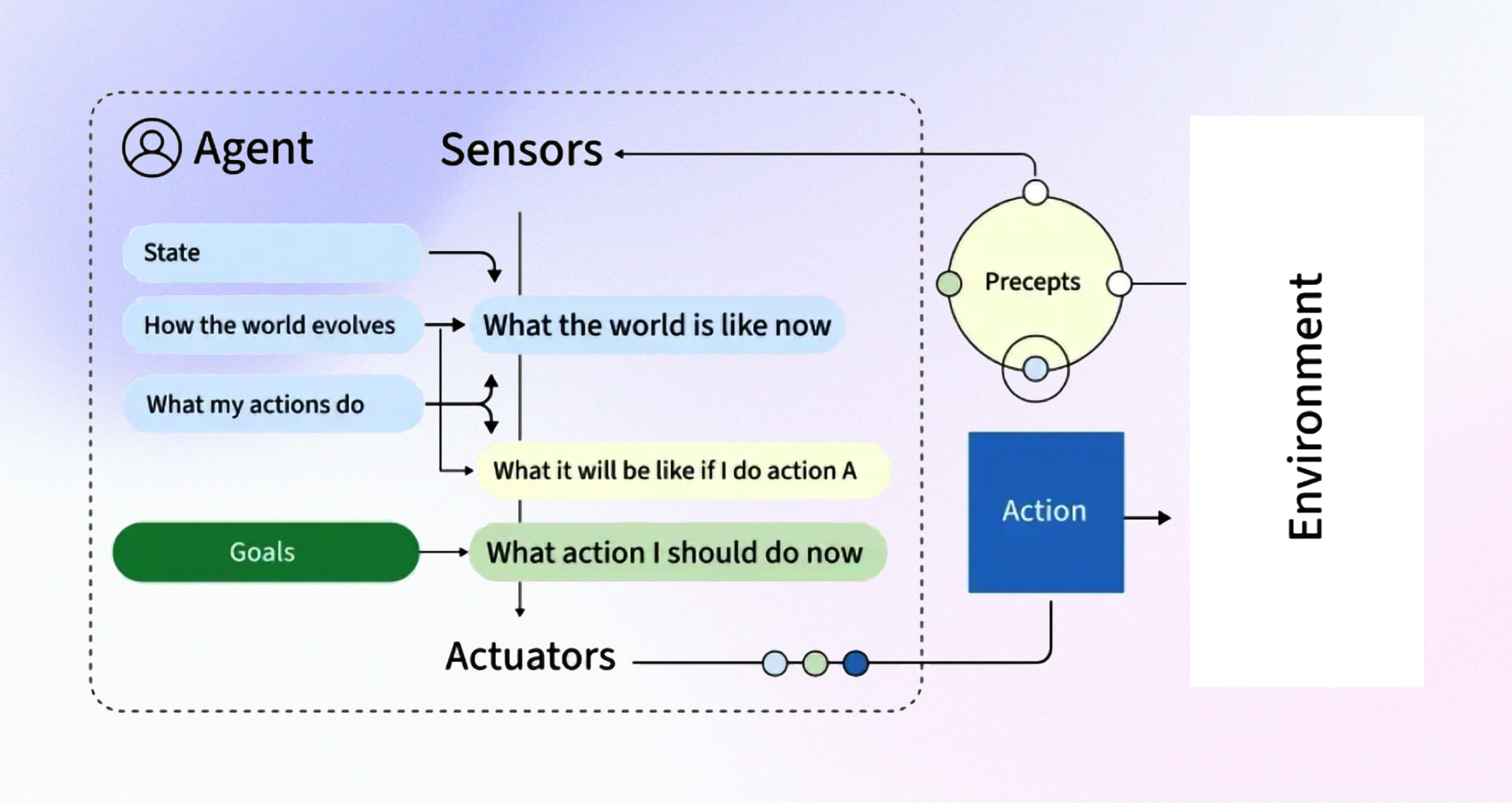

3. Goal-Based AI Agents

These agents evaluate different actions based on predefined objectives. In insurance, a goal-based agent could weigh settlement speed against claim accuracy to suggest optimal next steps for adjusters.

4. Learning Agents

These agents are designed to improve their performance over time by learning from data, feedback, and experience. In insurance, a learning agent could evolve fraud detection models as fraudsters change tactics or personalize premium pricing by analyzing emerging patterns in customer behavior and claims history.

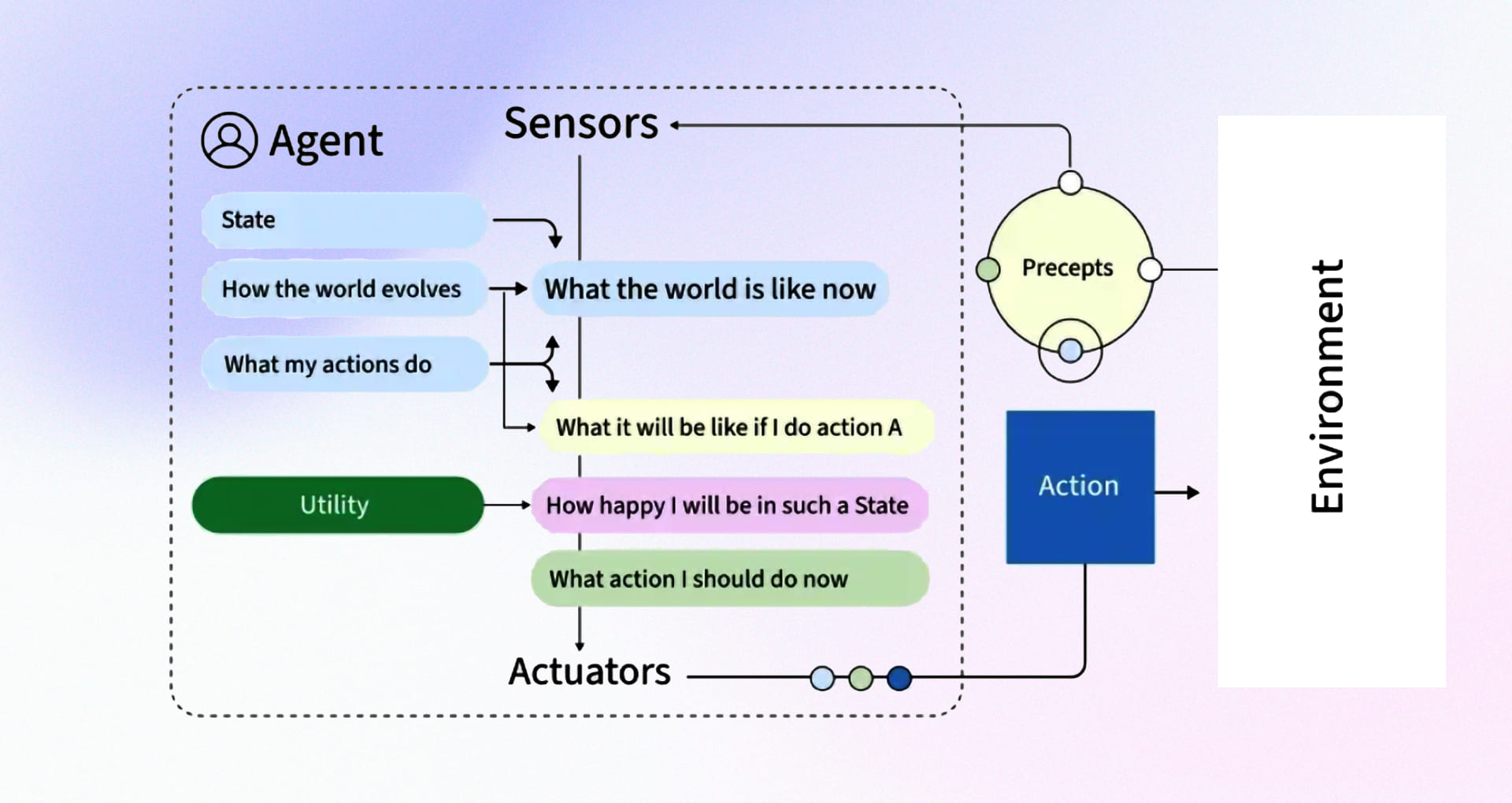

5. Utility-Based Agents

These agents don’t just follow rules or goals; they weigh possible outcomes to choose the action that delivers the greatest overall benefit. Their decisions are based on a “utility function,” which balances different factors and trade-offs. In insurance, such an agent could recommend the most suitable policy by optimizing across customer affordability, coverage adequacy, and the insurer’s profitability.

6. Multi-Agent Systems (MAS)

An MAS involves multiple agents working together, or sometimes competing, to achieve outcomes in distributed environments. The agents can be uniform in design or highly varied, depending on their roles. In insurance, an MAS could coordinate underwriting, fraud detection, and customer service agents simultaneously, enabling faster decisions while balancing risk assessment, compliance, and customer experience.

How AI Agents Become a Differentiator in the Insurance Industry

In insurance, AI agents stand out because they don’t just speed up isolated processes like claims handling or fraud detection, they create impact across the entire value chain. More specifically, here are the benefits of using AI agents in insurance:

1. Driving Proactive Business Models

AI agents reshape the insurance value chain by detecting unusual patterns early, turning future risks into prevention strategies. Instead of reacting to claims, insurers can intervene sooner and alert policyholders to health anomalies, climate threats, or asset vulnerabilities.

For customers, this means fewer disruptions and safer outcomes. For insurers, it reduces claims costs and opens the door to risk prevention as a new service model that drives retention.

2. Building the Autonomous Enterprise

AI agents in insurance industry opens the door to running operations with minimal human intervention. Human roles like underwriters and adjusters shift into “exception handling,” where they oversee complex cases instead of repetitive processing.

Customers benefit from faster decisions and smoother experiences, while insurers gain leaner operations, scalability, and lower error rates.

3. Augmenting Human Expertise

AI agents amplify human judgment and decision making abilities. For instance, underwriters can now model scenarios with thousands of risk factors in seconds, actuaries can simulate dynamic scenarios, and claims teams can resolve edge cases faster with AI-curated insights.

Customers receive more accurate and context-rich outcomes, while insurers see higher productivity and stronger decision quality.

4. Delivering Trust-as-a-Service

Trust is the currency of insurance, and AI agents make it tangible. Every action – premium calculation, claim settlement, fraud alert – can be explained and traced back to data. This transparency builds customer confidence and enables insurers to differentiate themselves by positioning trust not just as a value, but as a measurable service advantage that drives long-term loyalty.

5. Creating Adaptive, Event-Driven Products

With agentic AI, both policies and operations can respond in real time. Insurance products evolve dynamically, like travel coverage that auto-expands during delays or car premiums that adjust to driving behavior. while event triggers like flood alerts or market dips activate proactive outreach and automatic adjustments.

Customers get personalized, responsive coverage, and insurers unlock new revenue opportunities and deeper customer engagement.

Use Cases of AI Agents in the Insurance Industry

Below are the key AI agent use cases that you can build with Rishabh Software as technology your partner offering AI Agent Development Services.

1. Claims Processing Agent

Claims handling is resource-intensive and customer-sensitive. AI agents now manage the full lifecycle, from FNOL to settlement to automating steps like NLP-based extraction, policy verification, adjudication, and document generation. For example, Blackbook AI’s NLP Insurance Claims Agent enabled Bus Queensland to automate claim tracking and communication, leading to faster resolutions and avoiding the need for manual claims analyst intervention.

2. Fraud Detection Agent

Fraud remains one of the industry’s hard-earned blind spots, costing $308.6 billion globally each year. A Fraud Detection AI Agent steps in as a vigilant safeguard, using sophisticated machine learning to uncover patterns invisible to human reviewers.

It connects data points across historical claims, public records, and even social media to detect organized fraud rings and AI-manipulated evidence. This sharpened insight enables insurers to act with precision, protecting both their bottom line and honest policyholders.

3. Customer Support & Virtual Assistant Agent

AI-powered customer support agents are redefining frontline service by offering 24/7 availability, multilingual support, and instant resolution of routine queries such as claim status checks, policy updates, or account changes. Recent McKinsey findings revealed that insurers that excel at customer experience significantly outperform their peers in financial outcomes, with leaders delivering 20-65 percentage points higher TSR and stronger revenue growth.

A real-world example comes from Zurich Insurance, which integrated AI into a new CRM platform serving its 55 million customers. The system consolidated scattered policy data into a single interface and applied AI features like tone analysis and next-best-action recommendations – “like Spotify playlists, but for insurance needs.”

The result was impressive. Zurich’s agents can now access the right information in under three clicks, cut servicing times by more than 70%, and shift their role from transactional support to trusted advisors.

4. Underwriting AI Agent

Underwriting has traditionally relied on manual reviews of medical histories, financial records, and actuarial tables – a process that slows time-to-quote and introduces inconsistency.

An AI underwriting agent accelerates this by aggregating structured and unstructured data, like credit scores, health records, IoT telemetry, and external risk indices, into comprehensive risk profiles within minutes. Predictive analytics sharpen segmentation, reduce adverse selection, and improve pricing fairness.

QBE Insurance’s Cyber Underwriting AI Assistant has reduced broker submission review times by approximately 65%. This enables underwriters to process significantly more submissions while maintaining accuracy in risk assessment. This Insurance AI agent started in North America and has since expanded to Europe, Hong Kong, and Singapore.

5. Claims Triage & Routing Agent

Not every claim deserves the same handling, and insurers lose efficiency when all cases enter the same pipeline. A claims triage and routing agent serves as the intelligent front door:

By instantly assigning severity and complexity scores, the agent ensures low-value claims are fast-tracked with automation, while critical ones get immediate attention from senior adjusters. This avoids blind spots, prevents bottlenecks, and enables insurers to act in the moments that really transform customer trust.

6. Onboarding Agent

Customer onboarding is one of the most decisive moments in insurance, with research showing that customers who face a poor onboarding experience will switch to a competitor.

To prevent this, adopting an AI agent for customer onboarding offers multiple advantages. It handles sign-up and KYC checks, verifies identities within minutes, pulls in credit and health data, and generates personalized policy documents automatically. This makes the entire process faster and more efficient while ensuring higher customer satisfaction and retention rates.

7. Risk and Policy Management Agent

AI agents are increasingly being used as continuous risk evaluators and policy advisors. Instead of relying only on static customer data at the point of application, these agents draw on live inputs, like telematics from connected cars, traffic violation records, weather data, or wearable health devices and build a dynamic risk profile in seconds.

For example, when a customer applies for auto insurance, the AI agent instantly pulls telematics data from connected cars, traffic violation records, and even weather patterns in the applicant’s region. It then scores the risk profile instantly and suggests a policy with tailored premiums.

Similarly, in health insurance, AI agents analyze wearable device data, electronic health records, and lifestyle information to adjust coverage dynamically. Integration of AI agent in insurance company helps in speeding up the end-to-end activities and cut down the fraud losses and maintain accuracy alongside.

Developing LLM-Based AI Agents for Insurance: A Roadmap to Follow

To successfully develop LLM-based AI agents in insurance, you must go beyond a simple checklist and adopt a highly strategic roadmap that integrates technology with business goals. Here is a detailed roadmap for developing AI agents for your insurance business.

Step 1: Define Your Purpose and Decompose the Problem

Before building an AI agent, you must clearly define the business problem/challenge you’re solving and how an agentic approach will address it.

- Narrow Down on the Use Case: From the use cases we shared in the previous section, pinpoint a specific area where LLM agents can deliver significant value. Is it reducing the time to process a claim? Automating policy underwriting for low-risk customers? Or providing hyper-personalized customer support? Start with one area and get it right.

- Decompose the Workflow: Break down the chosen use case into a series of smaller, sequential steps.

Break the use case into smaller, role-specific agents. For example, an end-to-end claims agent may include a Triage Agent to categorize claims, a Verification Agent to check policy details, an Adjudication Agent to calculate payouts, and a Communications Agent to update the customer. This mirrors how human teams operate, with specialized roles working in sequence.

- Align Stakeholders: Engage compliance officers, actuaries, IT, claims leaders, and CX teams early. Cross-functional buy-in ensures the chosen use case is viable from both a business and regulatory perspective.

Step 2: Build a Secure, Domain-Specific Data and LLM Foundation

Basic LLM models can’t handle the complexities and jargon of insurance operations. To ensure accuracy, security, and compliance, you need a specialized, domain-tuned stack.

- Data Strategy: Collect and clean internal data like policy documents, claims histories, legal texts, and customer call transcripts. Combine this with external data streams like IoT signals, weather APIs, or credit data to give agents richer context.

- Choosing Your LLM: You have many options here:

- Azure OpenAI: You can use powerful models like GPT-4 via Azure OpenAI Service, which offers enterprise-grade security, fine-tuning capabilities, and integration with other Azure services.

or

-

- AWS: You can use Amazon Bedrock, a fully managed service that provides access to leading LLMs from various providers (like Anthropic’s Claude or Meta’s Llama). Amazon Bedrock’s Agents feature simplifies building multi-step agentic workflows.

or

-

- Open-Source Models: Host open-source models (like Llama or Mistral) on AWS Sagemaker or Azure Machine Learning. This gives you more control over the model and data but requires more technical expertise.

- Implement Retrieval-Augmented Generation (RAG): This is a critical component for insurance. Instead of relying solely on a model’s training data, your agents will use RAG to query your secure, proprietary knowledge base.

They can retrieve relevant paragraphs from a policy document or a claims manual to answer a customer’s specific question, ensuring responses are accurate, up-to-date, and grounded in your company’s data. Both AWS and Azure offer services to build and manage these vector databases.

- Beyond RAG: While retrieval-augmented generation is the most widely used method for ensuring insurance agents give accurate, up-to-date answers, it’s not the only option.

Fine-tuning an LLM on proprietary insurance data can improve performance in highly specialized use cases, like claims adjudication rules, regulatory language, or customer-facing communication tone.

In practice, many insurers adopt a hybrid approach, starting with RAG for speed and accuracy, and layering fine-tuning as use cases mature and standardization becomes critical.

Step 3: Develop, Test, and Deploy the Ecosystem

Once you’ve defined your use case and assembled the right data/LLM stack, the next step is to bring your agents to life and ensure they can work together reliably. This is where orchestration, testing, and deployment come into play.

- Select an Orchestration Framework

AI agents rarely work alone; they need to collaborate across tasks like claims triage, verification, and customer updates. Two major orchestration frameworks for this are:

-

- Managed Cloud Services: Platforms like Azure AI Agent Service, Agents for Amazon Bedrock, or Google Vertex Agent Builder provide enterprise-ready orchestration with security, monitoring, and role-based access baked in. These are ideal for regulated insurance environments.

- Open-Source Frameworks: Tools like LangGraph (LangChain), Microsoft AutoGen, CrewAI, or LlamaIndex Workflows give flexibility and control. These are great for prototyping or building bespoke workflows, though you’ll need to layer on governance and observability yourself.

- Integrate Business Tools and APIs

Agents need to take real actions, not just answer questions. That means connecting them to your existing systems through APIs: checking policy status, triggering payments, flagging suspicious claims, or fetching IoT/weather data. Think of this as building the “hands” your agents use to operate within your insurance workflows. - Design for Explainability and Compliance

Every decision, whether denying a claim or adjusting a premium, must be explainable to both regulators and customers. Bake in audit trails and reasoning visibility from the start, so you can always show why an agent made a decision. - Test in Simulated Environments

Insurance processes have edge cases regulators care about: borderline claims, fraud attempts, or rare but high-impact risks. Go beyond unit testing by simulating these scenarios and validating outcomes for accuracy, fairness, and cost efficiency. - Deploy with Monitoring and Cost Controls

Finally, deploy your multi-agent system on scalable cloud infrastructure. Use built-in monitoring dashboards (AWS CloudWatch, Azure Monitor, or open-source tools) to track latency, API costs, and task success rates. Cost controls, like batching queries, caching results, and setting guardrails for API usage, keep operations financially sustainable.

Step 4: Establish a Human-in-the-Loop for Continuous Optimization

AI agents for insurance are never “set and forget.” They require human oversight and ongoing refinement to stay reliable, compliant, and effective. Underwriters, claims teams, and compliance officers should remain involved as reviewers of critical AI-driven decisions, particularly in high-risk cases.

Just as important is preparing employees to work with agents rather than against them; structured training helps teams trust the system and adopt it faster.

Additionally, the ecosystem must also stay current. That means continuously updating the knowledge base with new policies, regulations, and market insights so agents don’t fall out of sync with reality.

Finally, progress should be measured through clear business outcomes, like shorter claims cycles, higher fraud detection accuracy, lower underwriting costs, and improved customer satisfaction. These metrics prove ROI and guide the next wave of improvements.

How Rishabh Software Can Help Build AI Agents for Insurance, Tailored to Your Business

Building agentic AI solutions demands domain expertise, secure architecture, and tailored workflows that align with your business needs. Many enterprises struggle to move beyond pilots because their AI systems lack scalability, compliance, or contextual intelligence.

Rishabh Software, a leading AI/ML development services provider, helps insurance businesses by designing a multi-agent ecosystem with specialized agents for underwriting, claims automation, customer servicing, and many other operations. We build such solutions on a domain-specific LLM stack, integrated with the client’s existing data pipelines, and apply explainability layers to ensure outputs were transparent and auditable.

If you’re looking to build agentic AI tailored to your industry, our consultants can guide you through the consultation, strategy creation, technology choices, deployment strategy, and more.

Frequently Asked Questions

Q: What AI Agent in Insurance?

A: An AI agent is a proactive, programmatic asset or digital solution designed to perform complex tasks independently, without human intervention. Unlike simple automation tools, it can handle multi-step activities, analyze situations, create its own plan, and execute it by leveraging various fully integrated tools and systems.

Q: Challenges to deploying an AI agent in insurance

A: The primary hurdles lie in data security, regulatory compliance, and integration with legacy systems. Success requires a structured roadmap that balances technology modernization with risk management.

Q: The Future of AI Agents in Insurance

A: AI agents will evolve from task automation to driving predictive insights, risk prevention, and hyper-personalized customer engagement positioning insurers to compete in a digital-first marketplace.

Q: Can AI agents integrate with our existing insurance systems?

A: Yes. Through APIs, middleware, and data pipelines, AI agents can integrate seamlessly with policy administration, claims, and CRM systems enabling value without disrupting core operations.

Q: What is the typical implementation timeline for AI agents in insurance?

A: For most insurers, pilots can be deployed in 3–6 months, with enterprise-scale implementations spanning 6–12 months depending on system complexity and data readiness.