For years, insurance professionals have relied on complex spreadsheets to stay compliant, analyze claims, address inquiries, and navigate customer profiling. However, accurate data reporting with conventional technologies is often tedious, time-consuming, and prone to errors. Business intelligence in insurance, accompanied by powerful data visualization capabilities can help insurers break free from the clutter of complicated worksheets and data silos while enabling informed decision-making.

Tech Investment Surge

The insurance Industry is projected to increase its technology spending by 8% in 2025, which is in alignment with operational excellence and innovation over Forrester’s report. Gartner highlights a new opportunity for insurance companies from AI-powered, real-time analytics and automated dashboards, allowing insurers to deliver smarter, scalable solutions while overcoming the limitations of traditional silos.

Market Impact: Efficiency, Fraud Detection & Personalization

The implementation of BI streamlines claims management and fraud detection in insurance. Predictive analytics and AI technology are now in use, helping restrain fraud, which in the US alone, is a $308.6 billion scourge to businesses and consumers. Real-time BI provides deep insights that promote personalized CX, enhance claims resolution speed, and enable proactive prevention.

Why It Matters Now

Insurers using BI report up to 40% greater operational efficiency and reduced costs, according to recent Deloitte and McKinsey research. With that in mind, let’s explore the potential of business intelligence for the insurance sector– specifically, why it’s the need of the hour & how the insurance industry can get huge gains from it.

Why Business Intelligence is Important for the Growth of Your Insurance Business

A BI platform supports every aspect of insurance business – from operations and claims handling to sales and marketing. It analyzes a colossal amount of data and then enables the display of the same in a digestible format to facilitate informed decision-making.

The potential of business intelligence in the insurance industry lies in the capacity to equip decision-makers with real-time access to actionable insights ranging from basic customer data to advanced analytics. Following are a few key areas where insurance companies can leverage it to achieve growth:

- Extract data-driven insights to arrive at better business decisions regarding policies, covers, premiums, product risk management & more in real-time

- Identify new income opportunities for cross-selling and upselling products as per current market conditions to better fulfill customer needs. It is along with potential risk and insurance portfolio exposures across offerings and lines of business

- Track KPIs with instant alerts or push notifications every time information is changed concerning a specific performance indicator. And, uncover possible bottlenecks that may be affecting performance and optimize

- Gain a 360° view of clients, their needs, behavior, and purchase preferences to customize products, attract new clients, and retain the existing ones with timely outreach

- Track insurance sales down to every individual agent’s performance

- Enable underwriters with easy access to premium and loss ratio

- Enable digital transformation in insurance through data-powered insights that streamline underwriting, automate claims, and enhance customer journeys while strengthening risk assessment capabilities

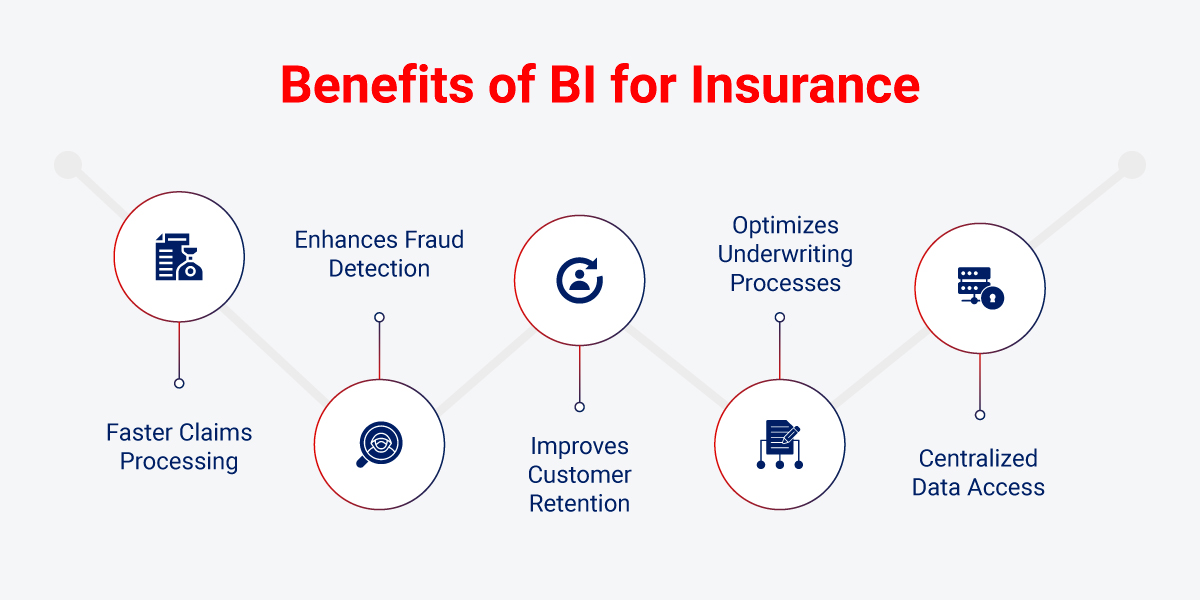

Key Benefits of BI for Insurance Companies

The industry experiences constant shifts, risks, and changes. Implementing BI software helps improve operational efficiency, increase profits, and enhance customer satisfaction. Here are the key benefits:

Faster Claims Processing:

The modern insurance landscape is rapidly moving toward creating more sustainable operations through streamlined claim submission, processing, and management. Implementing business intelligence for insurance industry automates workflows and enables efficient and accurate claim processing across processes such as documentation, investigation, assessment, validation, and more. With the added capabilities of data analytics and visualization tools like dashboards, heat maps, and interactive charts, BI provides a comprehensive view of customer data. This enhanced visibility enables insurance handlers to access clear, transparent information through seamless integration with customer relationship management (CRM) systems.

Enhanced Fraud Detection:

Insurance fraud costs the industry approximately $40 billion annually in the U.S. alone. This staggering statistic underscores the importance of enhanced fraud detection in the insurance industry. Leveraging data as a powerful weapon for fraud detection, the integration of BI provides a smoother and more efficient approach to weighing out the threat of insurance fraud. It harnesses diverse data sources, such as claim history, location-based information, and data collected from ERP systems, CRMs, and IoT devices, to deliver comprehensive insights and actionable solutions for combating fraud.

Improved Customer Retention:

Implementing BI in insurance processes enhances customer satisfaction by transforming traditional operations into data-driven workflows. By providing a holistic view of customer data through data gathered from multiple touchpoints, BI helps insurers identify process bottlenecks and improve accuracy, which reduces claim processing times and enhances customer engagement. This data-centric approach improves operational efficiency and facilitates better services and personalized offerings. Business intelligence enhances customer experience in insurance landscape through:

- Faster claim processing and settlement

- Reduces customer efforts throughout the overall insurance cycle

- Enhances communication and support across multiple touchpoints

- Removes process inefficiencies and operational bottlenecks that cause delays in the process

Optimized Underwriting Processes:

Prioritizing the advanced underwriting process is key to transforming the insurance landscape. Leveraging Business Intelligence (BI) helps optimize and streamline the traditional underwriting process through data-driven optimization and automation. Using data visualization tools, underwriters can gain a clear view of each stage, identifying inefficiencies, bottlenecks, and opportunities for improvement.

BI enables smarter segmentation, refined analysis, and dynamic underwriting strategies, enhancing pricing and coverage decisions. Predictive models further enhance this approach by forecasting risks and future changes, helping adjust underwriting practices and boosting profitability.

Centralized Data Access:

Modern insurance operations require seamless integration of business data across various functional areas. It consolidates data from numerous sources and presents it in a centralized platform, ensuring that all departments operate with consistent, accurate information for processing, decision-making, and conducting daily activities. BI platforms provide a unified data architecture that:

- Consolidates data from multiple sources (claims, policy, customer interactions)

- Standardizes data formats for consistent analysis

- Enables real-time access to operational metrics

- Maintains data integrity through automated validation

Applications of Business Intelligence Across Insurance Types

BI is transforming the insurance industry by converting vast amounts of data into actionable insights across the entire value chain. Through advanced analytics and real-time data processing, it enables a data-driven approach in each possible area. Here, we will shed more light on different types of insurance where BI applications are refining workflows.

Life Insurance:

- BI makes it possible for insurers to thoroughly analyze data across multi-touchpoints, including historical data sets, market trends, patterns, customer demands, and demand forecasts to optimize pricing strategies.

- Predictive models, when integrated with historical data, empower insurers to accurately forecast future claims and evolving customer demands, allowing for required strategic changes in policies.

- BI also gives insurers the ability to efficiently segment their customers based on various criteria, such as risk factors and geographical area, to offer a personalized targeting approach, improve retention rates, and enhance customer satisfaction.

Health Insurance:

- Claim processing and management is the core of health insurance operations. With BI integration, health insurers are able to monitor key metrics on various aspects to eliminate fraud and contribute to maintaining efficient claim settlement cycles.

- BI analytics provide deep insights into treatment patterns, provider performance, and patient outcomes, enabling effective healthcare cost management and network optimization.

- Another usage of BI for healthcare insurance is that it can precisely assess health-related risks using comprehensive patient data and adjust pricing accordingly.

Auto Insurance:

- Insurance business intelligence systems in auto insurance allow for conducting risk appraisals for specific drivers based on their driving records and history. This enables underwriters to issue a tailored policy for that driver.

- Business intelligence can also help insurance companies identify fraudulent claims. Through data analytics, insurers can identify fraudulent claims early, saving the company from major losses.

Property Insurance:

- BI-based platforms and solutions enable property insurance providers to keep themselves updated with forecasts of natural disasters by analyzing geographic and climatic data. This enables insurers to implement risk-management strategies proactively.

- Property insurance companies can utilize BI to offer personalized coverage options and recommendations to drive customer satisfaction and retention.

In case you missed our last installment on the power of data analytics in insurance and how it can assist insurance companies with big data management & data visualization, do give it a read. It would help you point out how to refine the workflows, take smart decisions and deliver a valuable customer experience.

How AI & Generative AI are Redefining Insurance Business Intelligence

AI and Generative AI are not just tech buzzwords in insurance; they’re operational game-changers. From accelerating decision-making to mitigating fraud and driving personalized engagement, these technologies are reshaping BI as a strategic core function.

The Market Has Shifted: AI and Gen AI in Insurance BI

Explosive Market Growth

The global AI-in-insurance market is on track to jump from $3.9B in 2025 to $11.2B by 2028 a CAGR of 25.1%. Generative AI, meanwhile, is projected to hit $5.7B by 2029, growing at an impressive ~40% annually.

Widespread Adoption:

91% of insurers globally now consider AI foundational. 83% name it a top-three priority in their digital transformation agendas.

Proven Outcomes:

- Claims processing time reduced by 70–73%

- Fraud detection improved by up to 28%

- Underwriting accuracy boosted by 54%, compared to legacy systems

Gen AI as a CX Engine:

Among early adopters, Gen AI now handles 42% of customer interactions, lifting retention by 14% and Net Promoter Score (NPS) by 48%.

Productivity + Premium Growth:

Analysts like McKinsey report Gen AI is driving:

- 10–20% improvements in operational productivity

- 1.5–3% growth in premium revenues

- Up to 3-point gain in technical margins

Fraud & Risk, Reinvented

With insurance fraud set to top $80B a year by 2025, Gen AI now acts as an intelligent first responder surfacing fraud patterns and anomalies before escalation.

The Real Impact: From Dashboards to Dynamic Decisions

Insurers are moving beyond static BI dashboards to real-time, intelligent decision support systems. Gen AI enables insurers to:

- Instantly summarize long-form documentation

- Generate contextual risk scenarios

- Co-pilot claims in multiple languages

- Auto-draft compliant reports

- Support underwriters and agents with real-time insights

This shift isn’t just about automating paperwork. It’s about enriching every decision, conversation, and strategy with context-aware, data-driven intelligence.

What’s Next: From Digital to Intelligent

Tomorrow’s market leaders won’t just digitize workflows; they’ll infuse intelligence into every layer of the enterprise. Generative AI isn’t an optional upgrade; it’s a competitive imperative. Waiting isn’t a strategy. Get a detailed breakdown of Gen AI in insurance use cases, tangible business benefits, adoption strategies, and deployment frameworks.

The upside is clear: faster claims, better fraud detection, smarter underwriting, and stronger CX. But scaling hits real limits in the form of fragmented, low-quality data; legacy cores; changing regulations and model-risk oversight; security and privacy demands; and user adoption. The next section covers key challenges and shows practical fixes to de-risk and scale BI.

Common Challenges in Implementing Business Intelligence in the Insurance Industry and Their Solutions

Implementing BI in insurance industry processes presents several entry hurdles due to the complexity of data integration, data quality and regulatory requirements. Here are the key challenges and solutions to address them:

Data Integration:

Insurance companies gather data from a vast ecosystem of information sources involving disparate sources such as CRMs, ERPs, and external sources. Integrating these diverse data sources into a unified BI platform holds many hidden challenges and can be labeled as a complex process to undertake.

Solution: To address these challenges, insurers can:

- Implement modern ETL tools and middleware platforms to automate the integration process.

- Focus on data standardization by ensuring proper formatting and data structuring.

- Also, cloud-based data warehouses should be considered for scalability and streamlining integration.

Data Quality

Errors, fragmented or incomplete insurance data gathered through traditional manual processes, data silos, and disparate legacy systems can often lead to incorrect risk assessments. This unreliable analysis can lead to incorrect pricing and claims processing.

Solution: To address this challenge, organizations can:

- Utilize automated tools for cleaning and validating data,

- Conduct regular audits, perform close monitoring processes, and maintain data quality over time

- Additionally, they can predefine quality metrics such as accuracy, completeness, and timeliness

Data Security and Privacy

The insurance industry handles sensitive customer data and policies, making robust data security and privacy frameworks essential. Ensuring secure handling of data streams is critical to maintaining compliance and trust.

Solution: Take steps to:

- Ensure that BI platform complies with industry regulations such as HIPAA, GDPR, and other relevant data protection laws

- Implement strong authentication and encryption methods, role-based access control and authentication protocols

- Leverage data masking and tokenization

Why Choose Rishabh Software for Developing Insurance BI Solutions?

Our well-versed team has the know-how of the operational understanding of the insurance business. Our comprehensive service portfolio is specifically tailored to help customers manage all possible workflows. We provide end-to-end visibility into all crucial KPIs for the timely and efficient achievement of policy targets. It is by integrating the data resources and utilizing the powerful capabilities of BI.

The data management needs of insurers are vast, complex, and diverse. We have it covered for any data management project with our personalized and full range of business intelligence services for businesses of any size or domain, including insurance mobile app development, Power BI solution development, dashboard development, data visualization, data migration, and automated data aggregation using OLAP engines. Our team can help develop custom insurance dashboards that serve as a centralized source of data lying in disparate systems while providing a unified framework for key decision-makers.

Success Story: ECM Portal Enabled a Netherlands-based Insurer to Improve Customer Relations & Operational Efficiencies

A leading service provider of health insurance, car insurance, and international insurance, serving more than 7 million clients worldwide was suffering due to a heavily underperforming website with several bottlenecks.

Challenges:

- No collaboration between document development & delivery

- Lack of a centralized content repository for efficient management of various policies & legal documents

- Customers having no access to insurance information

- High costs being incurred for managing & maintaining the existing website

Solution:

We redesigned their existing solution into an easy-to-navigate enterprise content management portal that offers real-time visualization of end-to-end information about insurance services. This enabled the client to ensure seamless assistance to insured policyholders, travelers, seniors, and lease drivers.

Benefits:

- Enhanced productivity with automated operations

- A unified repository with secure and easy access to insurance data

- Eliminated bottlenecks in business operations

- Improved customer retention along with higher operational efficiency across touchpoints

Frequently Asked Questions

Q: What is business intelligence in insurance?

A: BI in the insurance industry refers to the technology-driven process that enables insurance companies to analyze vast amounts of data and drive actionable insights. It transforms business operations using data analytics and predictive modeling and provides real-time insights that drive profitability and improved customer service. Business intelligence in insurance also helps sales managers and insurers understand market trends, customer behavior, and risk profiles, which are crucial for effective underwriting and pricing policies.

Q: How would the insurance industry use business intelligence?

A: The insurance industry employs BI in several ways that help make informed decisions. From risk assessment, fraud detection, claim management, and regulatory compliance adherence to improving operational efficiency, BI provides more visualized and actionable information to insurance leaders for data-driven decision-making.

Q: Why do insurance companies need business intelligence software?

A: Because BI integrates isolated, unstructured data and generates insights, it allows an organization to make decisions swiftly, reduce companywide spend, and improve client satisfaction. Business Intelligence funnels the focus of a company into user-friendly dashboards, automates the processing of claims, strengthens fraud detection, sharpens underwriting, personalizes sales, tightens compliance, and reduces operational inefficiencies. With the help of AI services and business models, teams are able to respond to FNOL swiftly, identify anomalous trends, evaluate risk, oversee regulatory KPIs, and assist agents with the best next offer. This translates to enhanced efficiency, reduced claims, optimized pricing, satisfied clientele, and cost-effective business management.

How to get started

- Pick BI with built-in AI/GenAI.

- Start with claims, fraud, and underwriting.

- Invest in clean, governed data.

- Train teams on dashboards/models.

- Set KPIs and iterate continuously.